Last week we learned inflation is running at the highest annualized rate since 1982. This led one Federal Reserve President (James Bullard of St. Louis) to say he will push to increase interest rates up 1% by July. Wall Street quickly upped their expectations for Fed Rate hikes to include

Tag: Quantitative Easing

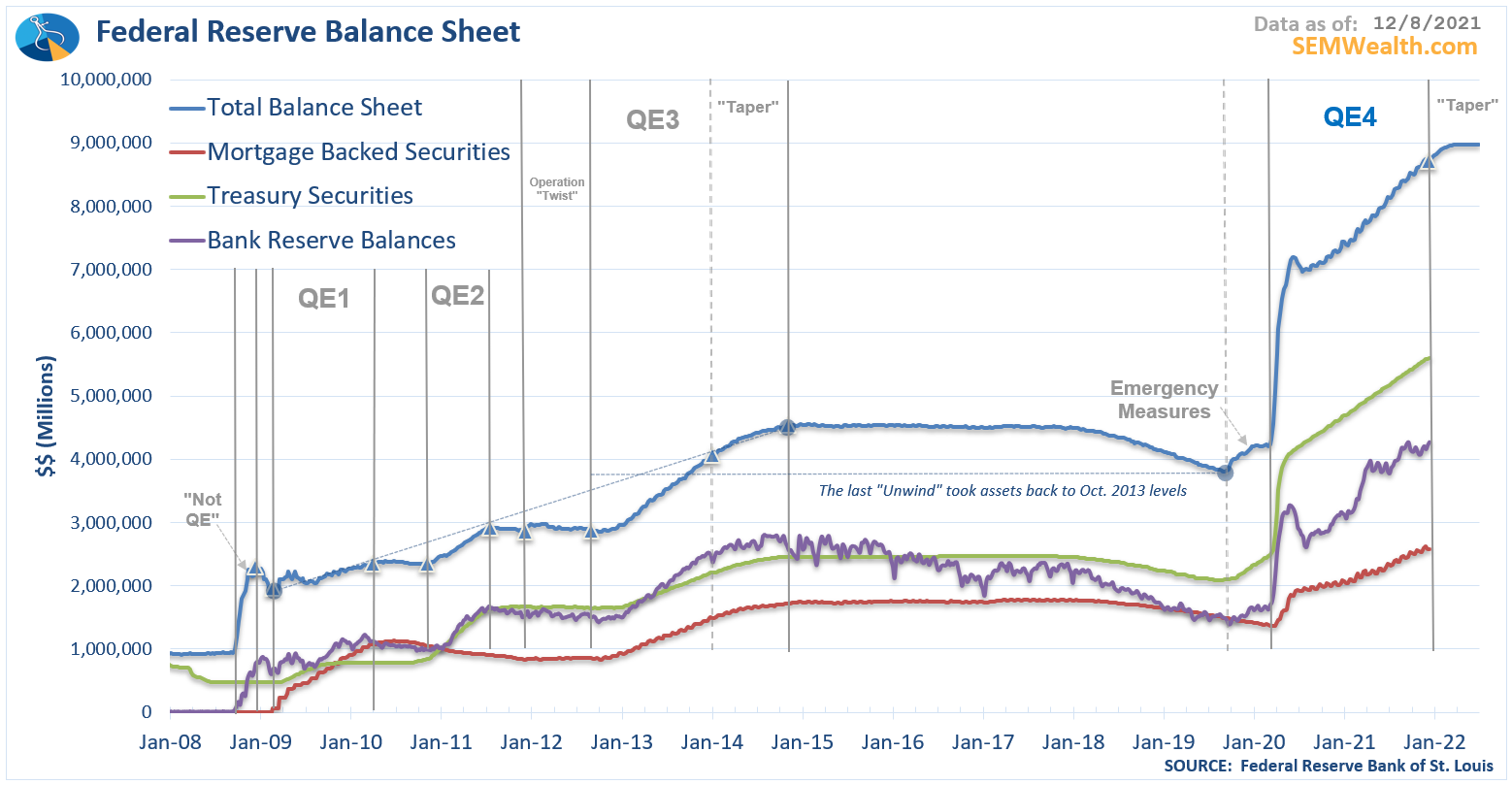

The Federal Reserve announced on Wednesday they were accelerating the pace of the tapering of their Quantitative Easing program. While markets were on edge after some shaky press conferences in prior months, this was already telegraphed in Congressional testimony at the end of November. Back then the markets initially panicked,

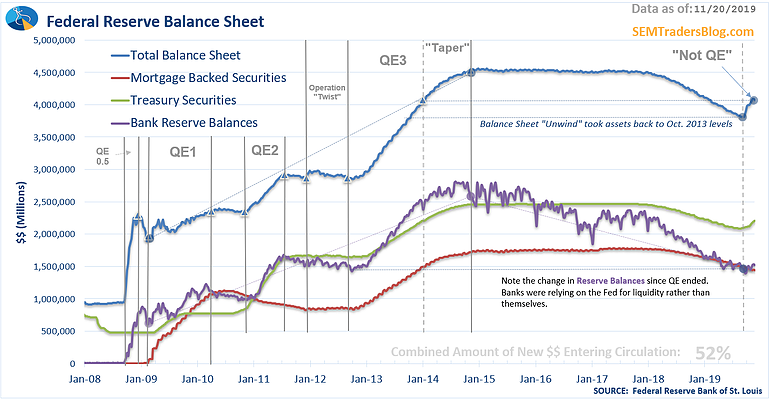

Stocks have been going crazy since the Federal Reserve stepped in to once again help the banks meet their obligations. While Fed Chairman Jerome Powell has said the current operation is "not Quantitative Easing", whatever it is it is having a significant impact on attitudes towards risk in our financial

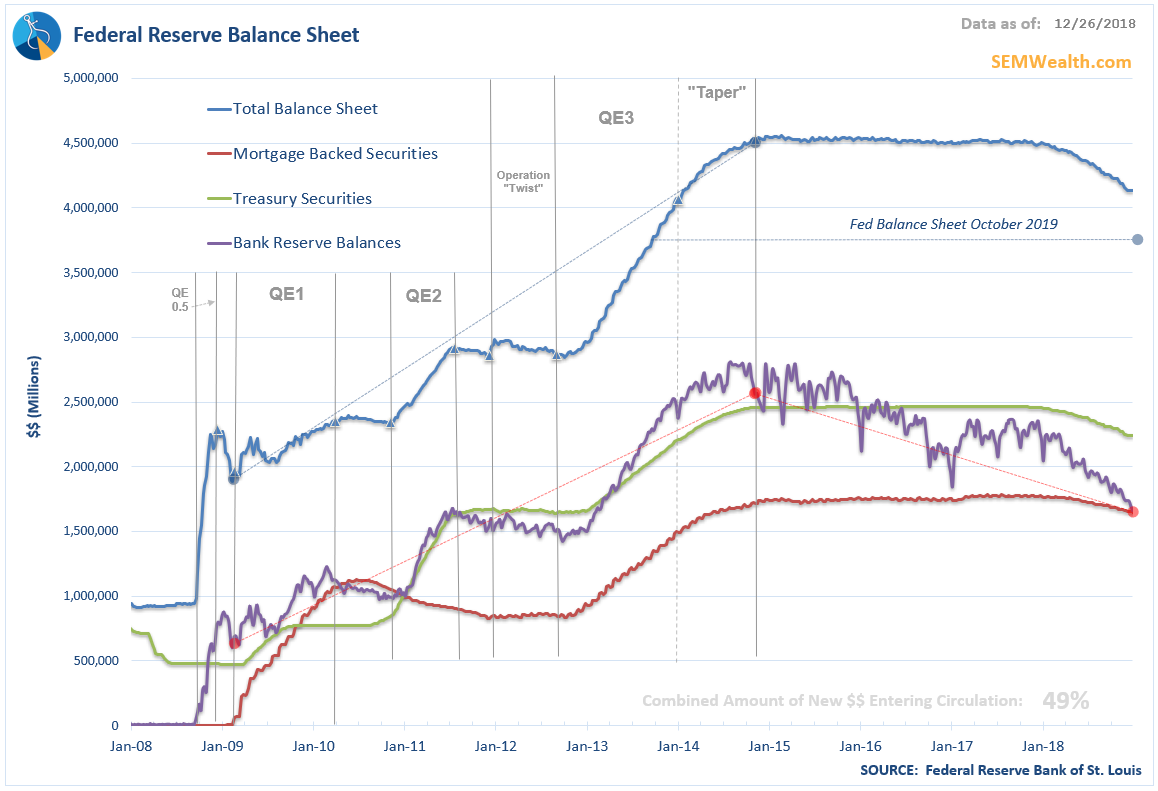

The Federal Reserve has come under intense scrutiny, not only from our President, but also from the stock market bulls who are blaming them for the 2018 sell-off. Specifically they are going after Fed Chairman Jay Powell saying he “doesn’t understand how the markets work” or

It’s another week where the highlight will be the “much anticipated” Fed meeting. I’m not sure how we got here or what will happen to get away from this focus on the Fed, but it’s not normal for a central bank to