Throughout the Bible we see examples of idolatry. I don't know about you, but whenever I read examples of idolatry in the Bible, specifically with the golden calf (see Exodus 32), I think the Israelites are crazy. Why would anyone worship that over God? God has done so many good

We paused on Monday to remember all those who sacrificed their lives to defend our freedom. As I've said many time, we live in the greatest country in the world because in times of crisis Americans have always come together to sacrifice for the good of the country. I've always

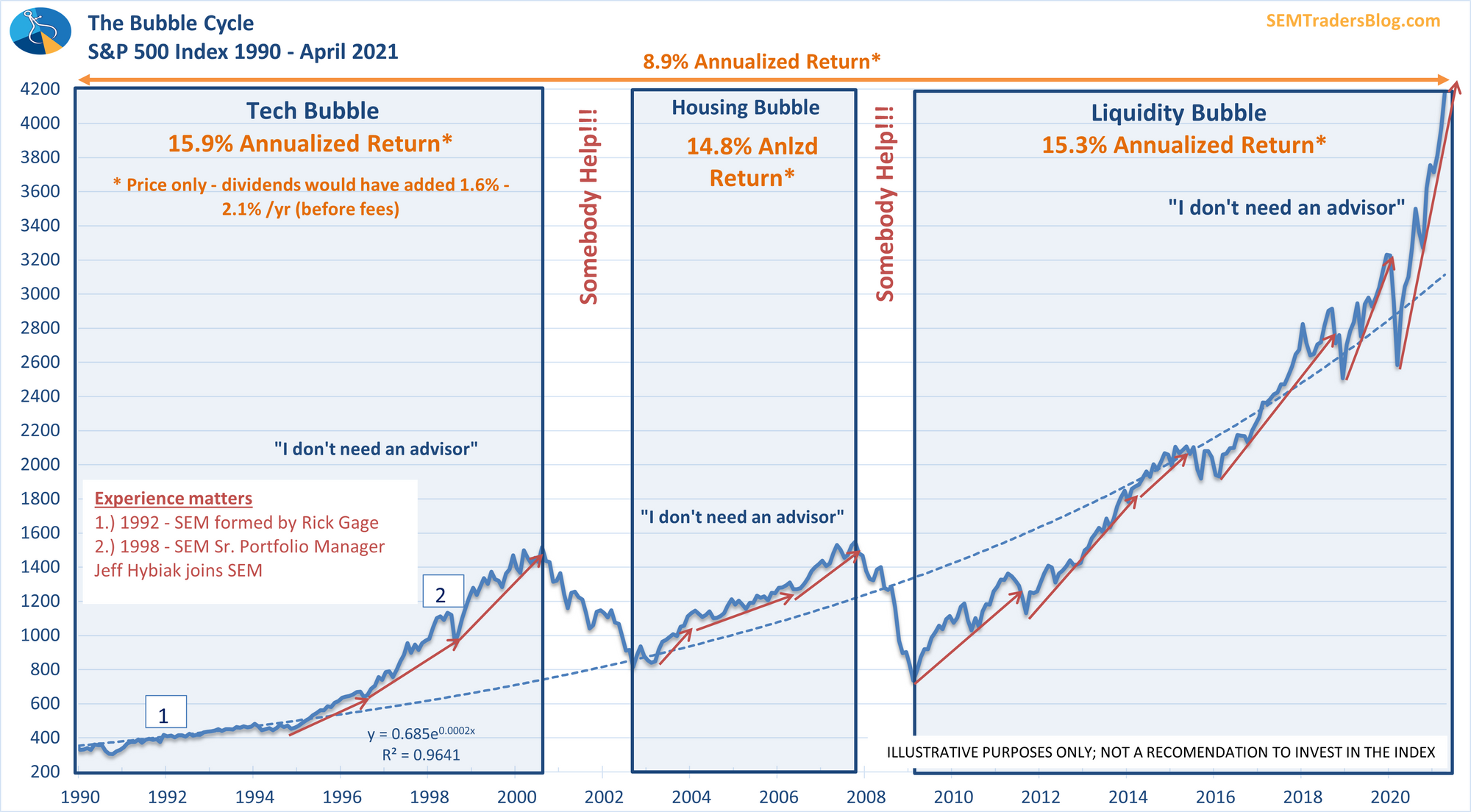

Stocks have essentially gone nowhere since mid-April. It seems all of the catalysts that led to the parabolic rally in the market for the past year have come and gone. Now the question is – what's next?

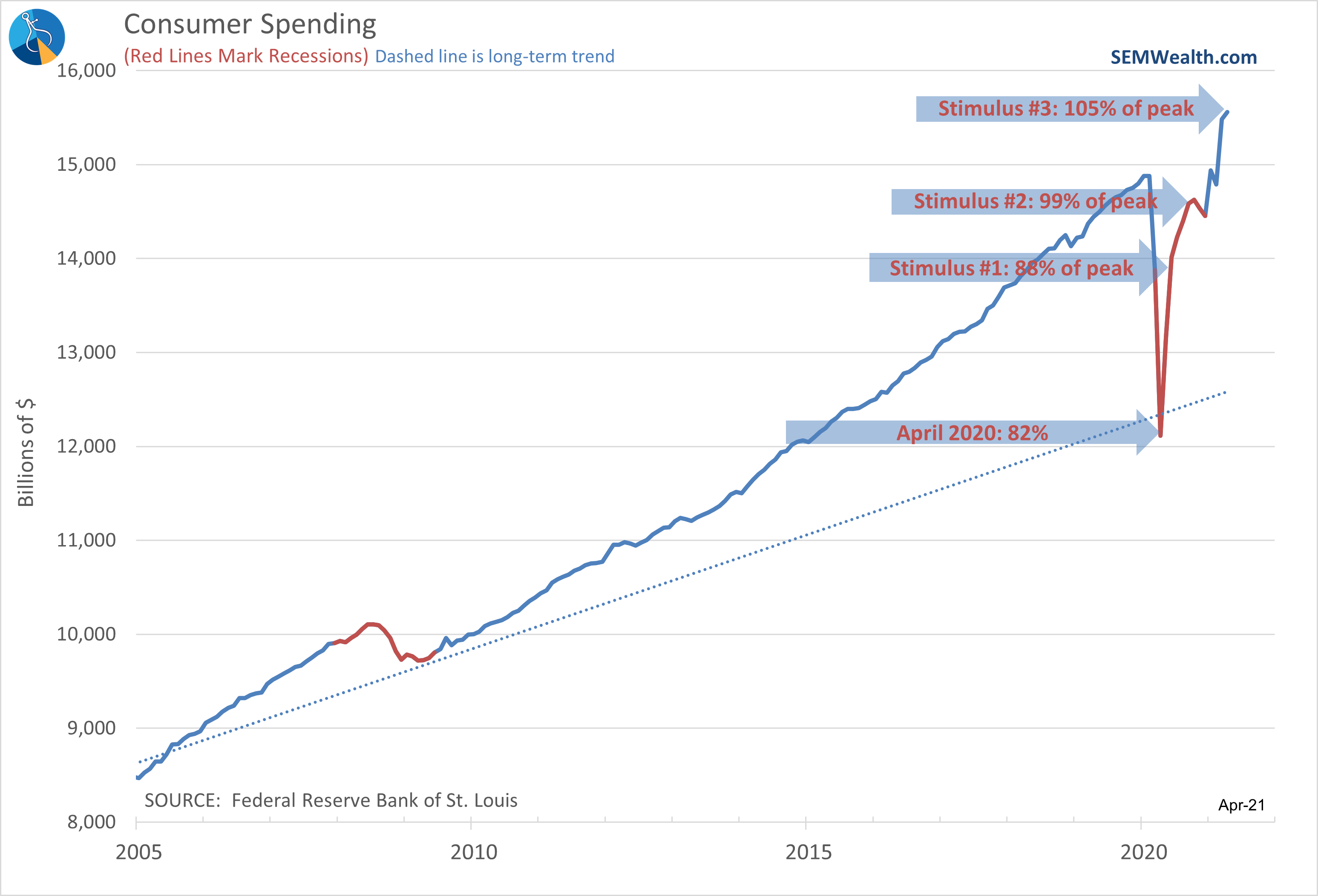

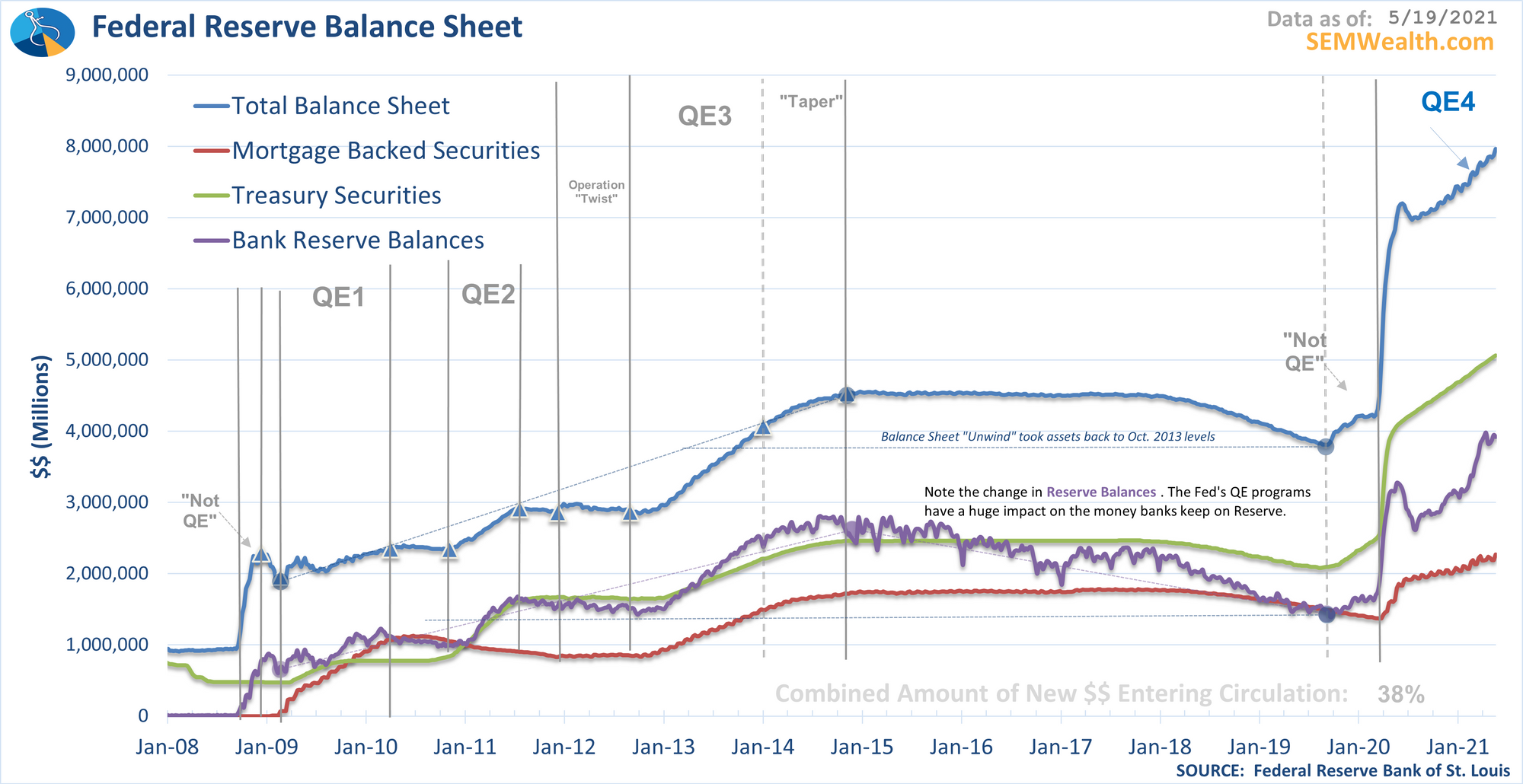

For most of this year we've talked about the 4 pillars of the rally:

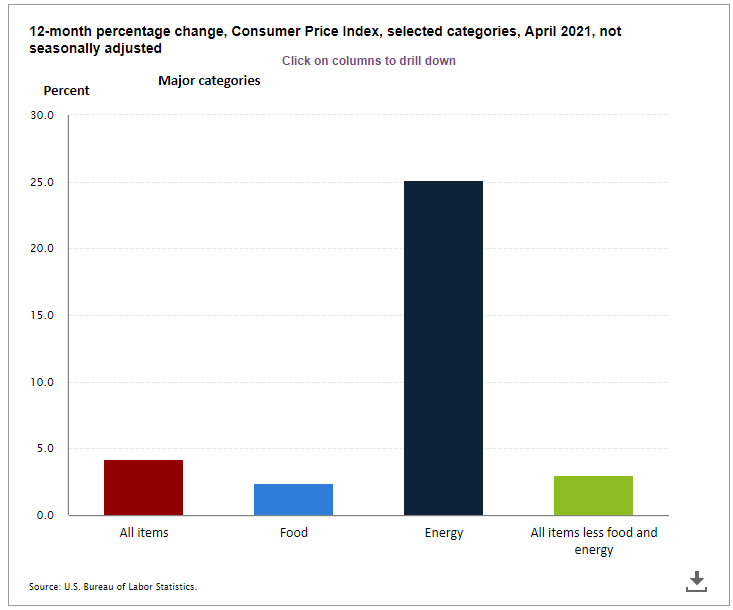

Based on the sensationalized headlines last week, one would think the market was at risk to give back all of its gains. This came on the heels of a much worse than expected inflation number on Wednesday. While "base effects" which is economists speak for what things looked like a

Our brains are fascinating mechanisms. The way we process information is far more complex than any computer can model. One of the biggest areas we focus on at SEM is understanding how we process data. A key thing everyone needs to understand is it isn't the absolute number, but rather