2020 has been a challenging year for a lot of people – feeling isolated, virtual school, job loss, losing loved ones, etc. It's been a reminder that we live in a broken world and nothing is ever promised. Some people might not have been affected too much by the changes, while

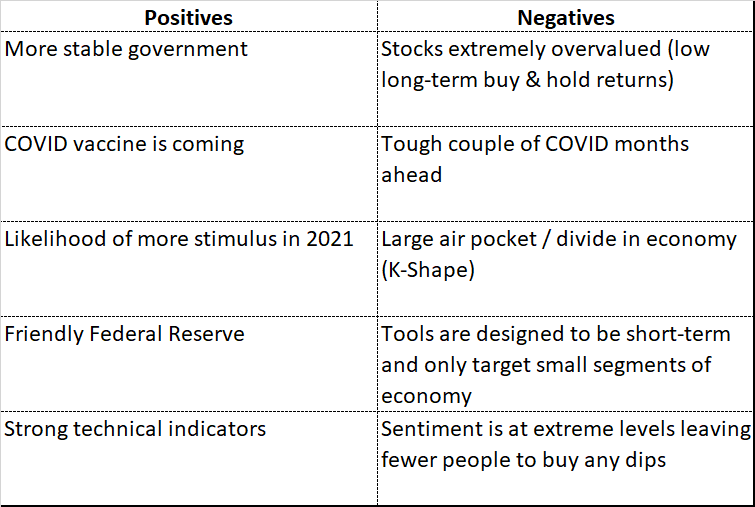

As we enter the final month of 2020 many investors will be making plans for 2021. I could write several thousand words listing all the things we should be considering. Instead, I thought we'd use my favorite tool – a 2-column list to look at the current market environment.

As I've

Throughout the last 37 weeks I've been providing musings each Monday summarizing what I'm seeing in the investment world. Some of them have been quite long and wide-ranging, others have been fairly brief. This week, there is A LOT of news we could talk about, but I kind of wonder

As we should expect in 2020, the results of the election have left an unclear picture about what happens next. The webinar below discusses:

- What we learned from the election results (and what we didn't)

- A look at some of the final outcome scenarios and what it means for the

For the second week in a row we are greeted with some very positive COVID-19 vaccine results. Don't mistake the rest of the article as me not being extremely excited about this development. As I've said from the outset, I have full confidence in the American people, our scientists, and