Stress will always expose weaknesses. For the past 15 years I've written and spoke about our broken economy. Massive budget deficits, continued reliance on a service economy, a huge trade imbalance, over a hundred trillion dollars in unfunded liabilities (Social Security & Medicare), a massive demographic imbalance impacting our labor

Tag: SEM Model Update

I think most people enjoy fall. The transition from the hot summer weather to something a bit more comfortable is a relief. In many parts of the country the changing of the leaves comes at the same time the insect population begins to diminish. For others pulling out hoodies, fall

Today is a sad day. For me, at least. Today is the first day in 17 days that we will not be giving out medals to the best athletes in the world, who worked mostly quietly on their craft for 5 years for this moment of peak physical showcasing. As

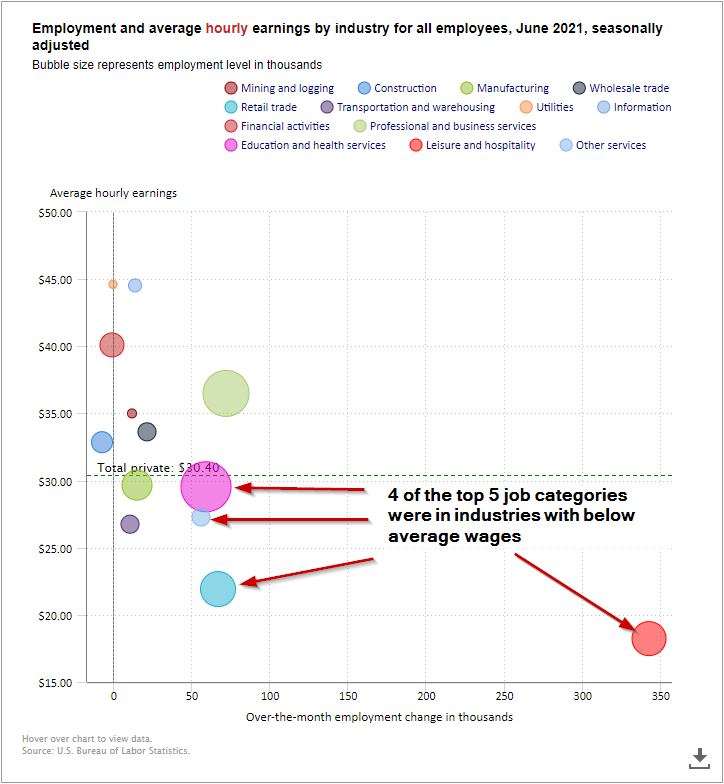

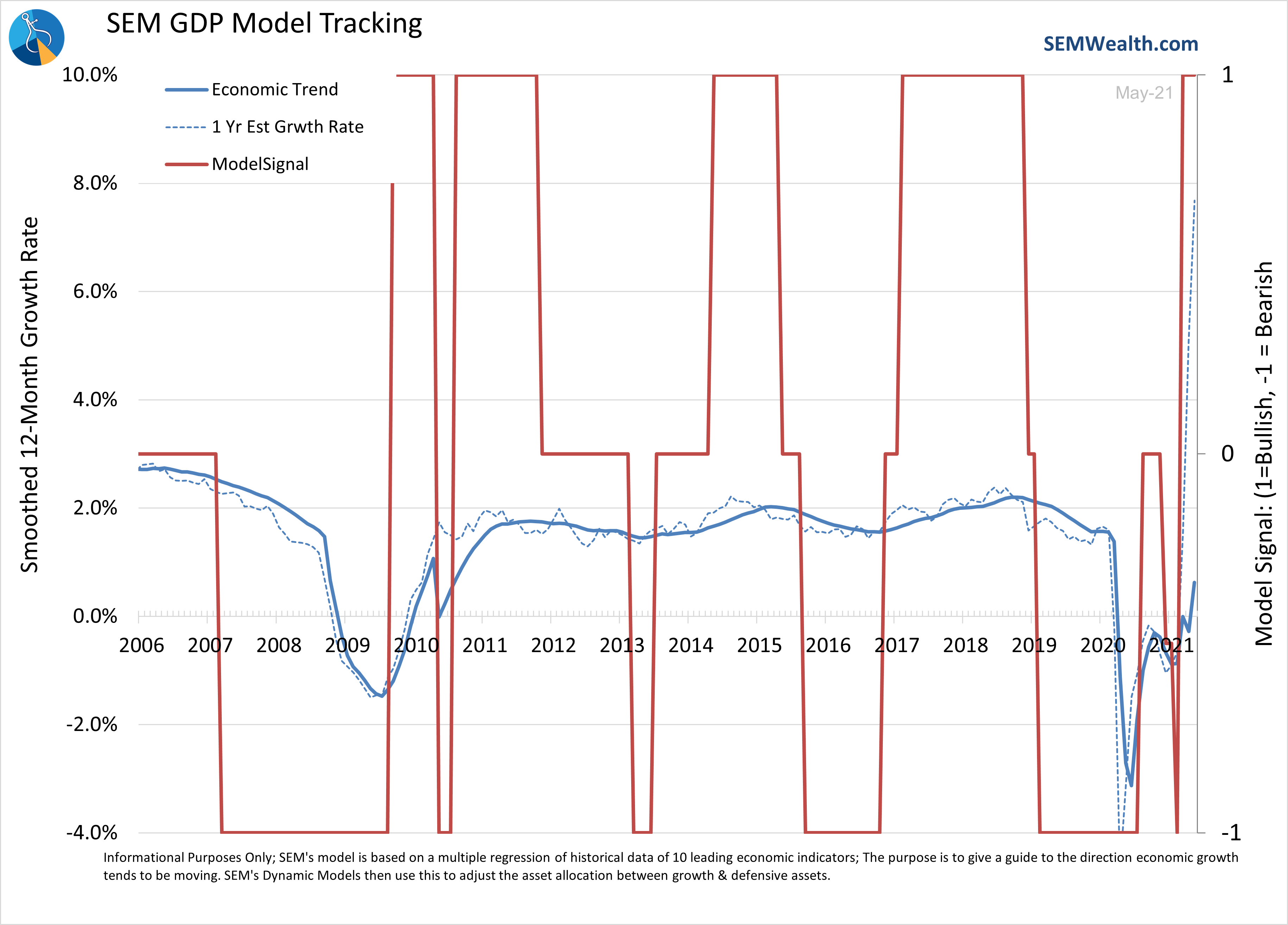

Moving into the second half of 2021 I thought it would be timely to take a walk through SEM's Economic Model to give us an idea of where we stand economically. The markets are obviously pricing in a spectacular recovery and we won't know until the fall what the economy

The economic recovery should be back in full force with anybody who wanted to be vaccinated already receiving their vaccinations, the CDC essentially saying those who are vaccinated can do whatever they want, the number of new COVID cases at very low levels, and pretty much every state fully lifting