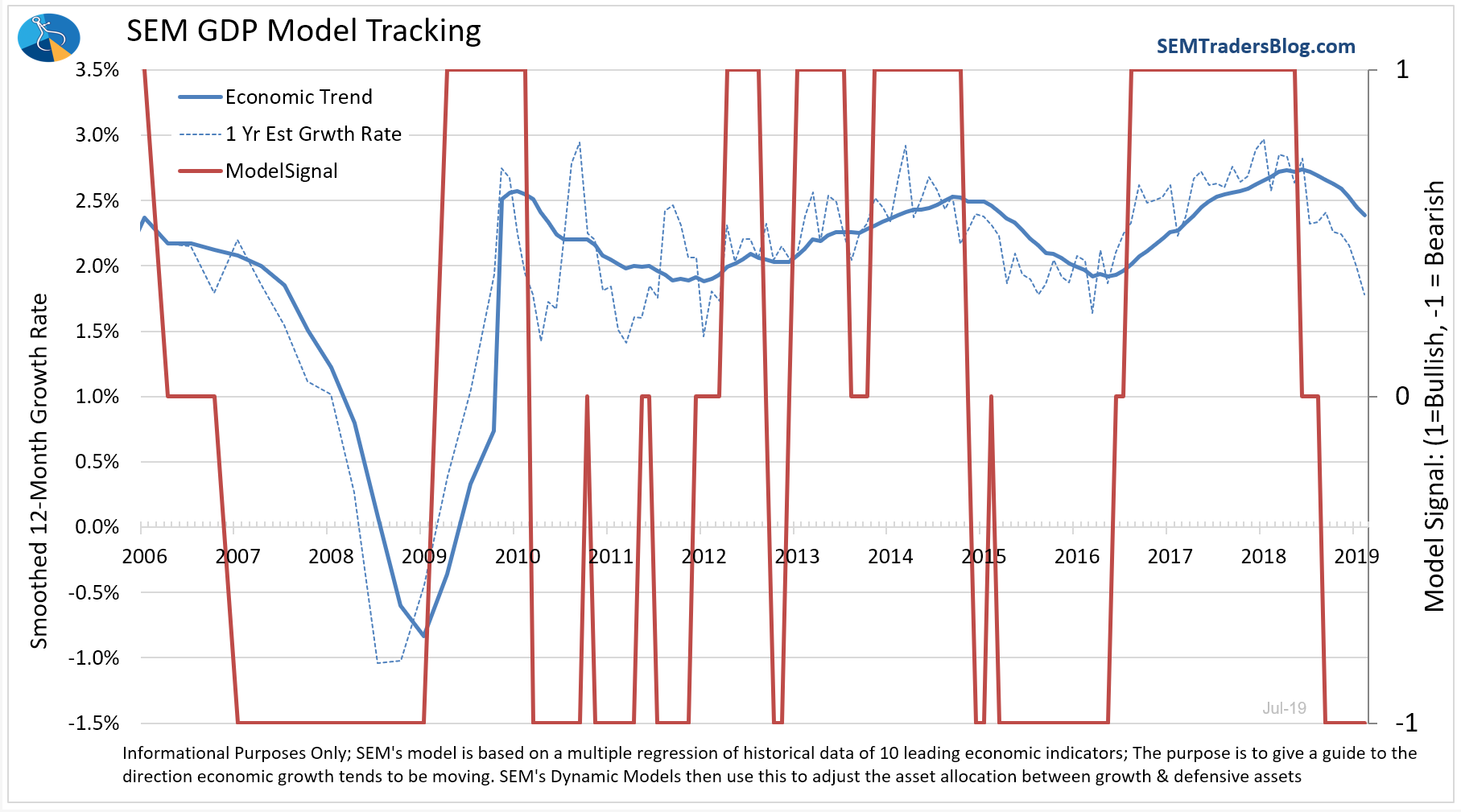

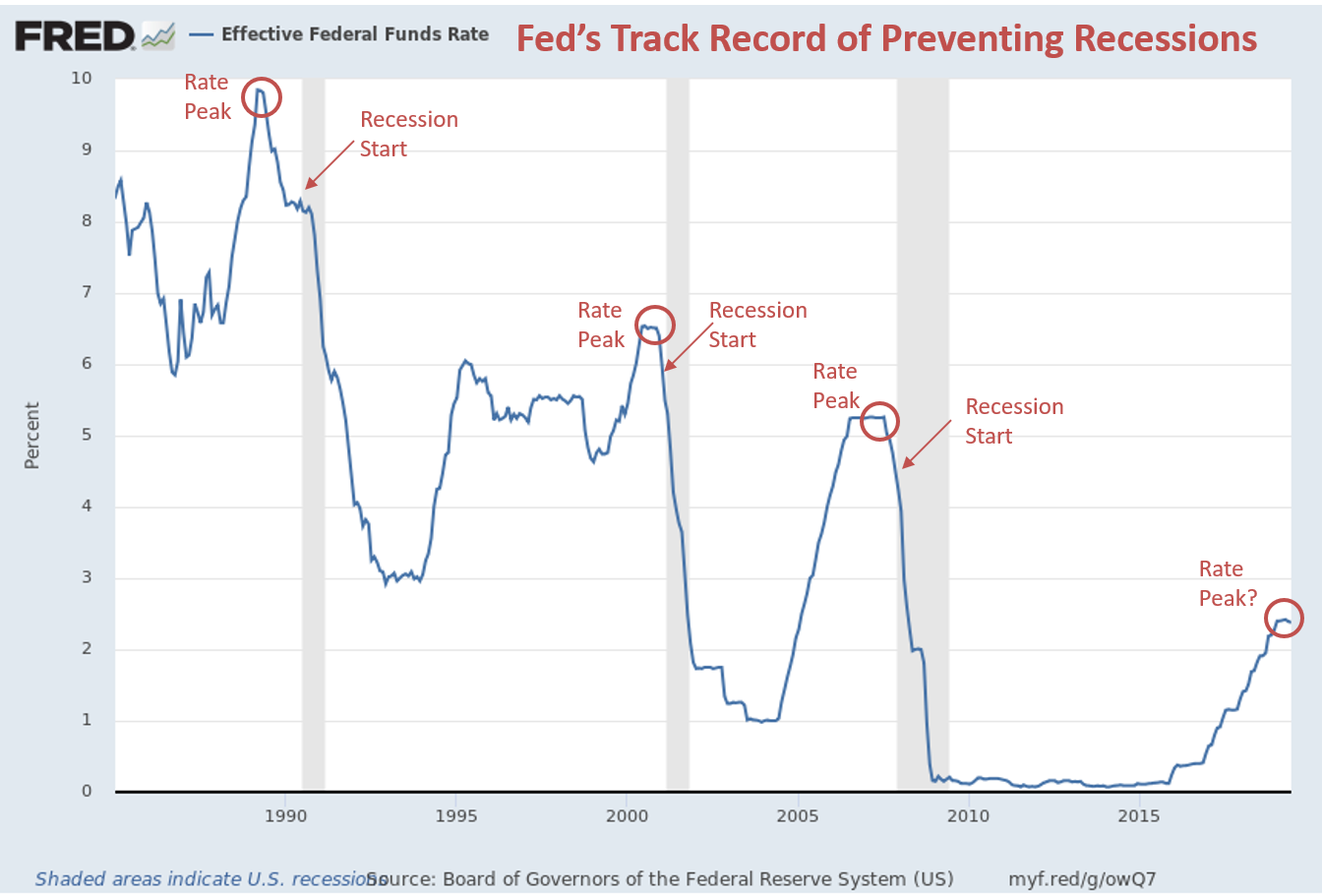

Last March the markets panicked as the yield curve “inverted”. It inverted once again this week causing a sharp sell-off on Wednesday. An inverted yield curve means short-term interest rates are higher than long-term interest rates. This has long been known as a leading indicator of a recession.

Some pundits have postulated that the President’s “hold my beer” tweet following the Fed’s decision to “only” cut interest rates by 1/4% instead of 1/2% was to force the Fed’s hand into cutting rates much more significantly in

Thursday started as a good day. After a slow start to the day, the stock market was staging a nice rally as investors figured one rate cut was better than no rate cuts. Both Treasury bonds and high yield bonds were sharply higher (which isn’t usually the case,

The Federal reserve cut interest rates for the first time since 2008. Since late 2015, they have raised short-term interest rates from near 0% to 2.25%. Since June when the Fed hinted at the chances they would cut rates at their next meeting, investors have poured money into the

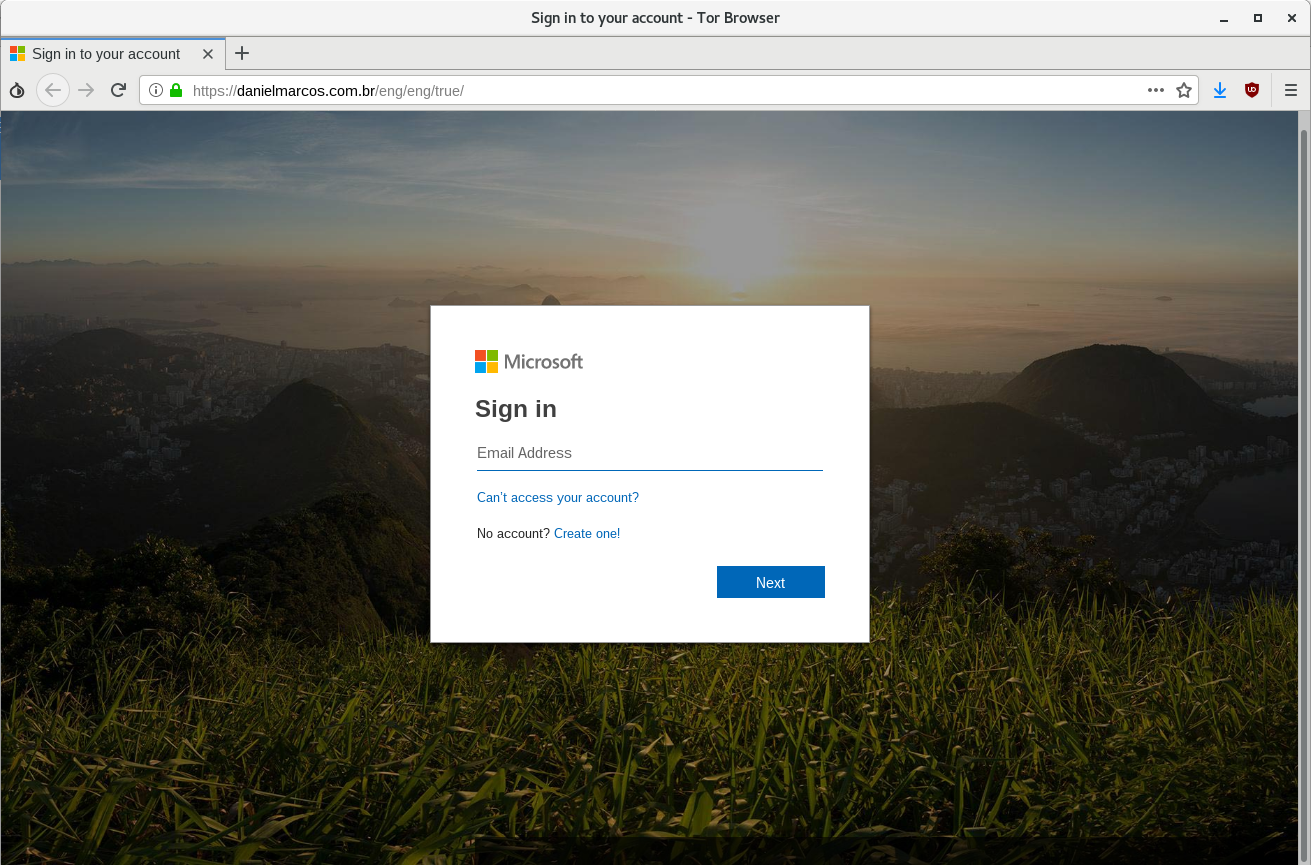

Last week we dealt with a phishing attack that turned out to be a bit scary. The attack used a technique that I knew was possible, but had only read about before (check out this post on Reddit). This was the first time I had actually seen it for myself.