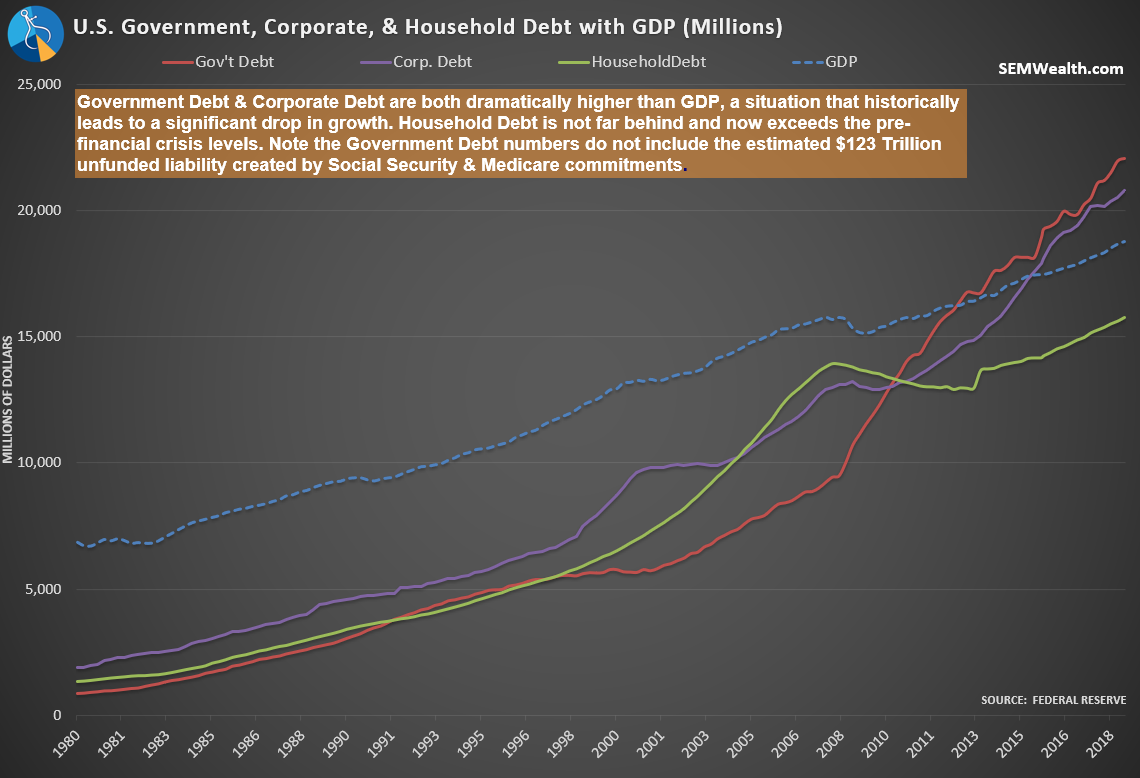

This week the Trustees of the Social Security & Medicare Trust funds released their annual report. They reported under current law Medicare will be insolvent by 2026 and Social Security by 2035. That’s in 7 & 16 years respectively. Their assumptions also include steady 3% economic growth with no

Debt is future spending brought forward. Another way to think about it, debt will hurt future spending. As I was talking to several advisors and clients this week after the end of tax season I couldn’t help but think of our country’s debt problems. Few people want to

I was quoted in two articles this week. On Sunday, the New York Times published “When Gambling Seems Like a Good Investment“. The article discussed ways financial advisors deal with aggressive clients. It gave me the opportunity to highlight our behavioral approach. In this case, I discussed how

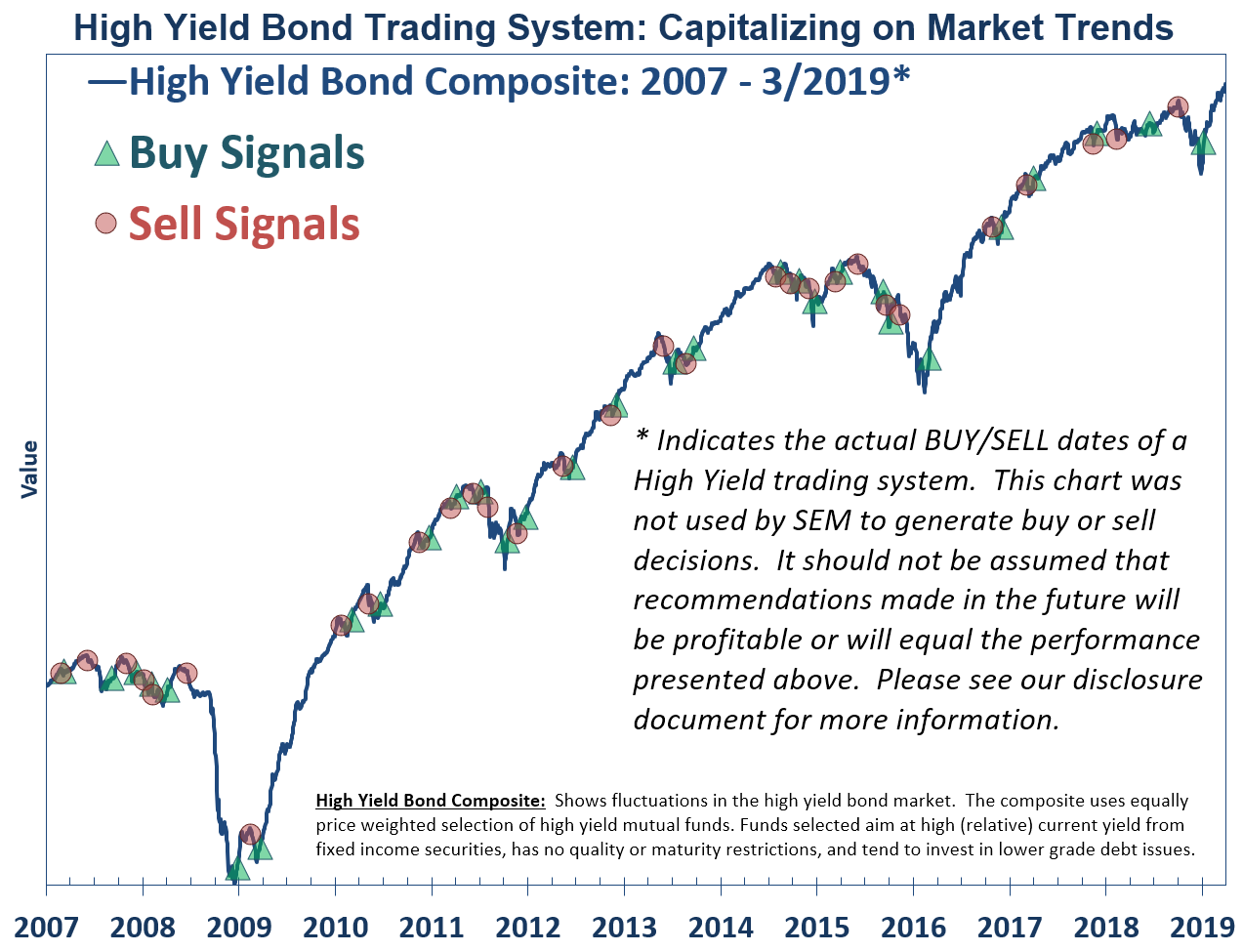

The last few months I’ve periodically pointed out some stress points that all investors should be wary of as the economic expansion and bull market approaches record length. While the Federal Reserve capitulated to the constant pressure from the president and Wall Street’s panic in the

Pressing Questions for Investors

The 4th quarter of 2018 was the worst quarter for stocks since the Financial Crisis, with December’s drop coming in as the worst since the Great Depression. The start of 2019 has seen nearly the opposite, posting the best start to the year