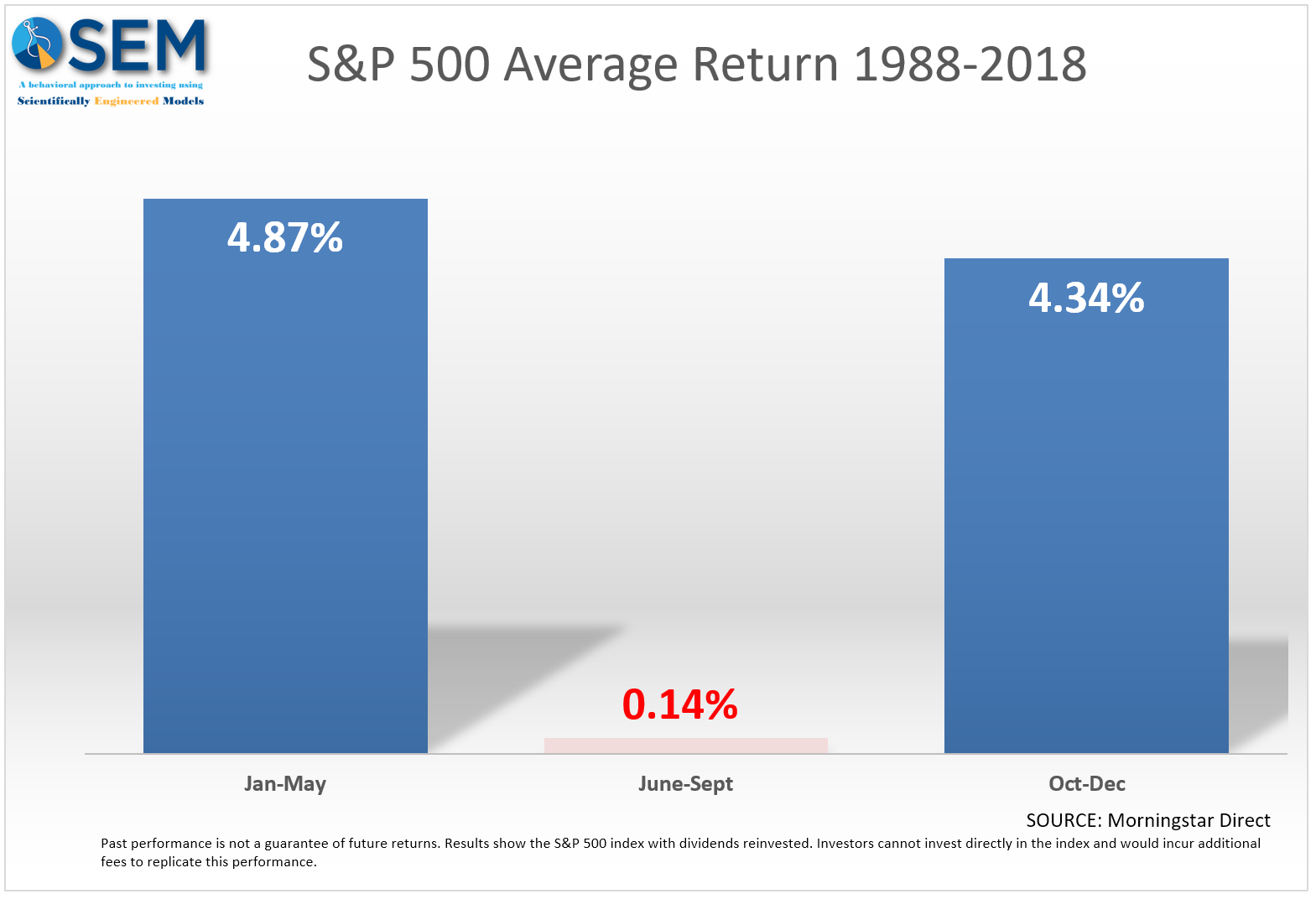

There are plenty of Wall Street sayings that become cemented in investors’ brains. Often times those phrases are not necessarily based on sound logic or representative of the current market. One of those that has (mostly) held up through time is “Sell in May & Go Away.”

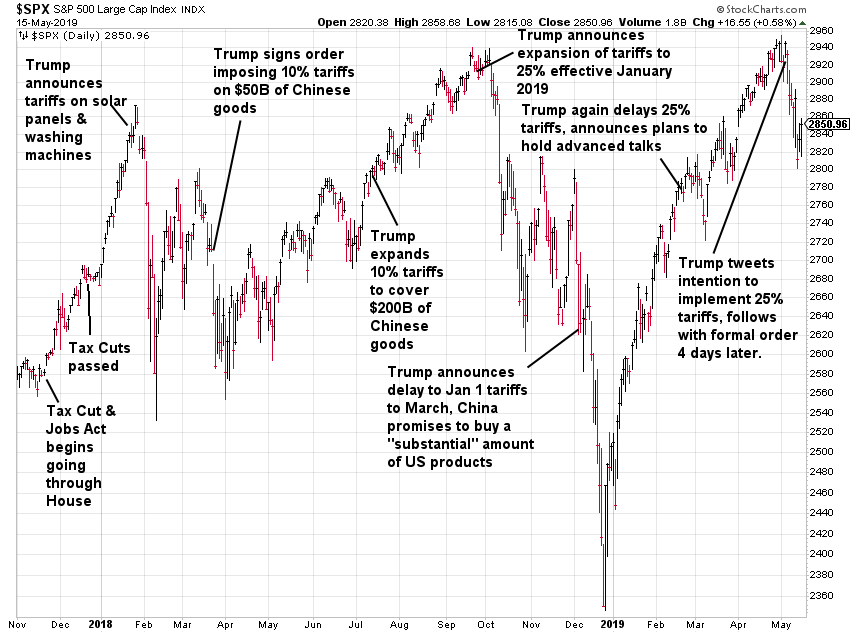

Stocks are attempting to stabilize after President Trump threw everyone for a loop by Tweeting his intention to hike tariffs on $200 Billion of Chinese goods ahead of what was expected to be the week that ended the 17 month trade war. Rather than going into the whys, hows, whats,

At the end of April the S&P 500 (barely) reached a new all-time high. The next day, Federal Reserve Chairman Jerome Powell mentioned the slowdown in the economy is likely “transitory”, which is Fed-speak for temporary. This seemed to remove the prospects from traders’ minds about a rate

GDP growth surprised nearly everyone in the 1st quarter rising 3.2% in the past year. The president of course pointed to his economic policies as the cause of this “great” increase. Never mind the fact the long-term average growth rate is 3.1%. This has been the

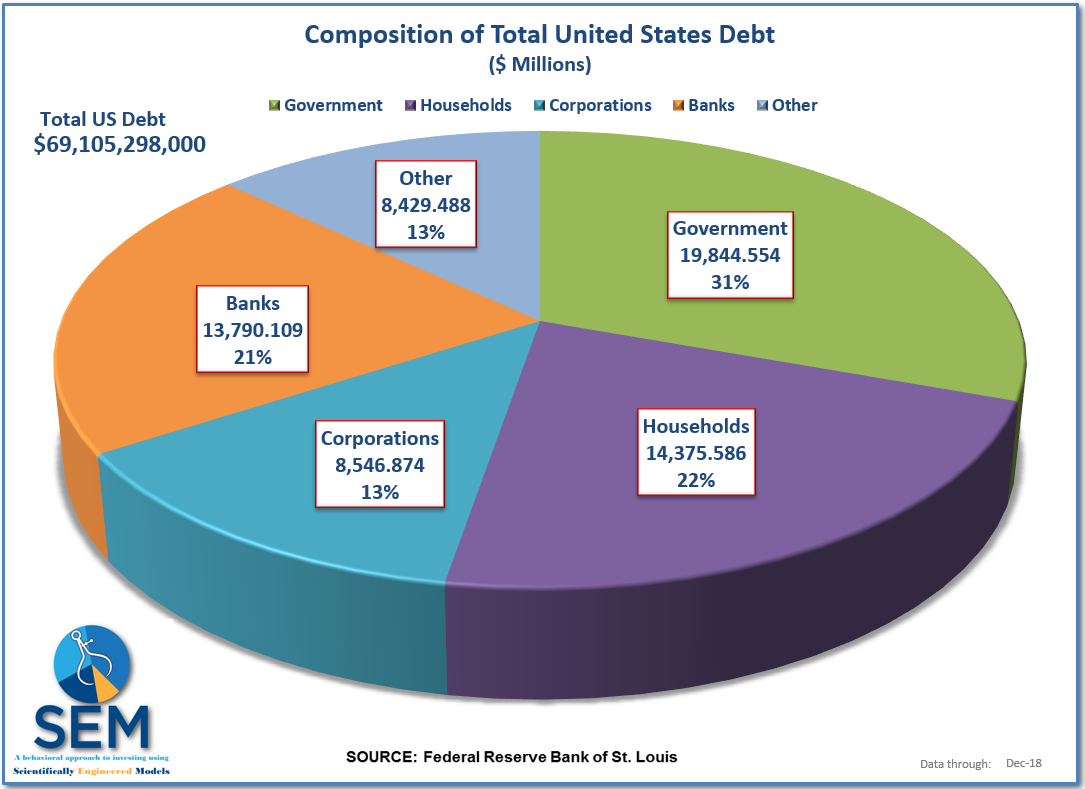

This week the Trustees of the Social Security & Medicare Trust funds released their annual report. They reported under current law Medicare will be insolvent by 2026 and Social Security by 2035. That’s in 7 & 16 years respectively. Their assumptions also include steady 3% economic growth with no