Summer is officially here and based on the weekend traffic, the lines at the grocery stores, the lack of inventory in the summer aisles at Target and Wal-Mart, Americans are out and about in full force. At the same time the stock market has stumbled, which begs the question, 'why

Tag: Fed Balance Sheet

Back in 2019 the daily blog entries turned into a weekly "Chart of the Week". There just weren't a lot of different ways to say what was happening – stocks seemed to go up every week. Any drop of 3% was bought aggressively. Valuations were at levels that indicated long-term returns

Last week's Musings focused more on the big picture and my message to clients and advisors on where we go next. With that focus a lot of my random thoughts last week were on the long-term impact COVID will have on our economy, the markets, and our lives. We will

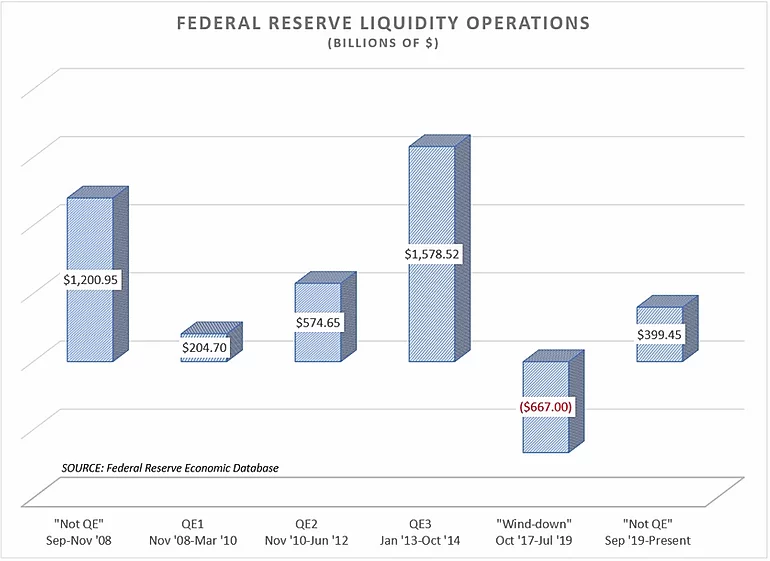

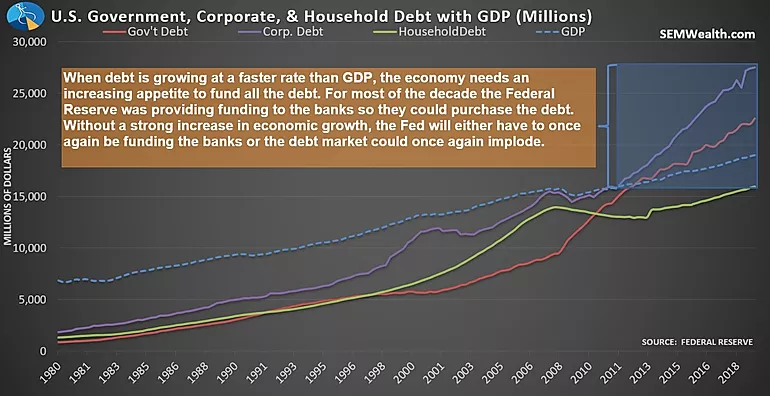

As we start a new decade it appears we will continue to have "unprecedented" measures by the Federal Reserve to keep the markets rising. While the Fed refuses to call the huge influx of cash into the banking system "Quantitative Easing (QE)," the fact the banking system still needs the

There are a lot of things that create bubbles, but the primary driver behind all of them is our emotions. Our brains are programmed to both assume what has happened recently will continue to happen and to only watch for scenarios they believe are possible. I've called this current bull