Like a prisoner, marking the days is a way to keep track of the passage of time. Days can blur together and it is easy to lose touch with the outside world. For the past 19 weeks I've been marking the weeks with the hope we'll be able to resume our "normal" lives. It was 19 weeks ago when our country suddenly panicked about the spread of the coronavirus. That was when first the NBA and then every major sport suspended their seasons. Schools and businesses shutdown and most of us were told to stay at home. Over the next two weeks both the MLB and NBA will resume/start their seasons. It will certainly look different than what we are used to.

Scientists continue to learn about this virus and how it spreads. The major sports leagues will help with those studies. Besides the excitement of a few more sports resuming play, here's my notes from my weekend reading:

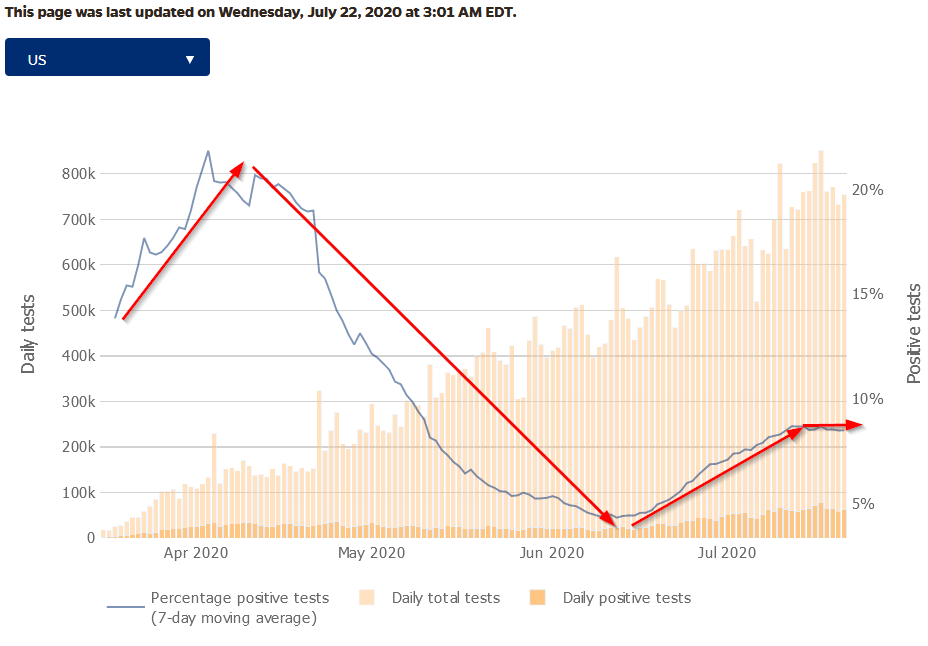

Is this not the second wave?

"Record case numbers" are the headlines, but I choose to focus on the percentage of positive cases. This gives us a more clear picture of the spread of the virus in a community as well as the overall trends. The problem now is the data is going to be less reliable as testing supplies are running out and results are taking over a week for many people. At that point, what's the point in being tested if you don't get the results until the very end of the time you'd infect people? Add to that the long wait times to even take the test and you get fewer people being tested.

Either way, the percent positive tests have not been moving in the right direction, although they've flattened over the past few days.

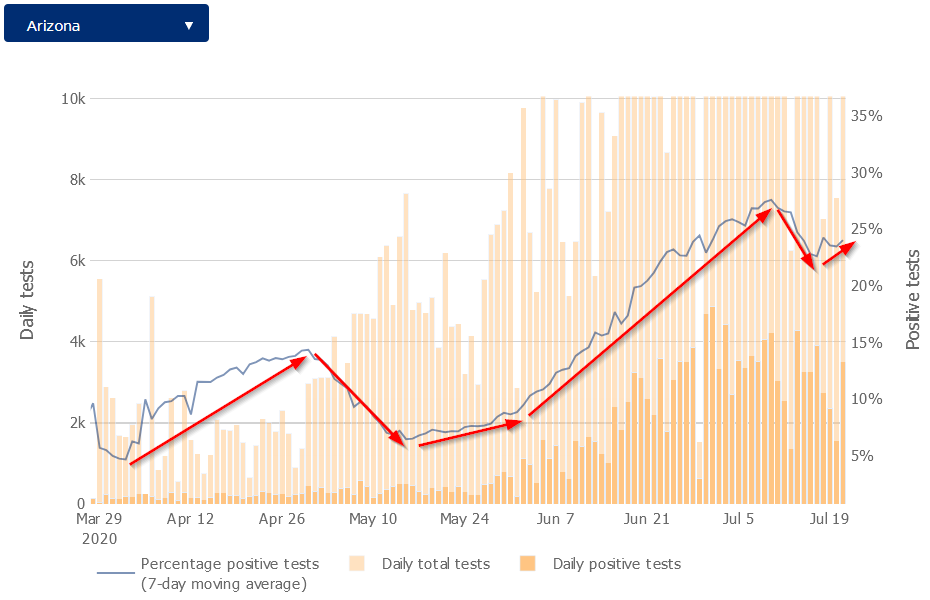

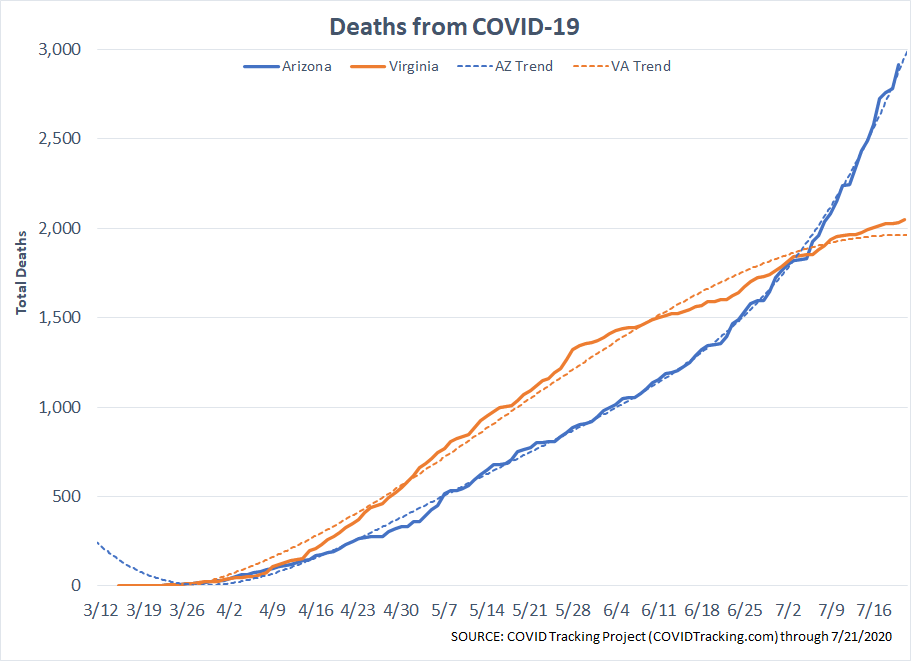

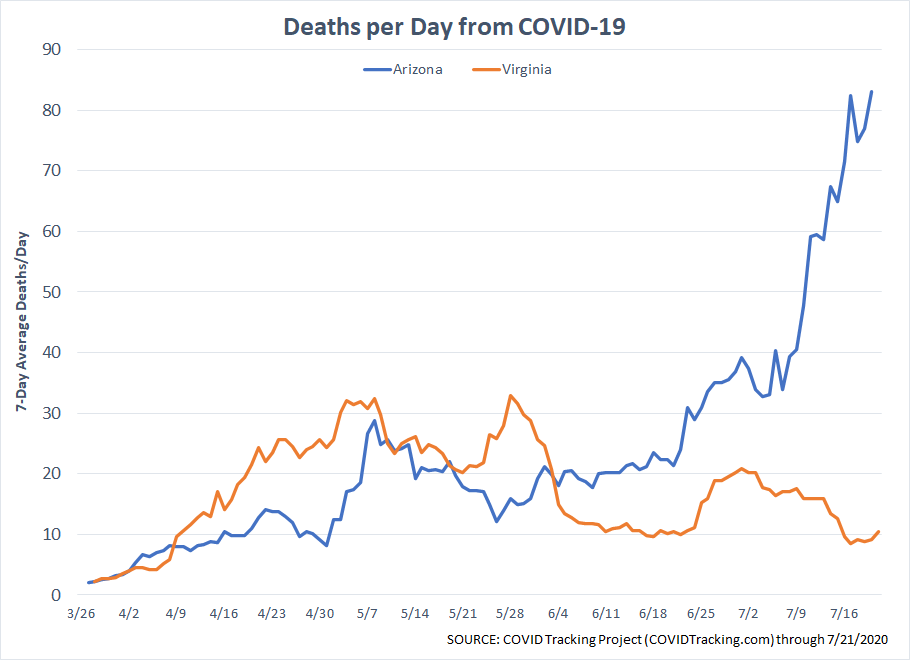

With offices and friends/family in both Virginia and Arizona I've been watching these two states closely. Arizona has been in the national news due to their outbreak. This didn't surprise me at all. I commented on March 25 that the attitude in Arizona was that the virus was not a big deal. The culture in Arizona is similar to Texas in that the people do not want the government telling them what to do.

These charts from John Hopkins have different scales. While the 7-day trend did improve in Arizona, keep in mind that's still close to 1/4 of all tests coming back positive.

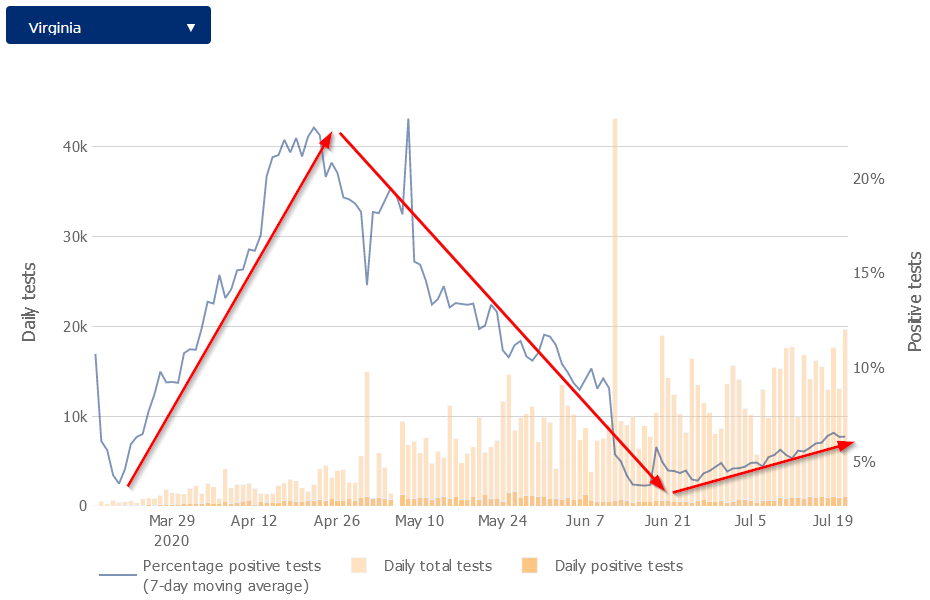

Virginia had a different experience. There were many outbreaks in nursing homes across the state, as well as widespread cases in the Washington DC area. The state took a very measured approach to re-openings. "Phase 3" began on July 1. Masks are still required, but restaurants can have indoor seating, gatherings up to 250 people are allowed, and some sports (such as soccer) have been able to resume play.

The state overall is seeing an increase in positive tests, but so far it appears those are all directly related to a large spike in the Virginia Beach area. That area is seeing close to 20% of all tests returned positive, while the rest of the state is less than 5%. Where we are at we've had 84 total cases (out of 22,000) people and 1 death. It will be interesting to see if the outbreak in Virginia Beach spreads to the rest of the state.

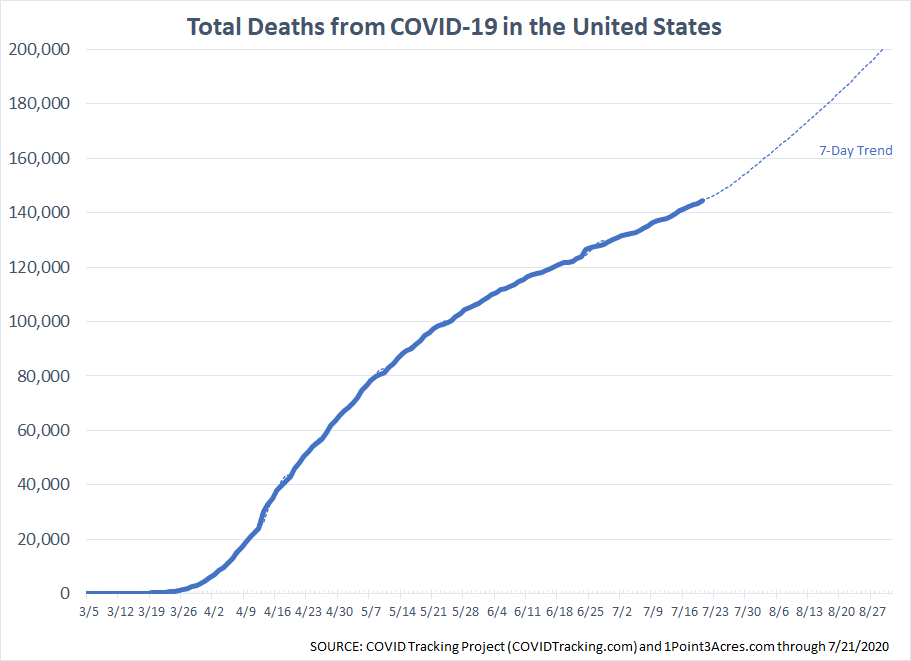

I realize many people question the test results. I've even seen some question hospitalizations. What is difficult to question is the number of deaths. Whether they are due to preexisting conditions or not, it is still somebody who died sooner than they would have without COVID19. I've been tracking these since early April when the President warned about 100,000 - 240,000 deaths. He had been spooked by both a couple of close business associates dying from COVID19 as well as some models that showed without any precautions deaths would go exponential.

We've hit the 100,000 mark. The rate of change on the trend has increased slightly over the past week, with the trend hitting the 200,000 mark by the end of August.

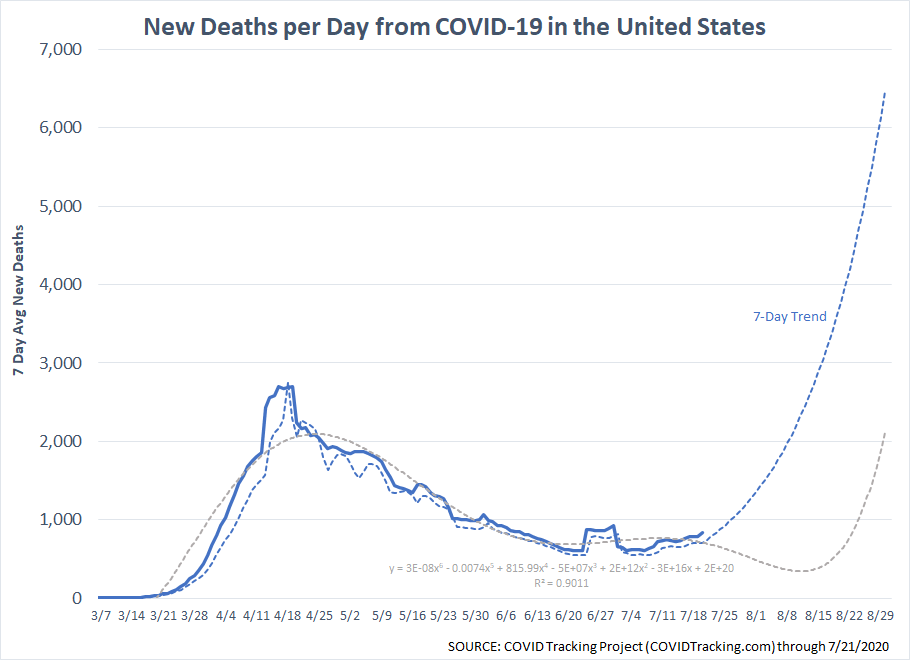

The deaths per day also had been trending downward and one model had them down to zero by the end of July, but is now showing a likely increase over the next month.

Looking back in at Arizona and Virginia, you can again see the difference in policies. I've pointed to Virginia as an example of what they meant when we were told the goal was to "flatten the curve".

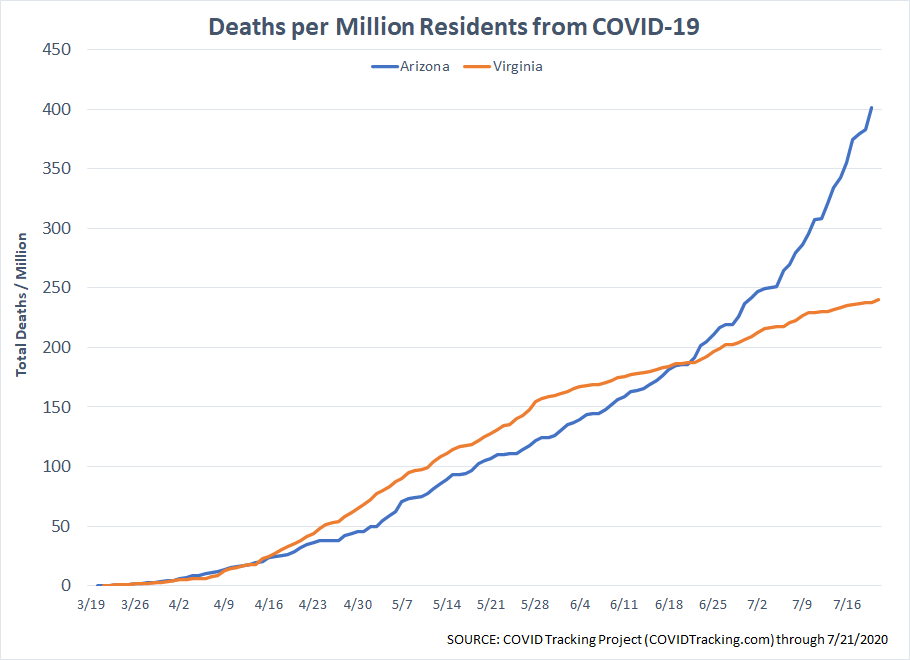

When you factor in the fact there are 2.5 million MORE people in Virginia than Arizona, this makes the difference even more glaring. When looking at the deaths per million people you really see what a curve flattening was designed to look like.

Finally, the deaths per day really highlight the issue. The more cases, the more deaths. Do what you want with the data. My point in showing it is to illustrate the very unscientific experiment we are seeing going on around our country. One state followed the recommendations of the CDC and other epidemiology experts, the other followed the "suggestions" of the President to "re-open quickly". Economically and socially we still do not know which way was right, but we do have more data today than we did 19 weeks ago when the whole pandemic began.

The best news is we are likely to get a vaccine. Of course we don't know when, how it will be distributed, or how many people can be vaccinated the first year, but I continue to have hope our scientists if given enough time will kick this thing. We also have learned so much in terms of treating the virus. Simple things such as being able to identify how it is attacking a patient's body is reducing the use of ventilators. Knowing many people died of blood clots, kidney failure, or attacks on the heart is also helping doctors reduce the number of people dying. I'm fully confident science will win and we are much better off now than we were 19 weeks ago.

Everything is political

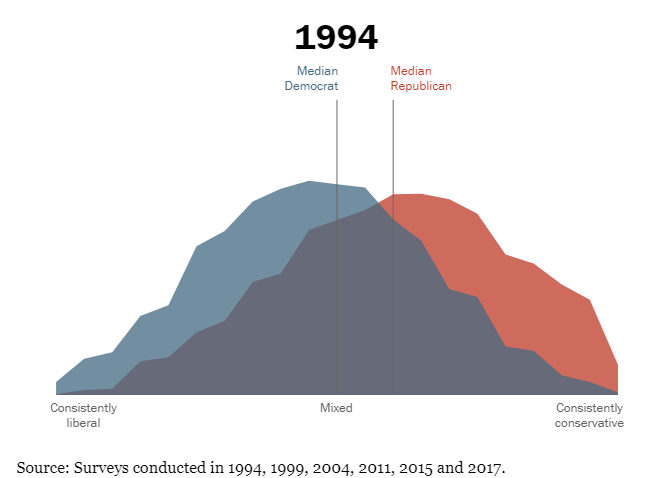

I realize I may have offended half or more of our readers with the first section of this week's musings. That was certainly not my intent. I'm a registered Independent because neither party represents what I personally believe is the way our country should be run. I strongly agree and disagree with aspects of both political parties. This allows me to vote beyond just the (R) or (D) behind a candidate's name. Based on several surveys I think many of you probably fall more in the middle of the political spectrum as well. The younger you are, the more likely you are to feel as if neither party represents your personal beliefs.

This is no surprise. It's part of the social cycle. One of my most popular posts dove into this issue back in 2017. I haven't seen the survey results updated since then, but based on what we see coming out of Washington, the parties are more polarized now than they were a few years back.

As an Independent, I don't see how mandating masks in certain situations, having some business restrictions, reporting data to the CDC, or funding virus testing for the individual states should be a political issue. As humans we've proven time and time again we are not that great at doing what we should. This is where the government is supposed to come in – to create guidelines and protections for the good of the country.

Think about this – if we as a country were good at doing what is best, we would not be overweight. 37% of Americans are "obese" (BMI over 40). Another 33% are "overweight" (BMI over 30) [source]. 70% of Americans are overweight. I'm in that category as well. [Side note - I've gained the "COVID-19" (actually 20) since March. That put my BMI over 30. I tried starting a month ago and got derailed by "life", but have vowed to get back on track to a healthier lifestyle. If we talk, ask how I'm doing and hold me accountable.]

Doctors are now finding a BMI over 30 puts you at higher risk of hospitalization and death from COVID19. In addition, it puts you at risk of heart disease, diabetes, and many other health risks. If we were good at doing the right thing (myself included), we wouldn't be an overweight nation.

We're all human, which means we naturally have certain biases when it comes to making decisions. This is why I continue to recommend reviewing Cody's excellent article on how our brains are adapting to COVID19.

What about the economy?

With an unprecedented pandemic, we are also seeing an unprecedented economic impact. This has created a lot of noisy data points. Focusing more on the bigger picture trends and where we end up will be important as we move through this crisis. The big question, of course will be what the impact of the spread of the virus across the south will be on the economic recovery. At a minimum, the recovery will be pushed back a bit.

The other big question is the impact of the CARES act. From PPP loans, to the stimulus checks, to the extension of unemployment benefits, the impact has already hit the economy for the most part. With Congress debating another round of stimulus we will have to see how much more they can do to jump start economic growth.

What we've likely seen is a delay, but not halt of business closures, layoffs, and loan defaults that always occur during a recession. PPP loans gave money to companies that had to be spent on employees who were not generating revenue. With those funds gone, business restrictions still in place, and the economy not growing as quickly as necessary, many of those companies will be forced to shutdown. It's a sad, but necessary part of a recession. Without a cleansing event where the weak companies are closed, investment capital is absorbed by weak companies instead of flowing to new or growing companies.

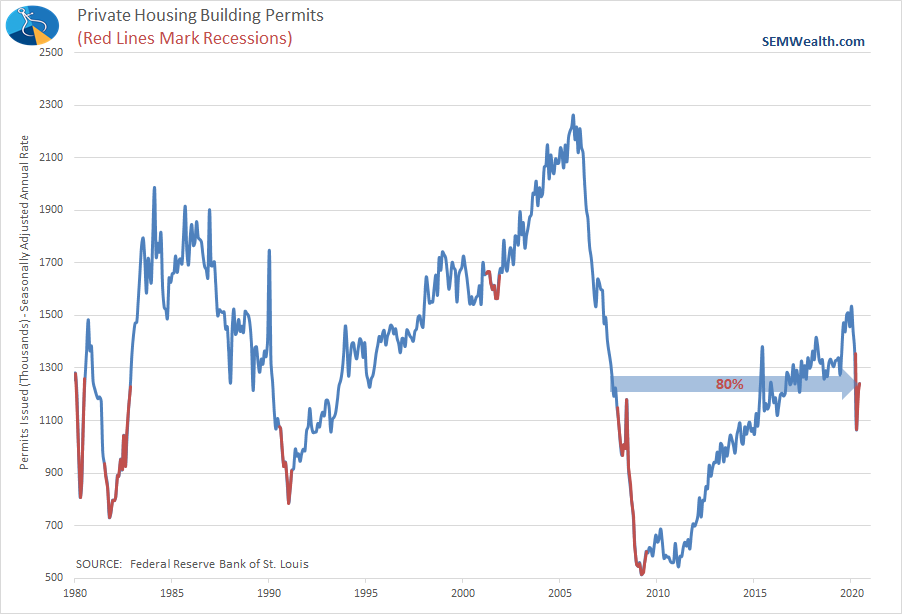

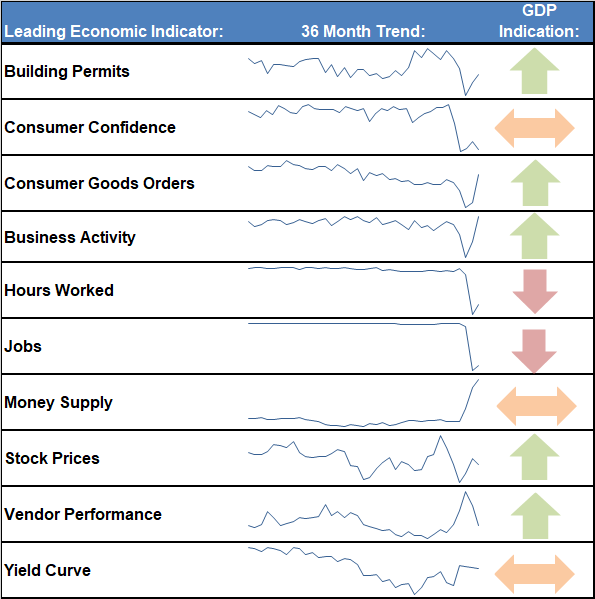

Last week we received a few more economic data points. Housing will be an interesting segment to watch. With more firms allowing permanent work-from-home arrangements, we could see more people moving further from the city centers. I've always watched Housing Starts and Building Permits closely as the amount of economic activity surrounding the building and purchase of a new home is significant. It also shows confidence in the economy. Last week we received the June housing numbers. Permits have grown to the point they are only 2% below where they were at a year ago. The problem is the level we are at is still just 80% of the January peak.

June's activity is just 54% of the peak before the housing market crashed in 2008.

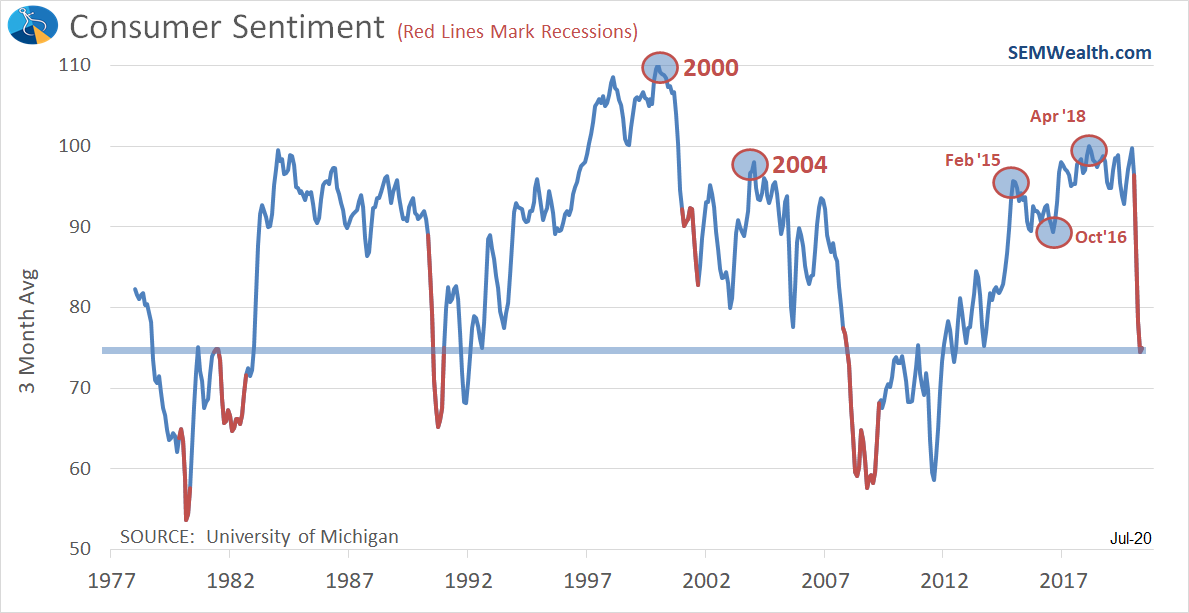

We also saw the preliminary reading on Consumer Sentiment for July. This number was a big disappointment for any of us hoping the economy is going to be roaring back by the fall.

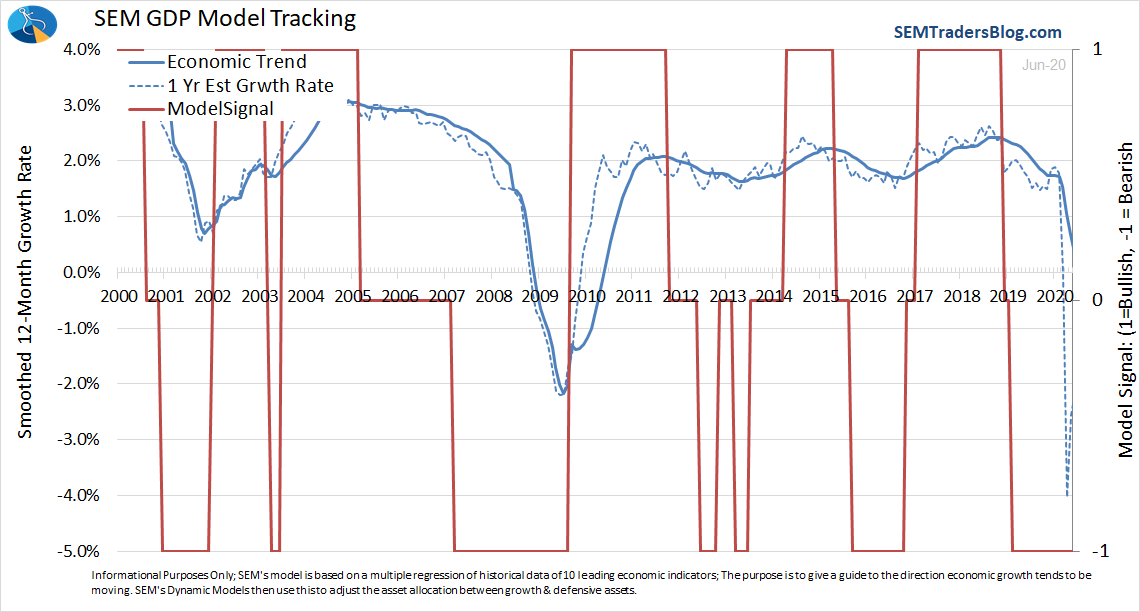

Our economic model remains "bearish" as it has been since February 2019. Remember, the economy everyone is longing for was already week when we started the year. The impact of the tax cuts had already worn off. Profit margins and revenues were declining. Leverage in both household and business sectors was above pre-2008 levels. Our model is designed to adjust around all the noise and pick-up on trends. So far, the bounce is nothing to be excited about.

Here's our updated dashboard:

What about the Fed?

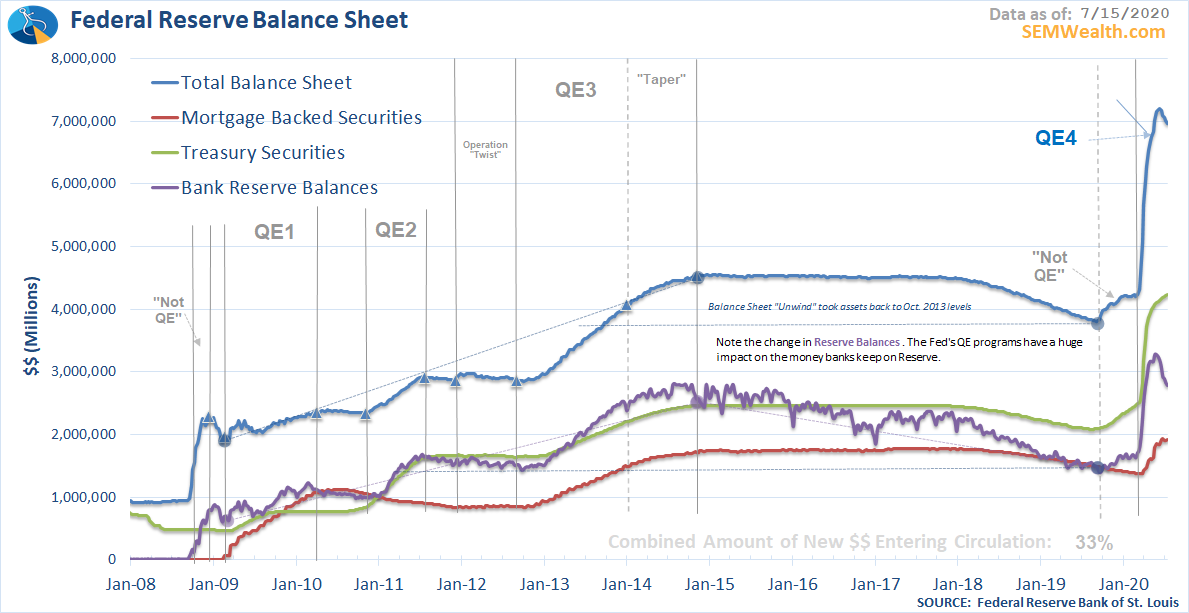

'Don't fight the Fed' has certainly been one of the more popular cliches used the past few months to justify the stock rally. I'll be the first to admit, what the Fed did in March and April to save the financial system was surprising and very effective. However, now we have an issue that makes the "unwind" they attempted from 2018 to early 2020 seem like a non-event. They've created their own "zombie" companies – saving companies that should not have been saved, which saps investment capital from companies who should attract more investments. At best, the Fed's actions will be a drag on growth. At worst, they've completely skewed the risk/return relationship which means we'll have more shocks in the years ahead where the system suddenly stops working and the Fed has to step in with "emergency" measures.

The good news is the usage of the Fed's facilities has slowed enough their balance sheet has declined a bit the past 5 weeks. In the whole scheme of things this could be a minor slowdown, but it is encouraging short-term. Increases in the balance sheet could also be seen as a sign banks are struggling, which could be a much bigger concern for those banking on a strong economic recovery. Here's the updated Fed Balance Sheet chart.

Remember, the "not QE" was before the pandemic. The banking system was showing signs of stress. This is the economy everyone is longing for. There is no telling how this plays out, but it is worth keeping an eye on.

Not being paid to take risk

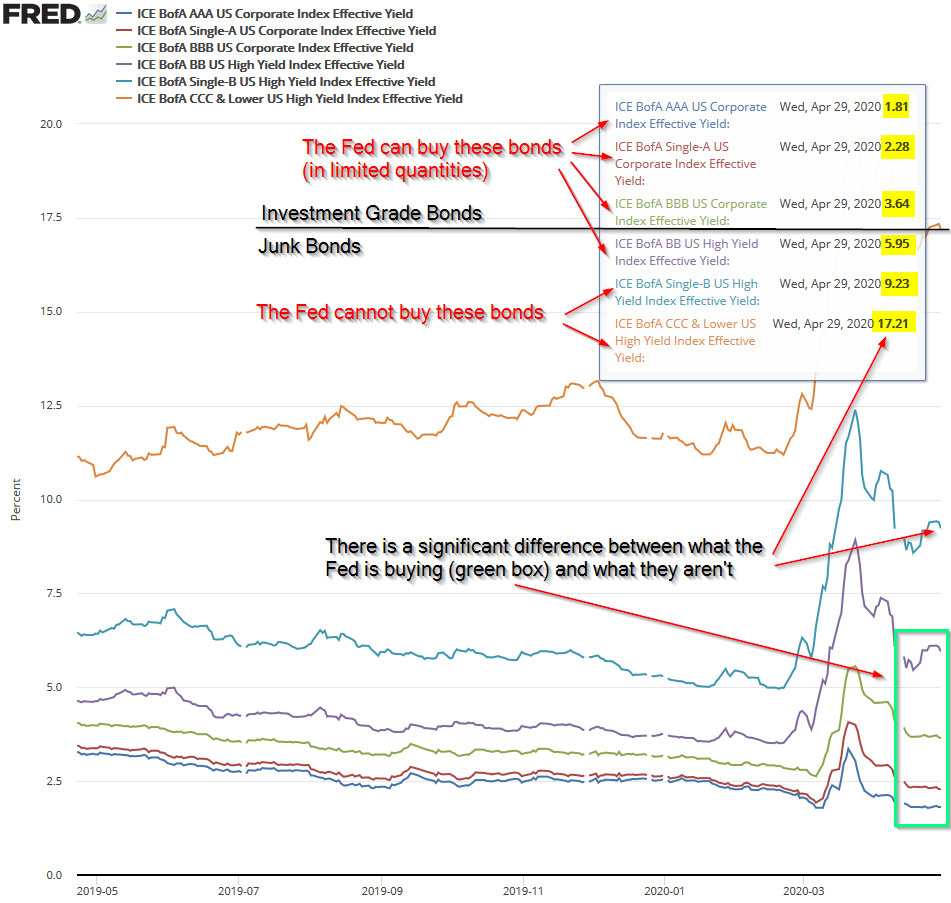

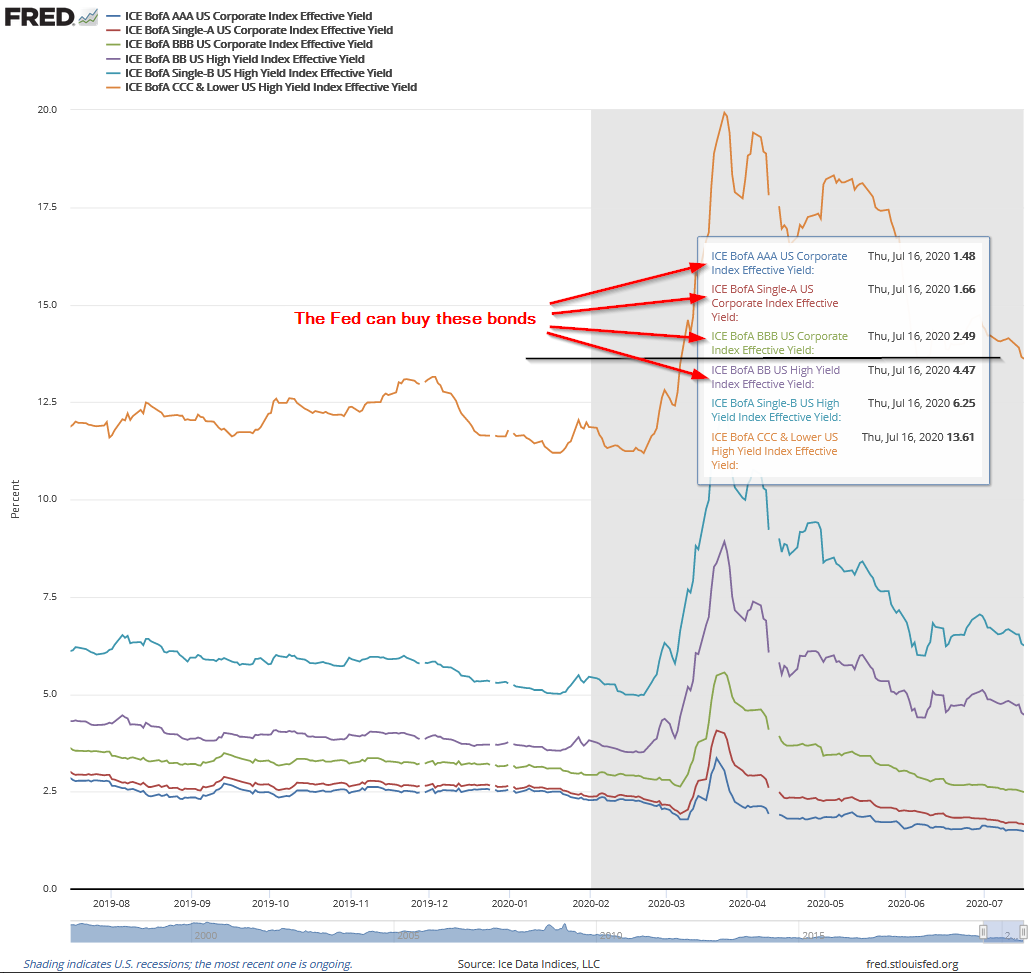

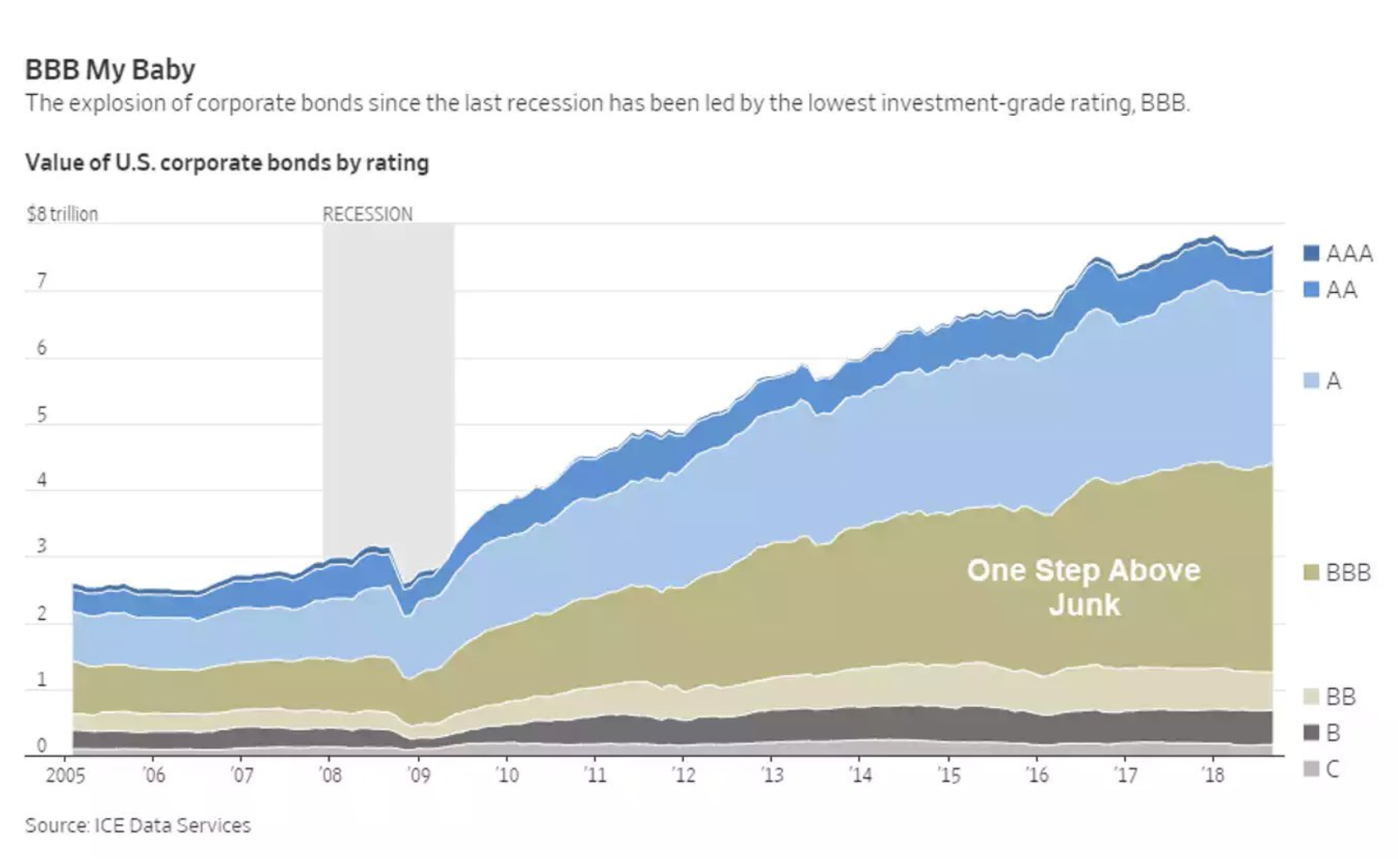

One of the key things the Fed has done is create a perceived safety net for the corporate bond market. We were quite excited about the opportunities in high yield bonds. As the spread between high yield issues and Treasury Bonds increase, we have tremendous opportunities to sweep into high yields at bargain prices. Unfortunately, the Fed has delayed the huge opportunities.

This doesn't mean we haven't made some nice gains (up 5-6% on the trade so far). We are still invested in high yield bonds, but the upside is greatly diminished since we entered the positions in mid-April. Given the huge risks in the bond market, especially in the bonds the Fed cannot buy (Single-B rated and below), the yield you're being paid is not too attractive given how we've yet seen the inevitable spike in defaults that come after a recession.

In addition, the risks we identified a little over a year ago in our "Investment Grade Junk" piece have not gone away. If anything they've gotten bigger. Like our opportunities in high yields, it's simply been delayed.

The biggest unknown is the impact the pandemic will have on pensions. I looked at one last week that promised a 5% guaranteed return for the next 10 years. At retirement, the employee could opt into an annuity with a starting payout of 8%. I've seen other pensions with guarantees in the 4-6% range the past few months. Look at the current level of yields. What are you investing in today to get a 5% guarantee? The highest rated junk bond is paying 4.5%. Whether in a pension, an insurance contract, or a money market account, with rates at 0%, the higher the promised payout, the higher the risk the "guarantee" won't happen.

Expectations are important

The key with our behavioral approach is to properly set expectations. While I'm confident over the long-term stocks will be higher than they are today, the next several years are likely to be difficult. Valuations in the stock and bond market do not reflect any of the long-term STRUCTURAL damage that has occurred. They do not factor in demographics, tax structure, entitlement programs, or pension obligations. If investors aren't ready for severe declines in their portfolios most will abandon them.

When that happens I don't know. I do know that three industry big shots all are concerned about the recovery and what that means for returns going forward.

- Alianz's Mohamed El-Erian: "The financial stress caused by COVID-19 is far from over."

- Doubleline's Jeffrey Gundlach: "A quick economic recovery is highly optimistic and probably not even plausible"

- Blackrock's Larry Fink: "The US economic recovery is going to take longer than the market expects."

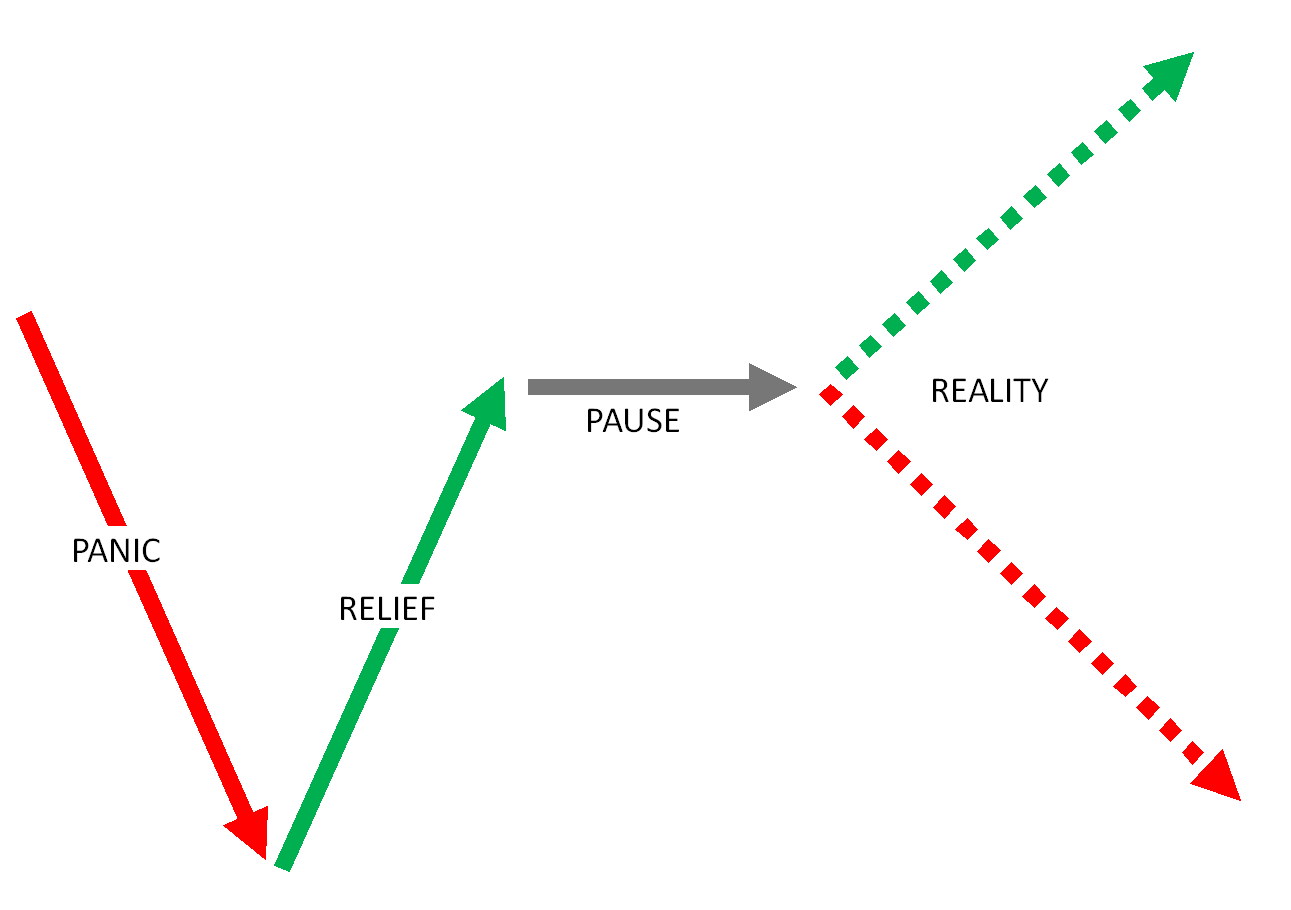

Whatever happens, we are ready

We outlined the pattern the stock market is following in last week's Chart of the Week. I'd encourage you to take a look. I'm quite pleased how we are positioned and would encourage you to look closely at your own strategies outside of SEM. This "pause" is the perfect opportunity to put yourself in a position to not have to worry about the next move.