If you've been involved in economics or finance for even a handful of years, you've probably already seen at least one "new era". If you've been around as long as I have you've seen at least 3 or 4 of them. As humans, it's easy to get sucked into this belief. Changes are exciting and our brains are programmed to believe this 'new' thing is going to completely change everything and lead us to question our core beliefs.

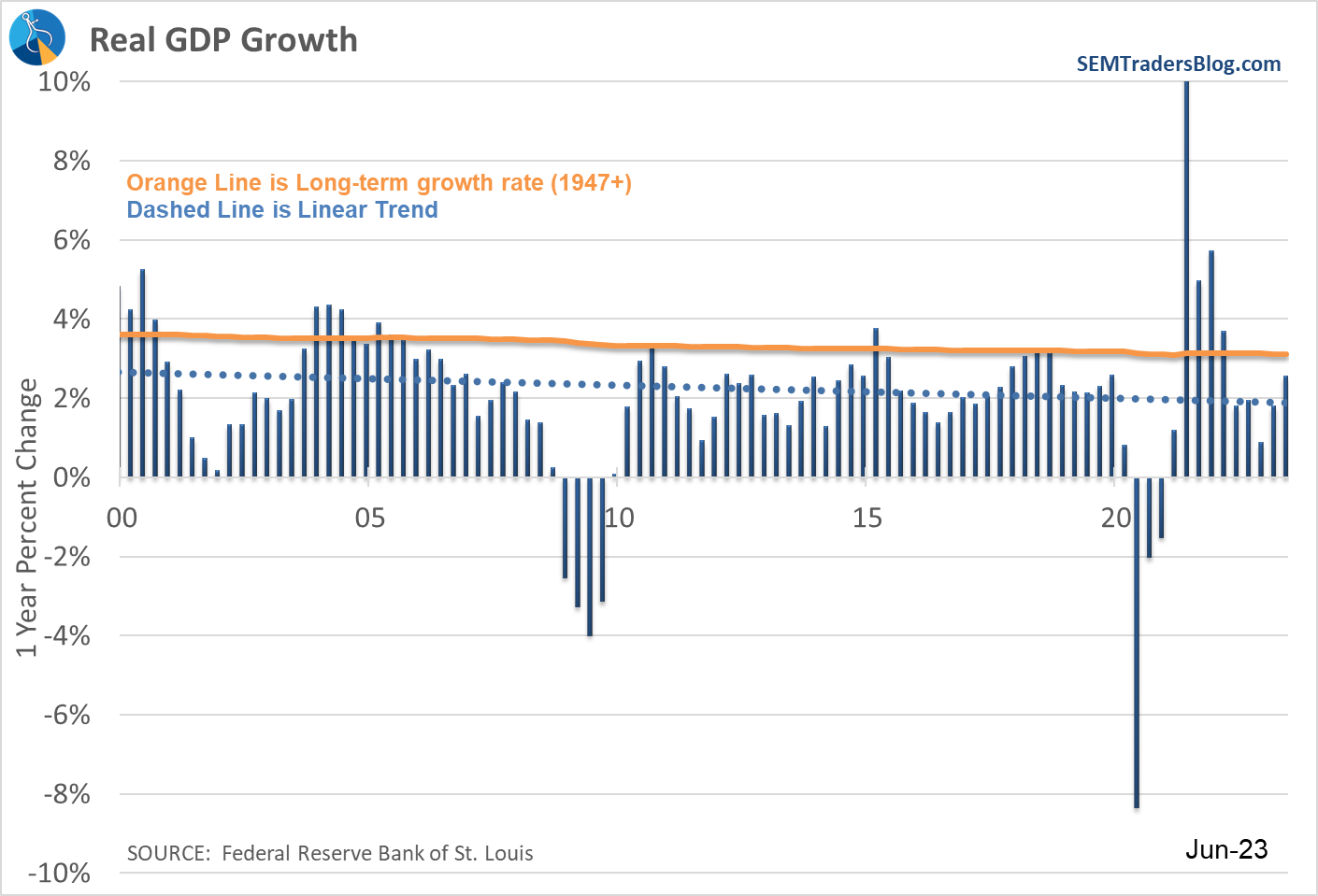

Last week, the first estimate of 2nd Quarter GDP surprised most people showing a strong jump. A year-ago arguments were being made that we were in a recession (because GDP dipped 2 quarters in a row). Last week's data has everyone claiming we've entered a new economic era where the government can prevent economic calamity by simply dumping a bunch of money without doing any damage.

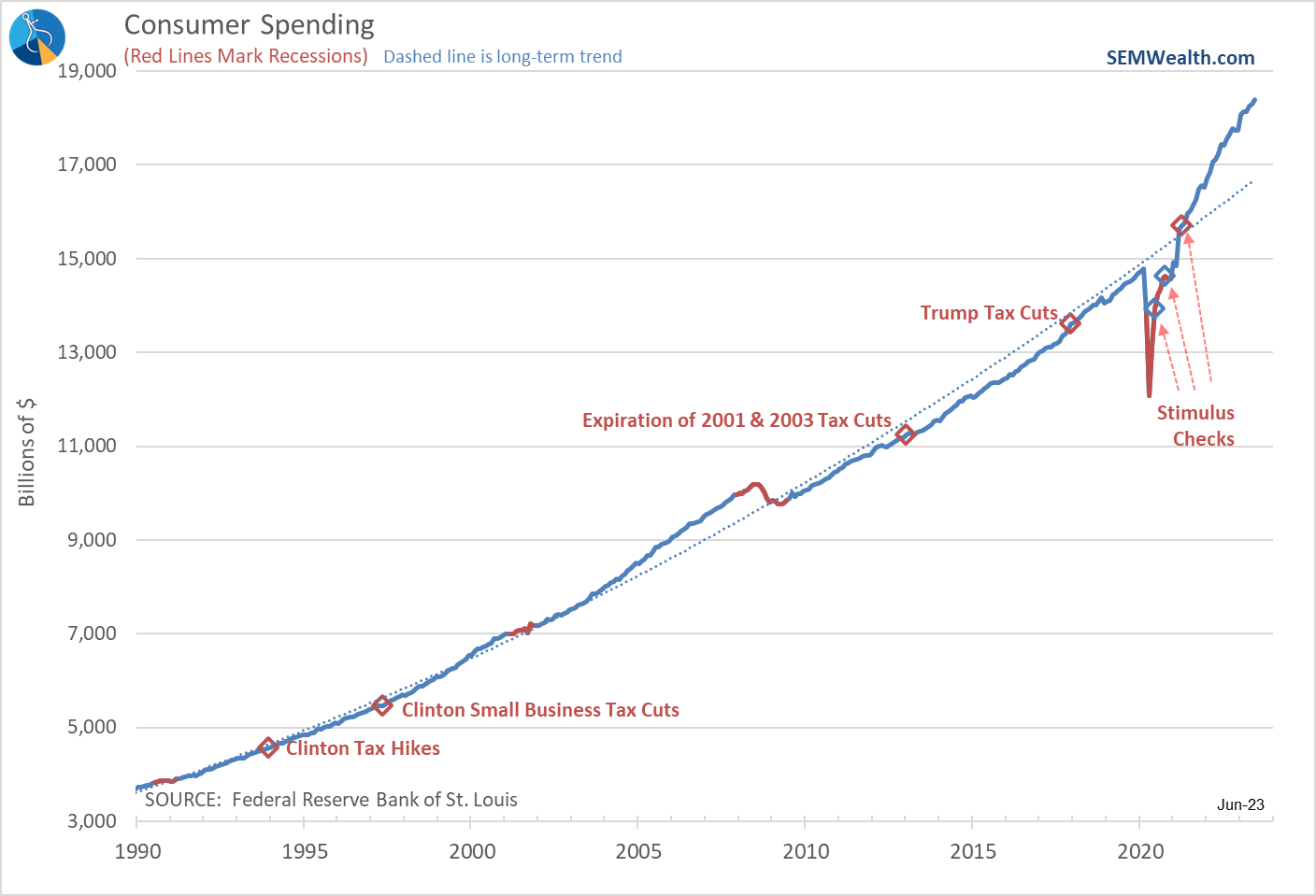

Consumer spending rocketed back to the long-term trend line before the 3rd stimulus checks hit. The pace of spending has slowed a bit, but still remains quite strong.

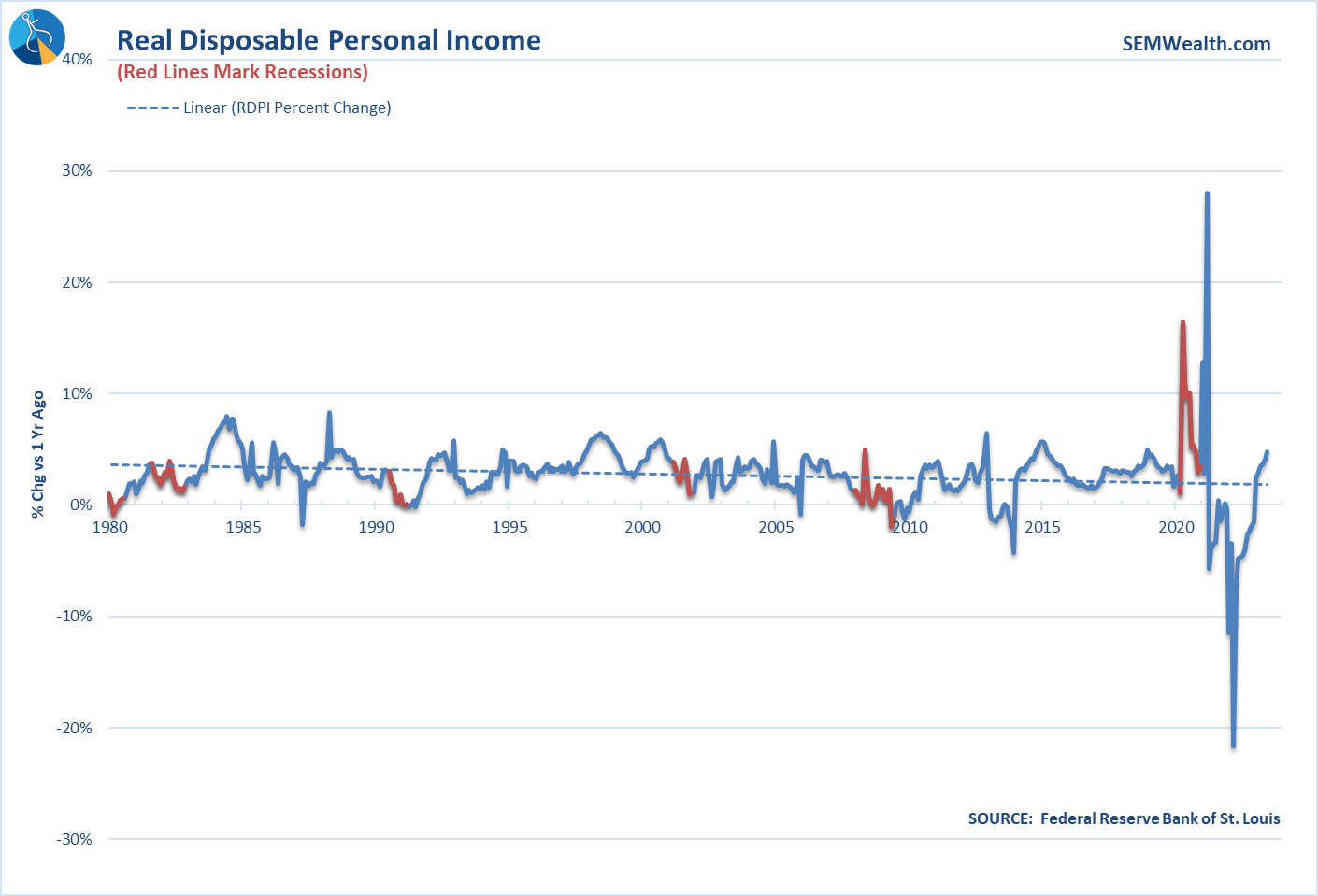

We've also seen a strong jump in Disposable Personal Income this year thanks in large part to inflationary increases in pensions, social security and overall wages. Everyone also received a tax cut to start the year as the tax brackets were all adjusted higher due to the spike in inflation.

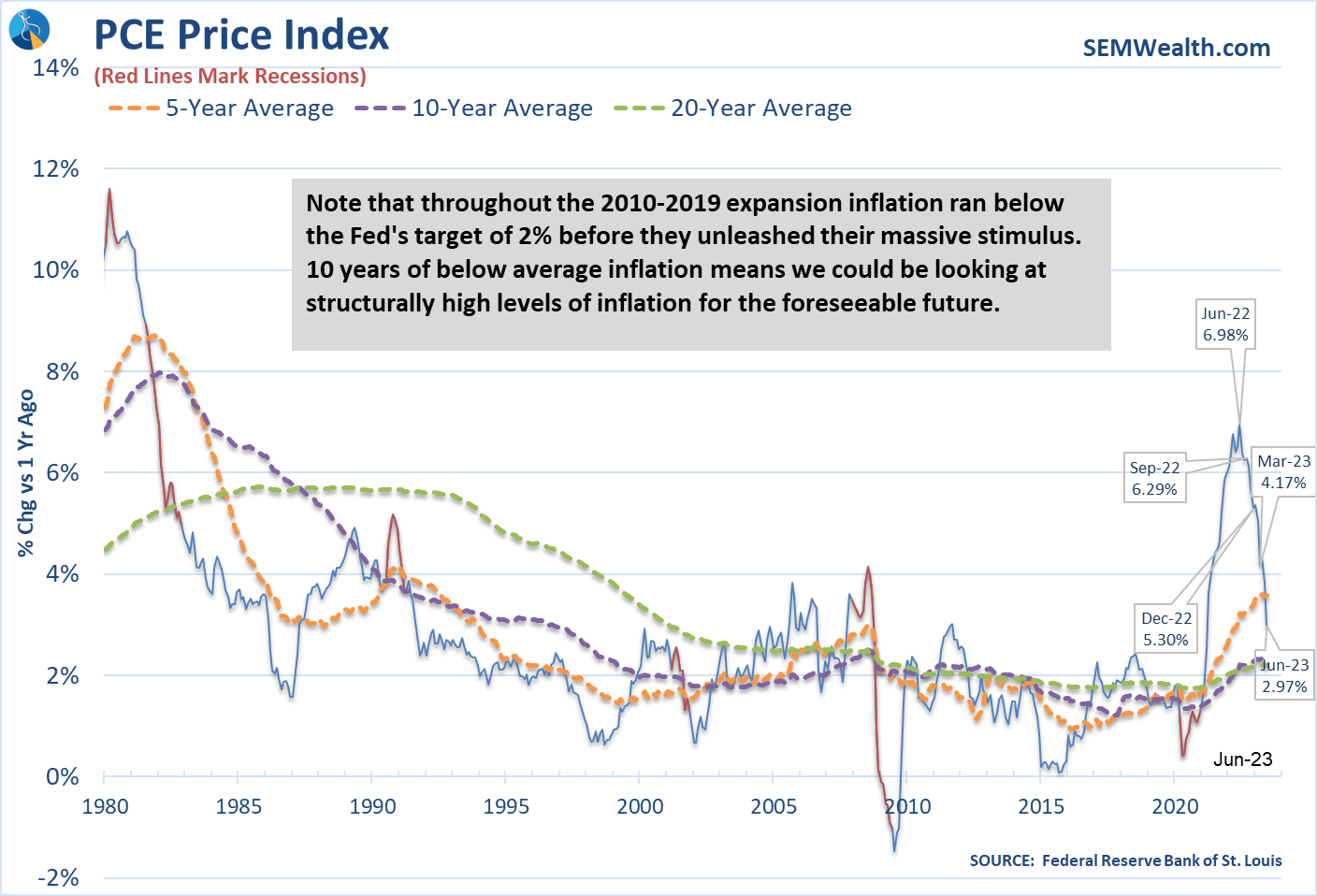

At the same time, everyone (except the bond market) seems ready to declare "Mission Accomplished" in the Fed's inflation fight. The Fed's preferred inflation index (PCE Price Index) dropped to 3% last month. Most believe this means the Fed can let it slide down to their target of 2% without any further rate increases.

On the surface everything seems fantastic. Maybe we are in a 'new era'. However, looking into the GDP data there are a couple of things happening which are certainly not normal.

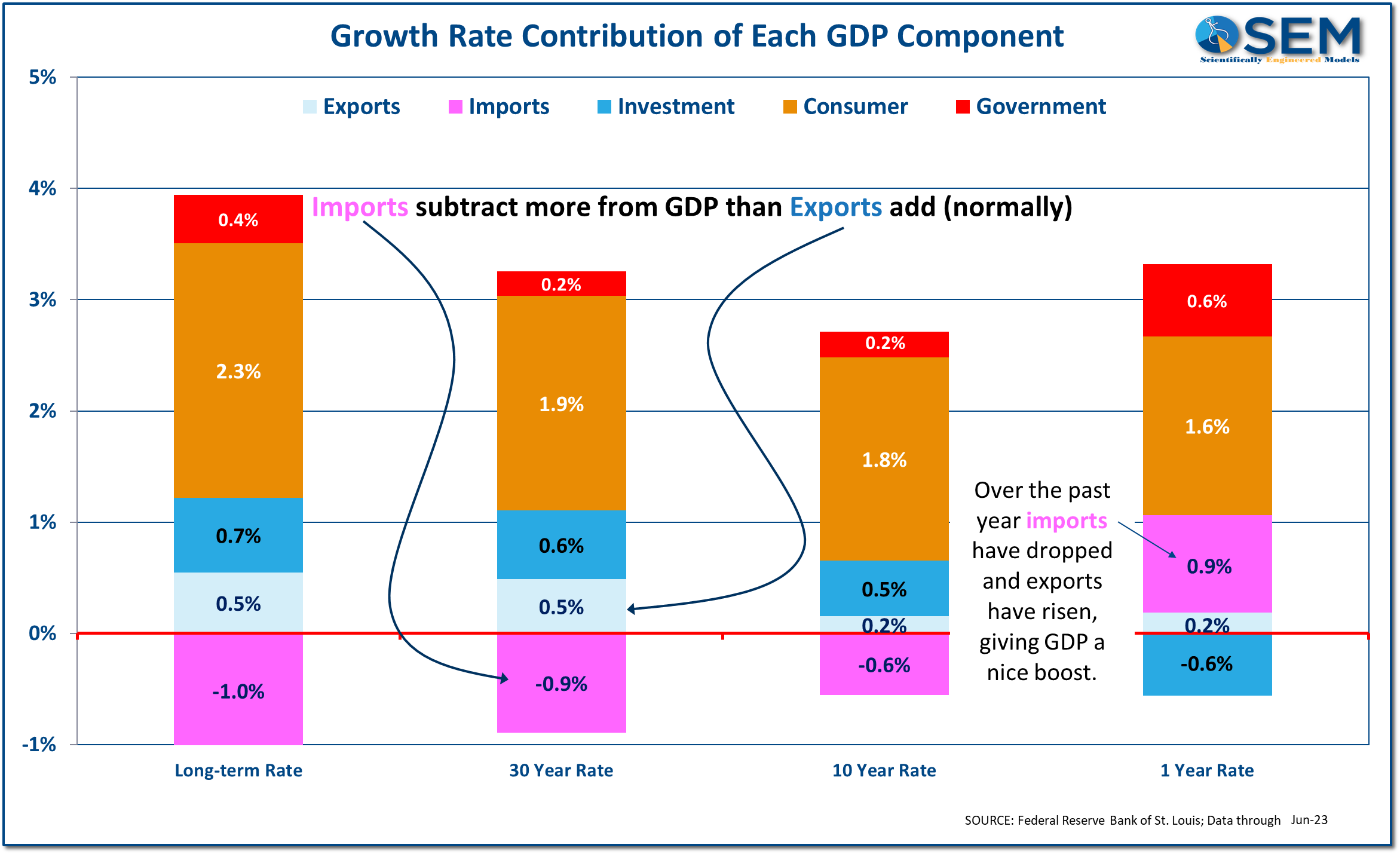

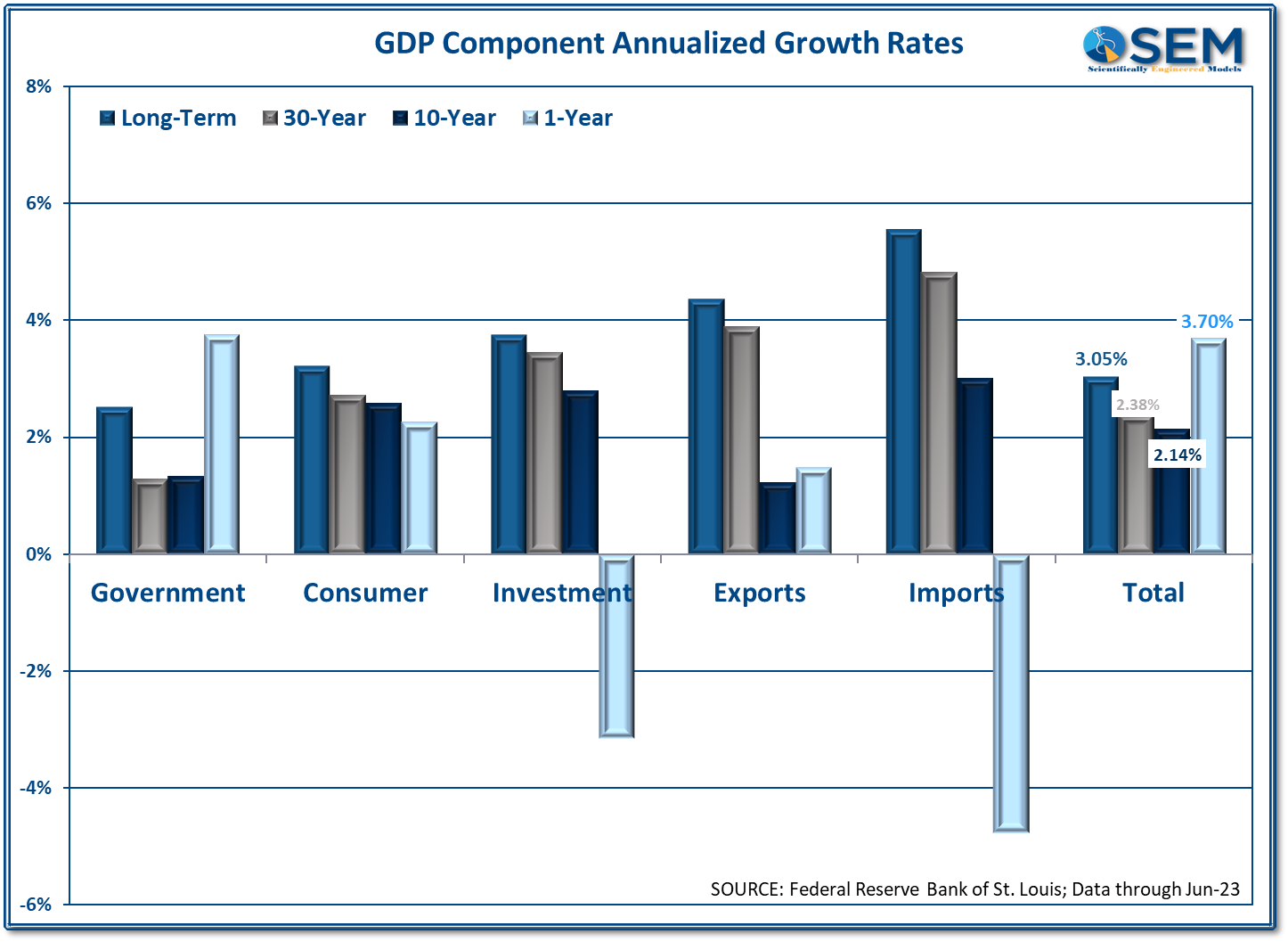

First off, pretty much every quarter for the last 40 years, we've imported more than we've exported which is a net DRAG on GDP (because we are sending more money out of the country than we are bringing in.) However, over the past year we've cut our imports so much (temporarily) both components are boosting GDP. This chart looks at the contribution to overall GDP over various periods.

The other concern is the fact net investment DECLINED over the past year. Wasn't the whole point of all these stimulus bills to encourage companies and investors to put money into long-term projects? We'll have much more on this in the coming months, but a decline in investment is not something you would expect if we were about to enter a 'new era'.

For now, looking at the 1-year change tells us something about our economy:

- Government spending is DOUBLE the 10-year average

- Consumer spending has actually dropped to below average levels

- Investment is declining

- Export growth has slowed back down to the 10-year average

- A decline in imports has temporarily boosted GDP

Don't get me wrong there are some exciting things happening which will change our lives for the better. Maybe we've even (temporarily) avoided a recession and magically engineered a reduction in inflation without any sort of economic slowdown (see 'No Landing'). If that's the case, this is indeed exciting for the near term!

Unfortunately, there are some core economic principles which cannot be changed. Investors/lenders will still demand to be compensated for the capital they are putting at risk. If weak companies attract more money simply because they are part of an index and investors are passively putting money into the index funds, new ideas/companies will not be able to be funded. If the potential returns for the given level of risk continue to decline, they will put their money somewhere more productive. In other words, for a 'new era' to be funded, capitalism has to work.

For capitalism to work we have to go through cycles where the 'bad' ideas/companies are wiped out. We have to go through cycles where potential returns are attractive given the high level of risk of investing/funding these 'new eras'.

We discussed the very high valuation levels in last week's blog and what they mean for potential returns (click here to read)

More importantly, while the Government and Federal Reserve have figuratively dumped helicopters of money into the economy (50% of GDP over an 18 month period) in their attempt to avoid a recession/depression. That money comes at a cost.

Debt is future spending brought forward. The only way the debt is productive is if it leads to large investments which changes the long-term growth rate.

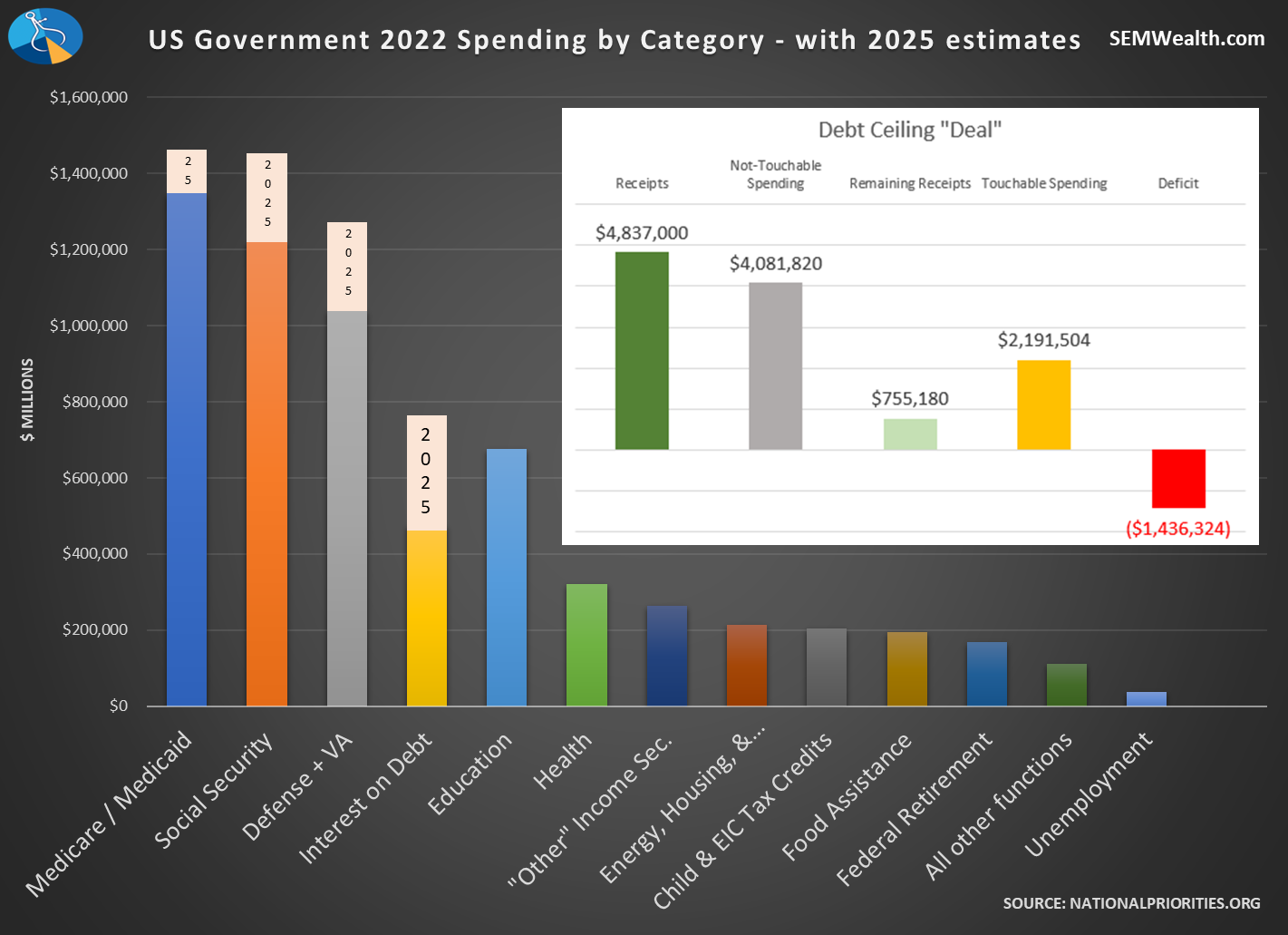

While SOME of the spending will lead to investments which should boost growth, our country is still spending far too much money in unproductive areas. We discussed this back in the Spring during the latest Debt Ceiling Circus. Interest expense will overtake spending on education by 2025. The Debt Ceiling Deal all but guaranteed this. The following chart takes the current spending and overlays the new levels already agreed to in the spring.

Note the $1.4 Trillion deficit which both sides agreed to as part of the deal. The Biden administration was shrewd in their negotiations to get to this point – tell the left they won't touch Social Security or Medicare and tell the right they won't raise taxes or touch Defense & VA Spending. Not to be harsh, but from an economic perspective spending money on retirees is a drag on the economy. If this truly was a 'new era' we would be INVESTING in future generations and minimizing the drag retirees have on the economy.

Instead we are seeing the opposite. This certainly does not justify paying much higher multiples for investments as we are seeing today.

Enjoy this 'new era' while it lasts. As anyone who has studied market and economic history it is never 'different this time.'

SEM Market Positioning

While all of the things above are certainly on our radar, we remain heavily invested. The key difference between our advice to readers and our own investments is we have a quantitatively based plan to leave the party when things start to look shaky (and we take those moves without broadcasting them in the blog)

There were no changes (again) last week in any of our models. We remain mostly invested in high yield bonds in Tactical Bond, Income Allocator, and Cornerstone Bond. We remain "bearish" in the Dynamic models (reduced risk exposure based on our economic model), and right in between minimum and maximum exposure in our 'strategic' models.