As we move closer to the final week before the final quarter of 2021, we can take this moment to take a step back to think about how much time has gone by in what has felt simultaneously a blink and an eternity. We are a full year and a

The US Government is out of money. Treasury Secretary Janet Yellen has said she is using "extreme, emergency measures" to move money between accounts in order to cover US obligations. She expects these methods to be exhausted around October 18. At that point the US would no longer be able

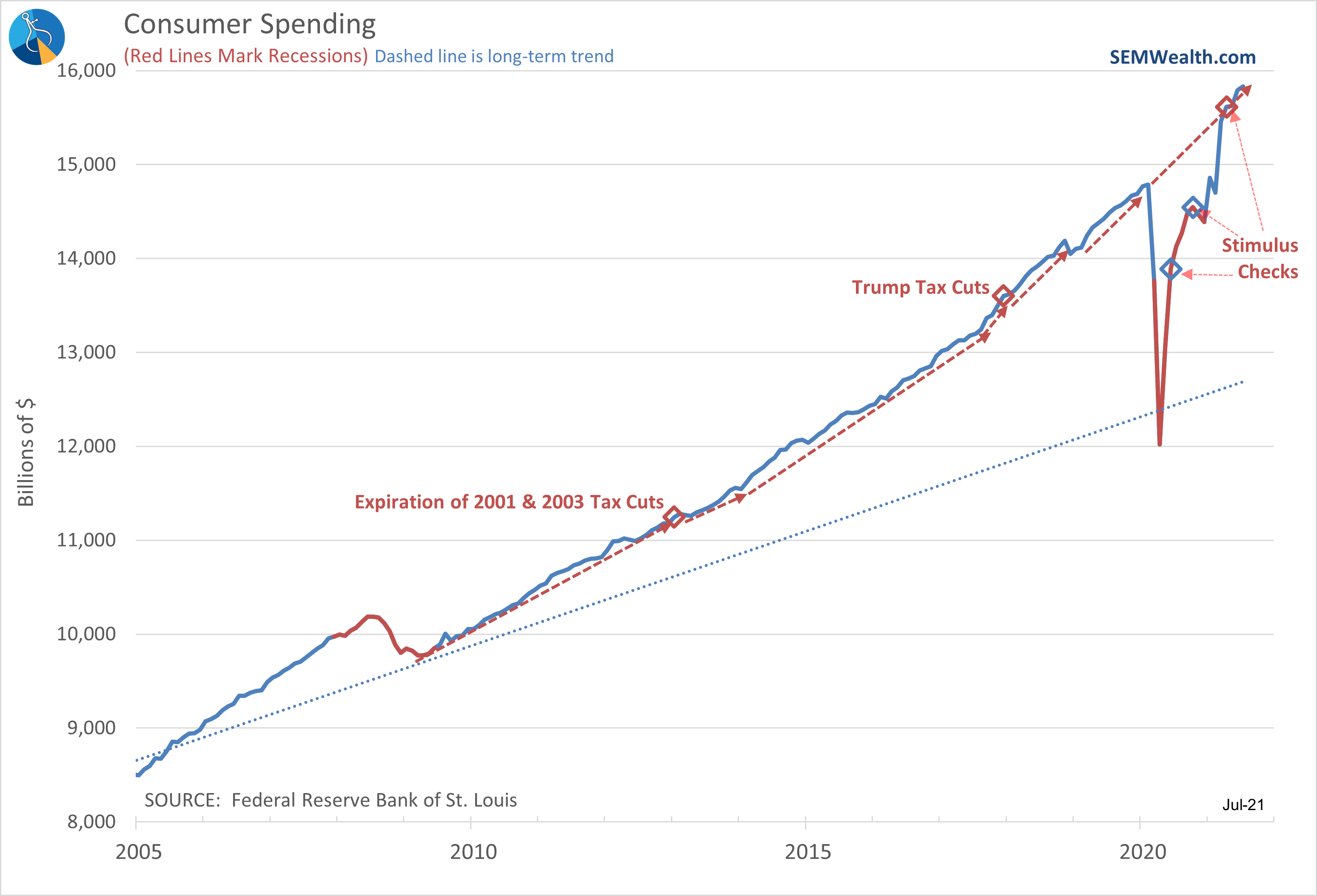

Humans can’t help but be very short-term focused. We all have incredibly busy lives, and it can be difficult to focus on the medium or long-term future when we have to worry about today and tomorrow. The concern is even if we don’t focus on the long-term, it

This week President Biden made a hard push for his $3.5 Trillion "infrastructure" bill. This came shortly after the House Ways and Means Committee released their proposed tax changes to help pay for the massive spending bill. I've received a lot of calls and emails from our advisors with

The shorter work week didn’t allow us much time to get new news that would point the market in a certain direction, but the market didn’t stay flat. We are at a point, like we’ve been mentioning quite often lately, that the market NEEDS positivity to continue