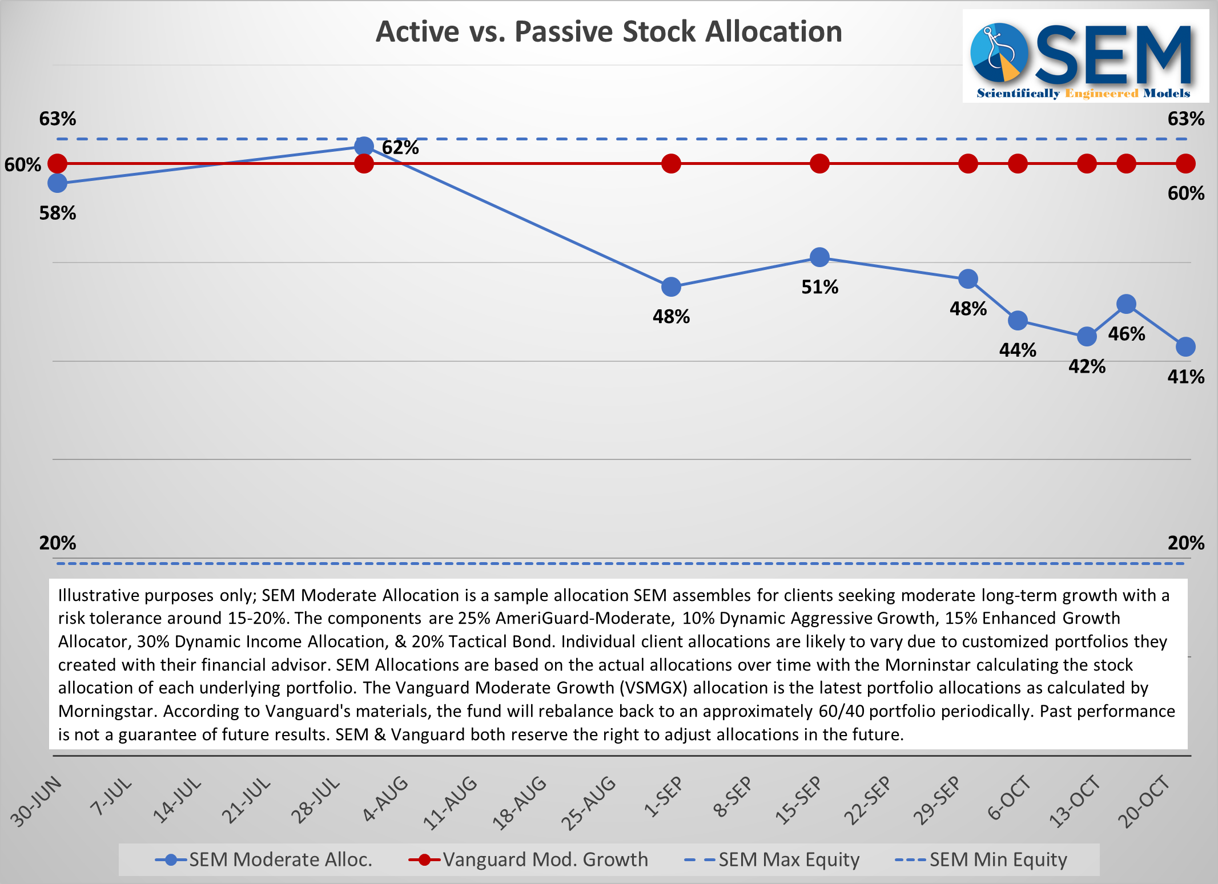

2017 was the least volatile year on record. While 2018 is not going to break records for volatility, after being lulled into a sense of complacency the past several years, 2018 has reminded us why having a well thought-out plan is important for long-term financial success. The stock market has

I recently experienced my first “real” tropical storm. I say “real” because I’ve been through other tropical storms. While living in Arizona for 20 years we often would get a tropical storm running out of steam after moving up through Baja. I’ve

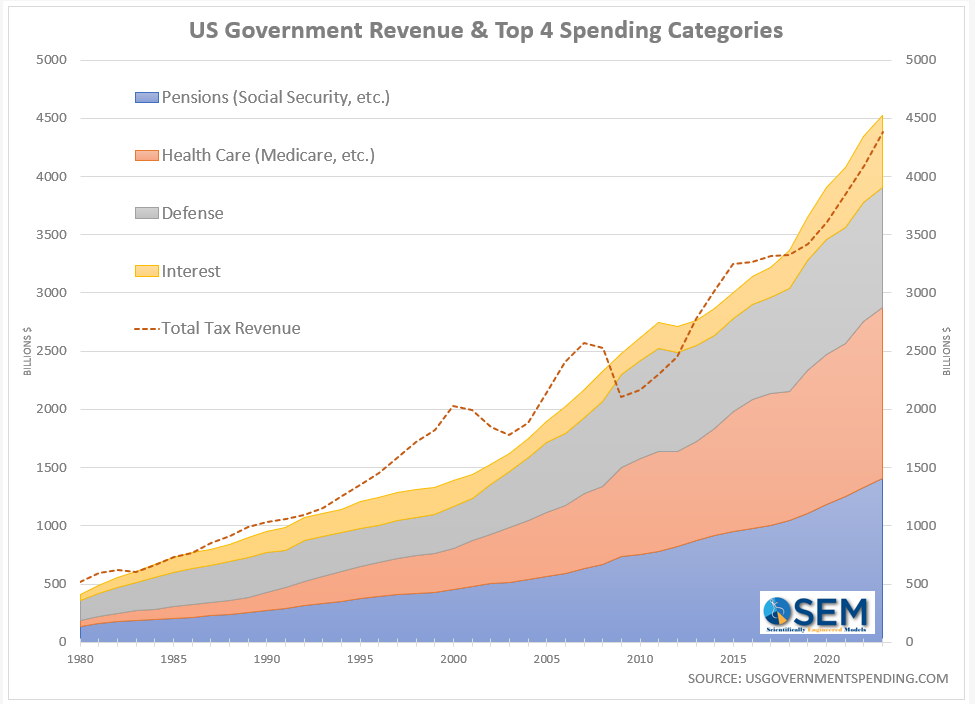

This week it was announced the current Federal Government Budget Deficit hit its highest level in 6 years. The combination of tax cuts, slower than expected economic growth, and increased spending accelerated the budget deficit at a rate alarming enough to lead even Republicans to call for cuts in spending.

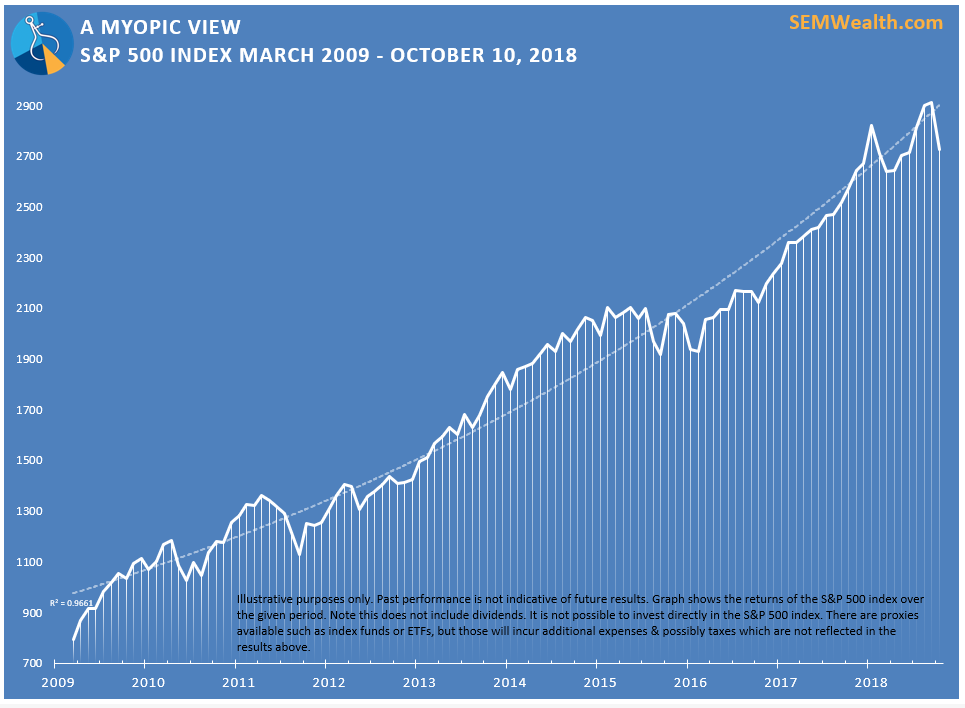

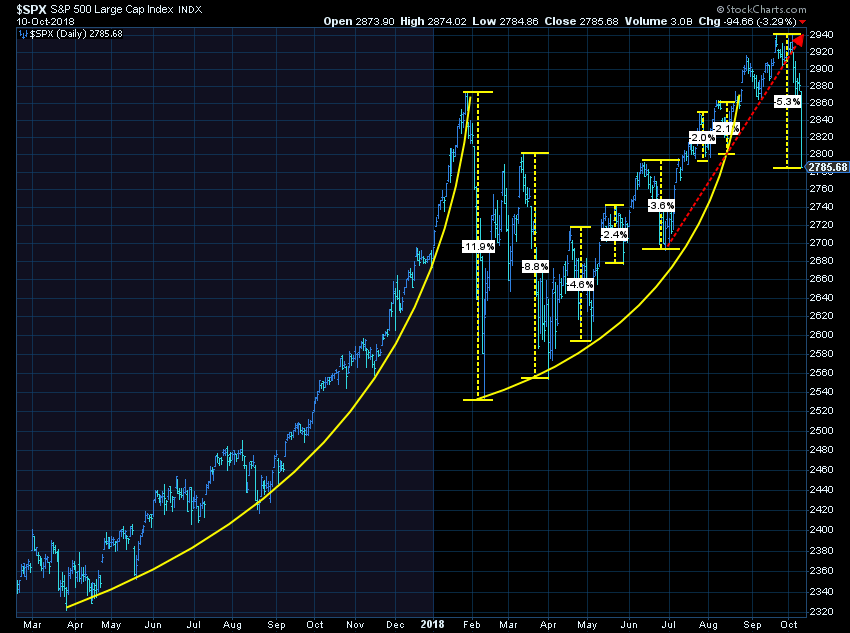

So something happened Wednesday & continued on Thursday. Something that seems to be completely out of the ordinary over the past 10 years of bullish markets. A 3% one-day S&P 500 drop will surely halt the record gains that the economy has been

Which sounds worse?

Dow plummets 800 points

-or-

Stocks decline 3%, still above June levels

Both describe what happened on Wednesday, but I’m guessing nobody’s smart phone was popping with the latter alert. Why would you click on that headline?

Yes, it