I'm not sure if the 3 day weekend in celebration of Independence Day was welcome given how different this July 4 was than all the others in my lifetime. I love our country so much, but I found myself needing to stay busy over the 3 days because every time I slowed down I was overwhelmingly sad about the state of our country. There are probably more descriptive words to use than sad, but I'm too mentally exhausted to come up with one.

I've studied demographics, the related social cycle, economic history, and human behavior enough that I should not be surprised at the state of our country right now. Heck, I've talked about how painful this period would be for the better part of a decade. It's just surreal to be living it. As a registered Independent (or "unaffiliated" in Virginia) I watch as both sides dig deeper and deeper into their political ideologies. This is part of the process, but doesn't make it any more comfortable.

We were privileged enough to see "Hamilton" at the beginning of the year as part of the "Broadway in Richmond" series. Who knew it'd be our first and only show of 2020. On the Fourth of July we watched it as a family on Disney+. First of all, to have my oldest daughter, who always hates when we talk politics or history AND our thirteen year old twin boys who "can't stand musicals" say they "loved it" says a lot about this impressive work of art. I know it is not historically accurate and some liberties were taken, but it was a reminder that our country has always had some divide. We've needed to compromise, but also not neglect or disparage those who disagree with us. You never know when you'll need them on our side. We're all part of the same team.

When we are dealing with unknowns, especially things that generate strong emotions, data is the only thing I have to turn to. I've always been a data nerd. When my dad limited my time playing games on our Apple IIC computer, I decided to make a database of all my baseball cards. I created a scoring system based on both career stats and improving trends. This allowed me to have a printout to know which cards I could trade and which ones I needed to target. Even then emotions still came into play. I wanted the entire Dodger roster. My data would often offend my friends when I tried to point out why I didn't think their card was worth what they wanted. Names were called, feelings were hurt, sometimes cards were thrown. At baseball practice, those feelings were put aside because we were all part of the same team.

My data might not agree with your outlook. My goal isn't to attack anybody's worldview. It's to provide an independent analysis to possibly give you a different look than you might see from others in our industry. The beauty of working with SEM is our economic, market, or political opinions have no bearing on our investment allocations. It doesn't matter if I'm "sad" or "excited" or even "delusional", if the systems say to allocate a certain way, that's what we do. It's the key to our success the past 28+ years.

Here's a quick update on last week's data as we start the 17th week of the Coronavirus panic.

Relative vs. Absolute Recovery

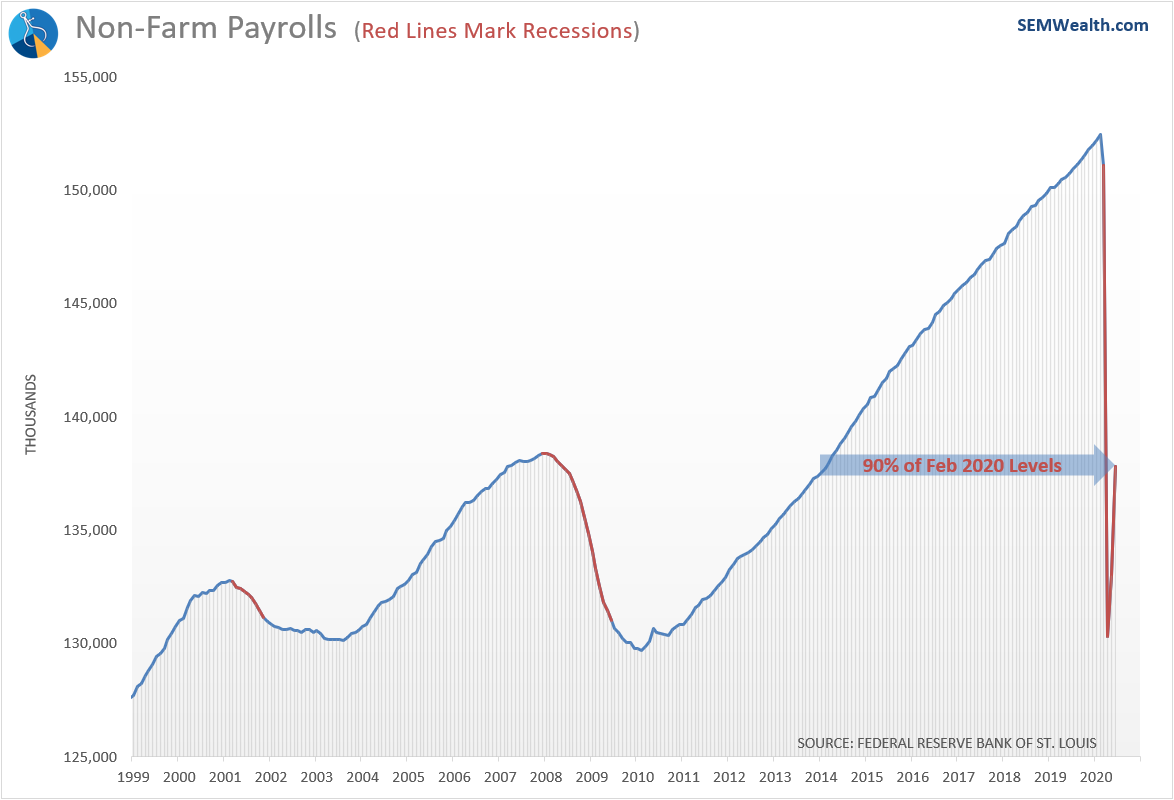

The market continues to focus on the "big" numbers showing the gains off the bottom. Those numbers are welcome, but what is more important for long-term growth (what you should be focused on if you are reliant on the stock market for your long-term gains) is the actual economic activity. Here's the updated jobs chart:

Through the second week of June (before the new round of shutdowns), we only had 90% of the jobs we had in February. What this chart doesn't show is the earnings from those jobs. I haven't had time to dig through those statistics since they do not factor into our economic models, but it is something to watch. If you worked 10 hours a week in June and didn't work in May, that counts as a "new job".

Economic Recovery Already Weakening

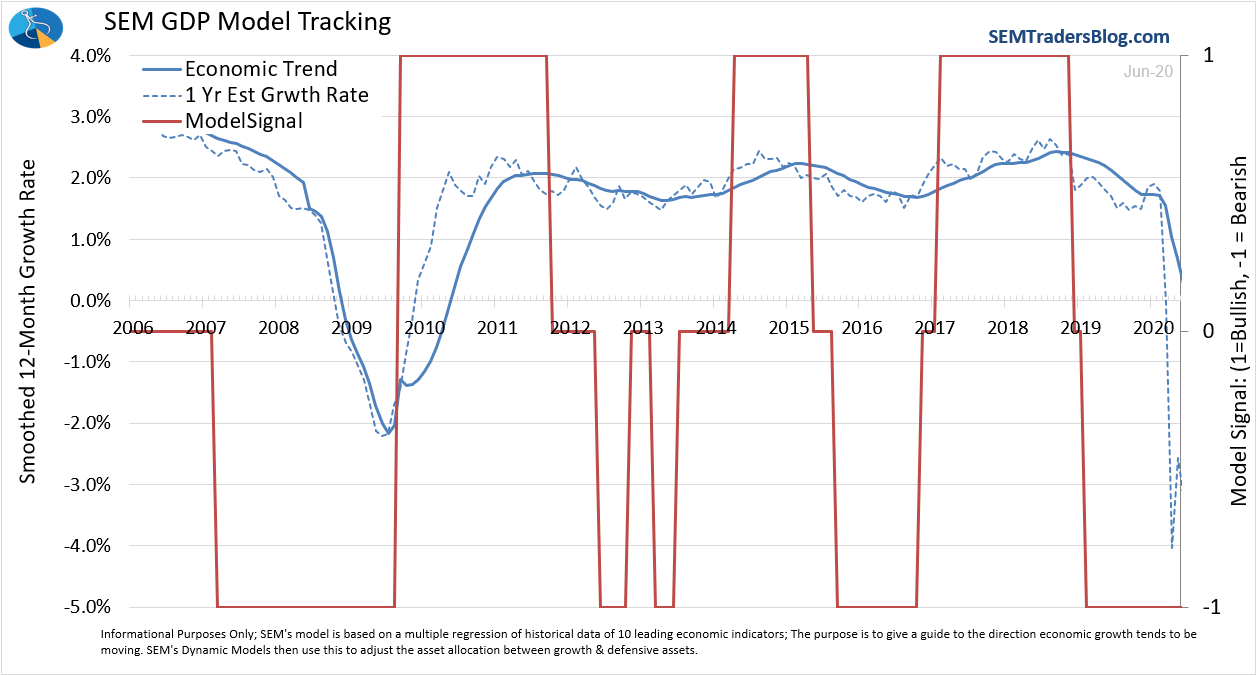

I was hopeful the sharp drop would make it easier for our economic model to flip back to "bullish". As you may recall, the model went bearish in February 2019 (a year before the recession started). This was due to the fact the impact of the Trump Tax Cuts only lasted a year, and companies were seeing their profit margins falling and revenue falling. The pace of job growth had slowed and consumers were going further into debt to support their spending. That's the economy many are hoping to return to.

Instead, the end of June numbers in our model show a slowing of the growth rate versus May (the dashed line). This leaves us in a "bearish" position in our Dynamic models. This doesn't mean we don't participate in rallies, it just means we avoid riskier assets like dividend stocks in our Income model and small cap stocks in our Aggressive model.

The data is obviously noisy, but the model is designed to adapt to the noise and volatility with a smoothing mechanism (the solid line).

Across the board our models are making money. Even though I question the logic of the rally, gains are gains. The nice part about our models versus those in a buy and hold or subjectively guessing what assets to own is we have a well designed set of systems to get us out when risk management becomes necessary again.

Watching the Experiments

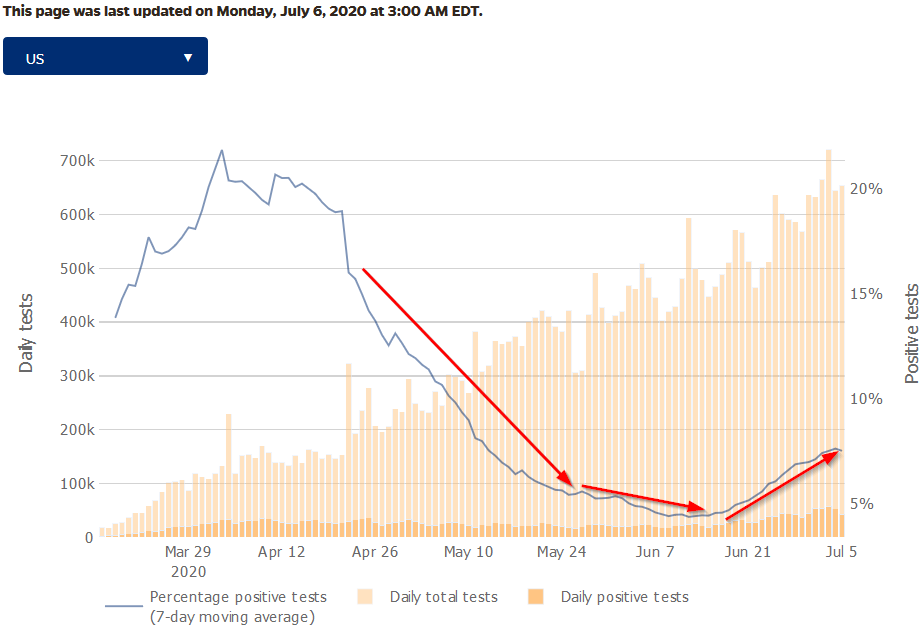

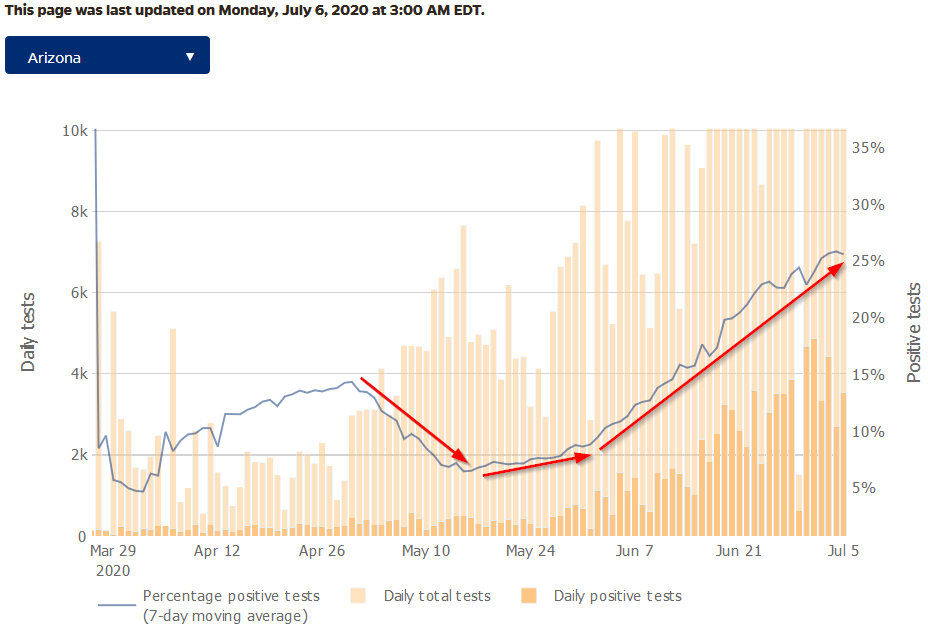

Finally, we continue to see "record" number of cases. We are always looking to "normalize" data so we actually have a comparison. This is why I like to watch the percent positive tests versus the actual number of cases. We have 50 different experiments going on in the country. Overall, the heavily populated northeast made the numbers very big. As they got things under control the rest of the country thought they could open up. Instead the virus has spread.

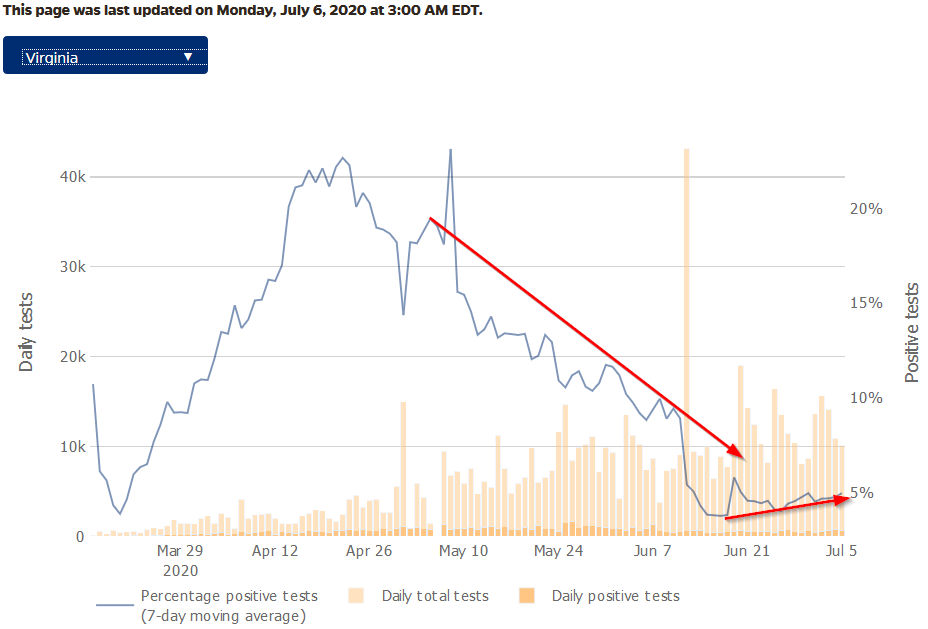

With offices in Virginia and Arizona I've been watching both closely. We've seen nearly opposite reactions to the virus. Virginia's doctor/governor has followed the recommendations of scientists, even as those recommendations shifted as they learned more about the virus.

Arizon'a business owner/governor instead listened to the pleas to stop hurting the economy. The attitude there was this whole thing was a hoax.

Hoax or not, the more I read about how the virus can hit you the less I ever want to contract it. I'm not as healthy as I once was and am considered "at risk" as doctors have discovered it's not just the "obese" (BMI over 40) who can have a hard time fighting the virus, but those "overweight" (BMI over 30). My BMI is 31.

Either way, I was on a video conference call with Dr. Rozien from the Mayo Clinic. His advice to be ready to fight COVID – exercise 30 minutes a day, cut your sugar intake in half, get 7-8 hours of sleep, and eat a balanced diet (along with good hand hygiene) also will increase your life expectancy and lower your risk of heart disease, diabetes, and other complications from our lifestyles.

I'm doing my best to follow his advice. I hit 4 out of 7 days of exercise last week. Hoping to make it 5 out of 7 this week. Those who know me know the sugar intake may be an issue. Even making the effort helps. It also helps with our attitudes and emotions.

Have a safe and healthy week!