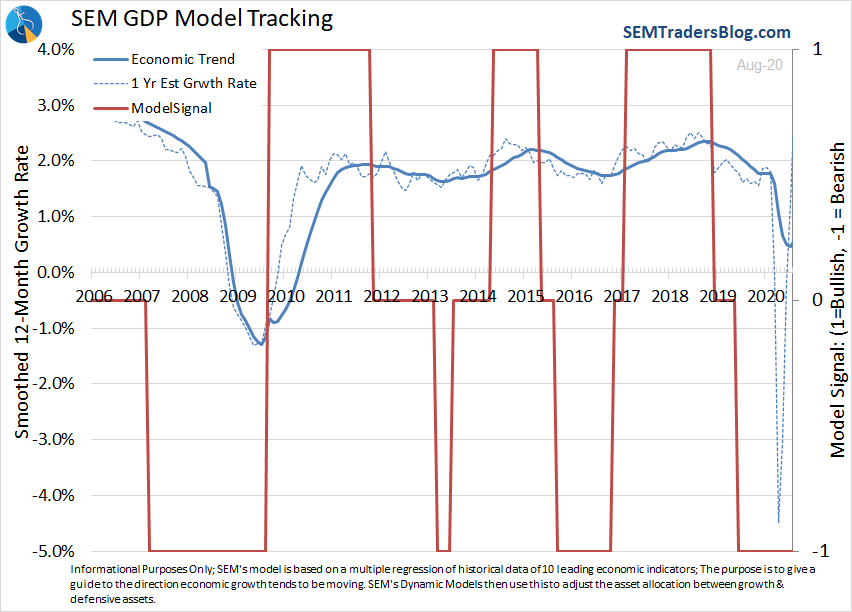

This morning we woke up to some encouraging news on a Coronavirus vaccine. 35 weeks after the US began to panic, it seems investors/speculators are banking on a huge economic comeback. We'll leave the speculation to them and stick to the data.

Tag: Economic Update

2020 just keeps on giving us more and more crazy news. With the President dealing with COVID19 along with a large number of people from his administration and members of Congress, the market and economy has yet another unknown to deal with. We don't like dealing with unknowns and will

Stocks are a forward looking mechanism. That is drilled into our heads constantly. It means stock market participants are constantly looking ahead at what the future will look like and then assign a "fair" price today to whatever you think the future will hold. The problem with that method is

I'm not sure if the 3 day weekend in celebration of Independence Day was welcome given how different this July 4 was than all the others in my lifetime. I love our country so much, but I found myself needing to stay busy over the 3 days because every time

Do you ever wonder what the history books will say about 2020? How much space will really be dedicated to the last few months? I often think about that as I study history. Think of how relatively little space was dedicated to the Civil War or World War I back