Last week's Musings focused more on the big picture and my message to clients and advisors on where we go next. With that focus a lot of my random thoughts last week were on the long-term impact COVID will have on our economy, the markets, and our lives. We will have a lot more on that in the months ahead, but we all need to keep in mind that many things will feel "different", but what doesn't change is the way our brains make decisions. We all have inherent biases when we make decisions. There isn't anything wrong with that, it's what makes us human.

Our hearts and brains are often conflicting.

Here's what's on my mind as we start Week 24 of the COVID19 Pandemic:

An Election Like No Other

With the Democratic Convention last week and the Republican one this week, we can say we are now officially in election season. It seems like we've been there for at least 2 years given how early candidates started campaigning against President Trump, which led to what seemed like 2 years of campaigning by the President. Emotions are clearly high.

Last week we had 3 clients request to go to cash until after the election. The message came from their advisor and I didn't get a chance to talk to the clients. The advisors know one of my top rules in investing – do not let your political beliefs influence your investment decisions. I need to get a message out to all of our clients soon. I don't know what the outcome will be, or what the reaction will be from the market. I've done this long enough and studied enough data to know the market does not always behave like we think it should.

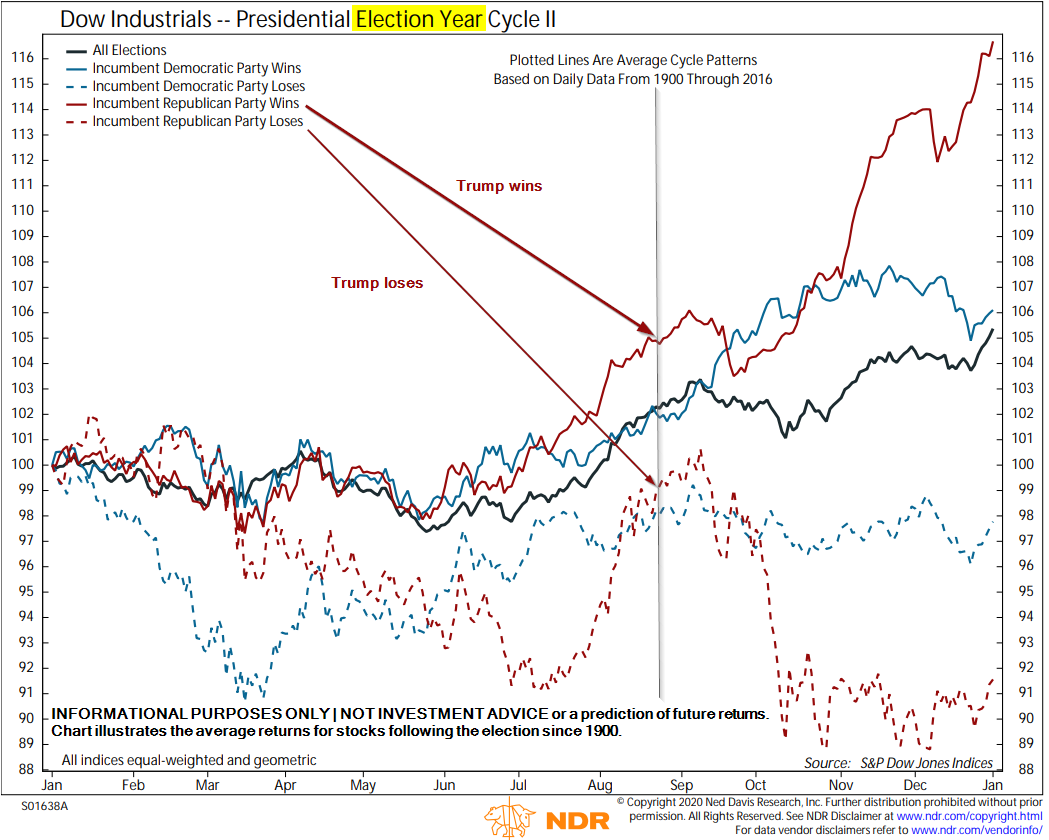

Ned Davis put together some data that may help guide us. There are two key takeaways:

1.) Nobody can confidently predict the outcome of the election.

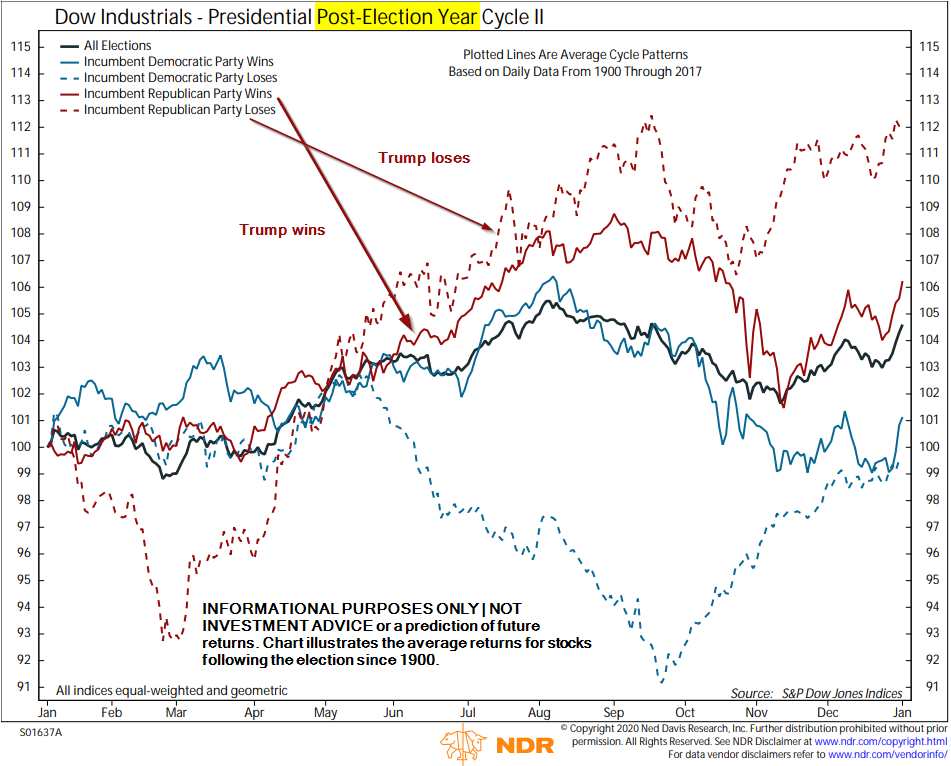

2.) Even if you get it right, the market may surprise you next year in its reaction.

First, let's look at the average cycle. I put arrows on there to highlight our two possible outcomes with a line marking where we are currently. Do you trust the polls or your opinion to make a decision that can cost you significant amounts of money (or missed opportunities)?

Even if the President loses, the following year could bring a sharp recovery higher.

My opinion, is Republicans are fighting an uphill battle. COVID has widened the gap between the "haves" and "have nots". If the economy remains weak, we could see a swing to total Democratic control, but that doesn't mean you should go to cash if you think I'm right.

Going to cash because you think Biden is going to win. Remember, the predictions were Clinton and Obama would be terrible for markets and the economy. They might campaign on one platform, but getting things done in Congress is a different story, especially when Wall Street starts talking in their ear about how bad their policies could be for the economy.

I will say if you are a Christian and looking to make a bigger impact with your investment dollars, rather than "going to cash" because you are worried about Trump losing, our Cornerstone Models could be a far better way to support your beliefs. Each month Courtney posts an update on what our Cornerstone partners are doing with our investment dollars in the models.

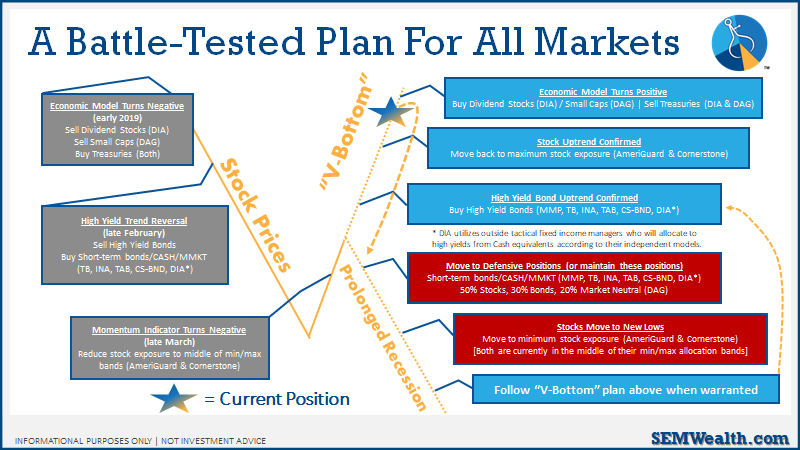

Trust Our Data Driven Process

This year has once again proven the value of our data-driven process. The relative sense of calm around our offices as the market was collapsing and then rocketing back higher was something I am most proud of. While fielding calls and emails from clients and advisors asking what to think of (fill in the blank headline), the message was simple – "we've been here before and our plan is working as it should."

I cannot emphasize enough how important our process will be going into the election. We don't have to predict who will win or what the impact will be on the economy or markets. We will follow the data and our process. Here's a reminder of what that process has looked like in 2020.

Here's a short webinar we ran earlier this summer describing our process.

Or here's a more fun look at the way we manage money.

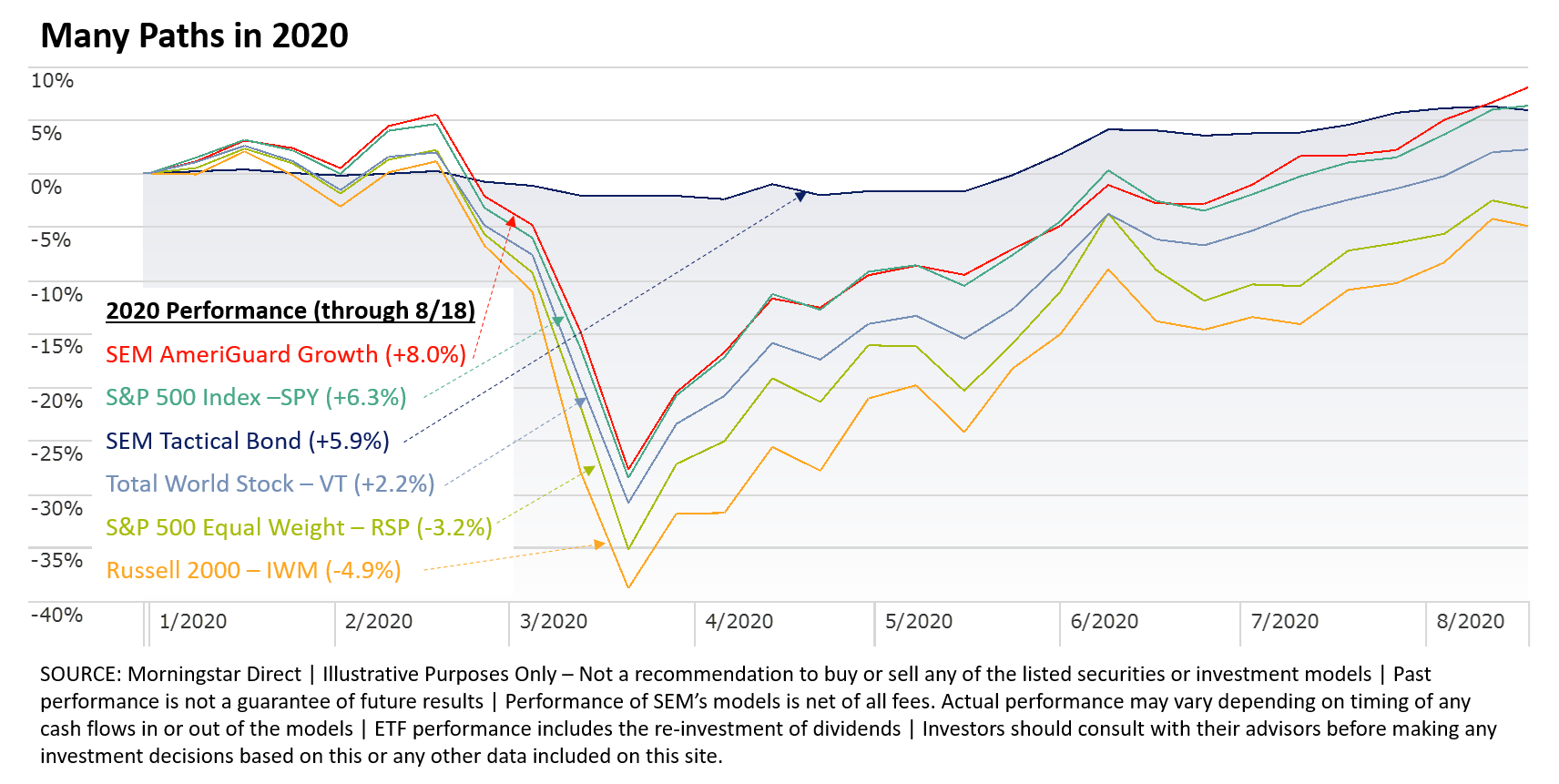

In last week's Chart of the Week, I showed the different paths you could have taken in 2020. In my opinion it is impressive that on both ends of our risk spectrum our models have performed the same or better than the S&P 500.

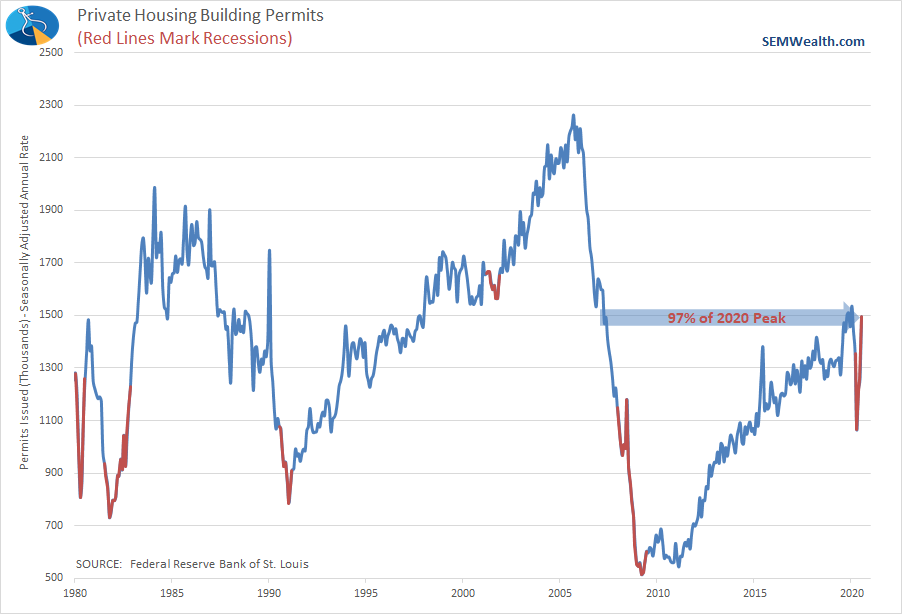

A Bull Market in Housing

One of the biggest impacts we've seen from COVID is the realization that businesses can function without their employees in the office. This along with insanely low interest rates on mortgages has led to an explosion in suburban housing markets. Building Permits have nearly recovered all of the losses in 2020.

I've always looked at Building Permits as one of the best leading indicators as the amount of economic activity that goes into building and moving into a new home is significant. One thing we will have to watch is if we have an air pocket in the economy with the change in unemployment benefits and the decreasing likelihood of another round of stimulus checks. This could lead to some fresh bankruptcies and business closures, which could lead to more unemployment.

We Still Have the Fed

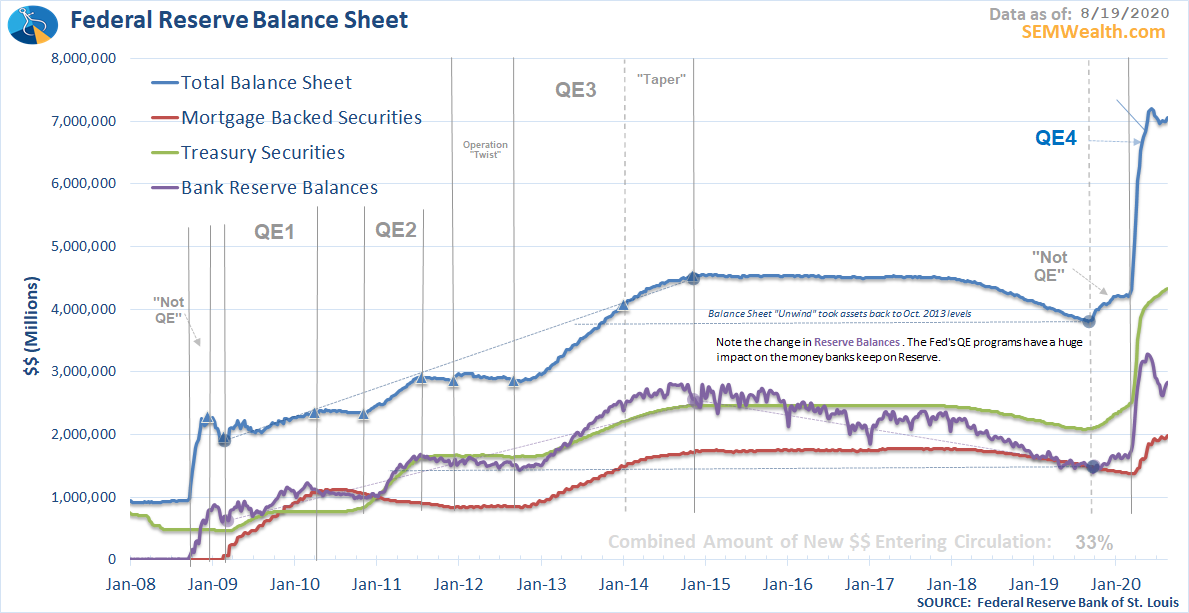

I mentioned last week how I'd be watching the Fed's Balance Sheet closely. They release the data each Thursday. We saw 10-year Treasury interest rates spike two weeks ago on the heels of 6 out of 8 weekly declines in the Fed's Balance Sheet. Last week they were more active in their purchases, boosting their purchases by nearly 1% ($54 billion). They were most active in the Mortgage Backed Security and Treasury markets. We subsequently saw a nice decline in 10-year Treasury yields.

Their purchases are "open-ended", but it doesn't mean we can count on them to save everything, which brings me to my last point.

Dangers and Opportunities in Bonds

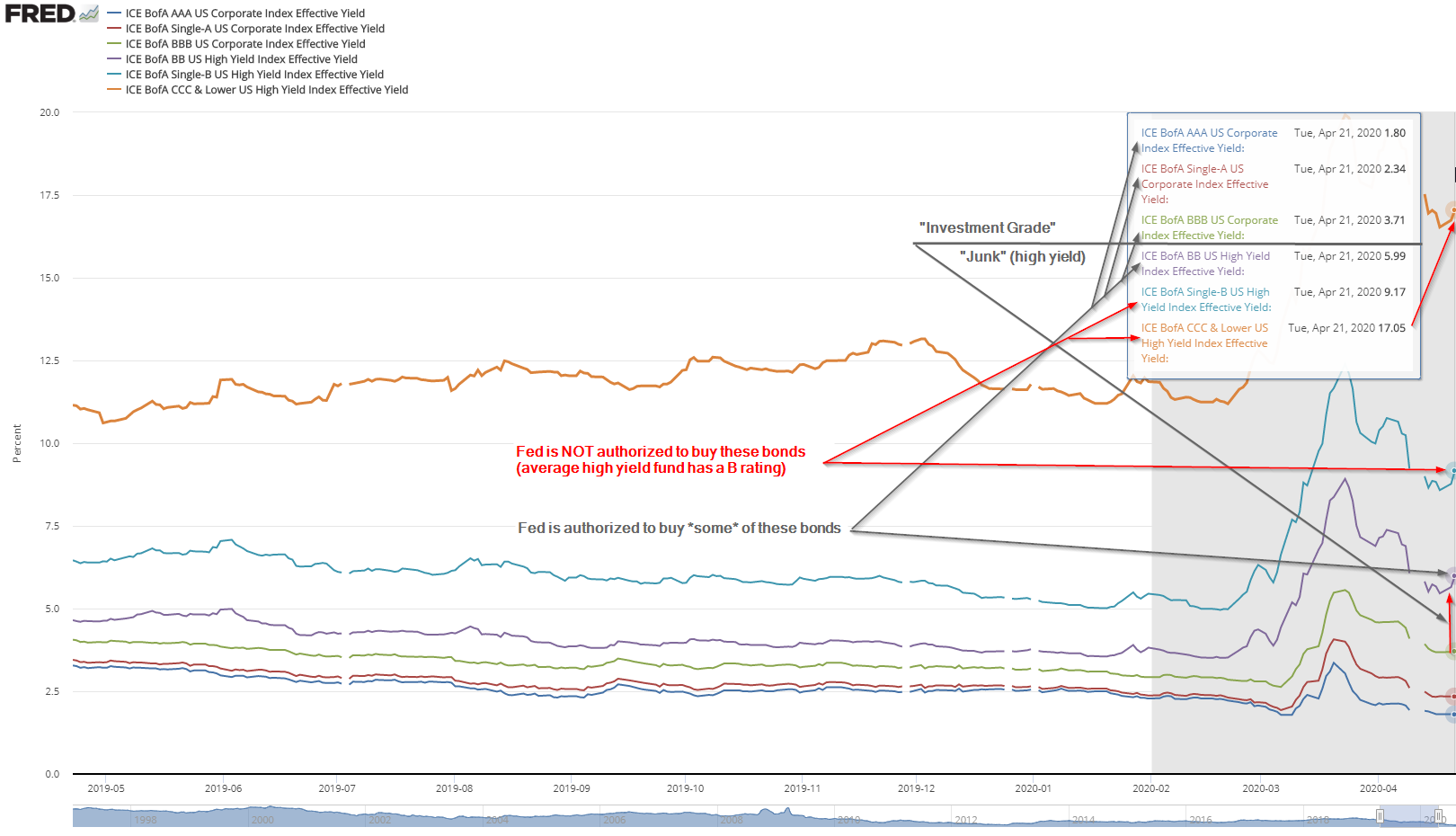

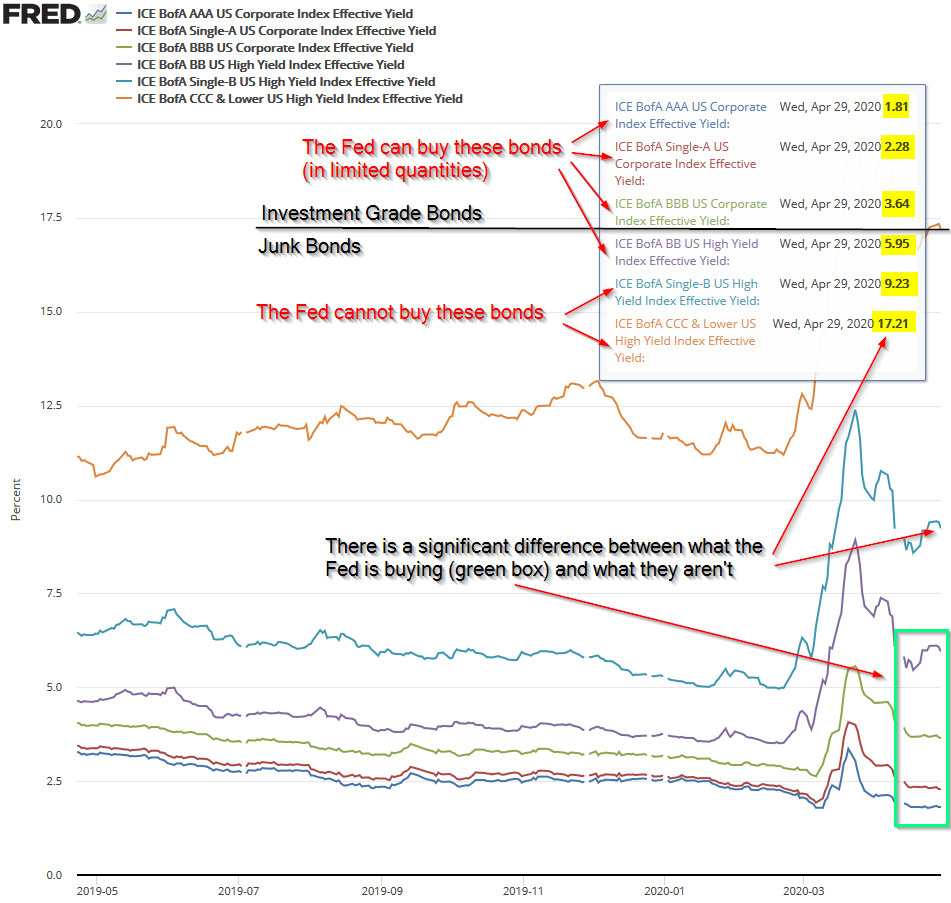

The Fed shocked everybody in the spring when they announced they were setting up programs to buy corporate bonds, including some select "junk" bonds. Junk bonds (aka high yield bonds) are rated BB and below and have higher yields because they are much more at risk of not paying their money back. The Fed's programs allow them to buy bonds rated as low as BB, but only if the issuer was rated BBB (lowest investment grade rating) or higher before COVID19 struck our economy.

In other words, they can buy bonds of companies who were healthy pre-COVID, but were hit hard due to the widespread shutdowns. Those companies already weak are not on the Fed's purchase list.

Here is a chart illustrating the wide divergence in the bond market. You can see the huge difference in yields between both "investment grade" (BBB) and BB. There is an even bigger difference between what the Fed can and cannot buy. If you look closely you can see yields moving higher in all high yield categories. As I mentioned earlier, the air pocket we are likely to see in the economy will probably lead to more bankruptcies, layoffs, and defaults.

We are currently invested in high yields in our Tactical Bond and Cornerstone Bond models, although two weeks ago we sold a bit of our exposure.

These models have made some sizeable gains since mid-April, but are now watching closely for more stress. At that point they will move back to lower risk investments and wait for the next opportunity. That opportunity could be HUGE.

I'm not sure when that comes, but history, data, and economic logic tells me we will see mass defaults in high yields (which also won't be good for the stock market). As we've shown over the past few decades, we'll be ready. Will you be?

Continuing the Experiment

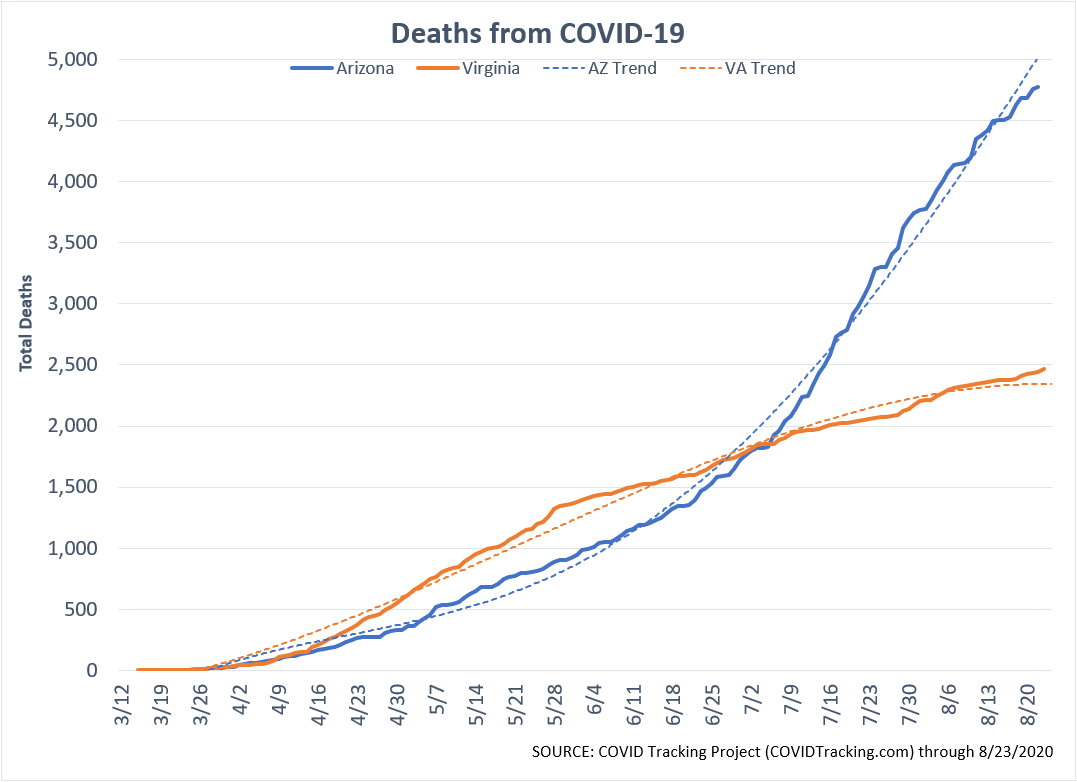

I've been documenting the difference between Virginia and Arizona since the beginning of the pandemic – both having nearly opposite responses. As I've said before, there are a lot of variables in this experiment and we won't truly know what worked and what didn't work until scientists can study the virus more.

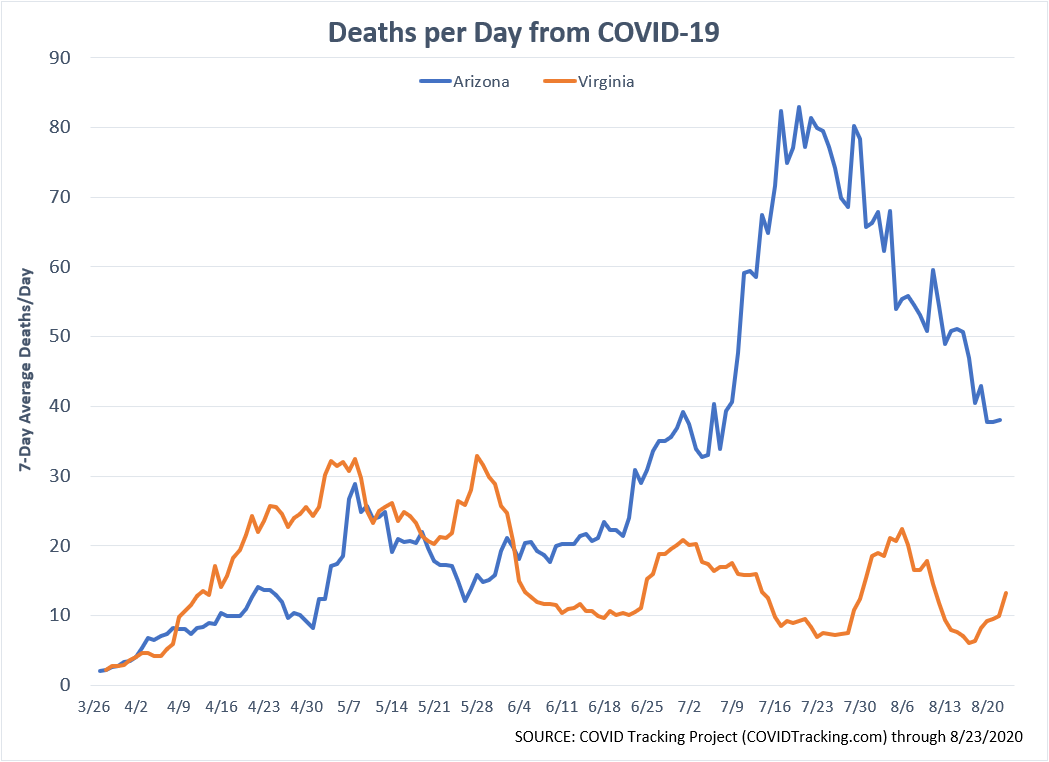

Keep in mind when looking at the charts below that Arizona has nearly 2 million LESS people than Virginia does.

With the increased restrictions in Arizona, their deaths per day has drastically fallen; however, it's still almost double what Virginia is seeing.

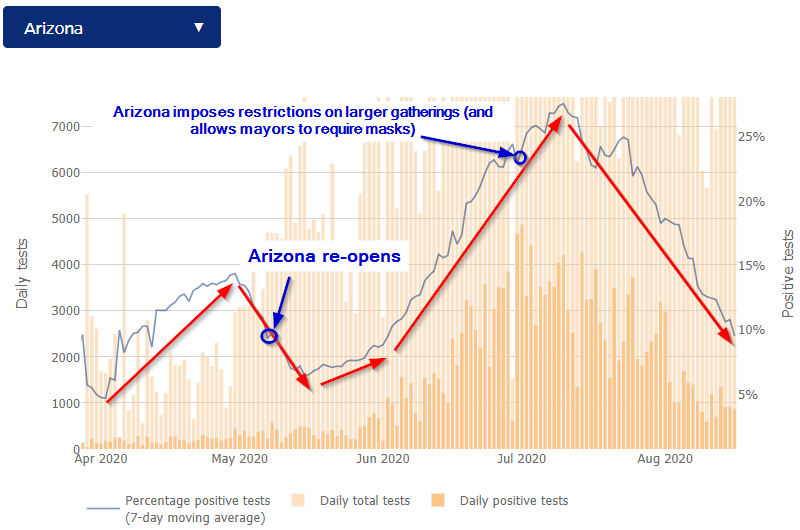

Using the percent positive tests normalizes the number of cases. More testing = more cases. After mandating masks and imposing more restrictions in July, Arizona is now back to around 10% positive tests.

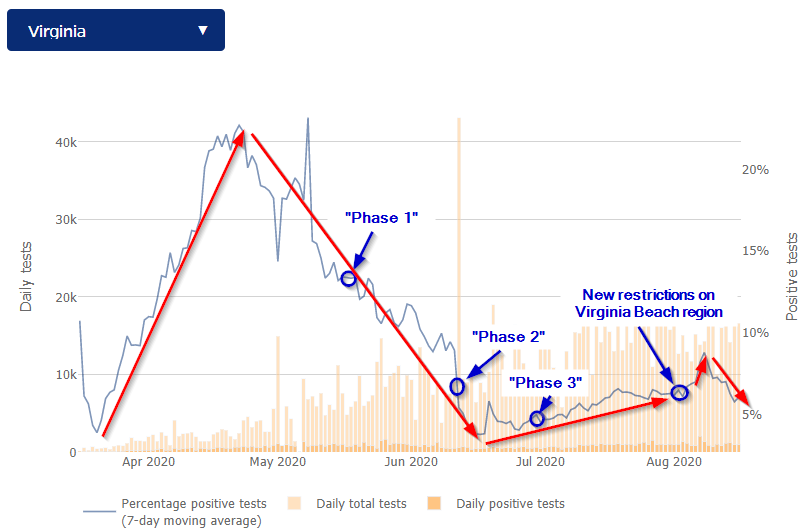

Virginia saw an increase in percent positive tests after beginning "Phase 3" in early July. In August the Virginia Beach region had new restrictions in place, and we are now seeing the percent positive tests decrease again.

With many schools opening up and having varied procedures, we will have more data in the coming weeks.