Each summer I like to take some time away from the day-to-day operations/noise to focus on bigger picture projects, research, and professional development. It's a time to work through my reading list, catch-up on the latest updates from the CFA Institute, and most importantly refresh my brain. Given that our trading systems are all data-driven and pre-programmed, all investment operations continue as usual whether I'm at the trading desk or not. This is a luxury few investment managers enjoy. In my absence, the Traders Blog will be in Cody's hands.

Before heading out, given the likelihood we are in a bear market driven by an economic slowdown, I wanted to provide a short synopsis of where we sit.

SEM Models at Minimum Exposure Levels

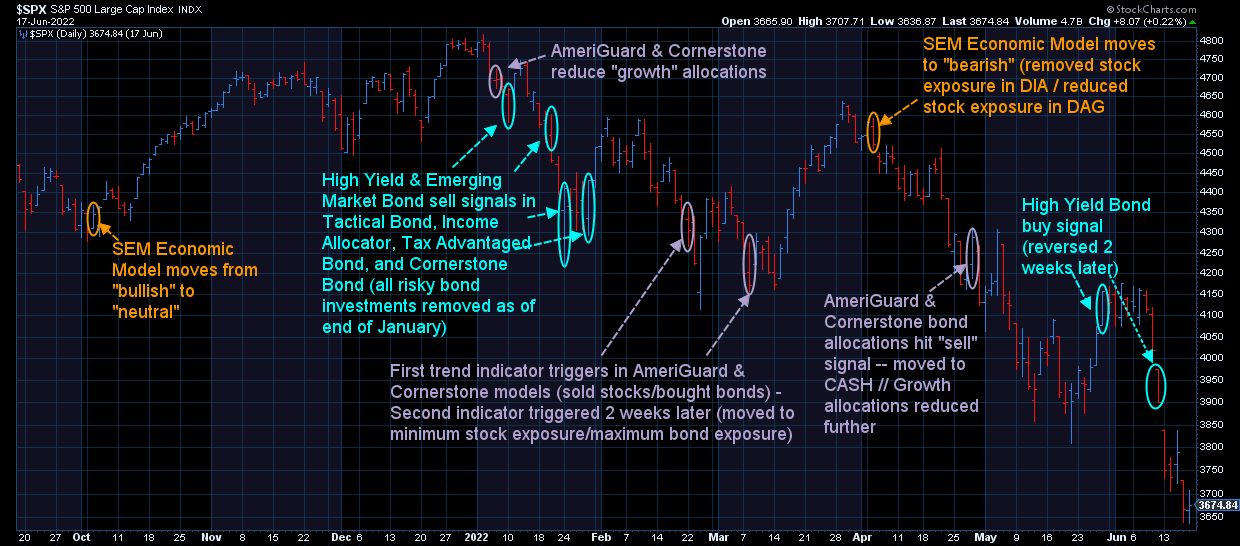

I think this is the most important aspect of everything. We began selling last fall (via our economic model). The data continued to get weaker during the first quarter and we reacted accordingly. We took more losses than we'd like (we never like losing money), but every system is working as designed and all are well within their risk parameters.

We did take a hit in our tactical income models. The institution(s) who allocated a significant money into all bond sectors the last week of May did not shift the momentum enough to have other institutions follow. The day of the trade, both Rick and I felt it would likely be a loser, but here is the key – our opinions do not override the models because there have been plenty of times we felt that way where we would have missed a SIGNFICANT rise in the market. We took a hit, as did every single tactical income manager we use and follow. We all have retreated and sit ready to pounce on the next buy signal.

One key to remember, Dynamic Income and Cornerstone Income, which are designed to be complimentary to Tactical Bond and Cornerstone Bond, made almost as much money the past two weeks as the other models lost. We almost always recommend a blend of those two models for conservative and moderate investors.

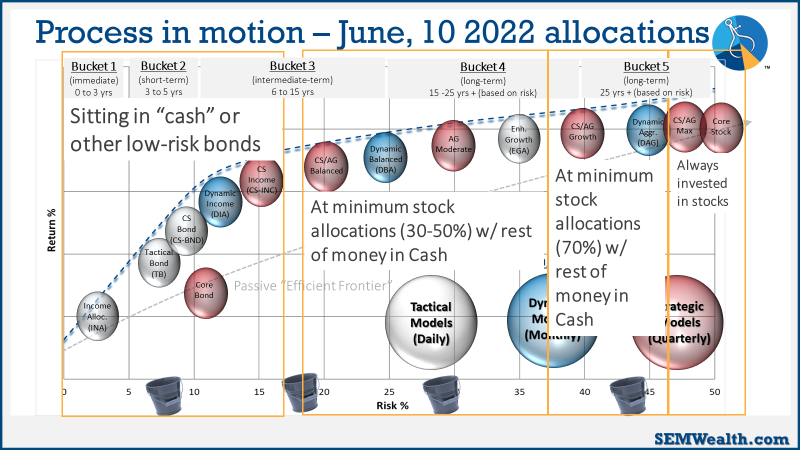

This chart is key to understand how we sit. The shorter the time horizon the more we have in cash and other lower risk investments.

In case you missed it, we sent this video/blog to clients on June 14. Refer to it whenever you or one of your clients is concerned about the current market.

Fed is "serious" about inflation, does it matter?

The Fed's decision to raise interest rates by 3/4% on June 15 was welcomed by most market participants. I've said for the past year the Fed was completely wrong on inflation. Here's what I said a year ago (click here to read the whole post):

In this case I say, "what if we find inflation is significantly higher a few months down the road and the Fed is too late to start pulling it back?" Worse, "what if inflation hurts economic growth?"

The problem now is it could be too late. Interest rate hikes won't help stem the rise in gasoline and food prices. In fact, it could be argued it will make things worse. The mega-cap energy companies are being maligned for "excess" profits. Leading into the first quarter, the largest energy companies had broken even for the last 8 quarters. The first quarter of 2022 they finally recovered the losses from 2020. People forget oil prices went negative briefly in 2020 because we had too much oil and nobody was buying it. When prices remained low, oil producers shutdown. This hurt smaller energy companies and those providing ancillary services. Those companies aren't posting "excess profits", but instead are trying to survive. Raising interest rates along with the big spike in junk bond yields will only hurt the supply of oil (and thus keep prices uncomfortably high).

[By the way, taxing the big energy companies for "excess profits" will only keep prices high – the government should be incentivizing INVESTMENT and INCREASES in production, but I doubt we'll see that.]

Same goes for food prices. We have a serious supply shortage and need INVESTMENT in all aspects of food production and delivery. Higher rates won't help and will instead hurt.

Finally, with inflation already hurting the middle class, they are about to see rates on credit cards and auto loans go higher, which will put further strain on household budgets.

I'm not saying the Fed shouldn't have raised interest rates. They could have gone even more aggressive. What is most disappointing is they chose not to accelerate their "Quantitative Tightening" program (the reversal of QE4). They created all kinds of asset bubbles via QE and instead of addressing this, they instead are only focusing on interest rates.

The market cheered the "seriousness" of the Fed decision, but I'd venture to guess as logic, common sense, and reality sets in we'll see stocks drift lower. The biggest question will be what happens with bond yields and whether or not the selling pressure will ease down the quality sector.

Why do we trust the Fed?

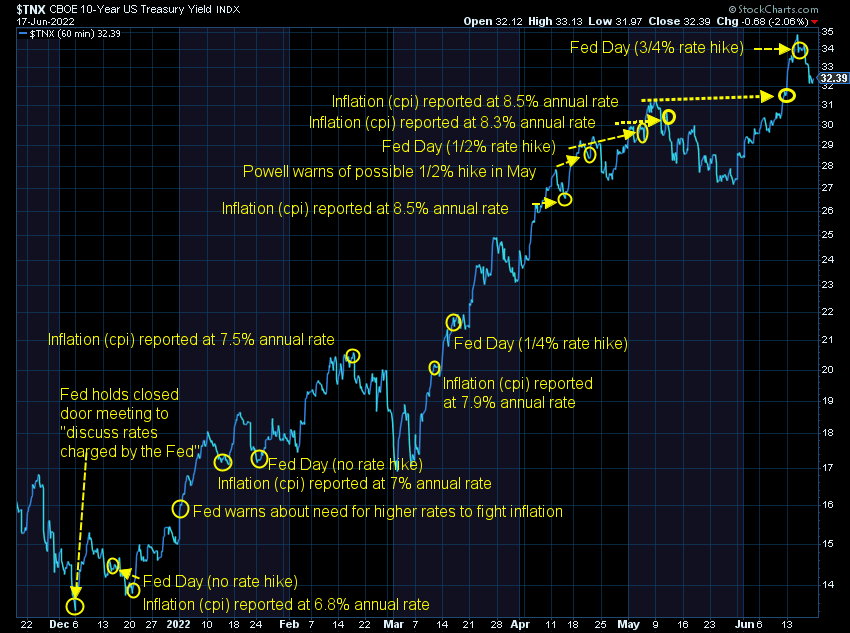

This chart of bond yields tells the whole story. The bond market saw inflation. The Fed did not. The bottom of bond yields came in December when the Fed held an unscheduled meeting to discuss inflation and Fed policy. This was after they told us throughout 2021 inflation would be "transitory". They didn't decide to finally raise rates until four months after they "discussed" changes in rates. A month ago, Chair Powell said a 75 bps rate hike was not on the table. Now they not only hiked rates by that amount, but said it's a possibility they will do that again next month.

Since 1998 the Fed has tried to prevent any sort of financial pain. By doing so they have made the bubbles even bigger, which makes the bursting of those bubbles much more painful. Despite a horrid track record, I still expect markets to rally whenever the Fed says things look "good". They will eventually be right, but I'm afraid that won't be until after severe damage is done to the economy and bond markets alike.

Beware of Bear Market Rallies

Last week, I discussed how all bear markets are different (in what caused them), but also how they are all the same (in terms of how we react). I'd encourage you to keep this post handy:

Cody was asking me last week about whether or not the "panic" had already started given that the S&P 500 was down nearly 25%. I said, "no".

We're barely into the bear cycle. Remember true bear markets are both depth of the loss and the duration of it. Seeing your account go down seemingly every week, month, or quarter is draining. We also haven't even had any bad economic news other than inflation. When we get the official "we're in a recession" call along with an increase in unemployment, that's when you'll see more of a panic.

Right now the only people "panicking" are the ones who either didn't save enough money are new to investing or jumped into stocks last year just because they were going up.

In the first 5 1/2 months of 2022 we've fallen a little over 20%. In 2000, the market dropped 12%, but then got almost back to the all-time high in late August. It crossed the 20% down mark in early March 2001, so 8 months later. The 20% drop is a little faster this time, but not by much. Note the big rally after it was down around 28% followed by another painful drop.

I mentioned in last week's blog how there are some similarities to this market and 2000. This includes the likelihood of just a "mild" and probably short recession. This doesn't mean severe damage cannot be done. Note the 33% drop in the S&P 500 from November 2001 through October 2002 — after the recession was already over.

Things won't play out exactly like 2000-2002. There are obvious differences. Heck, I could be completely wrong and the worst is already over. Remember that's the key with SEM – we don't have to make predictions like this.

Are stocks undervalued?

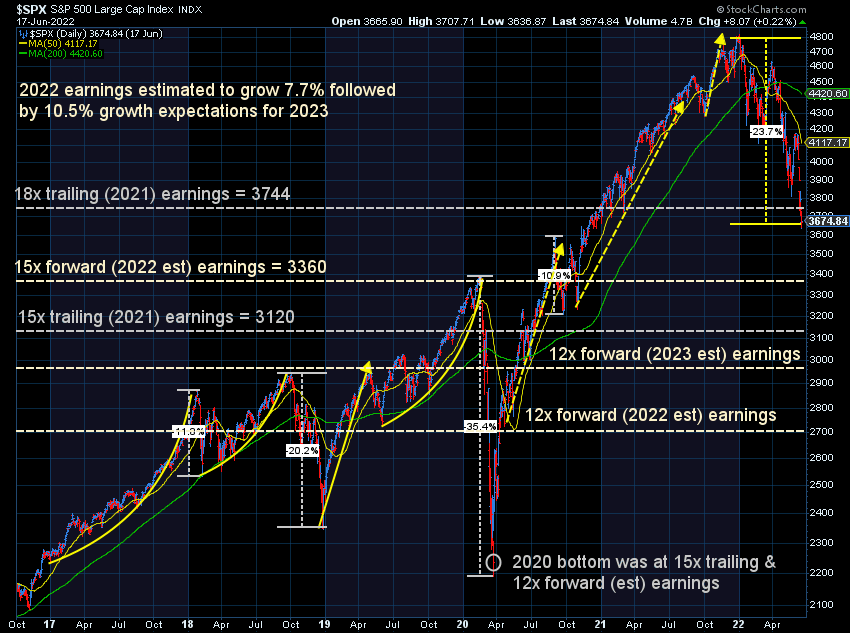

The key question is whether or not stocks are attractive at the current valuations. That of course requires us to know what damage is being done to earnings, how long the slowdown lasts, and whether or not the Fed throws us into a recession. Since we don't know any of that, I thought I'd walk through a simple exercise of determining levels of the S&P 500 that could be considered attractive.

The "median" P/E over the long-term (based on the last 12 months of earnings) is 15 with the forward P/E (based on EXPECTED earnings) is 12. This also happened to be the level the S&P 500 reached in March 2020. Looking at the chart below, if we revert back to the median (and March 2020) levels "fair value" for the S&P is somewhere around 2700-3120 (or another 18-29% from here). That would put the total losses around 40-50%.......if earnings do not decline from here and if valuations do not go to the depths of past recessionary bear markets (in the 9-12 range).

Right now the stock market has only dropped to a P/E of 18, which is hardly an attractive valuation level unless you believe the Fed interest rate hikes, runaway inflation levels, abysmal consumer sentiment, and rapidly slowing economy will not hurt earnings.

For what it's worth bonds also aren't too attractive, especially those where there are increasing changes of some defaults (such as high yield bonds). With bonds we use the spread between junk bond yields and Treasury bonds as an indicator of valuation. Based on our high yield trading system, which has been used in real-time all the way back to our inception in 1992, I don't get remotely excited until the spread gets in the 550 range (yields 5.5% higher than Treasury bonds). I get very excited when it is about 1000 (yields 10% higher than Treasuries). Right now we're at 480 basis points.

Remember our Bear Market Tips

I can't emphasize this enough. See the video/blog for details:

- Don't Panic

- Ignore the Media

- Be Patient

I won't be completely out of touch with the markets, our systems, or our investment team. Hopefully the markets can settle down for a while. They won't keep going straight down. We'll see some rallies. We'll see some good news. We'll hear people confidently declare the worst is over. We've been around for over 30 years because we ignore all of this noise and simply focus on the data.

Stay tuned to the blog for additional updates.