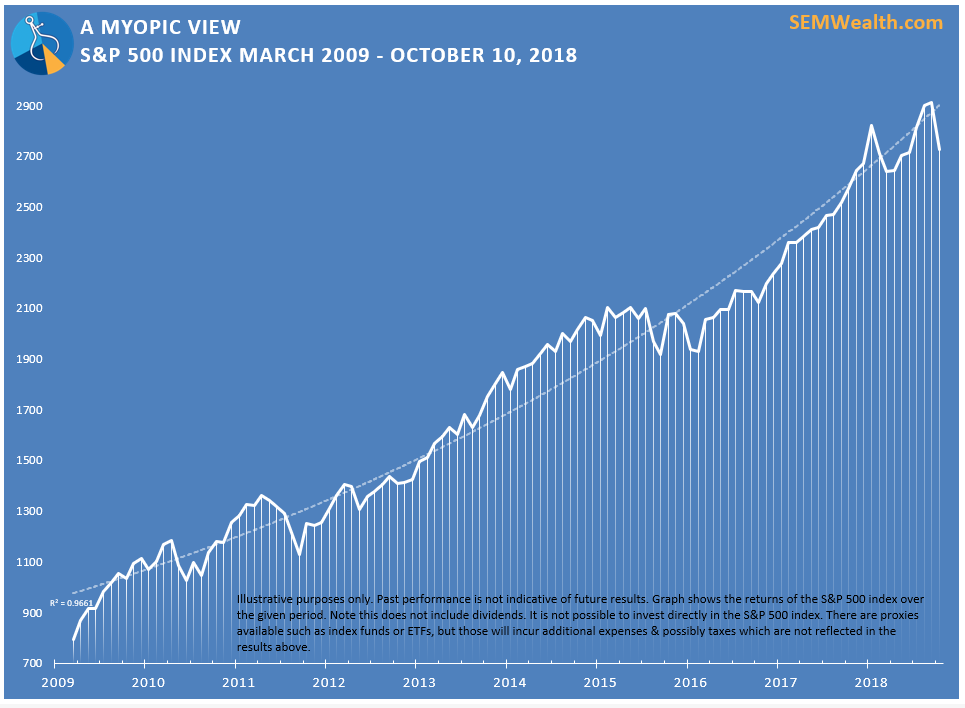

So something happened Wednesday & continued on Thursday. Something that seems to be completely out of the ordinary over the past 10 years of bullish markets. A 3% one-day S&P 500 drop will surely halt the record gains that the economy has been

Tag: Chart of the Week

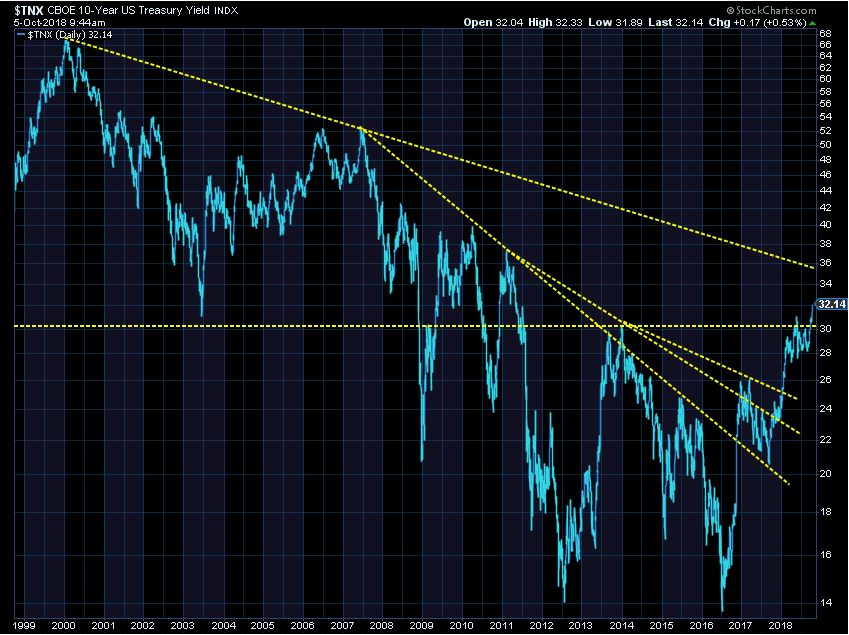

When you hear a non-business radio station discussing the rise in interest rates it is clearly something people are starting to notice. Most people, including too many financial reporters want to group all interest rates into a single category. They do not understand the inner-workings of how interest rates are

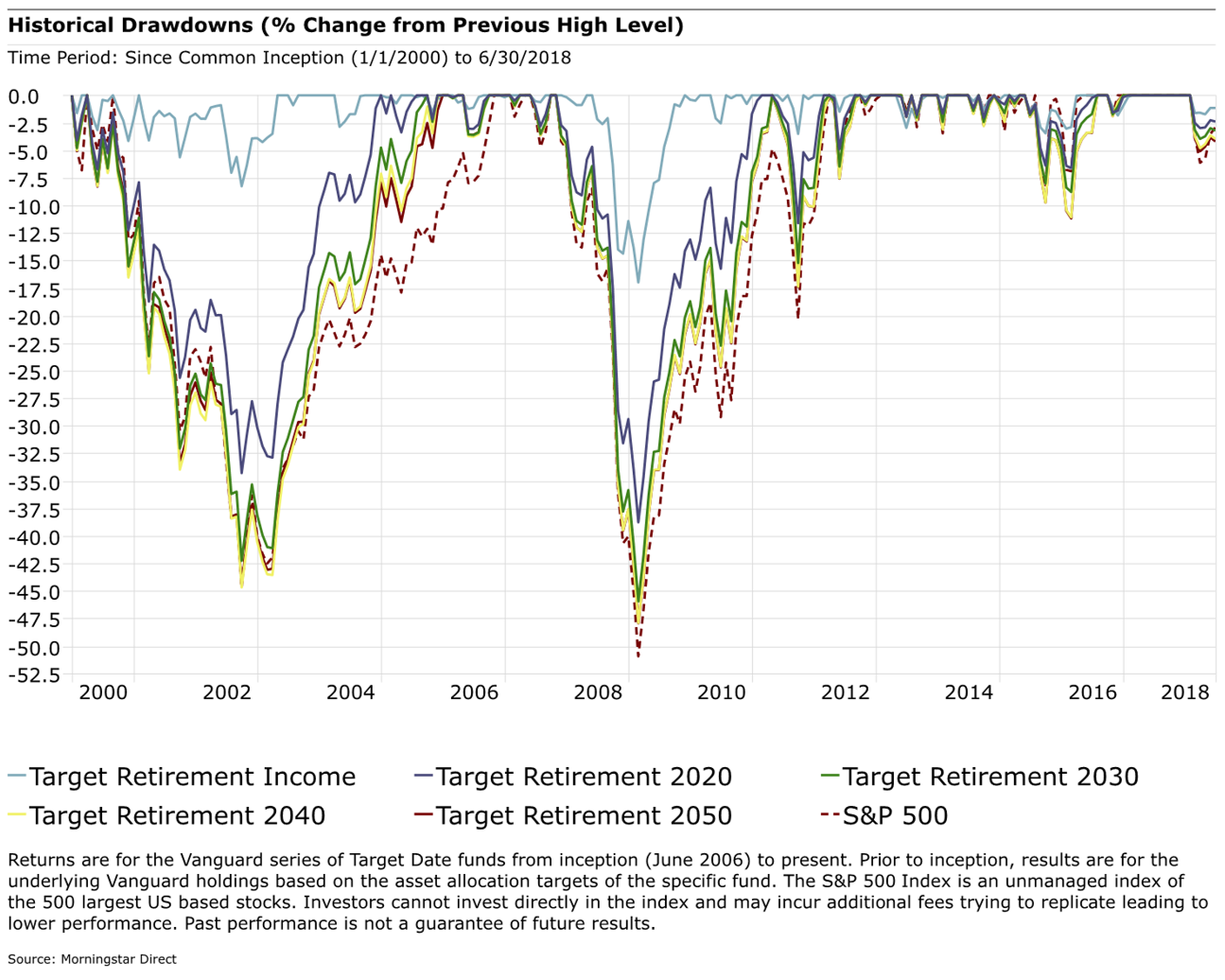

I realize in a 9-year old bull market talking about risk management will not generate a lot of clicks to our site. For whatever reason, the past few weeks have seen a large number of portfolio reviews from prospective clients that included “Target Date” funds. These funds have

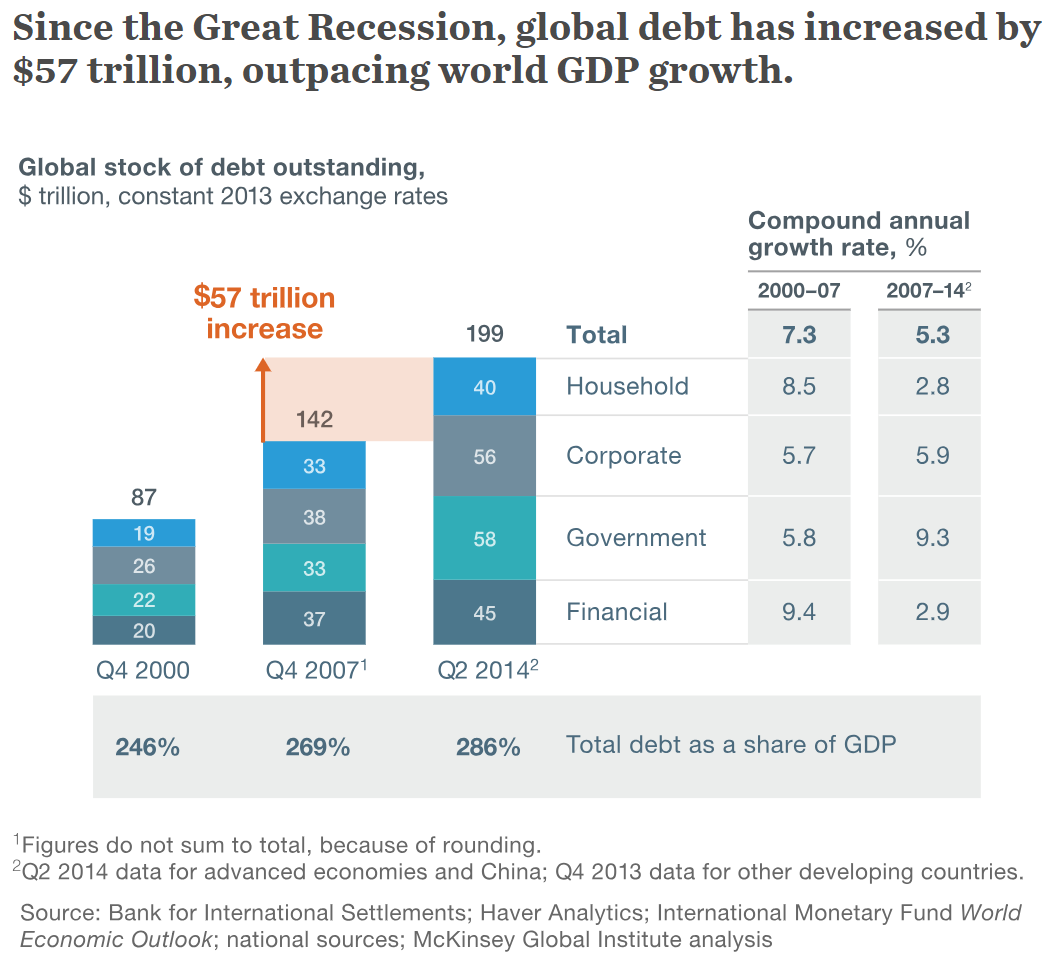

Last weekend was the “official” 10 year anniversary of the Great Financial Crisis. (This was when Lehman Brothers failed. Long-time SEM readers know the crisis actually began in 2007 with the failure of a few smaller mortgage brokers.) There has been a plethora of specials surrounding this anniversary.

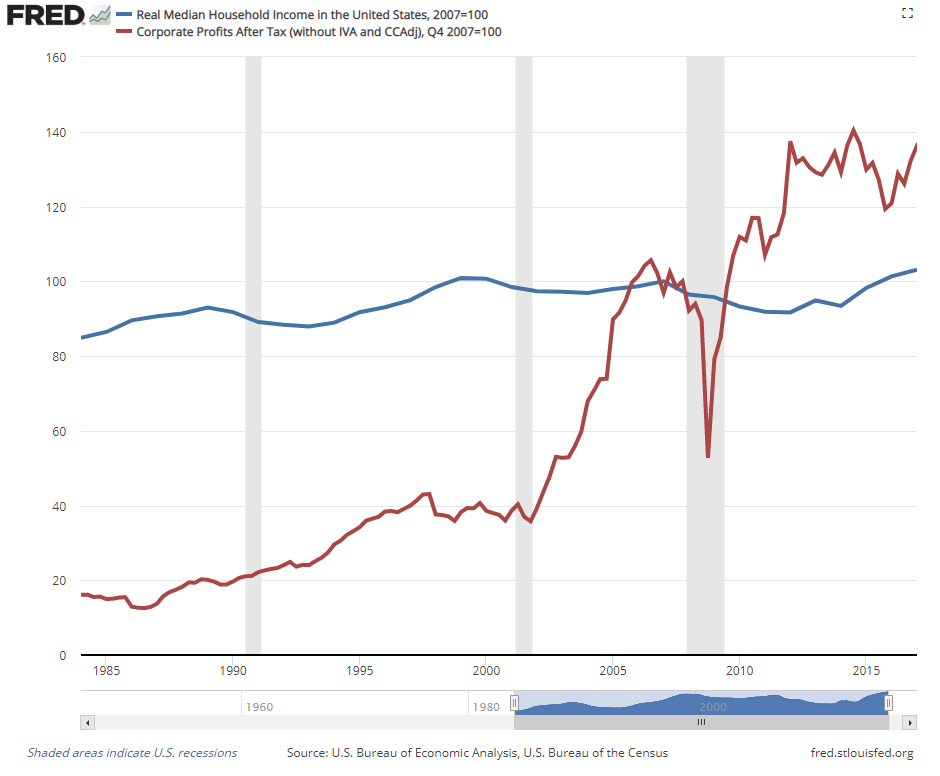

This week we learned the Median Household Income of Americans finally surpassed the 2007 peak. Inside the report released by the Census Bureau was a long discussion of the “lost decade” for most Americans. Masked by the overall income level is the fact average earnings are down, but