In Ernest Hemmingway's The Sun Also Rises, the main character was asked, "How did you go bankrupt?" He responded two ways, "Gradually, then suddenly." When asked, "what brought it on?" he said, "Friends. I had a lot of friends. False friends. Then I had creditors, too. Probably had more creditors than anybody in England."

As I watched the market last week and finished up the September economic data updates in our model, this exchange came to mind. The September jobs report has many people raving about the strength of the labor market. Of course, that's a double-edged sword as it likely will falsely make the Fed believe they need to continue in their aggressive rate hiking path.

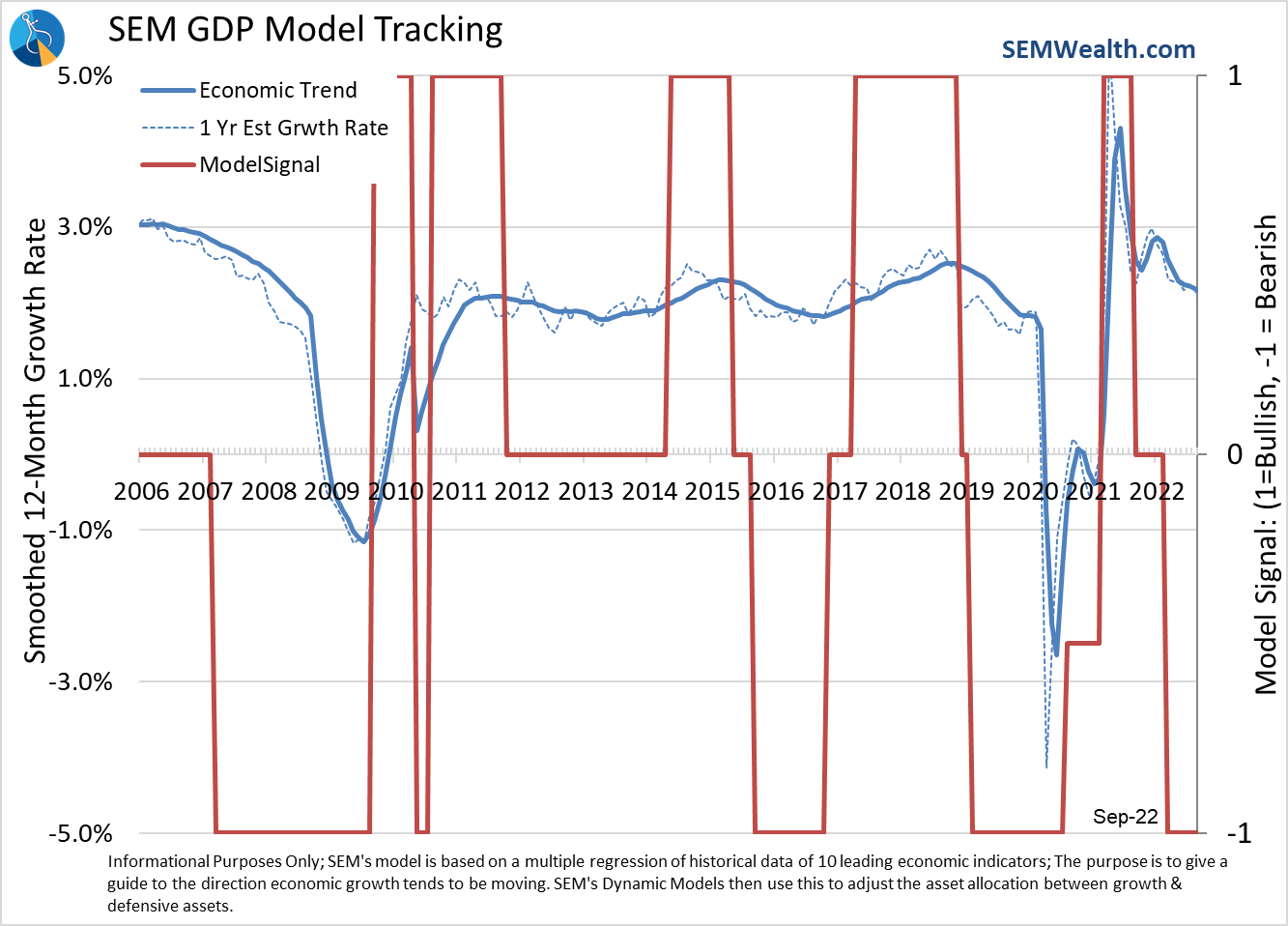

A year ago, our economic model switched from "bullish" to "neutral". At that time the stock market was on its way to a 20% return. Everybody loved stocks. Investors were dumping low risk strategies because the stock market was a "can't miss" solution. It was a "new era" everyone told us. The Fed surely wouldn't let the market go down.

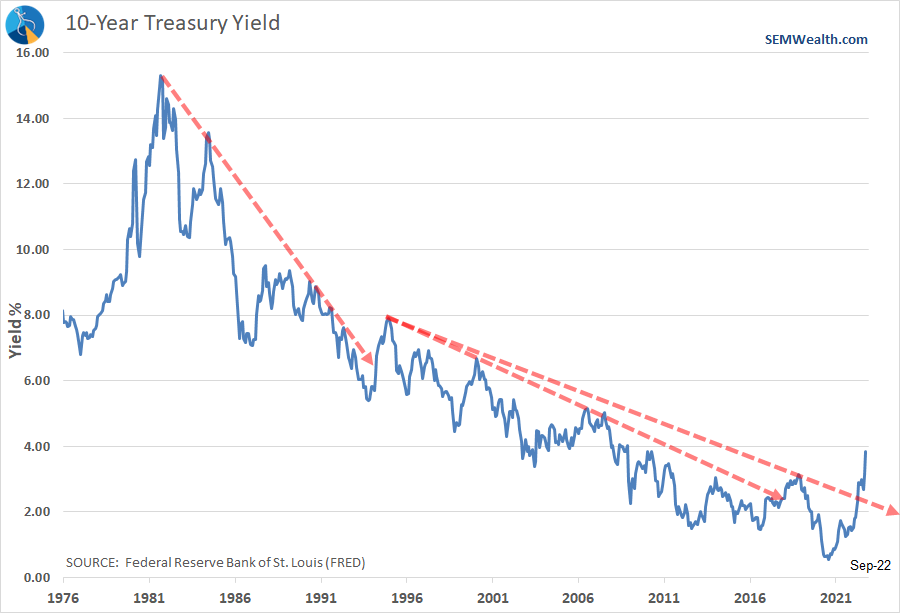

At that time I drafted our fall presentation series I would present for the Financial Planning Association, our clients, and our advisors. It was titled "Navigating Uncertainty." Unlike the Wall Street pundits who believed the market would continue to march higher, I warned what the data told us – stocks were at historically high levels, the economy was slowing, inflation was going to be a problem, bond yields were about to break their 40-year downtrend, and many investors and advisors would experience their first REAL bear market for the first time.

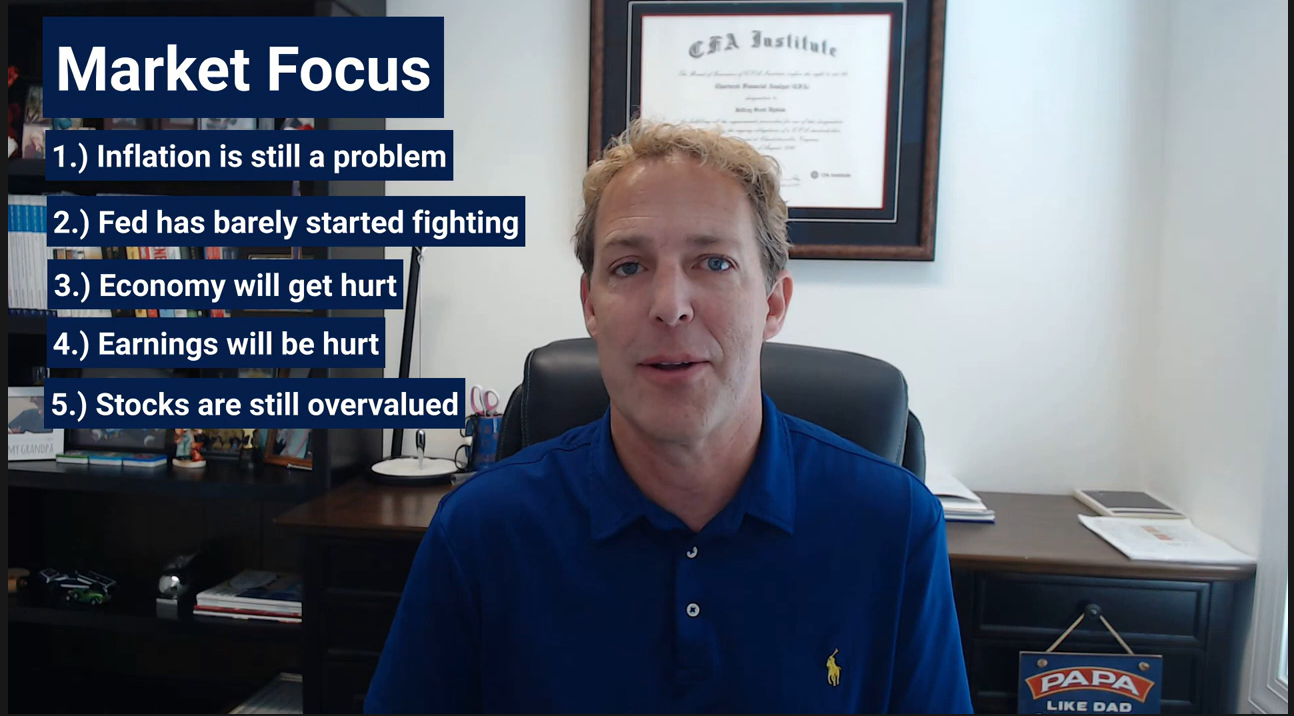

I've written over 100,000 words in this blog over the past year. I don't know how many ways to say it. We are in a bear market until the DATA (not the "experts" in the financial media) tells us differently. We're going to have some big rallies, but recessionary bear markets hit differently. If you want a quick summary of the environment and how SEM is positioned to handle it, check out our client newsletter.

If you want a bit longer explanation, check out our six-minute "Navigating the Bear" video (with a written summary below it.)

We also posted a six-minute video in June with some "Bear Market Tips).

Last week I looked at the Fed's dilemma. The economic data is only making their job more difficult. I'd encourage you to take some time to read it, especially any time the market rallies. Just because the market goes up, doesn't mean the bear market is over.

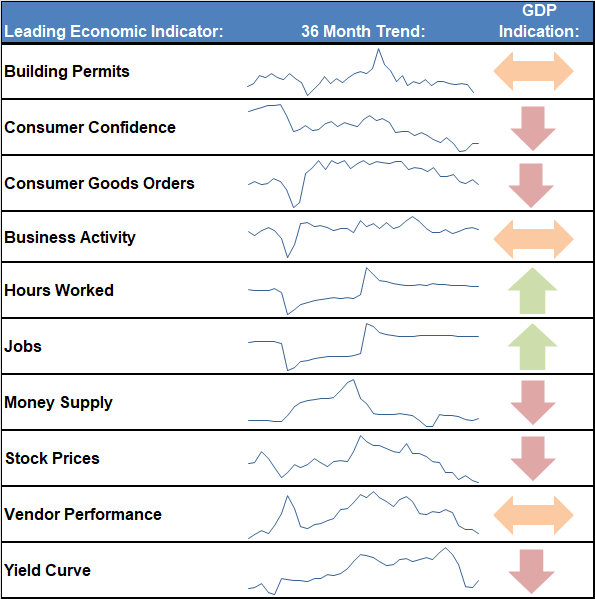

This week, we will walk through our economic model. The bottom line is the economy is still gradually slowing. At some point the Fed is going to push too far and we will suddenly be in a recession. Gradually, then suddenly.

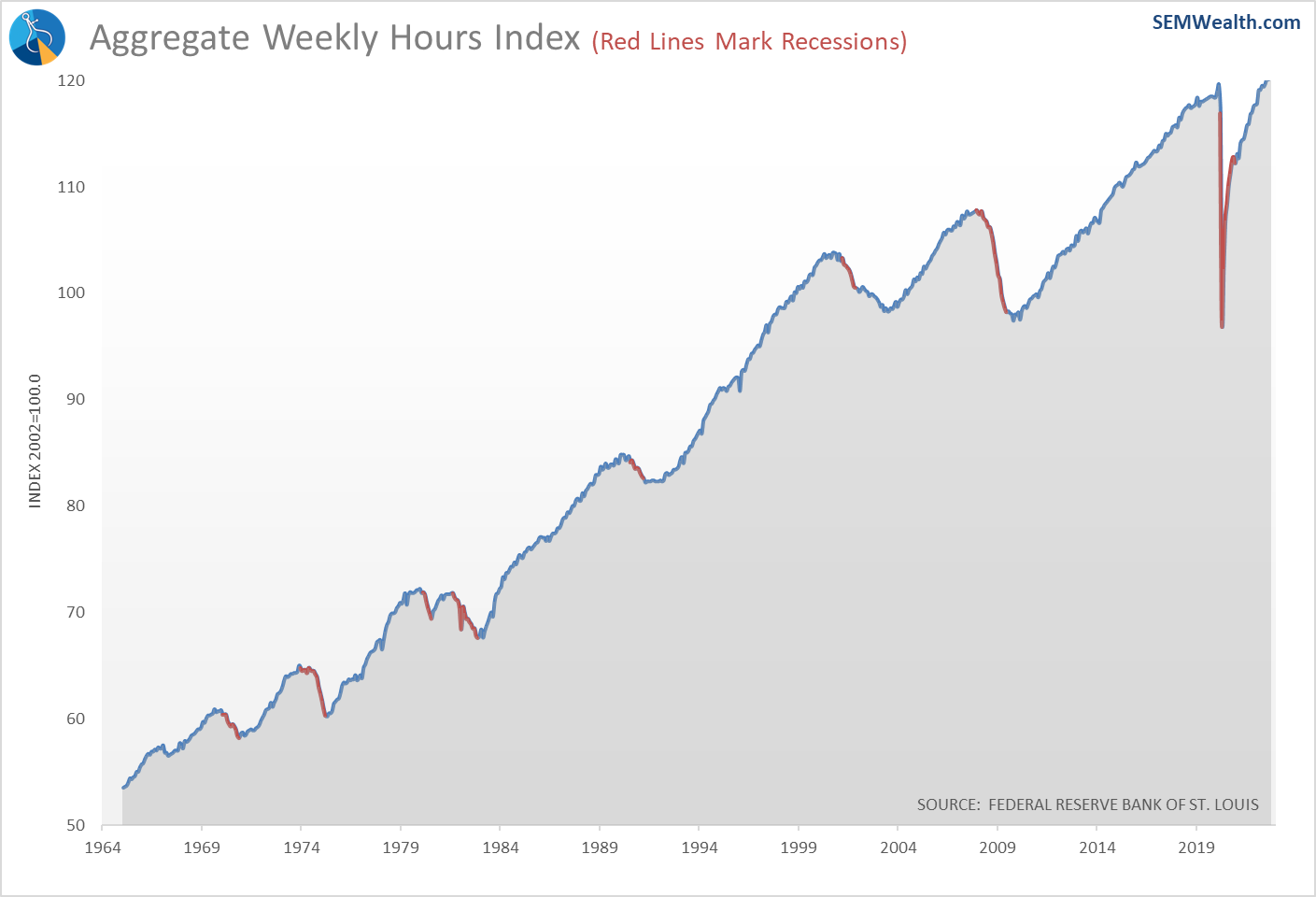

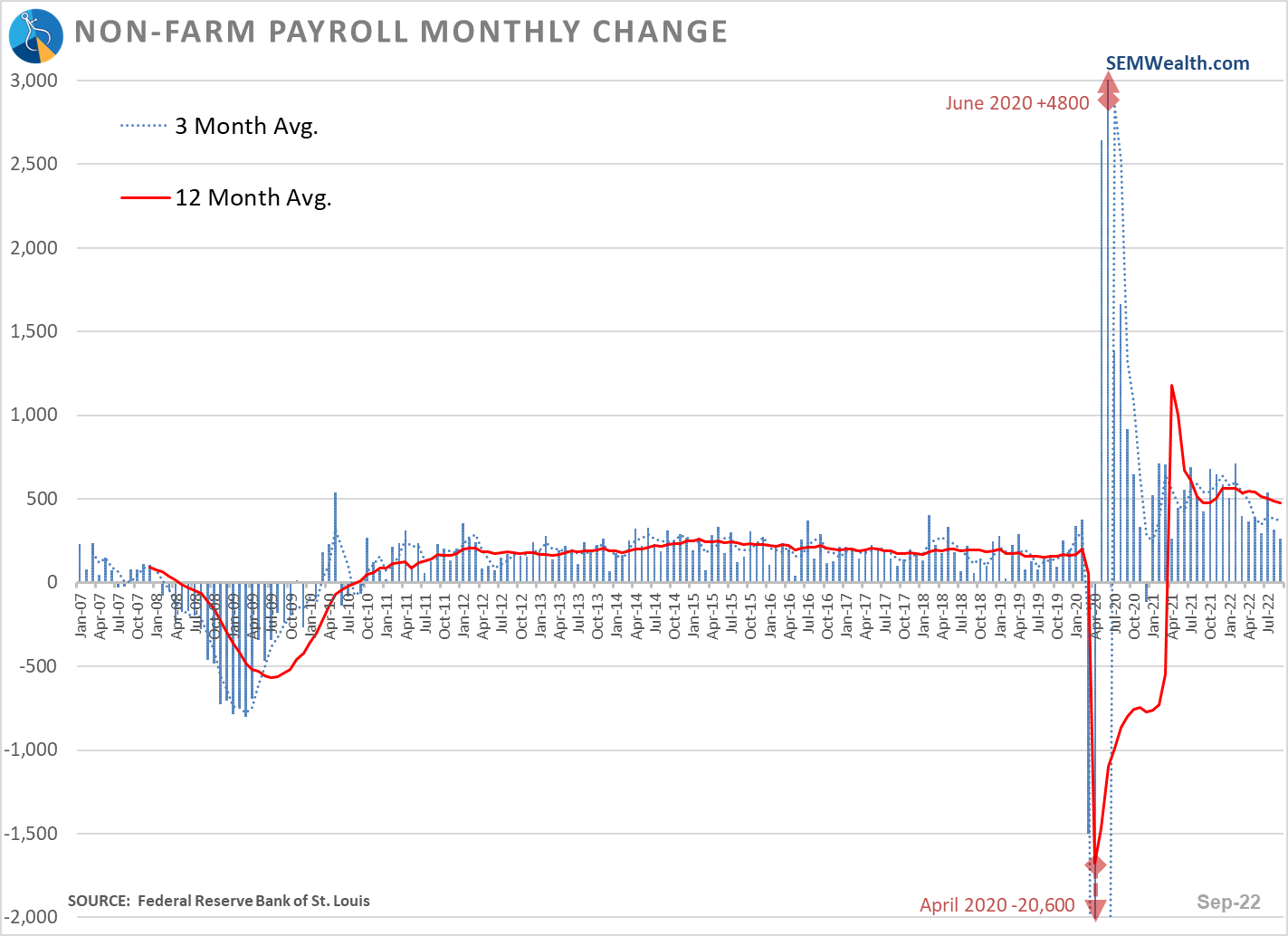

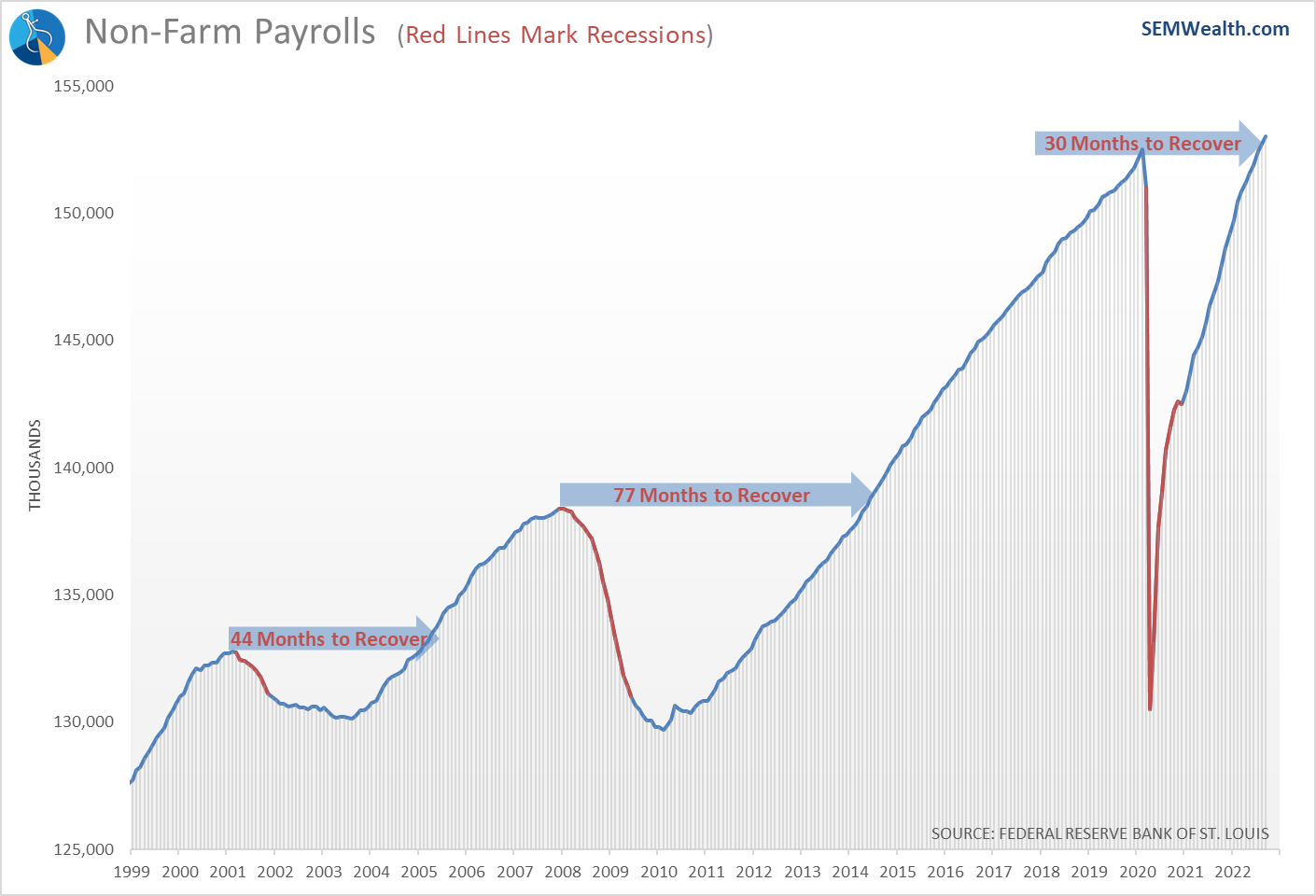

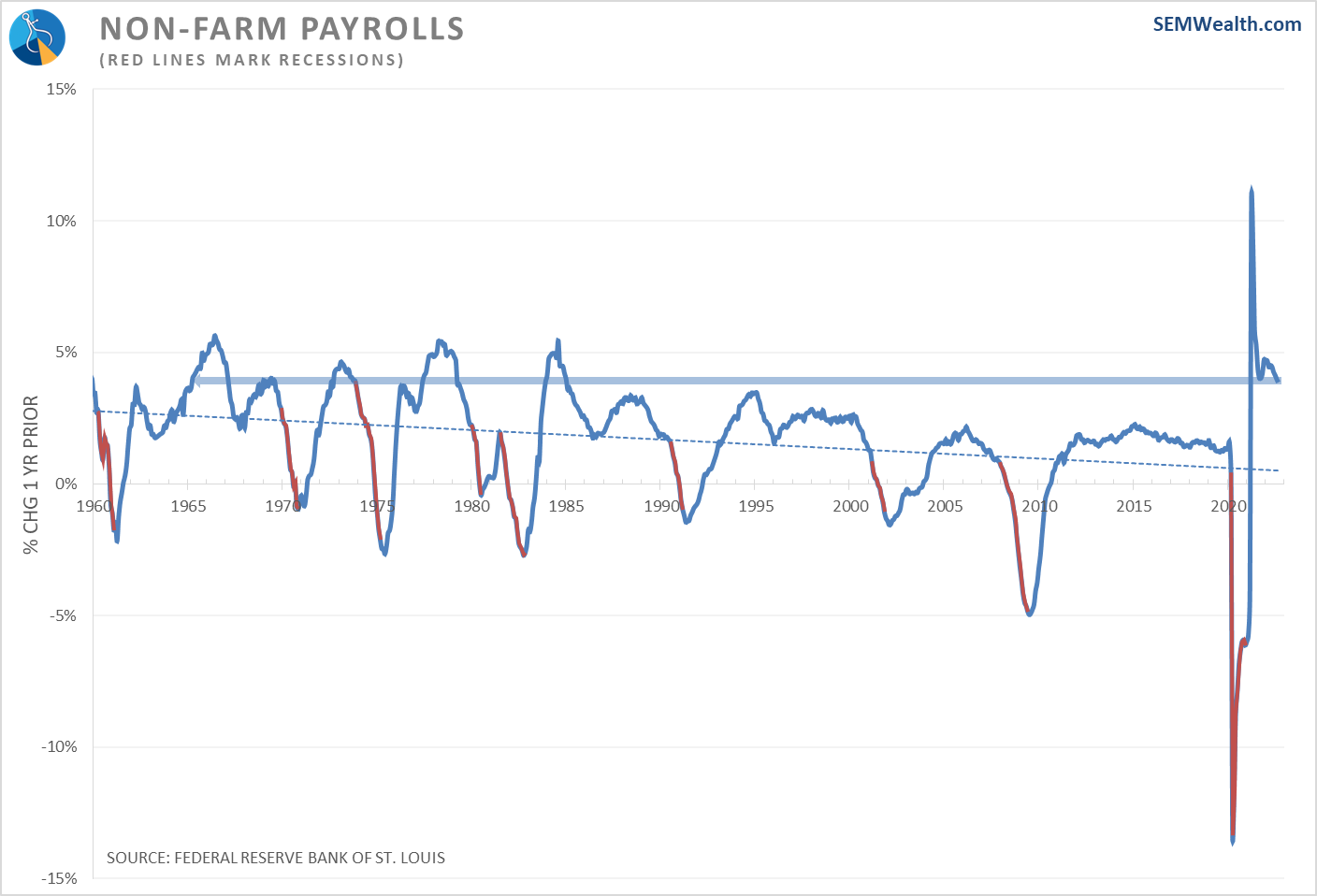

As you can see, the labor market is the lone bright spot in our model. Hours worked are increasing. We're seeing more people entering the labor force as the stimulus money wears off, inflation hits household budgets, and COVID fears wear off.

The pace of job growth has slowed, but it is still well above any modern economic recovery.

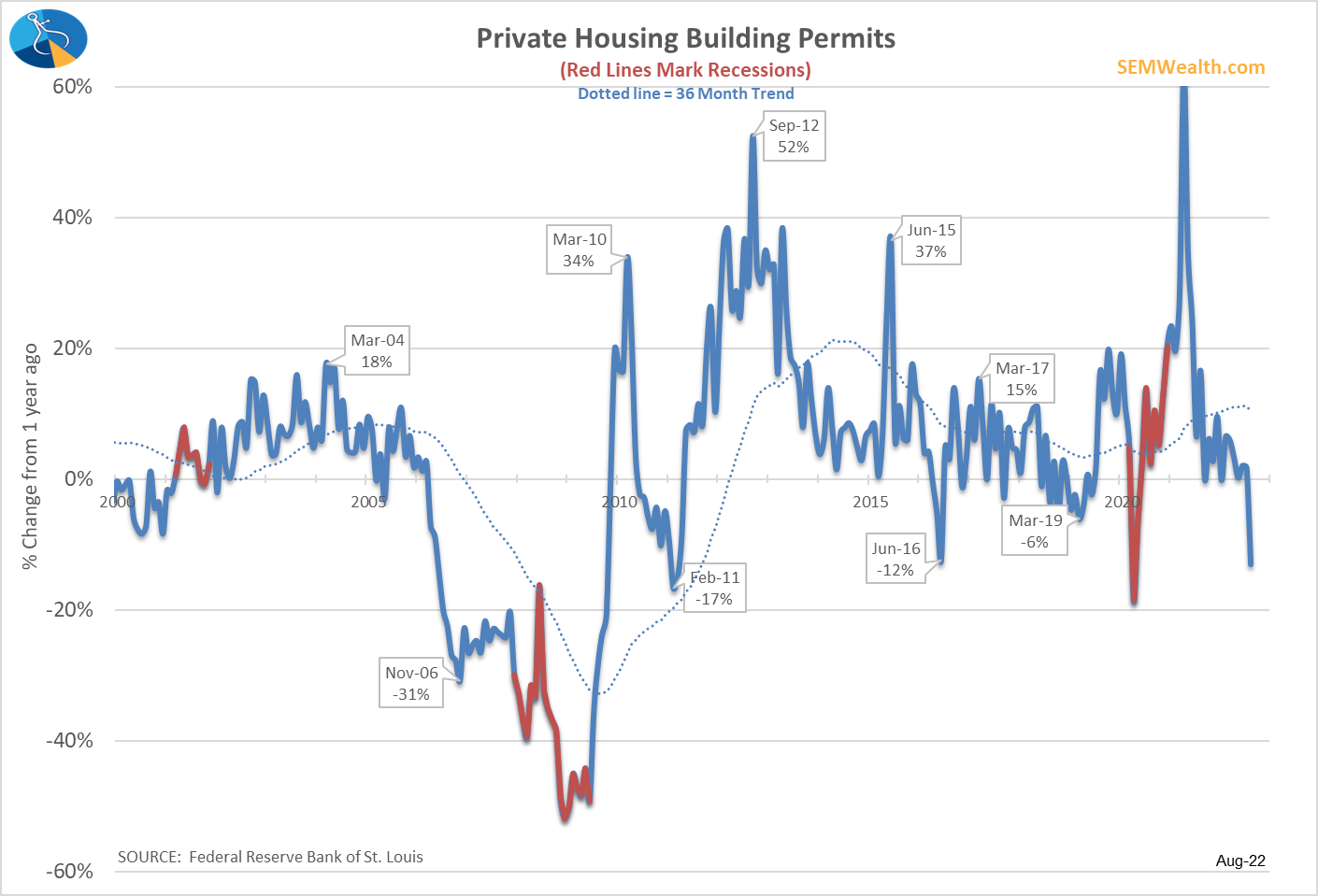

Remember, what matters in the economy is the direction and even our "neutral" economic indicators are on the verge of going bearish. The housing market led to a huge surge in economic activity. That is about to go away based on the latest building permits data.

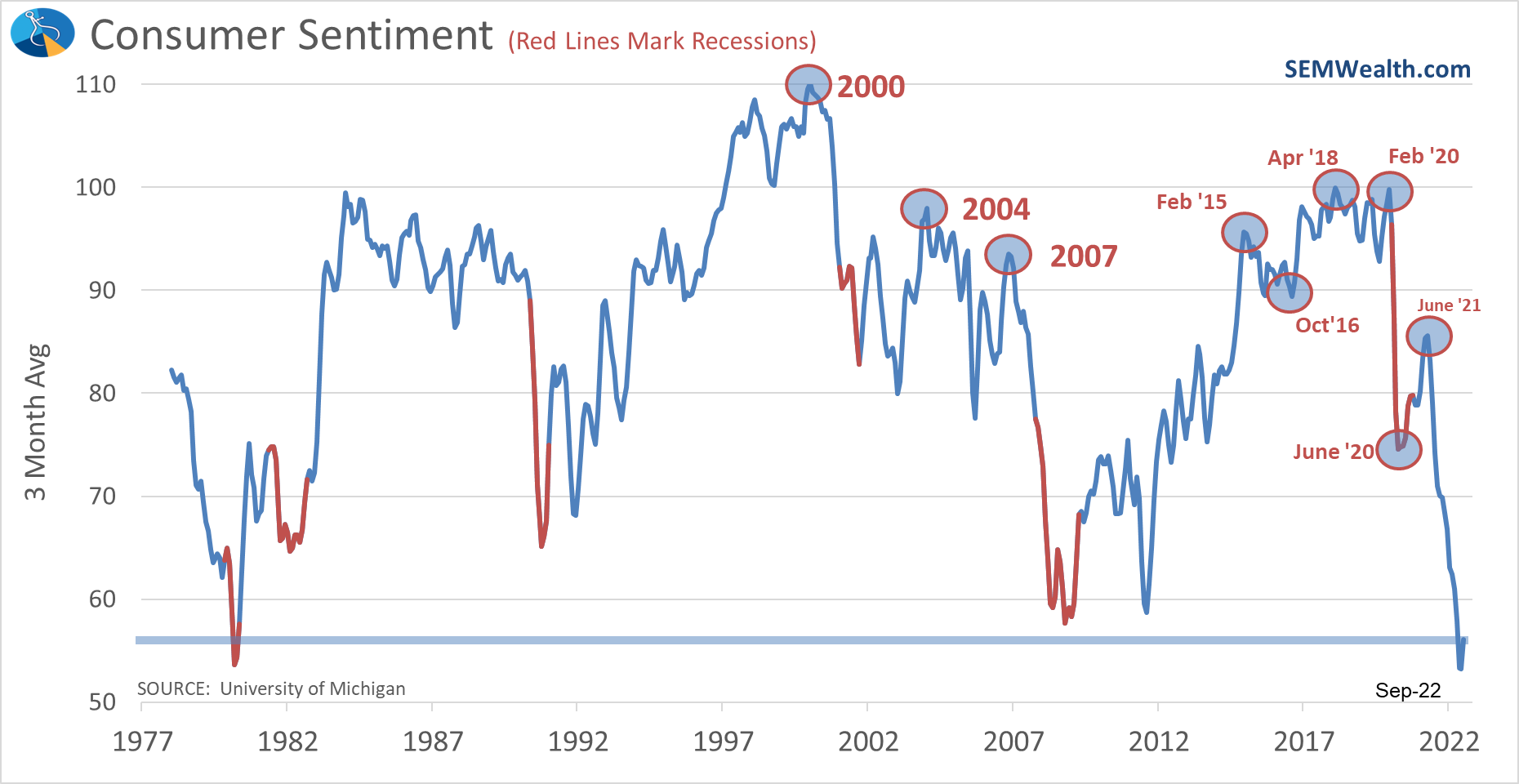

Consumers don't feel great. Ironically, the peak for the post-COVID recovery came the same month the last round of stimulus checks hit.

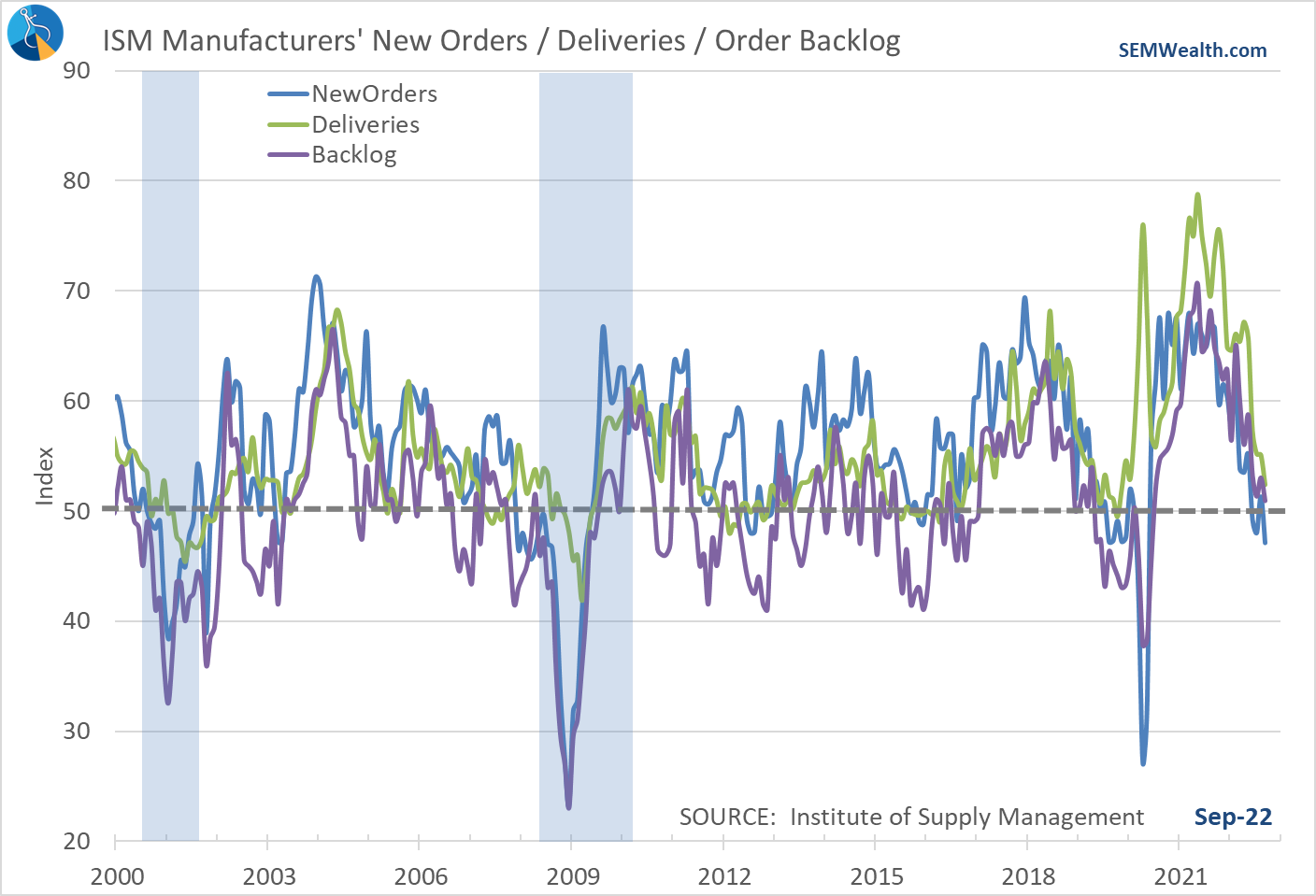

On the manufacturing side, the new orders component is already indicating a recession, with the other leading indicators not too far behind.

Overall, our economic model remains as it has since April of this year – Bearish.

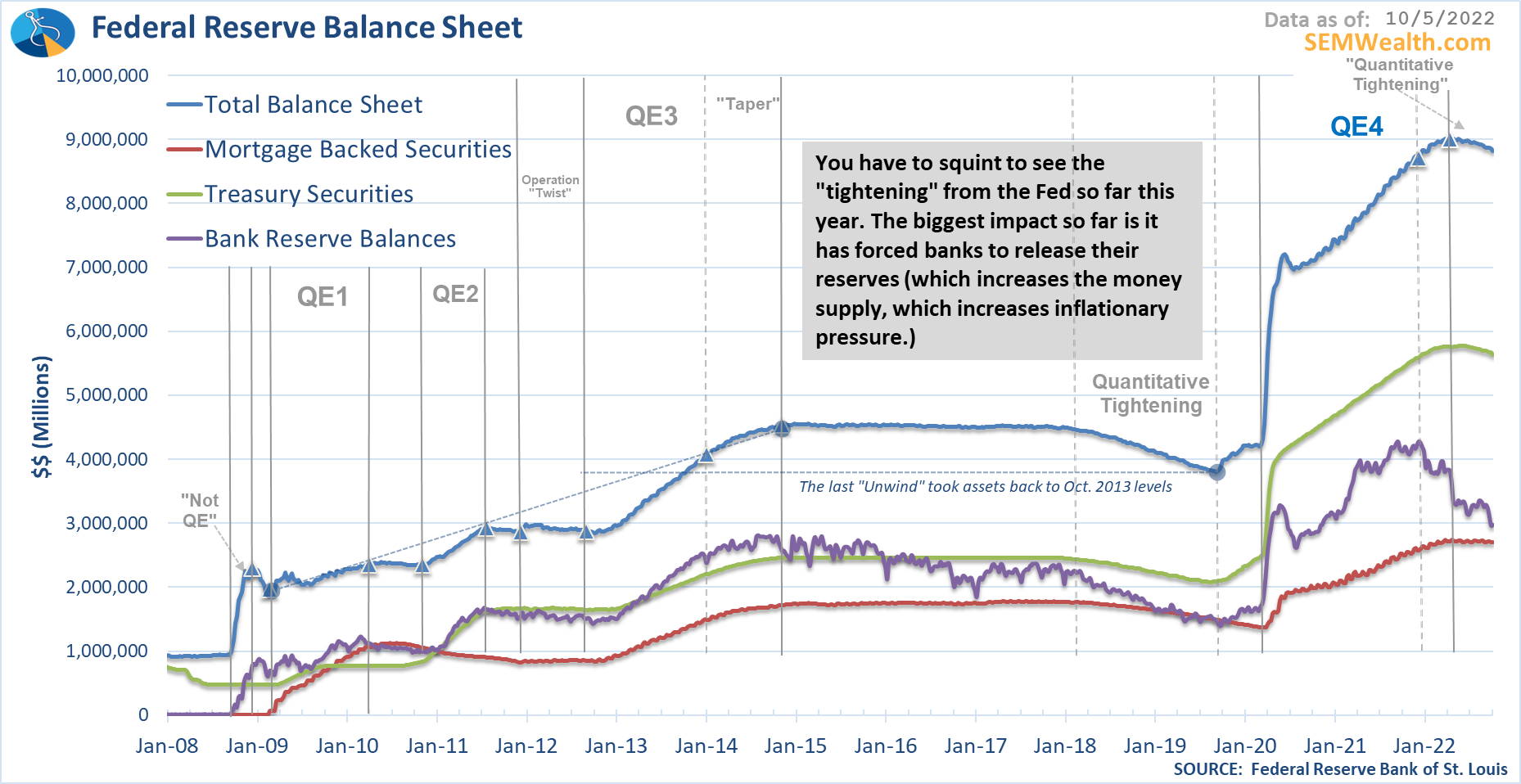

Our brains are programmed to find similar environments and use that to base our decisions. The problem is we haven't been in this type of environment. For instance, for most of this century, anytime the market or economy has stumbled the Fed has been there to "stimulate" it back up (or inflate a new bubble as I've argued for 20 years.) Look at the post financial crisis recovery. The Fed went through 3 rounds of Quantitative Easing. They finally ended it in late 2014. The economy stumbled a bit, in mid-2015 and early 2016, but regained some footing helped with the (temporary) boost of the Trump tax cuts.

In 2018 the Fed finally began to "unwind" their stimulus (Quantitative Tightening). The market went through 2 near-20% drops and the economy was again on the verge of recession. In 2018 and again in 2019, the Fed had to inject some emergency liquidity into the system when the financial system was breaking from the inside. The system has not been able to function on its own since before the housing crisis.

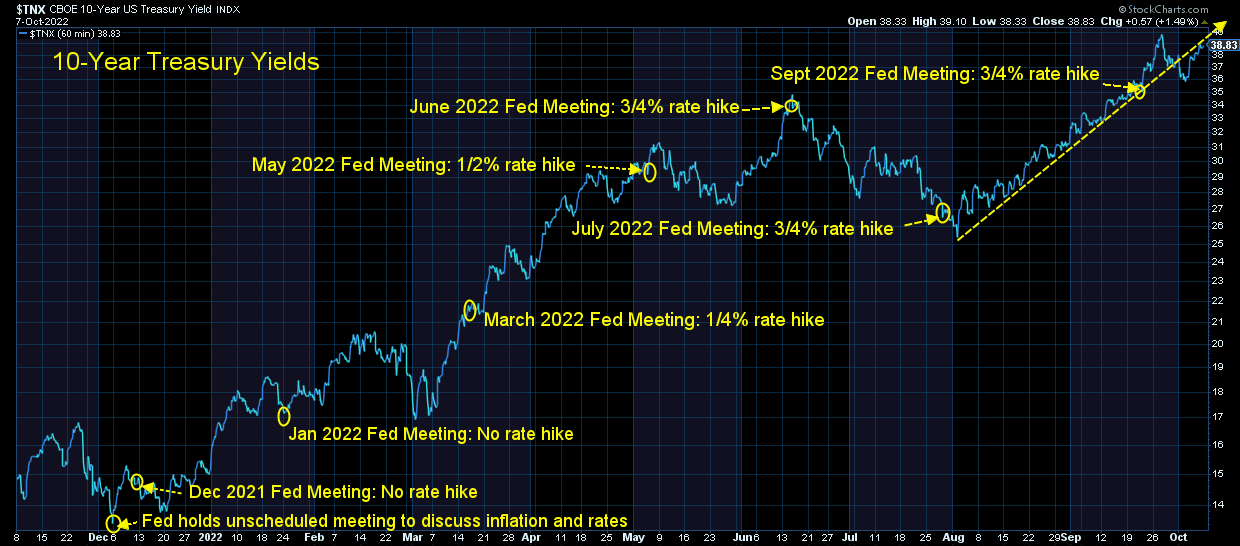

The problem of course this time is inflation is running out of control. The free market is telling the Fed they need to do something. Things are going to break because for the first time in 40 years bond yields are going up at the same time the stock market is going down.

Gradually, then suddenly. That is what we should expect.

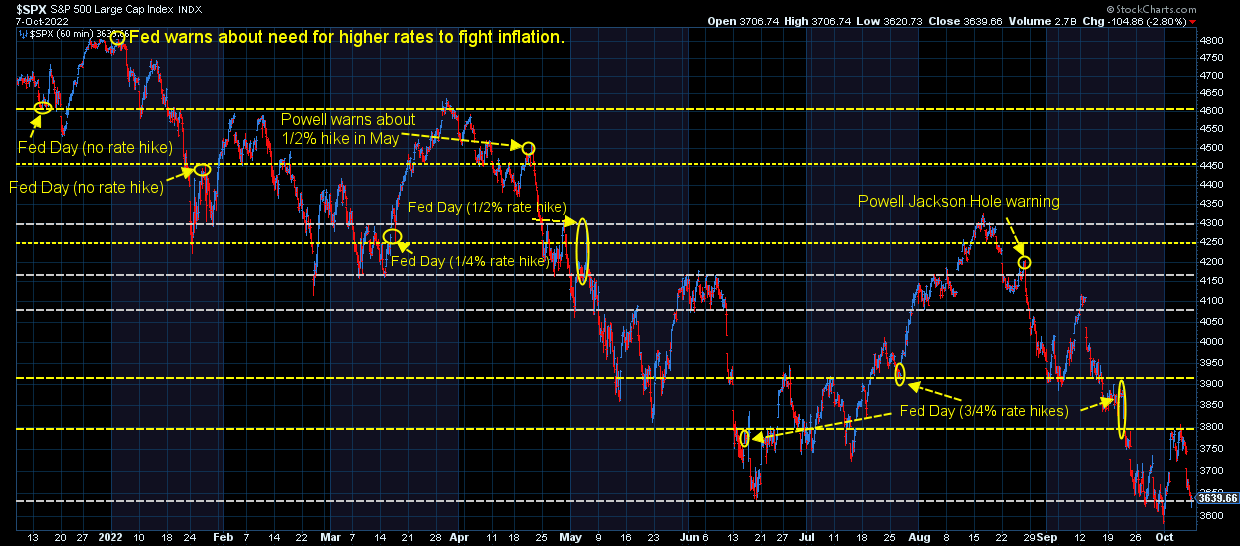

The Bank of England (BOE) suddenly has a crisis on their hands. Their pension system is overly exposed to derivative instruments that were meant to hedge their long-term exposure. Now with inflation running well higher than their models predicted and interest rates going up so much to fight it, they are border-line illiquid. The BOE tried to ease those concerns with a series of measures to bailout the pensions, which led to a big drop in US 10-year yields and a big rally at the beginning of last week.

Now 10-year yields have shot back up to the steep uptrend line. Those BOE measures are not likely going to be enough, and the question is how many other pensions, insurance companies, and banks have similar exposures? (Answer: probably more than most of us want to believe.)

On the stock side, the rally took the market up to the last Fed meeting levels before reality set back in and we closed the week near the lows. Eventually we will see a successful "retest" of the lows. I'll leave it to the endless "experts" on CNBC and Bloomberg to guess when that happens.

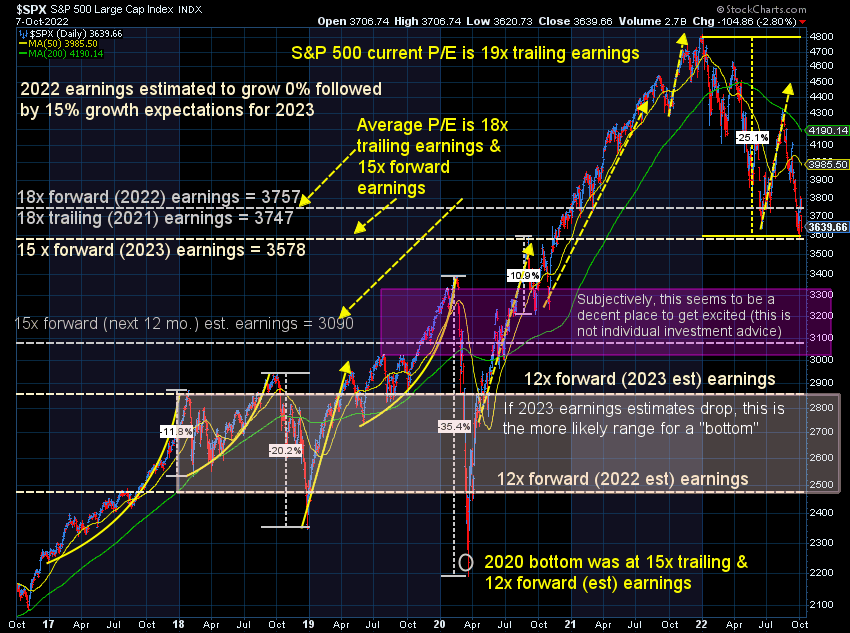

I continue to be baffled by the growth estimates Wall Street is putting out. They continue to believe we are going to see a sharp earnings recovery in 2023. Of course a year ago they predicted 10% growth for this year. The way things are going earnings will DECLINE a couple percent in 2022. Take their estimates for what they are worth.

Unfortunately that's all we have to go on when looking at likely future returns. Just as I warned a year ago about dismal returns due to high starting valuations, we are moving towards a point where we could expect mid-teen annualized returns when valuations hit lower levels. Based on history, a recessionary bear market ends with the P/E around 15x trailing earnings (last 12 months) or 12x forward earnings (next 12 months expectations). Of course, the problem is we don't know where the "E" part of that equation will end up.

As it is now, a subjective entry point for long-term money would be somewhere between 3000-3300. That's 8-17% lower from here. That number goes lower as earnings go lower. Potentially that could be a lot lower (2500-2900). Stated another way – if we are going to see a huge rebound in economic growth in 2023, we are very close to the bottom. If instead, earnings growth is slow (or negative) in 2023, the "bottom" is still 20-30% lower from here.

The only way to deal with the unknown and to remove our biases is a data driven approach that looks at history and market-based data to make decisions. While the exact causes of this bear market look different, what doesn't change is the humans behind the buy/sell decisions. We've been monitoring this for over 30 years and rest comfortably knowing we have a plan for both navigating the markets as they fall, but more importantly a plan to deploy assets when the inevitable bottom begins to form.

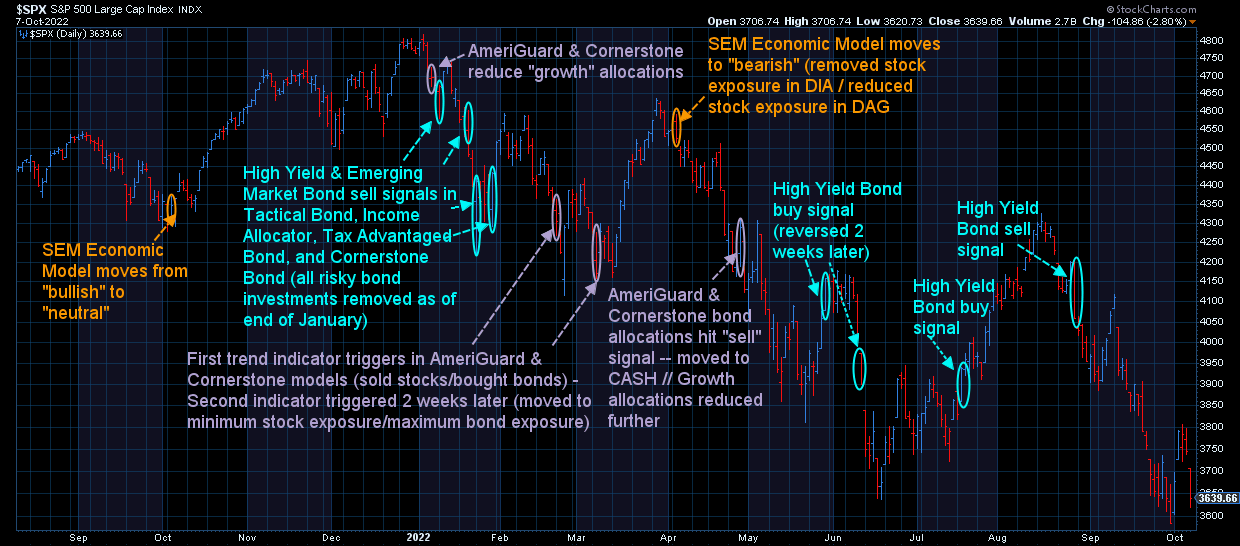

This chart illustrates the value our diversified approach has brought. We use three distinct investment strategies – tactical, dynamic, and strategic in order to spread out the decision making. While none are perfect, blending them has proven to be helpful in navigating difficult markets like this.

Follow us on Social Media

While the blog will continue to be the source for deeper dives into everything that is happening, we post a lot more short-form content to our social media channels. Some are funny, some are quick takes on that day's news, and some are answers to questions we've received. Regardless, if you're looking for some different financial content, make sure you are following us.

Here's an example from last week:

@finance_nerd Replying to @elite20207 It’s been a bad year for stocks and bonds. Should you sell your investments? #investing #Stockmarket #marketcrash2022 #recession2022 #financialliteracy #Inverted ♬ original sound - finance_nerd