Last week was a roller coaster that required nearly nightly updates to the Monday Morning Musings. This was mostly due to the angst and uncertainty over the Fed meeting. With the 2%+ move off the lows in the last hour on Friday, the S&P 500 eked out a slightly positive week. This by itself is impressive, but as I explained in my Platinum Advisor call late last week, we can think of these moves like a rubber ball on a set of stairs.

The volatility will oscillate based on how big the move is. Depending on how it hits, the ball may bounce back to the higher level, or fall to the next one. It may also stay somewhat in place with smaller oscillations on each bounce. Whichever way it moves when it hits the next level, we'll see more oscillations based on how it hits. Put another way, volatility breeds volatility. This is a new environment for many newer investors. It is also an environment that has surprised some advisors and institutional investors while others have warned about a Fed induced bubble about to pop for several years.

Weekly Talking Points

- Markets move in cycles. 5% corrections are very normal. 10% corrections like we've seen also happen on average once a year. When those happen, we'll see wide swings in stock prices as market participants wrestle with a "new" atmosphere. This makes it more likely to get sucked into both fear and greed ("I knew I should have cashed in on my gains" vs. "This is the buying opportunity I've been waiting for.")

- Bond yields are likely to tell the story over the intermediate term. If long-term rates spike, it could create problems for riskier/growth stocks. If long-term rates fall rapidly, it could be a sign bond investors believe the Fed is too late and are likely going to cause a recession. A slow move in bond yields would be welcome for stock investors.

- Earnings continue to show the highest level of disappointment since at least early 2016. It's not just that earnings are not beating expectations by a wide-range, the level of uncertainty from corporations is weighing on P/E ratios, which could be an on-going problem for stocks.

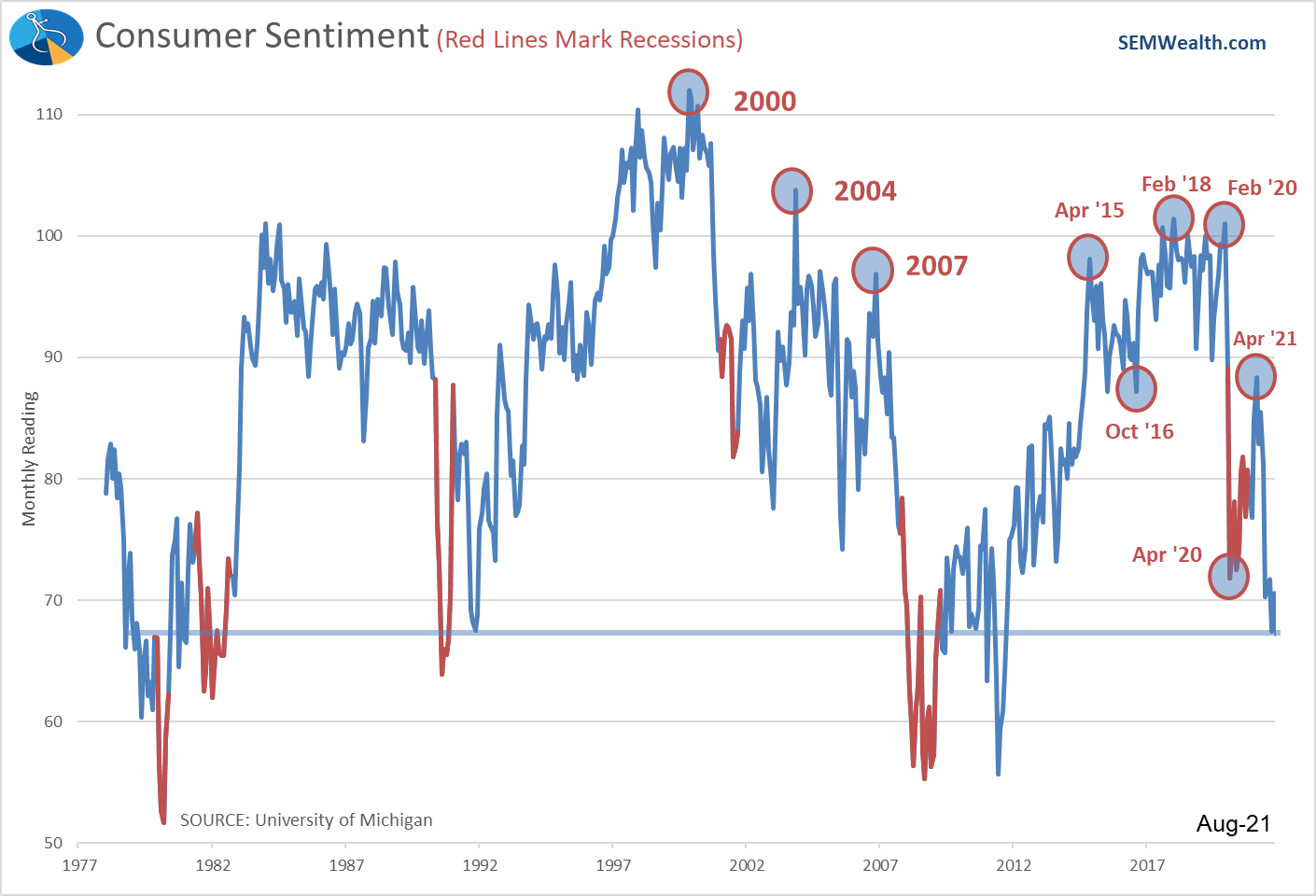

- Economic data remains mixed, but the biggest issue is the fact nearly all pandemic stimulus has ended, which means Americans are back to living on their 2019 budgets. Those who didn't use the stimulus to get ahead financially are likely going to struggle this year. Consumer sentiment is at its lowest level in 10 years, which doesn't bode well for future spending.

- Every decision should fall back on the financial plan, cash flow strategy, and investment personality. Some people are probably still far too allocated to stocks and other risky investments, which means any bounce is an opportunity to sell. Others may have been sitting on the sideline and any sell-off is an opportunity to step back into riskier investments. For SEM clients, unless the financial plan, cash flow strategy, or personality have changed, there is probably little reason to adjust allocations.

Last week did bring some more economic data that was lost amidst all the volatility. Here is a brief summary of things I think we should all be paying attention to.

Problems Ahead?

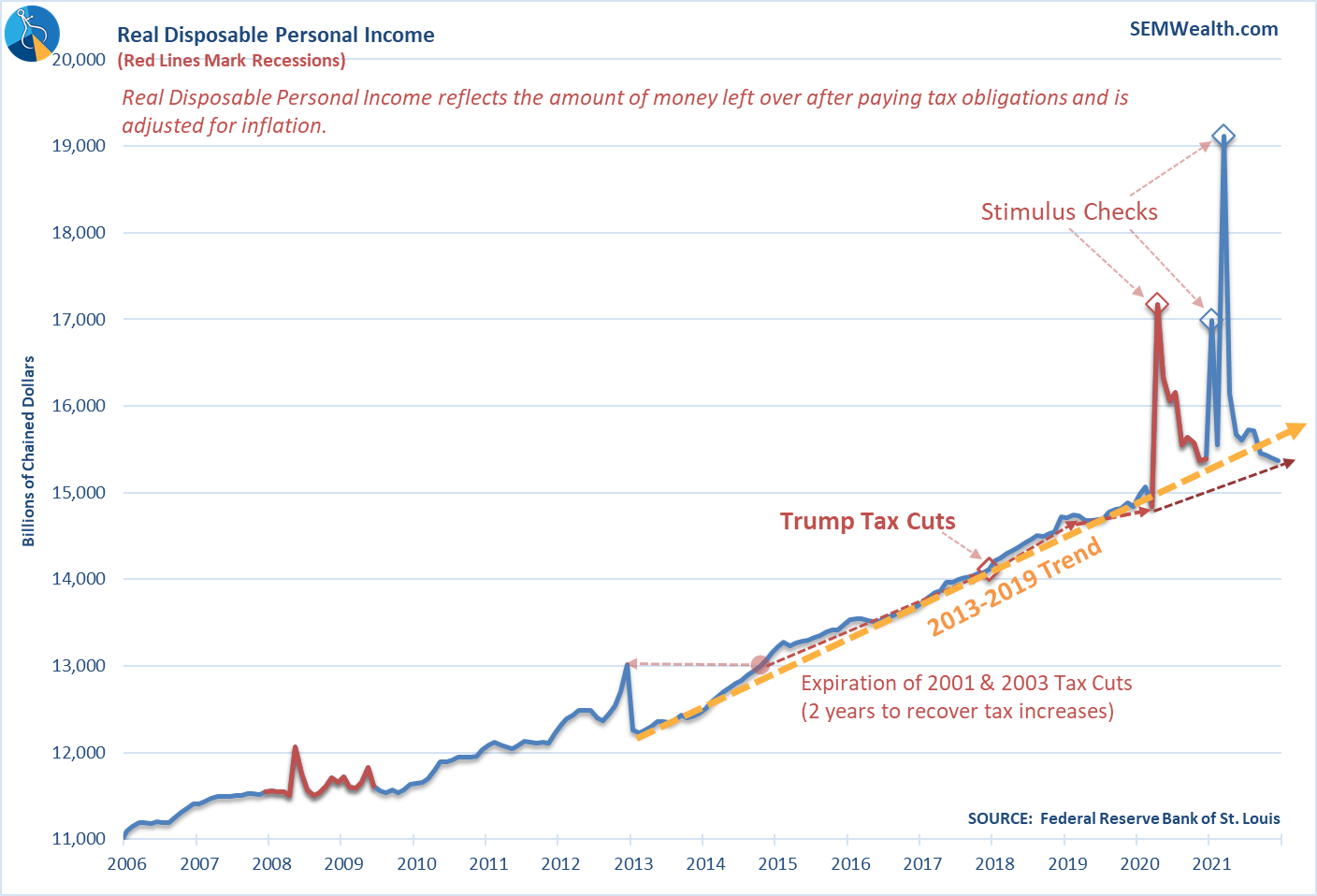

I identified this data point in our year-end newsletter as the most important one for the economy. After 3 rounds of stimulus checks, plus 6 months of extended child tax credits income levels spiked. However, since that ended, we've seen the trend in personal income fall below the longer-term trend we had been tracking going all the way back to the expiration of the "Bush" tax cuts of 2001-2003. Less income leads to less spending.

This next data point is shocking to me when you look at how strong most indicators have been for the past year. The fact consumer sentiment is below the depths of the pandemic and continued lower again last month should be a huge concern for anybody banking on robust economic growth. Less confidence leads to less spending.

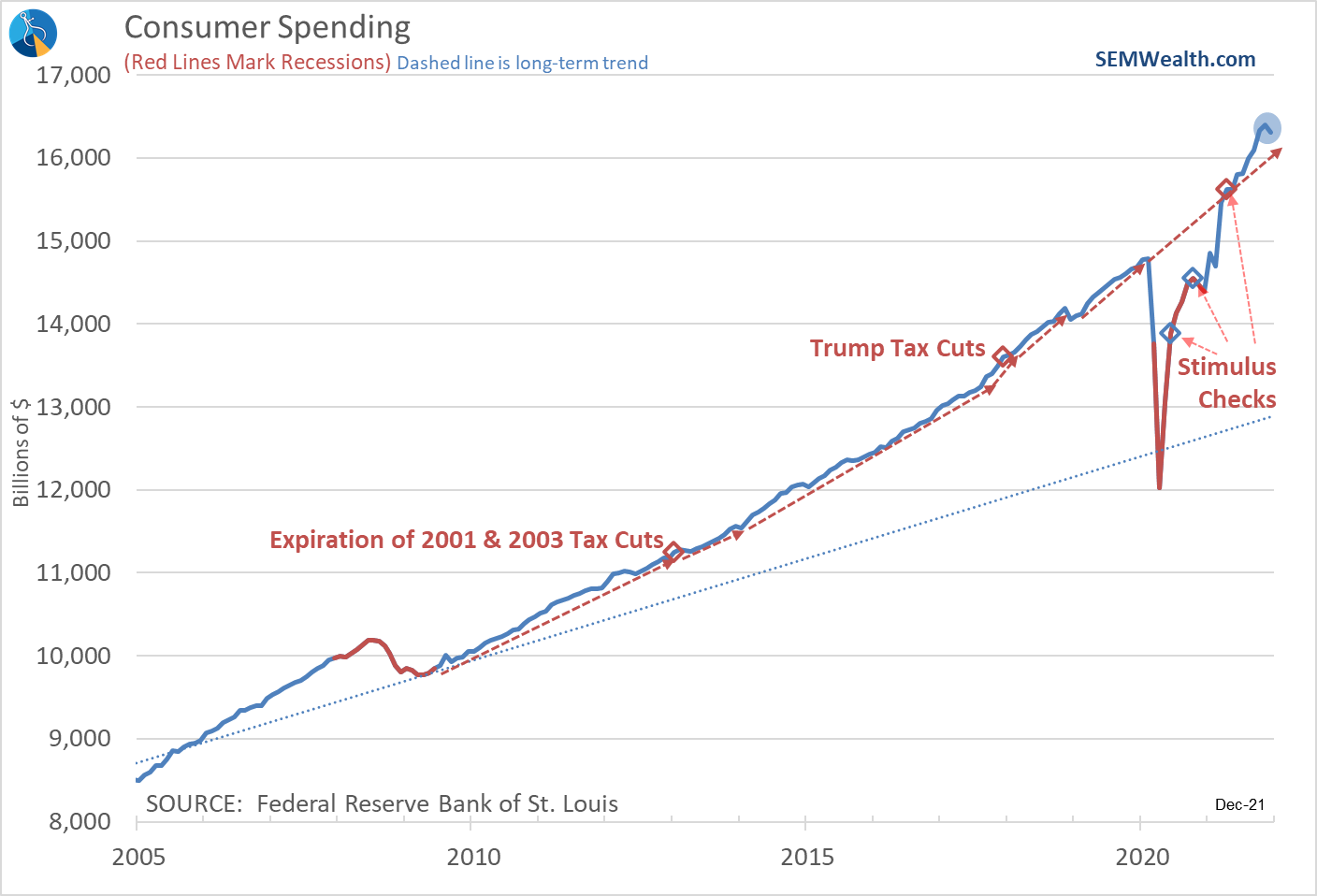

One month does not make a trend but spending in December actually fell. It's still above the trendline, but it is something to watch. Less spending means lower inflation.

What about the Fed?

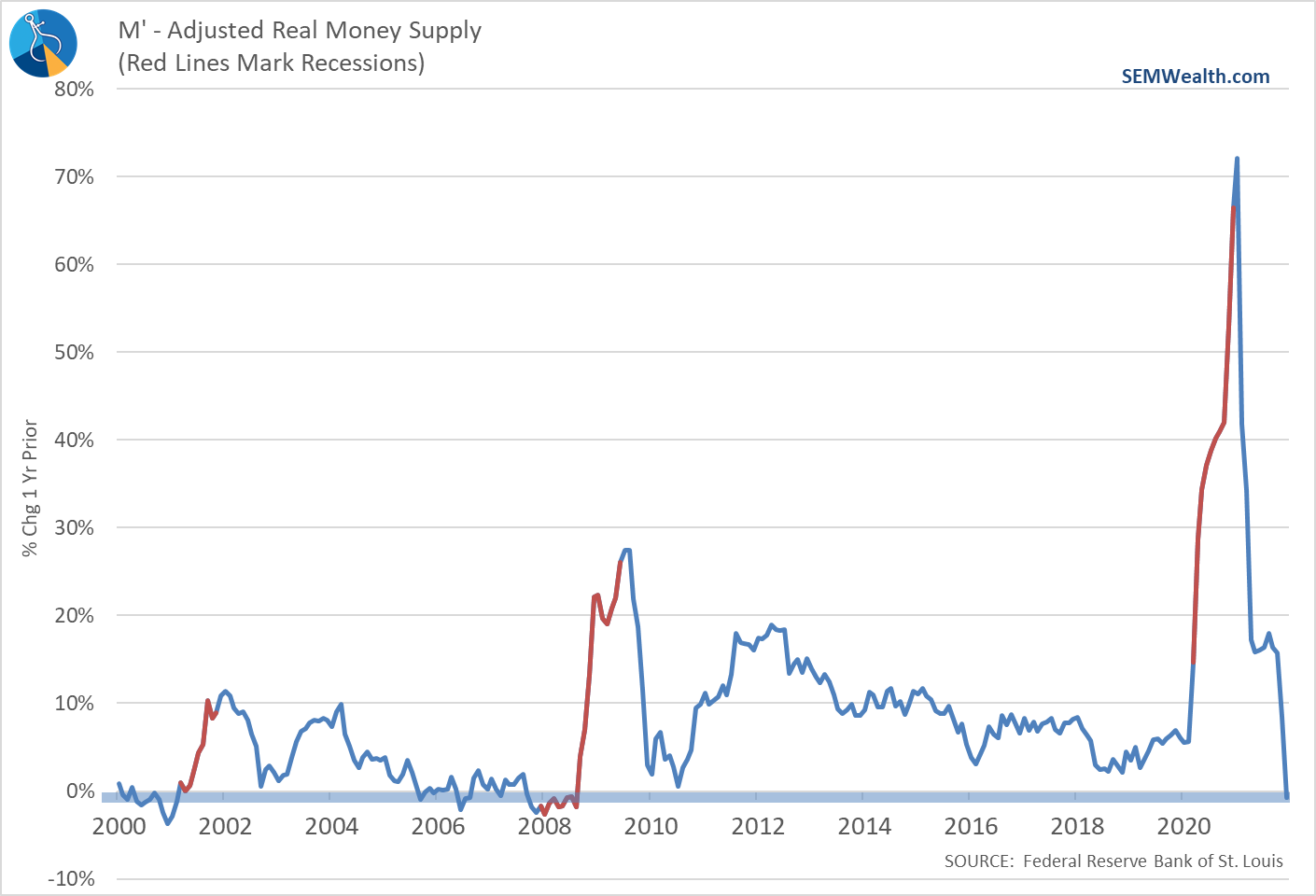

The Fed of course is worried about inflation. While they haven't implemented any mechanisms to actually pull back their stimulus, I found the next data point interesting. Our money supply shrunk for the first time since 2008. That in itself is incredible. The fact that every month since 2008 the money supply was higher than it was a year ago is staggering. Less money supply means less inflation (and less spending).

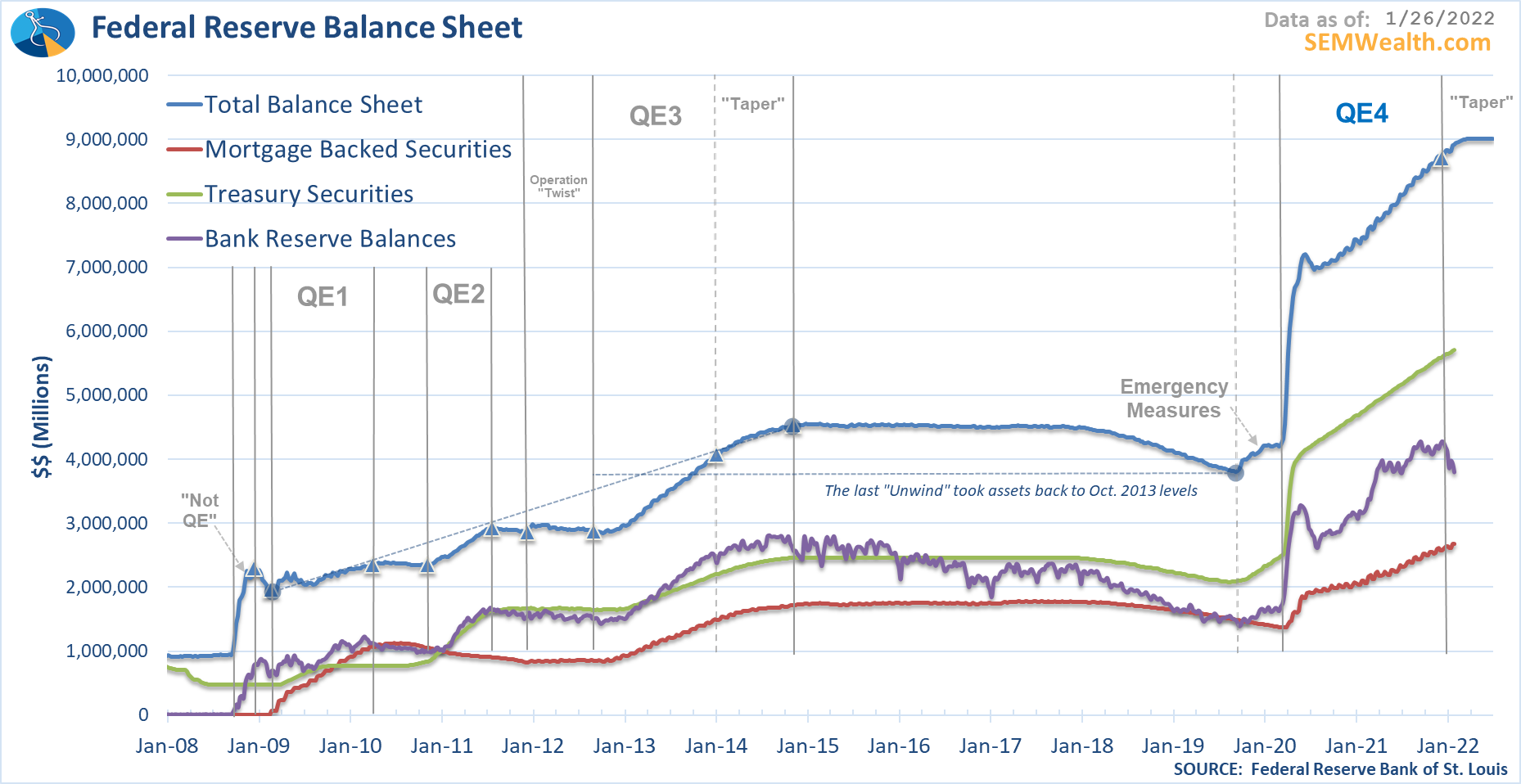

Much has been made about the Fed's Balance Sheet with much angst about how they will begin to unwind their mammoth positions. The chart below illustrates the incredible growth in their balance sheet compared to what happened during the financial crisis. They were unable to unwind little more than 15% of their financial crisis position should be a warning that we are entering unprecedented territory if inflation is not controlled ASAP.

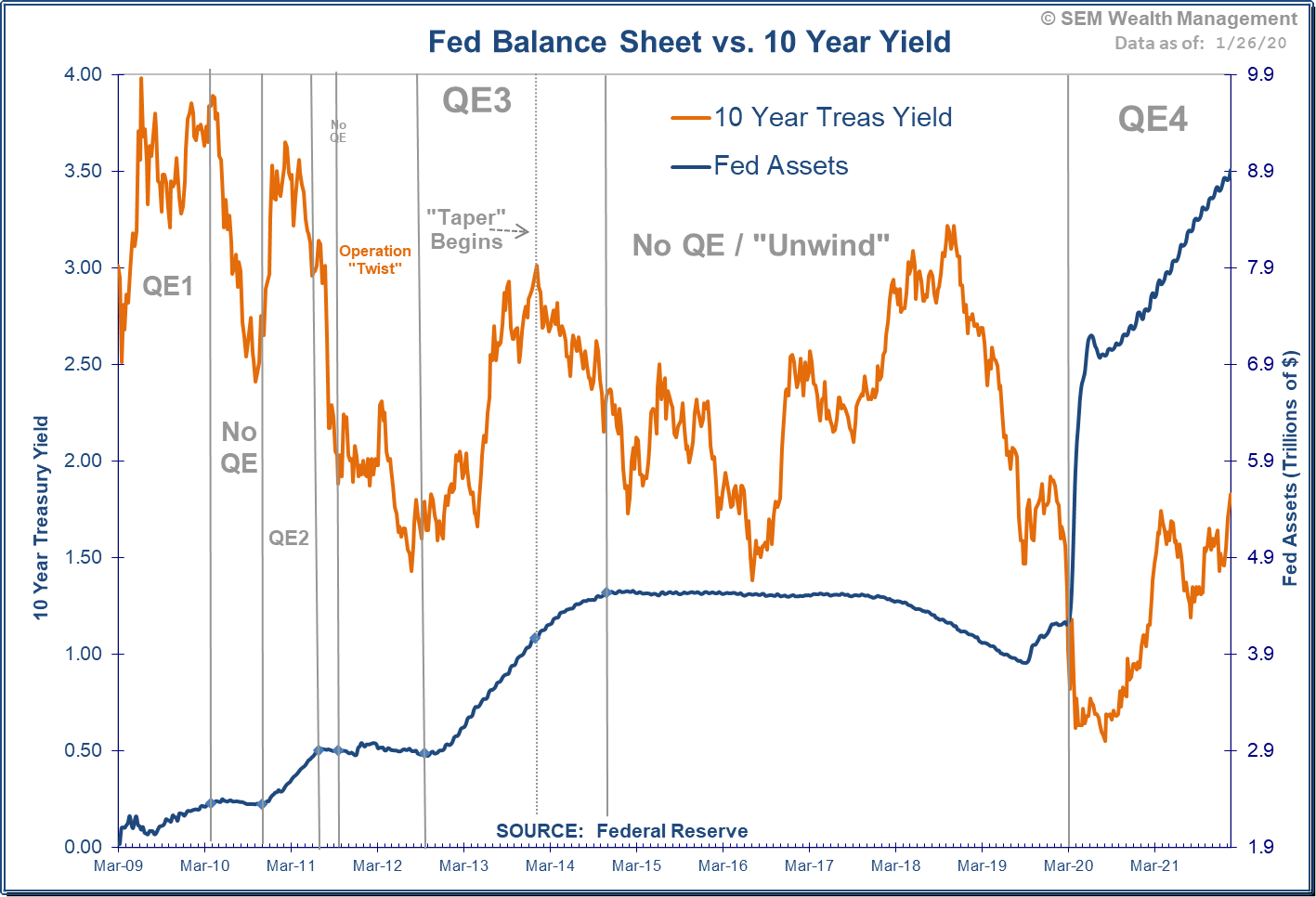

The more interesting thing to watch is what the Fed's QE programs have done to interest rates. The point of QE is supposed to be to suppress interest rates. In practice, this chart illustrates they have generally created the opposite. When they were running a QE program, long-term rates rose. When they ended it, long-term rates fell.

With the big spike in long-term rates this year, it will be interesting to see if this marks the end of the run-up in yields. The reason long-term yields would fall would be if the bond market believed the Fed's actions would create an economic slowdown.

What about Inflation?

Inflation of course is what most people are concerned with and probably explains the big drop in consumer sentiment.

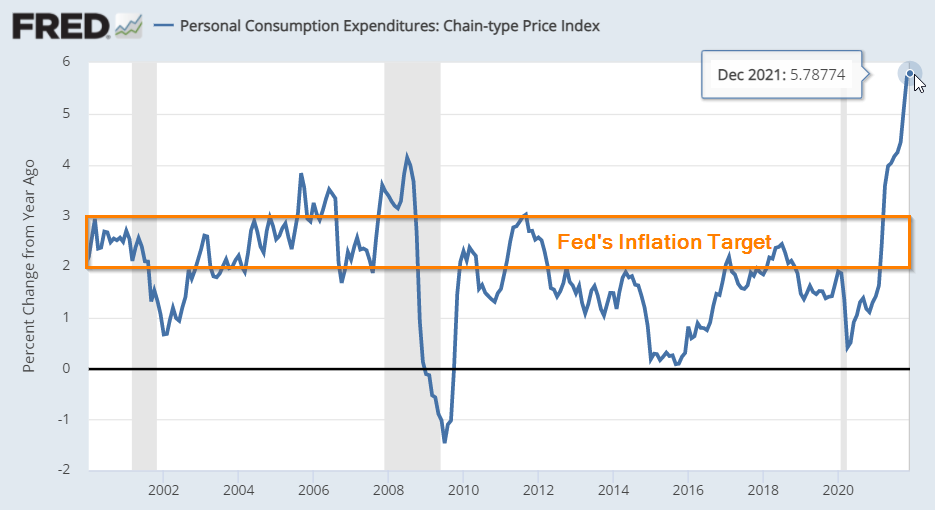

Much is made about CPI. There are so many flaws to that metric I don't have time to go into it. The Fed (and I) prefer this method – the PCE Price Deflator:

Inflation running near 6% is certainly a concern.

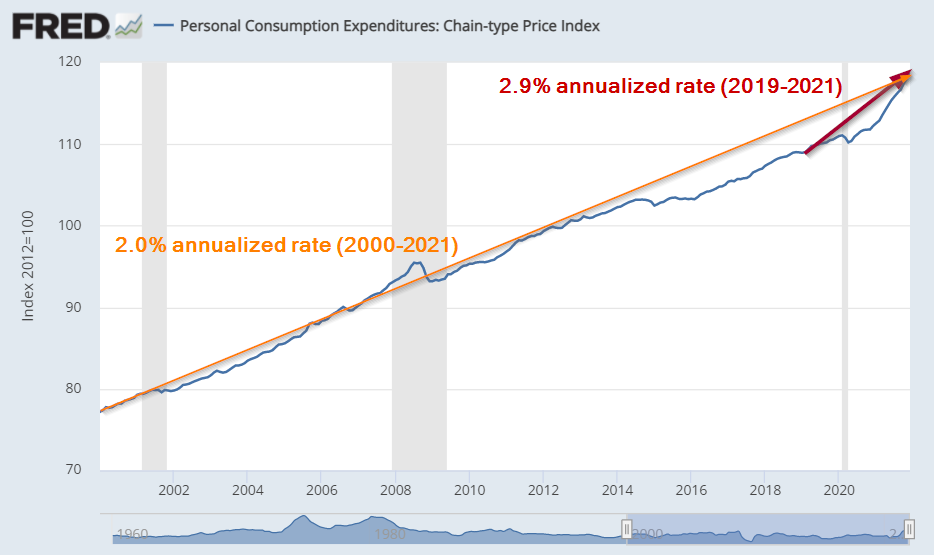

Taking a step-back, the 3-year annualized inflation rate is 2.9%. The long-term inflation rate in the US is around 3.1%. Going back to 1980, that rate is 2.7%. The Fed has desperately tried to get inflation up to 3% the past 20 years and failed. The recent spike has finally put them up to the very bottom of their new 2-3% inflation target. They probably overshot their target as they did not factor into their own stimulus equation the fact Congress was going to dump $5 Trillion into the economy and the vast majority of it would be spent.

That said, if the 3-year annualized rate cools somewhat, the Fed may be comfortable easing back a bit on their planned rate hikes.

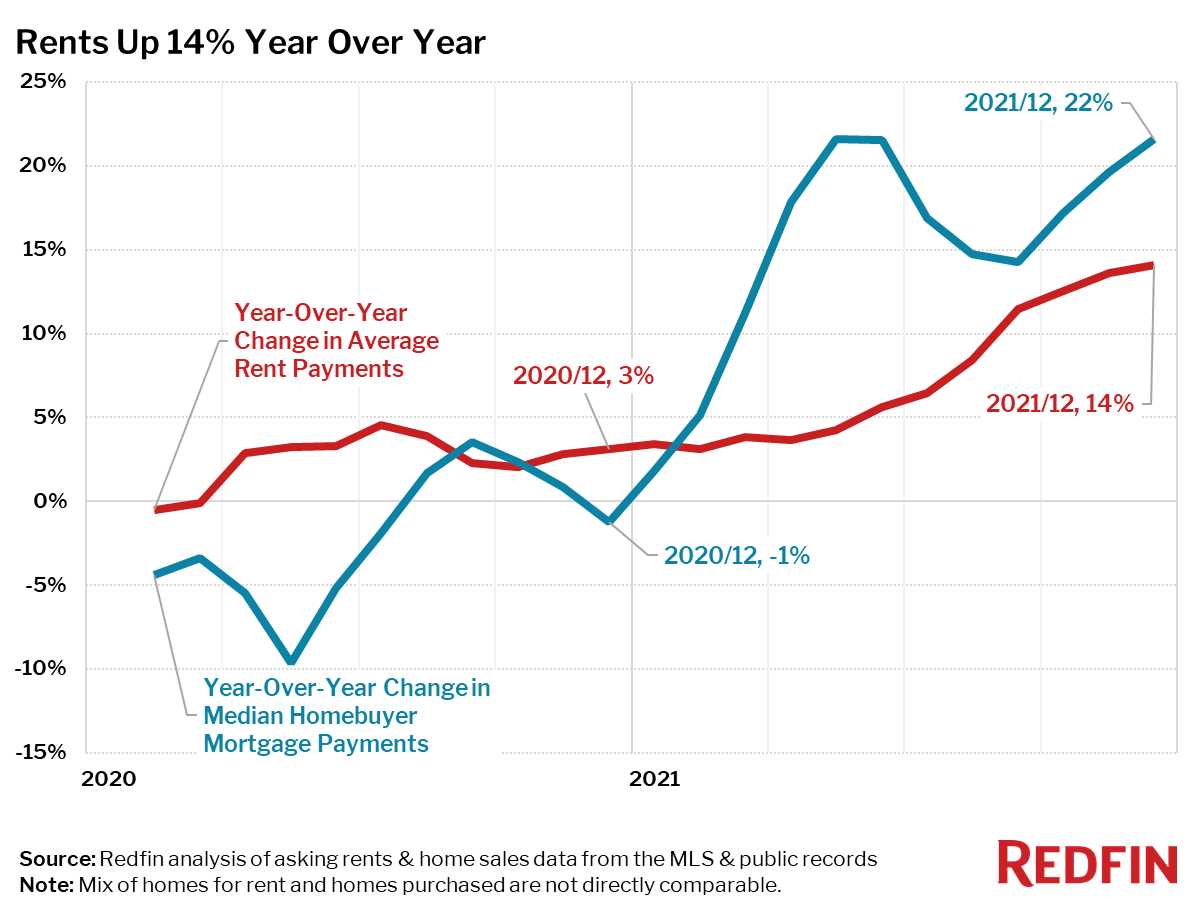

The bigger concern for the economy is inflation does not hit Americans equally. The government excludes food and energy prices because they can be so volatile. Unfortunately, the lower your income the higher percentage of your monthly budget is dedicated to food and energy. The inflation measurements also do a terrible job accounting for housing costs. Redfin over the weekend showed the change in the amount of money being spent on housing costs.

A lot of people have raved about the housing market. Unfortunately, this has led to new homeowners having to dedicate a significantly higher percentage to their mortgage payments. Worse is what's happening to those who haven't been able to purchase a home. Nationwide rental payments were up 14% in 2021. This is putting further strain on lower income Americans and even impacting middle class younger Americans hoping to purchase their first home. It's hard to save for a down payment when you both have to pay significantly more each month after a lease renews as well as when home prices have gone up so much.

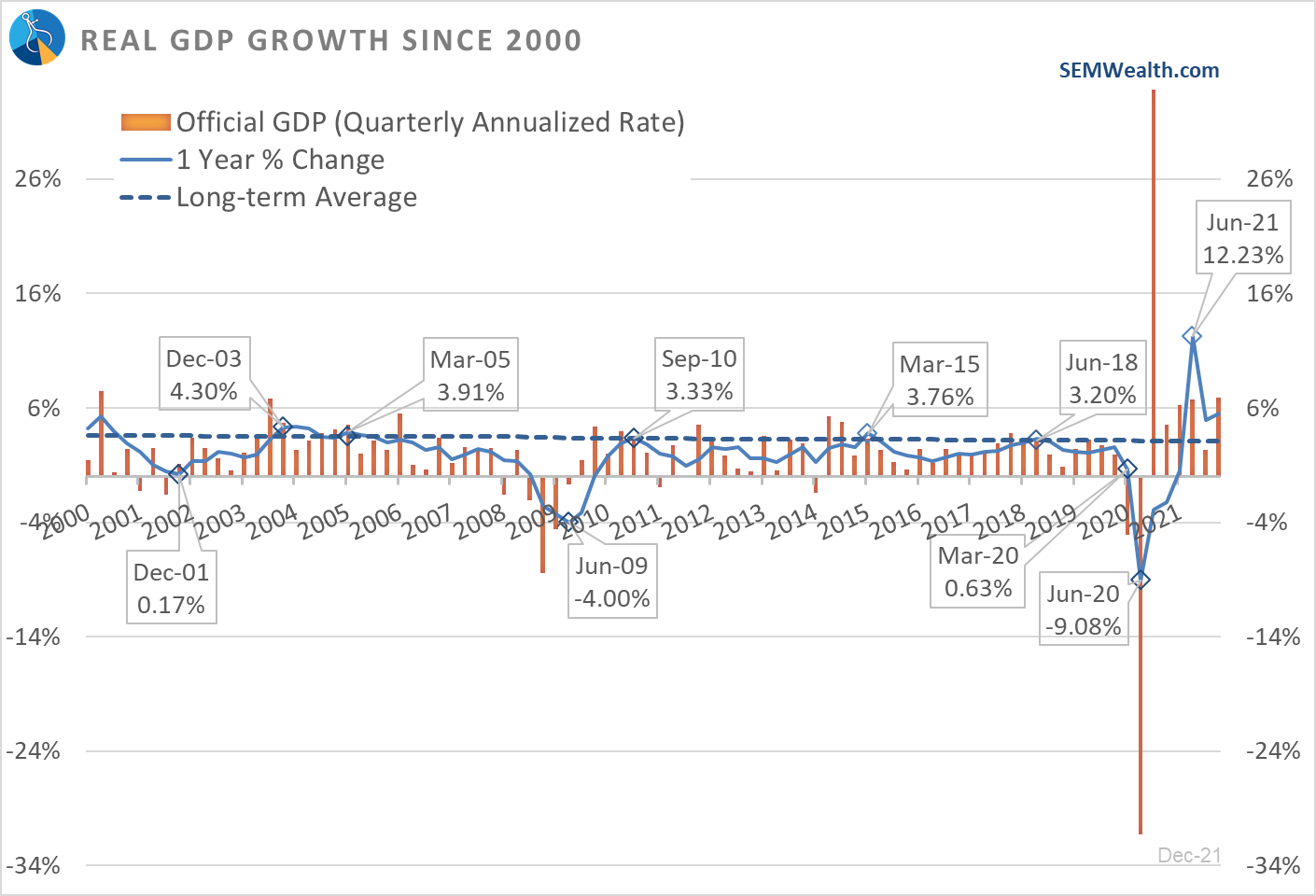

Strong Growth Leads to Inflation

The 4th Quarter GDP release showed a decent recovery versus the 3rd quarter. We've experienced the highest 4 quarter GDP growth this century. One reason we have inflation is because we have seen such strong growth. Not that any politician from either party would take my advice, but if I were advising the president, I would tell him to push back on the inflation worries. I'd see it going something like this:

"Look here, the reason we have inflation is because in my 1 year in office we've seen the best economic growth since Bill Clinton was sitting in my chair. President Obama didn't even have this kind of growth and you loved him. Of course, prices are going up. We sent people a crapton of money and they are spending it. If you want a job, you can have a job. Household debt is down. The savings rate is up. Come on, man, look at the economy!"

I of course don't believe that, but I'm shocked President Biden and his advisors haven't tied inflation to the drop in unemployment, the last round of stimulus, and the strong GDP growth. Politics is about messaging more than policy and this administration has missed an opportunity to spin a very bad data point into something good. Once the President announced he was going to do something about the inflation problem, he became responsible for it.

What I'm Watching

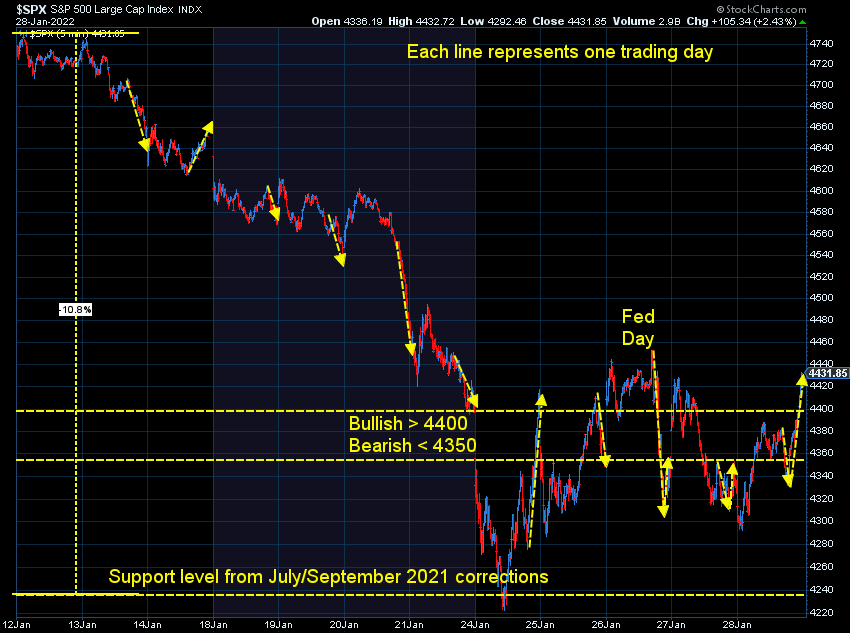

Last week I shared the 5-minute chart of the S&P as an interesting data point that I'm watching. This doesn't enter into any of our decisions or trading systems, but it does help us relay the "feel" of the market for our advisors and clients. In general, the opening of the markets is controlled by "retail" (individual) investors and the last few hours by "institutional" (professional) investors. Large drops on the close are signs institutions are reducing their exposure to stocks. Large rallies could mean they are accumulating stocks.

The last 3 days we saw the last 2-hours turn into a "V". Institutions started selling into the close, but there was some buying during the last 30 minutes to spark a nice rally off the bottom.

Overall, the S&P 500 is fluctuating in about a 3.5% band. It never pierced the lows from Monday, and it managed to close above the prior Friday's closing price. Some sort of stability could lead to a recovery of some of the early January losses. Ironically a retest of the lows from Monday and even going below them could be a positive sign. It would wash out the "dip buyers" who may not believe in the long-term prospects of the market.

As mentioned in the "talking points", bond yields are much more important. This 5-minute chart shows the big run off the lows in mid-December. The trend is technically still higher, but they appear to be stabilizing. The fact they didn't break above the "Fed Day" highs (for now) could be seen as a positive. A move below 1.7% would be quite telling.

I think showing this chart is more important for all those people panicking over the run-up in bond yields. The long-term downtrend line would have yields at 3%. This shows how much the Fed has manipulated bond yields since the Financial Crisis in 2008. Long-term bond yields are only back to the pre-COVID levels. Stocks were fine back then with yields around 2% and theoretically it could be viewed as a positive that the Fed is allowing the bond market to return to more "normal" levels.

For our part, despite the big fluctuations last week, we didn't have any changes in our allocations. We had already taken money off the table in our lowest risk models. The Dynamic models were already in their "neutral" positions. Our longer-term 'strategic' models are designed to let normal corrections play out and do not get concerned unless it starts to look like this is turning into the bigger 15-20% or larger correction.