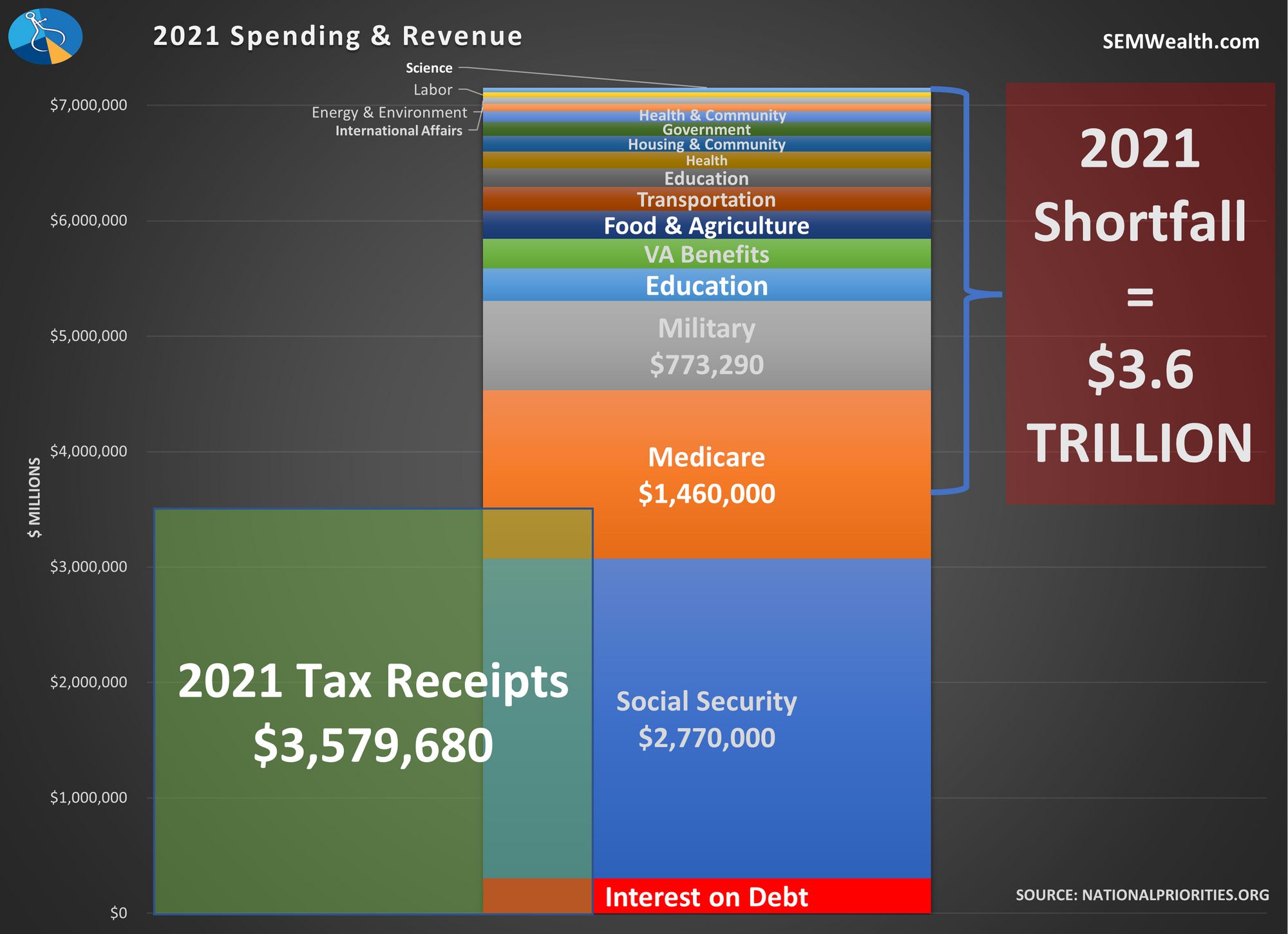

I don't know about you, but I'm already tired of hearing about the debt ceiling. The media is sensationalizing it. Both sides of the political aisle are blaming the other side and acting like they had nothing to do with it. Worry is picking up among individual investors. Meanwhile the

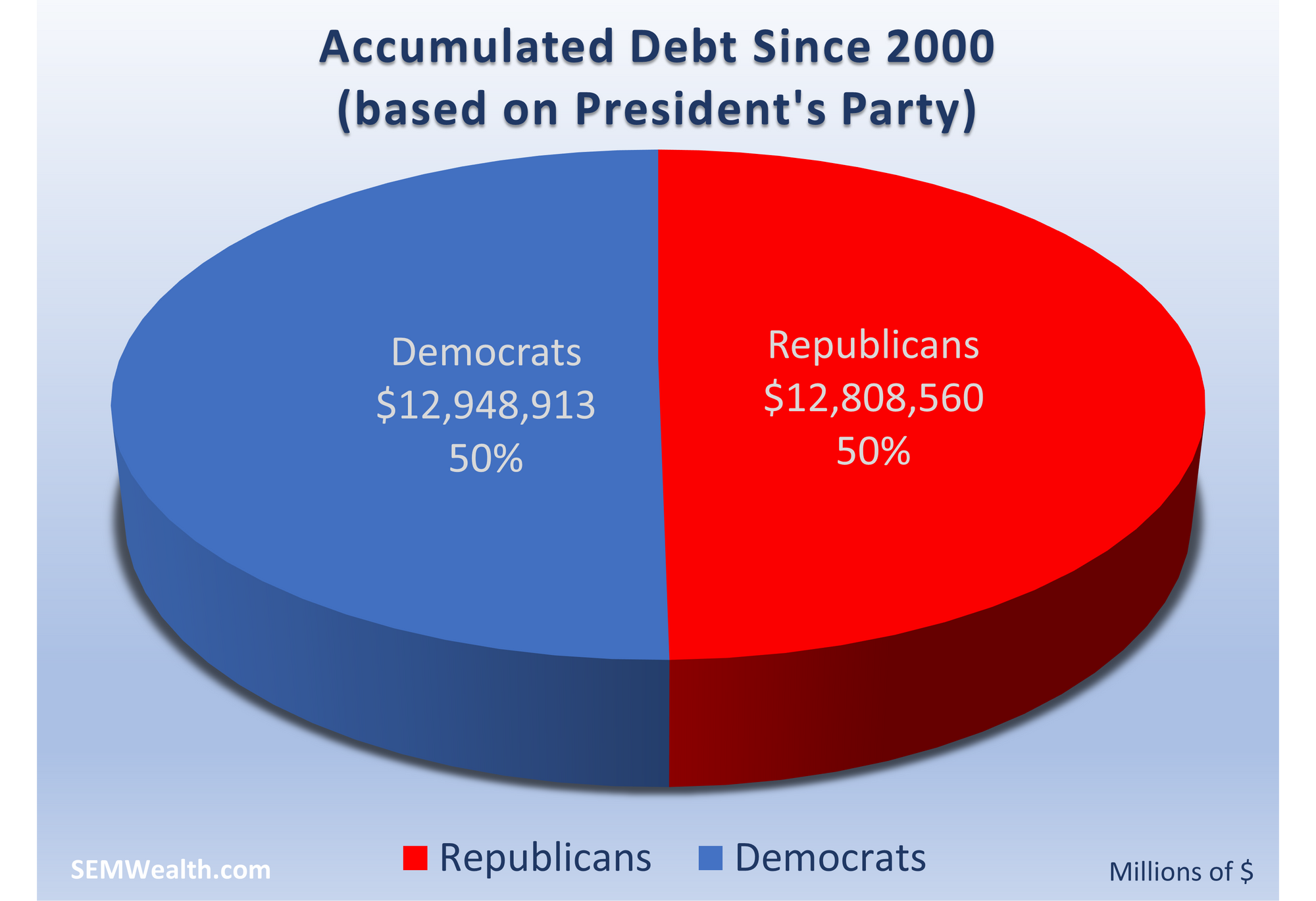

I hate talking politics, but we've been fielding a lot of questions about the debt ceiling and the chances of default. I've actually been avoiding writing about this because every time I think about it, my blood pressure skyrockets. The fact that we are back here AGAIN is a failure

Wisdom is the quality of having experience, knowledge, and good judgment. People's wisdom is revealed in their character – the way they live, speak, treat others, and handle life situations. In the passage we're looking at this month, James compares worldly wisdom to godly wisdom. This isn't the first time James

Despite the much better than expected payrolls report, nearly all of the economic data in our model is showing signs of stalling out. Our economic model has been "bearish" since April 2022 after going "neutral" in October 2021. Our model isn't designed to call the beginning of a recession or

We wake up this morning with news of the 2nd largest bank failure in the history of our country. Interestingly enough, this is not being looked at as a major move by investors. After the failure of Silicon Valley Bank in March and the swift actions by the Fed, FDIC,