Back in June, if I told you on December 21 we'd have two vaccines being distributed and Congress just agreed on a nearly $1 Trillion additional stimulus bill how many of you would have bet the stock market would be looking to open down nearly 2%?

If 2020 has taught us anything it's to expect the unexpected. The discovery of a new strand of the Coronavirus in the U.K. has dampened the spirits as we start the second to last week of this miserable year. So far it seems the new strand is no more deadly than the other strands, but it spreads significantly faster. There also isn't any data that the vaccines are not effective on this strand. It is normal for viruses to mutate. They often become more infectious, but less deadly.

With the short week and many people taking the week off, here's a brief look at what's on my mind:

- Remember, when stocks are overvalued, the smallest piece of negative news can cause big reactions in stock prices. The "buy high, sell higher" environment leads to investors knowing they are taking on too much risk, but hoping to be smart enough and fast enough to get out before the party is over. (See "When will the bubble burst" and "No risk in sight" to better understand the current market environment.)

- They still need to actually write the legislation, but getting help for those hurting the most is welcome news and something our economy needs. Once again there is probably going to be too much money going to those who don't really need it and not enough going to those who do. (For more see, "Winter is Coming")

Some COVID19 Musings (Rants)

- We of course won't know until well after the fact, but I wonder if we have the faster spreading version of coronavirus in the US already. While I knew very few people in the spring and summer who contracted COVID, it is spreading like a wildfire and getting way too close to our "bubble". It is such a random, unpredictable virus with some people having slight symptoms for less than 12 hours and others ending up being admitted to the hospital. Some have been so fatigued they could barely get out of bed for two weeks. This isn't anything I want to deal with.

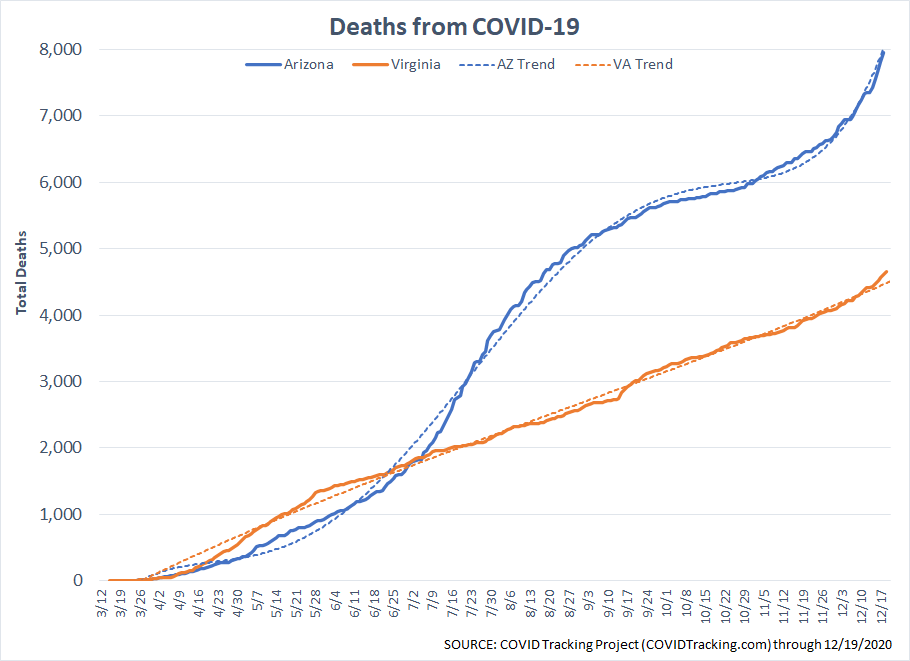

- Early in the pandemic I commented on the difference in how different regions have reacted to the virus. Areas (like Arizona) have essentially no restrictions and one of the highest Rt rates in the country while others (like Virginia) have fairly heavy restrictions with one of the lower Rt rates in the country. (Rt is the rate the virus is spreading. See Rt.live) Looking at Arizona's COVID deaths versus Virginia's you can see the different waves. Keep in mind, Arizona has over 2 million less people than Virginia and far fewer heavily populated regions.

- Speaking of different reactions – the Rose Bowl was moved out of California and to Texas because Texas has loser restrictions on the number of fans that could attend along with other COVID related restrictions. The NCAA claims the move was "for the safety" of fans and players due to the "high number of cases" in California. California has the 3rd highest Rt rate. Texas has the 4th highest. The NCAA should have just been honest and said, "it's all about the $$$$".

- While we're on that topic, how does Notre Dame, who had said they would consider not playing in the playoff if family members couldn't attend, get destroyed by Clemson and still be considered a top 4 team? Again, the committee could have said, "it's all about the $$$$."

- While I've always respected the debt and budgeting advice of Dave Ramsey (don't get me started on the investing advice he's able to give without any regulatory oversight), his Christmas party and overall attitude towards COVID is enough for me to lose all respect for him as a person and organization.

- Since learning early in my career how much one of Mr. Ramsey's workshops or seminars cost, I've always vowed to provide similar advice for free. The type of people that need the most help, often have no extra money to pay for the workshops. Next year we'll be launching our own workshops. Check out the preview here. If you're an advisor and would like to offer these in your area, let me know.

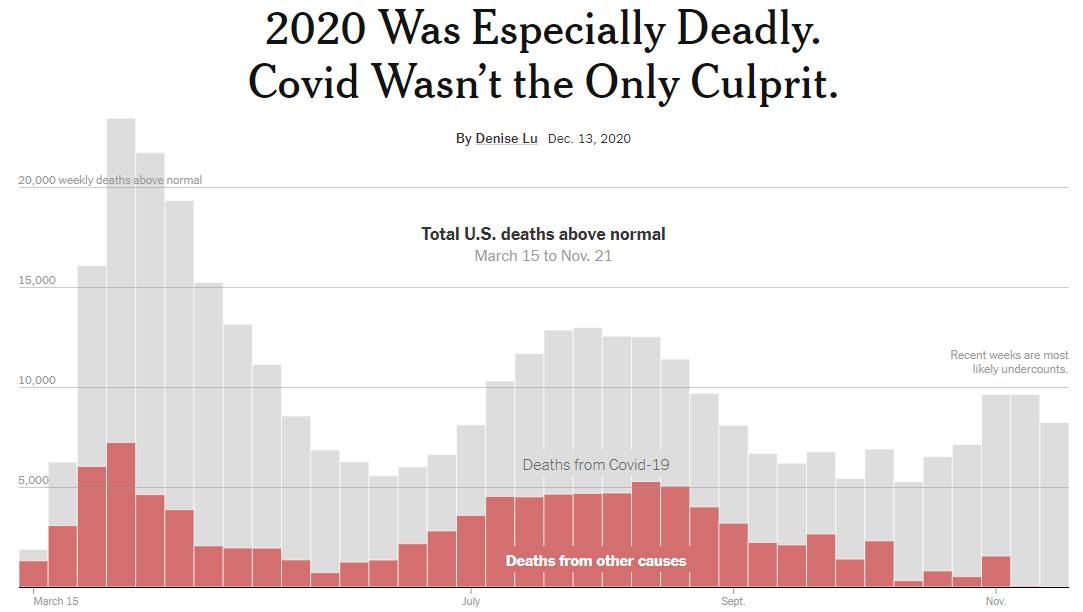

- I know the death numbers have been questioned, but I also know there are far more people dying this year than is "normal". Each person dying of COVID had an average of 2 "co-morbidities" (underlying conditions). America is an obese country and this virus attacks those who have health problems due to our obesity. This doesn't make it less tragic or something we shouldn't care about.

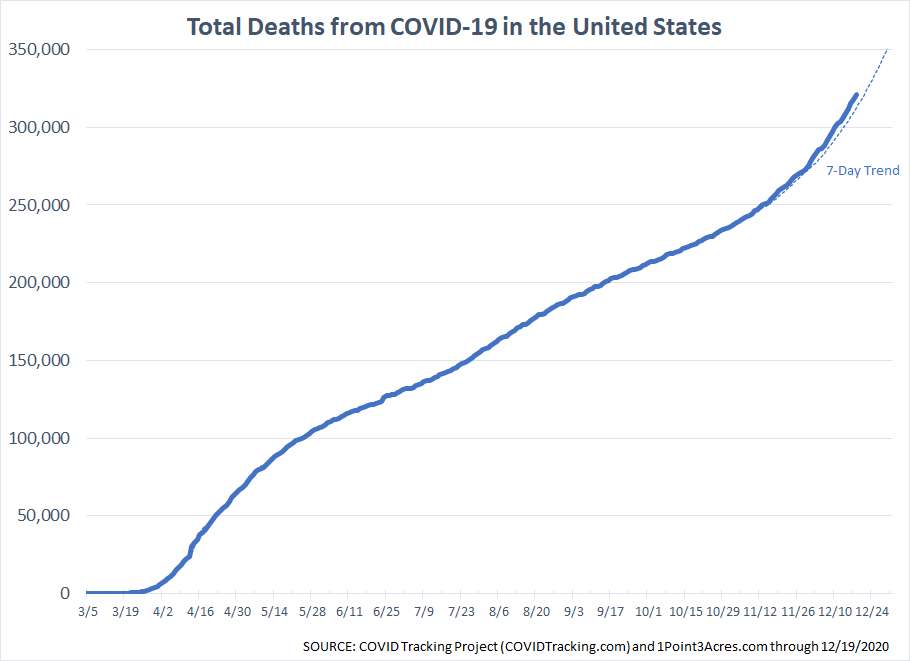

- Through October 3, according to the CDC, there had been 299,028 excess deaths in the United States this year. Remember, excess deaths are those higher than you'd expect in a normal year. The data from John Hopkins and the COVID Tracking Project show those numbers are getting much worse.

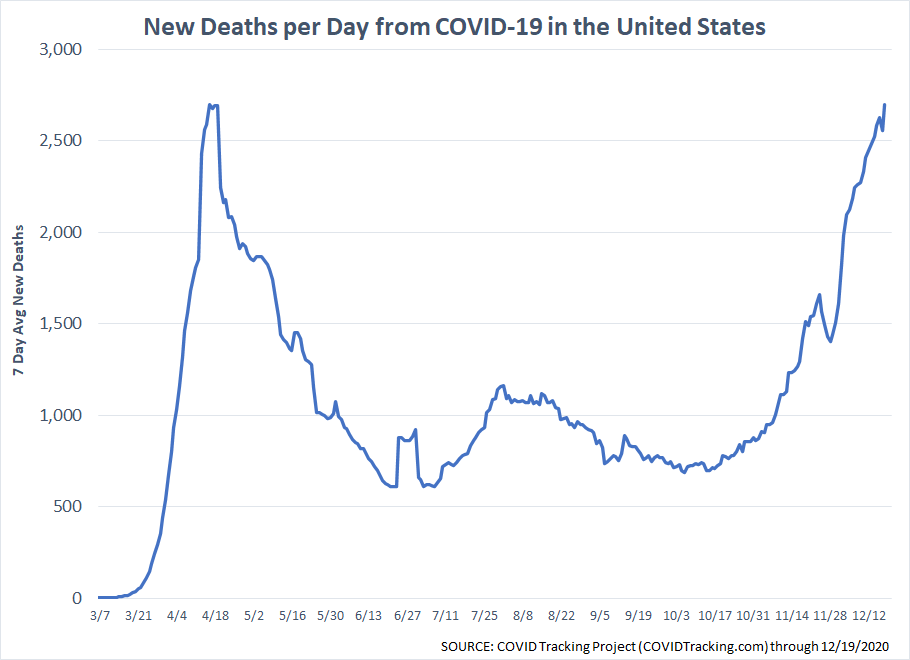

- At the rate we're going, this week the 7-day average of COVID-19 deaths will likely pass the peak from the spring.

- Look, I'm as tired as anybody over all these restrictions, but we're almost there. Between the vaccine, warmer weather, and "herd immunity" we should be looking at a spring where we can finally get back to whatever "normal" will look like.

Back to the Market

- I've already been on several 2021 outlook calls and everybody has the same advice: reduce large cap growth, overweight value stocks, small caps, and international stocks. Everybody hates bonds, especially US ones. Logically that all makes sense, but a.) I'm always weary when everybody is recommending the same thing and b.) I'm glad we don't have to manage money this way.

- I've not heard anybody predict an sort of economic problems. Again, I'm always weary when everybody is saying the same thing.

- One big name firm essentially endorsed the way SEM manages money when answering a question about fixed income. He said, "at these levels we have to understand your income can be generated by cashing in the gains on your account and not focusing on the yield." We've been saying that about Tactical Bond for 20 years whenever somebody asks us what the "yield" is. 2020 has again proven the value of having Tactical Bond as the core fixed income holding in most portfolios.

- The Janet Yellen/Jerome Powell Treasury/Fed dynamic is intriguing. For years both have called on more fiscal programs to balance the economy. Now Ms. Yellen will have the authority to push for these things. Like all structural problems, the long-term solutions are necessary, but could create short-term problems. With Joe Biden not having the same focus on the performance of the Dow, we may see more volatility in the markets as they work to implement some of their solutions.

- Short-term, the market "wants to go up". There are plenty of people who sold and stayed out of the market this entire rally. Any sell-off will initially be met with those people looking at it as a buying opportunity.

- Want to make a real difference? If you're a Christian, check out our Cornerstone Portfolios. Here's a great article from Courtney talking about why these portfolios are so important to us.

- Now is the time to make your plans for 2021. This year provided a "proof of concept" to SEM's behavioral approach. We can build customized portfolios for nearly every type of client, financial plan, and personality. You don't have to rely on predictions, vaccines, stimulus bills, or political parties to be successful. We let the data determine where and when to invest and leave the emotions out of it.

I hope all of you have a wonderful Christmas. Personally it's been an emotionally draining year. Life goes in cycles. We're ending the year on an up note with the birth of our second grandchild, Blake. Despite the tragic loss of our son Tyler, we know our family is incredibly blessed and so many families this year have had to deal with tragedies of their own. Nobody will ever take the place in our heart Tyler possessed, but Blake has already nestled right in there to help heal the pain a bit.