Long weekends are a good time to relax, reflect, and plan. Historically the end of Labor Day weekend also marked the time the 'head honchos' from Wall Street returned to the office with fresh ideas and some big portfolio adjustments to make. With everyone able to work remotely now, I'm

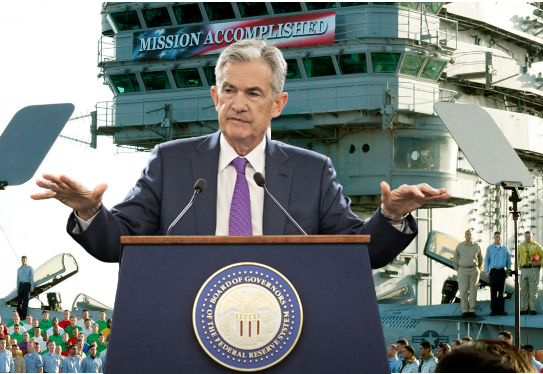

“My confidence has grown that inflation is on a sustainable path back to 2%"

“The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

"We do not seek or welcome further cooling in

The problem with the Fed telling the financial markets who have become Fed policy dependent over the past 10 years that they are "data dependent", is every single piece of data is viewed as "critical". Every data release has been under a microscope with giant leaps being made as to

Over the past 10 days, we've seen a lot of headlines which read, "stocks post best (worst) day since (2022 or 2020 or even 2008)." This has obviously created a lot more contact with SEM and our advisors regarding the state of the markets or the economy. We've enjoyed several

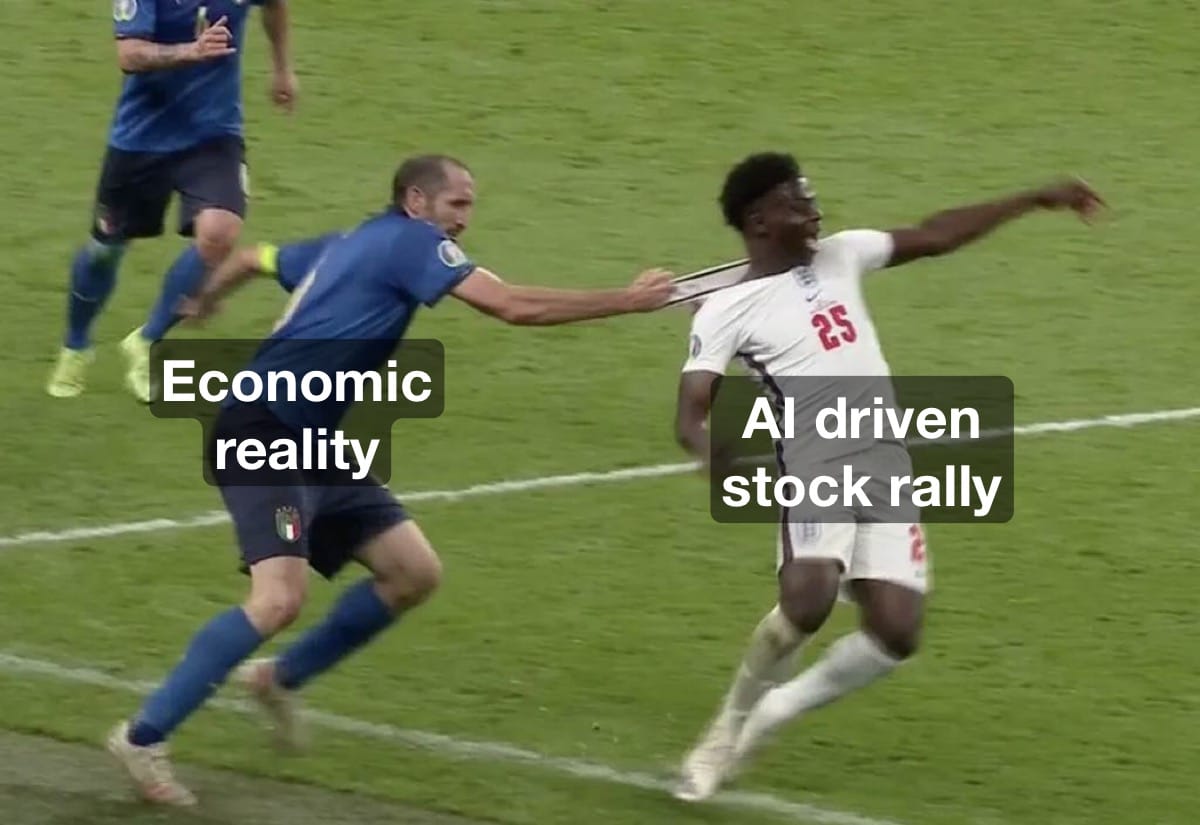

Four weeks ago the title of the blog was "Be careful (what you wish for)." At the time bad economic data was viewed as 'good' news for stocks as it meant the Fed was likely to cut interest rates at some point soon. I warned at the time about the