SEMWealth.com has a lot of resources available. Are you having a hard time finding them on the website? This short webinar briefly walks through where to find the most popular resources, how the website can be used in client presentations, and the overall layout to allow you to use

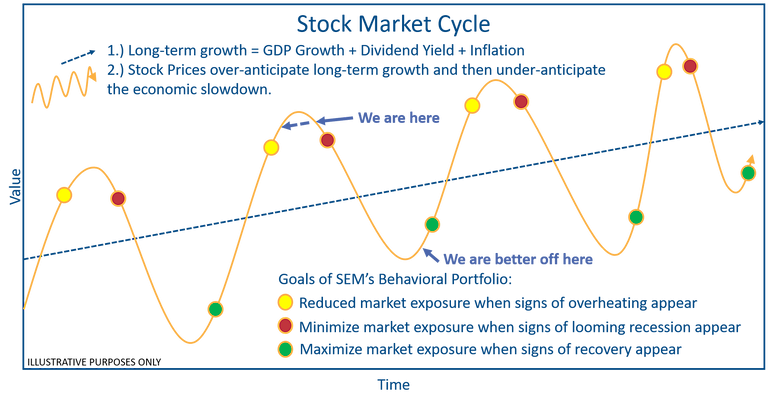

Despite my nickname of "Mr. Sunshine" I actually am an optimist at heart. I believe America will continue to prosper and be a global economic super-power. I have faith our citizens will be able to (eventually) put aside their growing ideological differences and do what is right for America. I

Happy National Championship Tuesday! My prediction of the Tigers winning the game came true, and I’m sure all you funny guys and girls out there also felt the same way about your own predictions (for those that aren’t aware, both teams’ mascots were the Tigers.) And for those

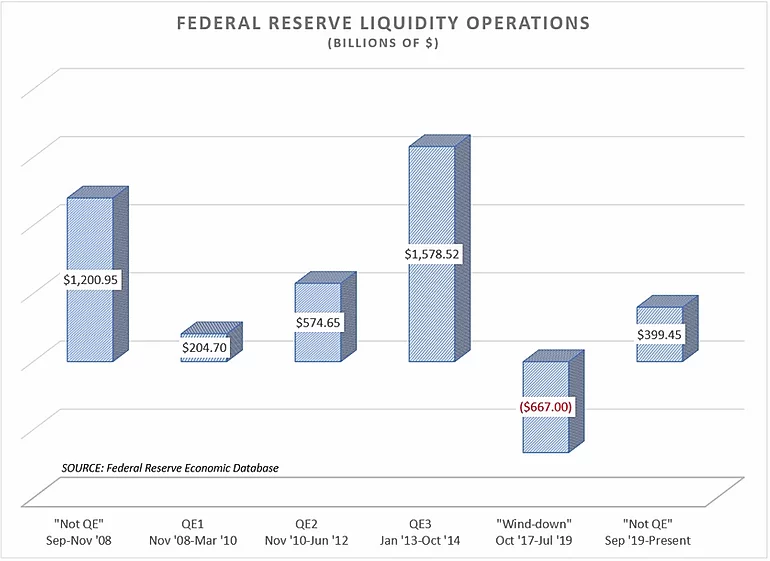

As we start a new decade it appears we will continue to have "unprecedented" measures by the Federal Reserve to keep the markets rising. While the Fed refuses to call the huge influx of cash into the banking system "Quantitative Easing (QE)," the fact the banking system still needs the

Party like it's 1999!

On paper 2019 is going down as the best year for the S&P 500 since 1997. The euphoria and confidence we are seeing at the end of the year feels quite similar to what we experienced at the end of the 1990s. It is