It's been bad enough trying to remember what day it is the past 11 weeks. Throw in a Monday holiday and we'll be confused all week. Today feels like Monday, with a slightly refreshed feeling thanks to an extra day away from the computer screens. More importantly, despite the "hardships"

Tag: Valuations

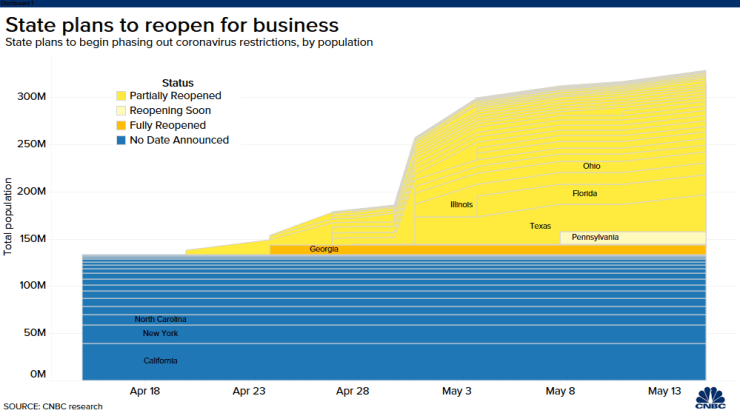

We are starting week 9 of the COVID19 Panic. Many more states opened up on Friday. Here in Virginia we have one more week (hopefully) before non-essential businesses with less than 10 people in their stores/shops at a time can re-open. As I said last week, we're going to

We keep hearing about the buying opportunities that have developed due to the COVID-19 pandemic. For the first time in at least 10 years, I'm finally excited about the buying opportunities that have developed. No, I haven't gone crazy after two weeks in our home/office. This is exciting!

Since

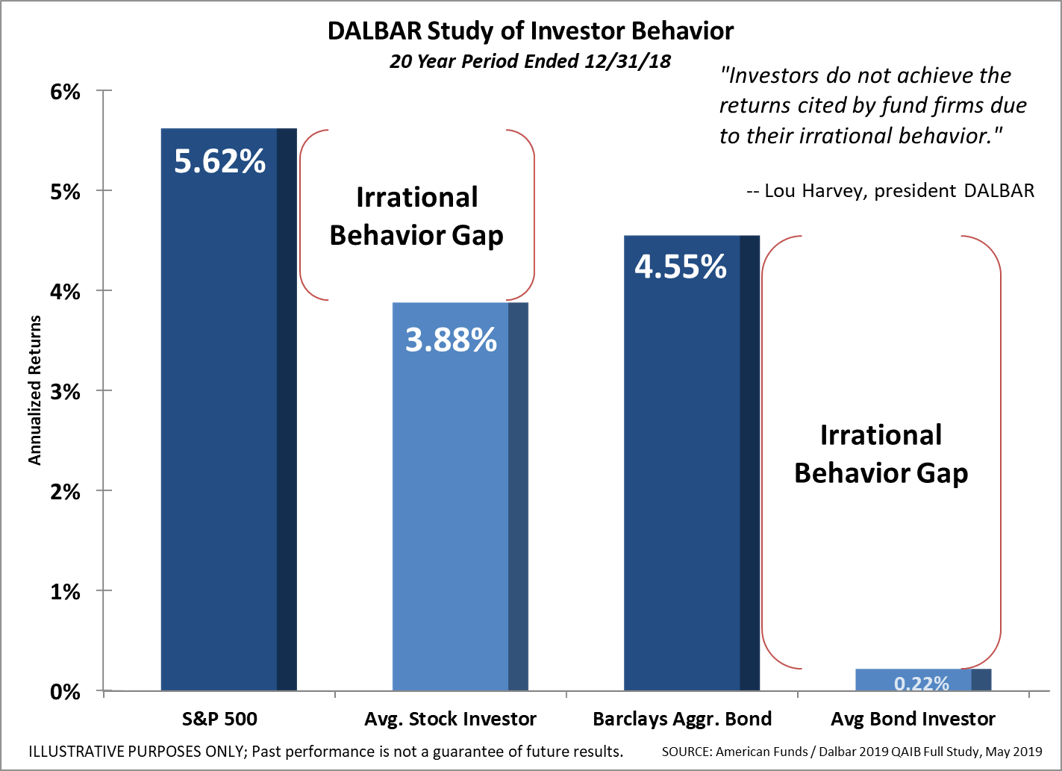

Since our founding 27 years ago, SEM has understood one critical fact — investors are humans, not robots. Each year DALBAR releases the Quantitative Analysis of Investor Behavior (QAIB). They study the buy & sell patterns of stock and bond investors and compare the returns of the average investor to

Stock market cheerleaders often point to the high earnings growth rate projections when recommending investors “buy any dip” in the stock market. Last week we highlighted both the very high expectations for earnings growth along with a big increase in the “multiple” (Price/Earnings ratio). Essentially,