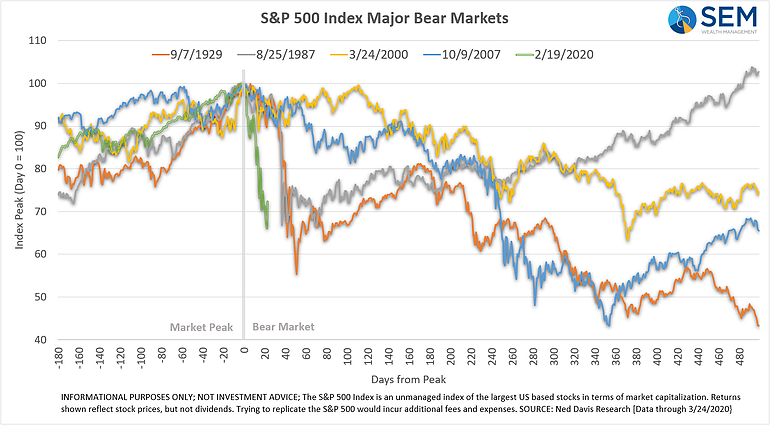

The bear market of 2020 is unprecedented. The pace of the decline has exceeded all records, including the steep fall in 1929. While the move is unprecedented, the reason we only use quantitative models at SEM is this allows us to not guess about the next move and how to

Tag: Chart of the Week

I've spent my entire career criticizing the Fed. A group of academics sitting around trying to control the economy with interest rates and the various other vehicles always ends up causing additional problems elsewhere. I've argued for the past 10 years the Fed would again create bigger problems due to

The headlines this week were alarming. On Monday we saw "Worst drop in 12 years", "Trading halted", "Credit markets seizing up", "Oil prices crash", and many more were all over my smart devices. Thursday was even worse with the "worst loss since 1987" headlines. Hopefully readers of this blog were

When your only tool is a hammer, everything looks like a nail.

This was the first thought that came to my mind on Tuesday when the Federal Reserve announced an emergency rate cut of 0.50%. We saw a Pavlovian reaction by market participants with stocks rallying 3% in the

The market has been in a free fall this week. While I watch CNBC and Bloomberg on alternating days in the office, at home we watch the local news in the mornings. It is typically filled with weather, traffic, reports on happenings in the Richmond area, and some "feel good"