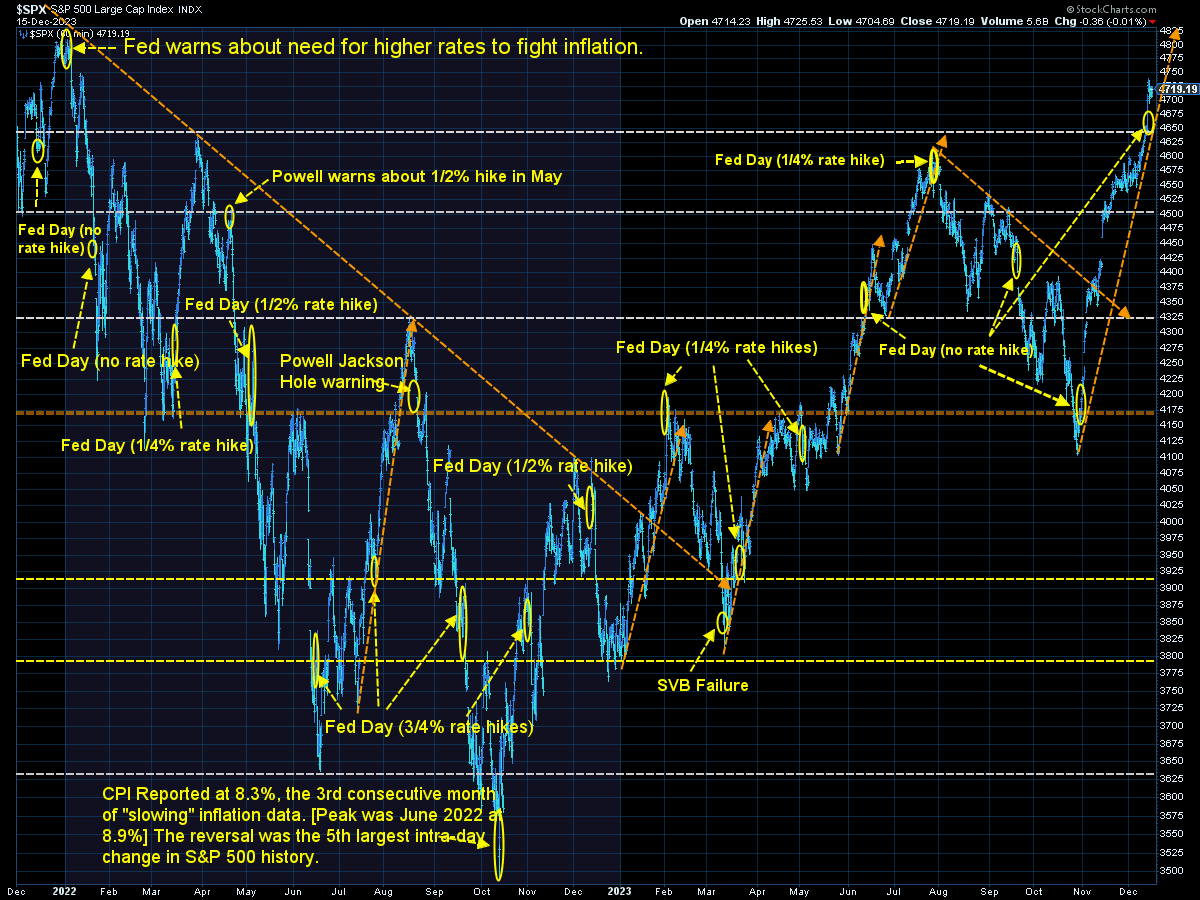

For most of my career there has been a nearly unshakable belief that the Fed was all knowing and could control the direction of the market. This is despite the fact they've always been too late to change direction or to fully understand the inner workings of the financial system. They keep rates too low for too long, create a mania/bubble and then move rates too high for too long which collapses the bubble. This chart from Rosenberg Research highlights the Fed's rate hike cycles. Note just 22% of the time did the economy not land in a recession.

More importantly, history suggests when the Fed cuts rates it is too late and the economy still goes into a recession.

This time could be different at least for the short-term. I've never seen a Fed Chair so aggressively pivot on their stance so quickly especially when the stock market is close to all-time high valuations. This is not a game-changer, but it does tweak our 2024 Outlook a bit.

For a full review, check out our introduction here:

Here's my current assessment combining my experience, our quantitative research, and my subjective opinion.

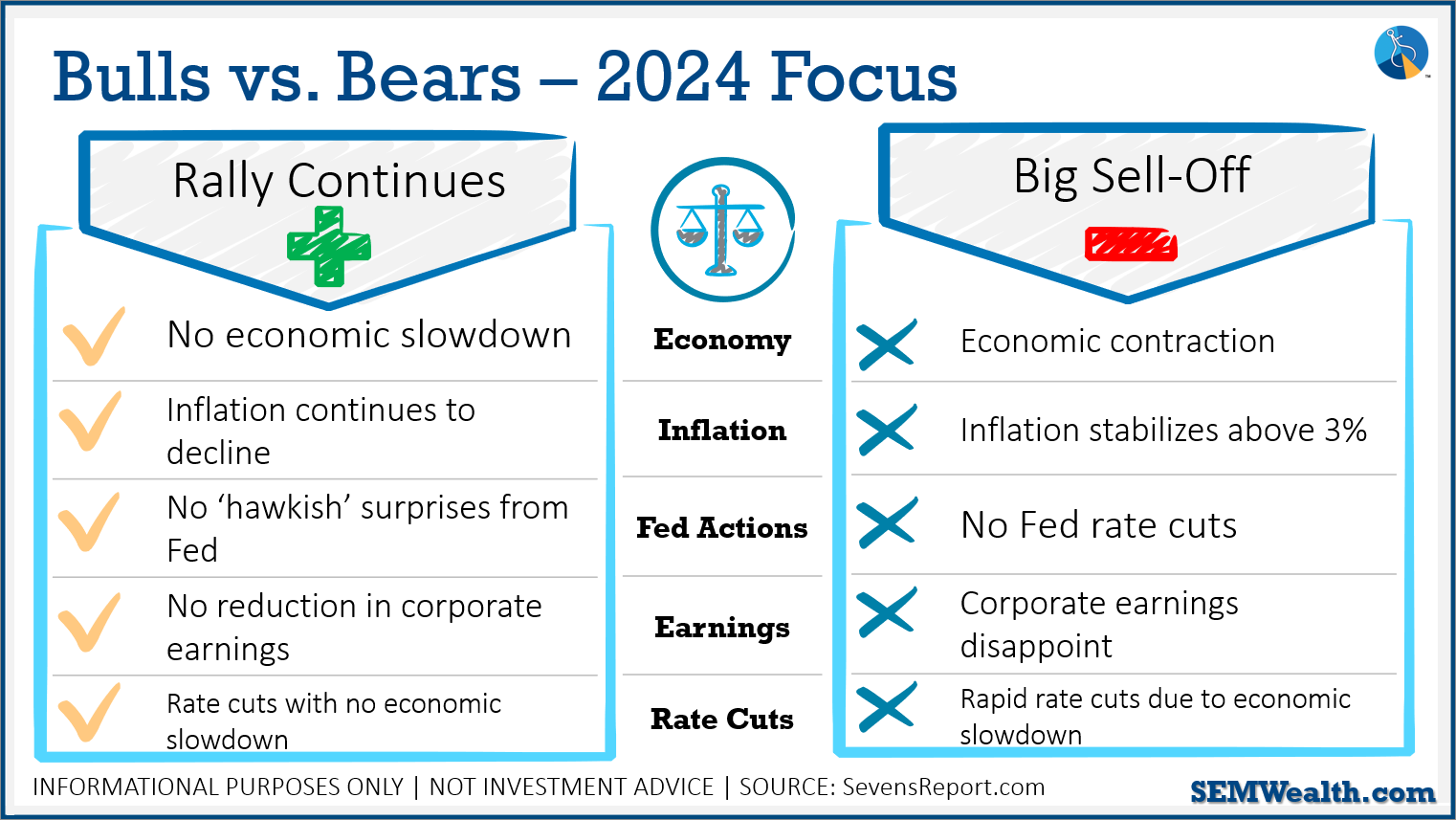

2024 SCORECARD

(each category ranges from +1 to -1 for a max score of 5)

ECONOMY [-1.0]

Based on SEM's economic model. See our latest economic update here.

Keys: Will the labor market be able to continue supporting consumer spending?

INFLATION [0.5]

CPI is trending down, albeit more slowly than before.

Keys: Will housing, food, and service inflation (all of which are still uncomfortably high) come down or will they pull up overall inflation?

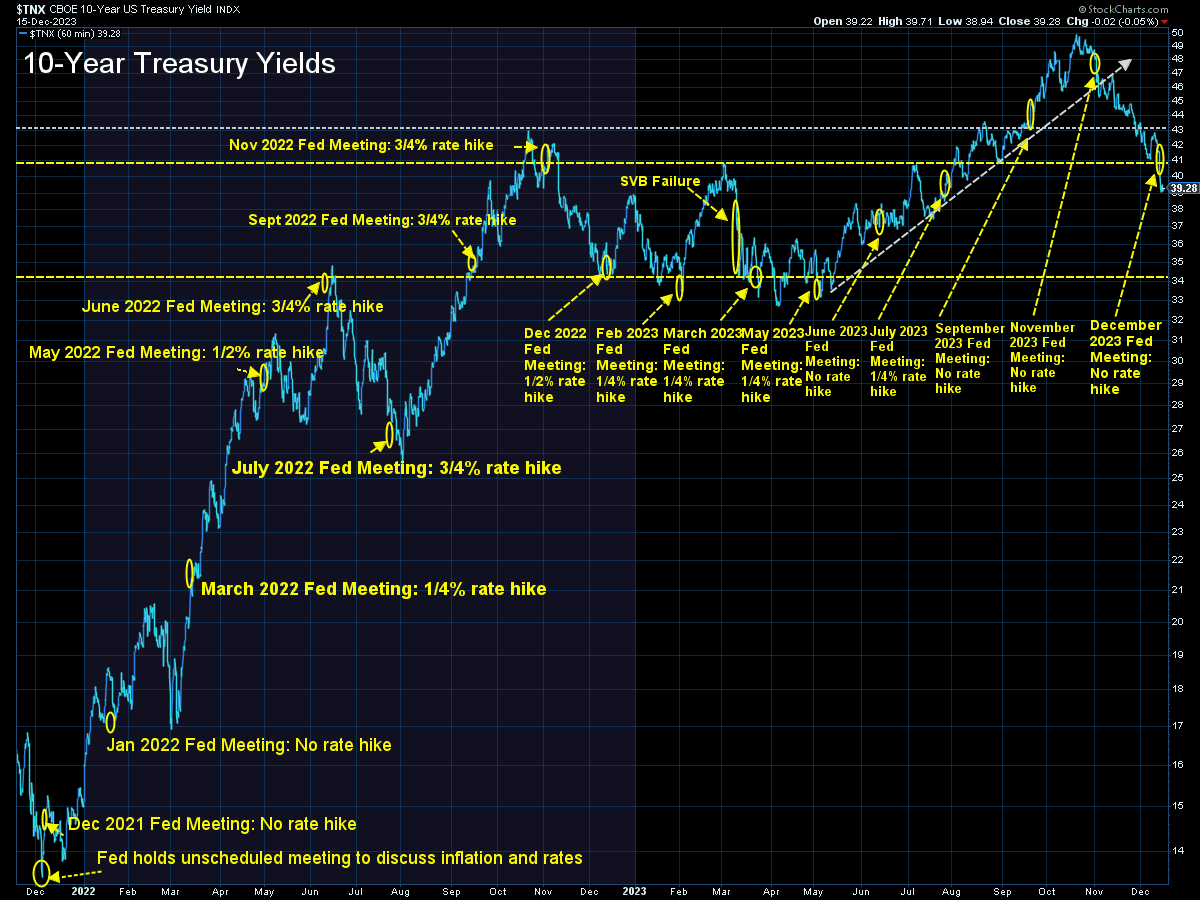

FED ACTIONS [1.0]

The December 'pivot' was jaw-dropping considering the current level of market valuations.

Keys: Will the Fed really allow the mania in stocks and bonds to continue knowing how that could reverse the trend in inflation?

EARNINGS [-1.0]

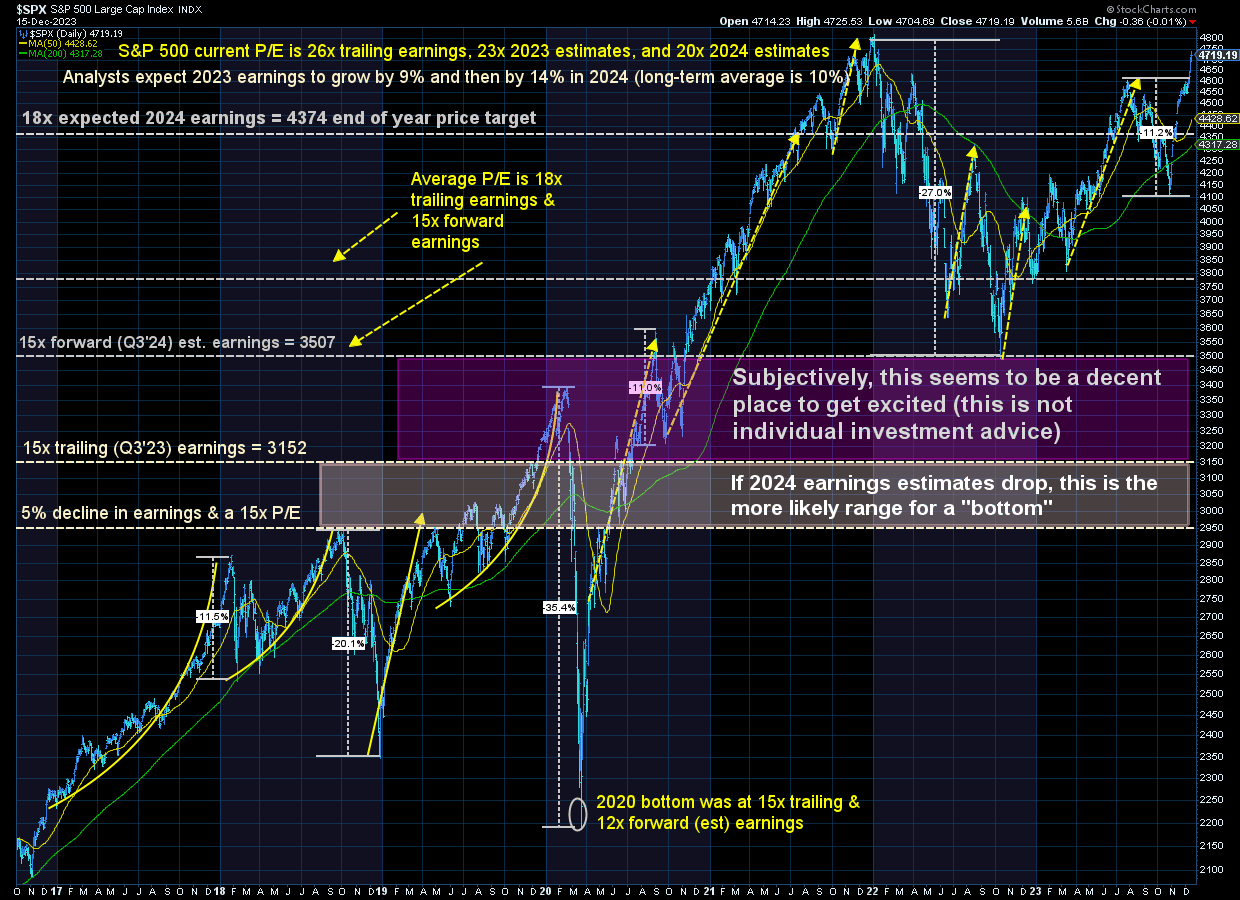

Earnings expectations call for 14% growth in 2024 (versus a 10% long-term average & 9% growth in 2023). This is entirely too high in my opinion.

Keys: Will earnings be able to grow faster in 2023 despite economic growth slowing to 1.5% (versus the current 3% growth rate)?

RATE CUTS [0.5]

The Fed all but announced a rate cut by March with 2 more the rest of the year (for a total of 0.75%). The problem is the market immediately priced in 6-8 cuts by June 2025 for a total of 2%. This would be the fastest cut in rates EVER.

Keys: Will the Fed be forced to tamper expectations?

OVERALL SUMMARY [0]

The environment is certainly more favorable than it was 2 weeks or 2 months ago, but the large move in the markets has already priced that in. The rest of the year could still be positive, but a 'neutral' rating of 0 makes sense as we flip the calendar.

-High valuations are fine so long as growth is strong.

-High valuations create tremendous risks if growth disappoints.

-The Fed WILL NOT be able to reverse slowing growth immediately.

Therefore, the critical question for 2024 will be whether economic growth will remain strong.

Market Charts

The rally since the November Fed meeting has been nothing short of spectacular. At this pace the S&P 500 will be at all-time highs before the end of the year.

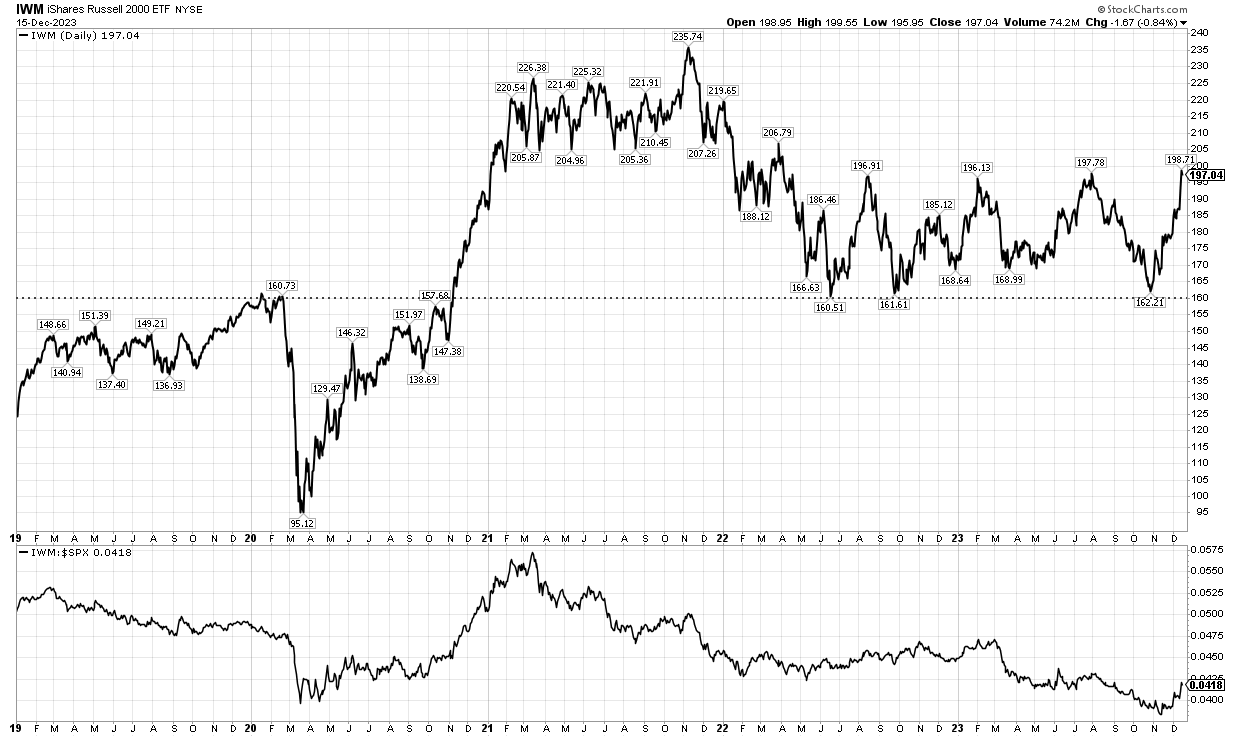

The good news in the rally is the most beaten up areas of the stock market – small cap and value stocks have been outperforming over the past 6 weeks (something our models identified in August and again in November). If economic/earnings growth is stronger than expected there is a lot of room for catch-up. With the S&P 500 less than 5% from an all-time high, the small cap Russell 2000 is still 17% from its high.

The bad news is the S&P 500 is priced to perfection and if growth disappoints valuations have a long way to go to be attractive.

On the bond side the 10-year Treasury broke 4% for the first time since August. This is certainly encouraging and should take pressure off the economy.

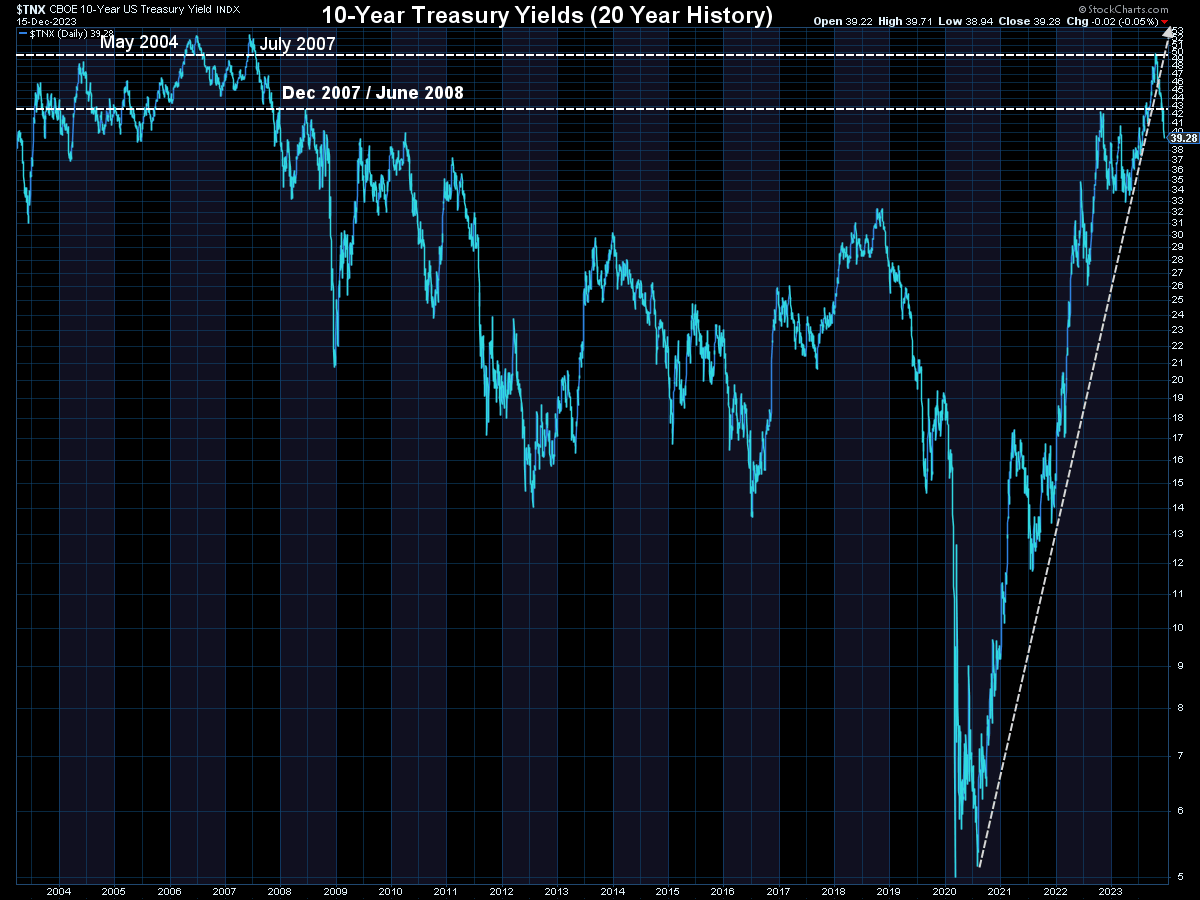

Longer-term, rates are still higher than we enjoyed in the 2009-2019 expansion. Structural inflation likely has adjusted higher meaning we may not have much more room on the downside for rates (unless we head into a recession, which would be very bad for stocks).

SEM Model Positioning

-Tactical High Yield went on a buy 11/3/2023

-Dynamic Models reverted back to 'bearish' 12/8/2023

-Strategic Trend Models went on a buy 11/27/2023

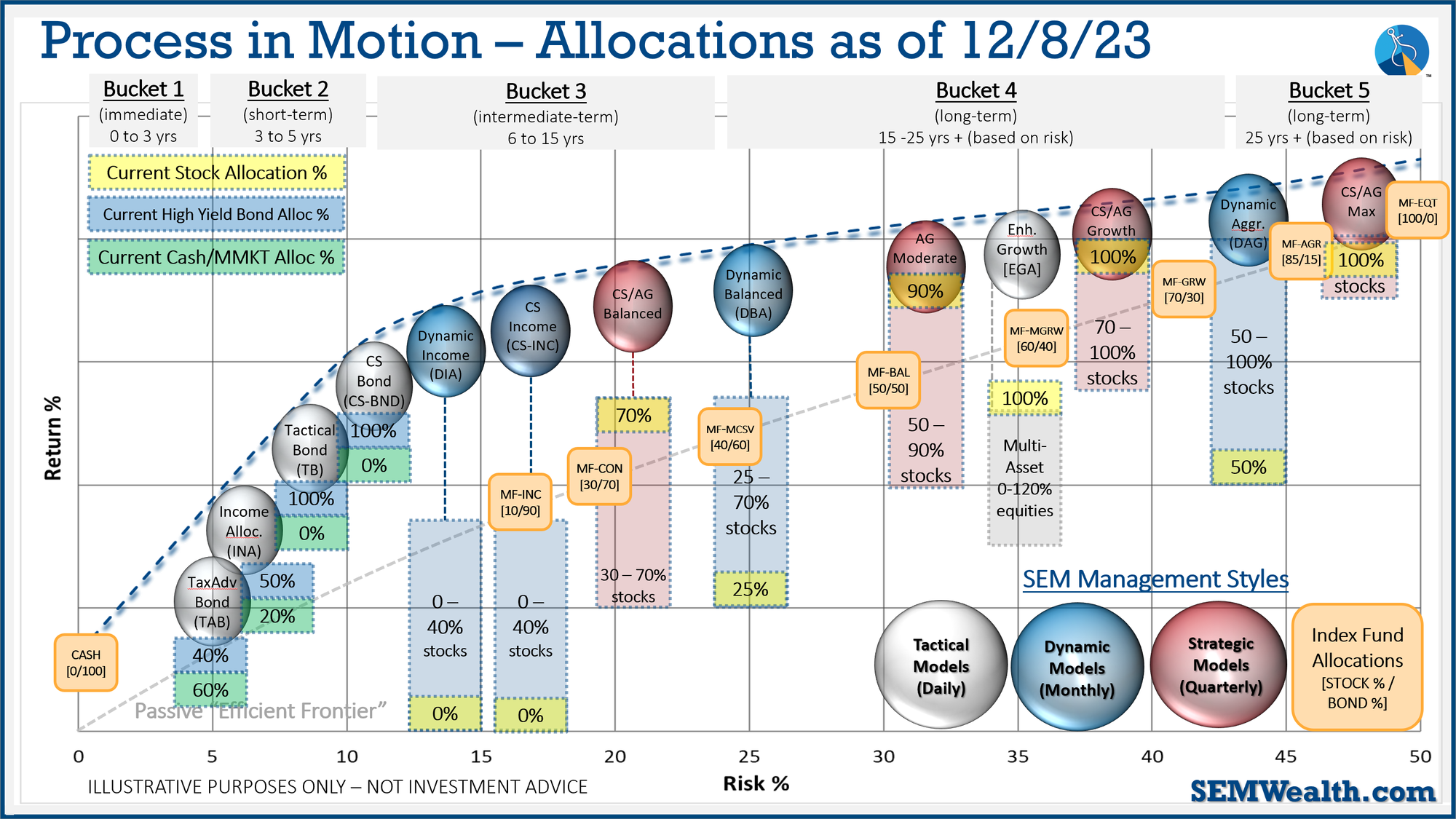

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

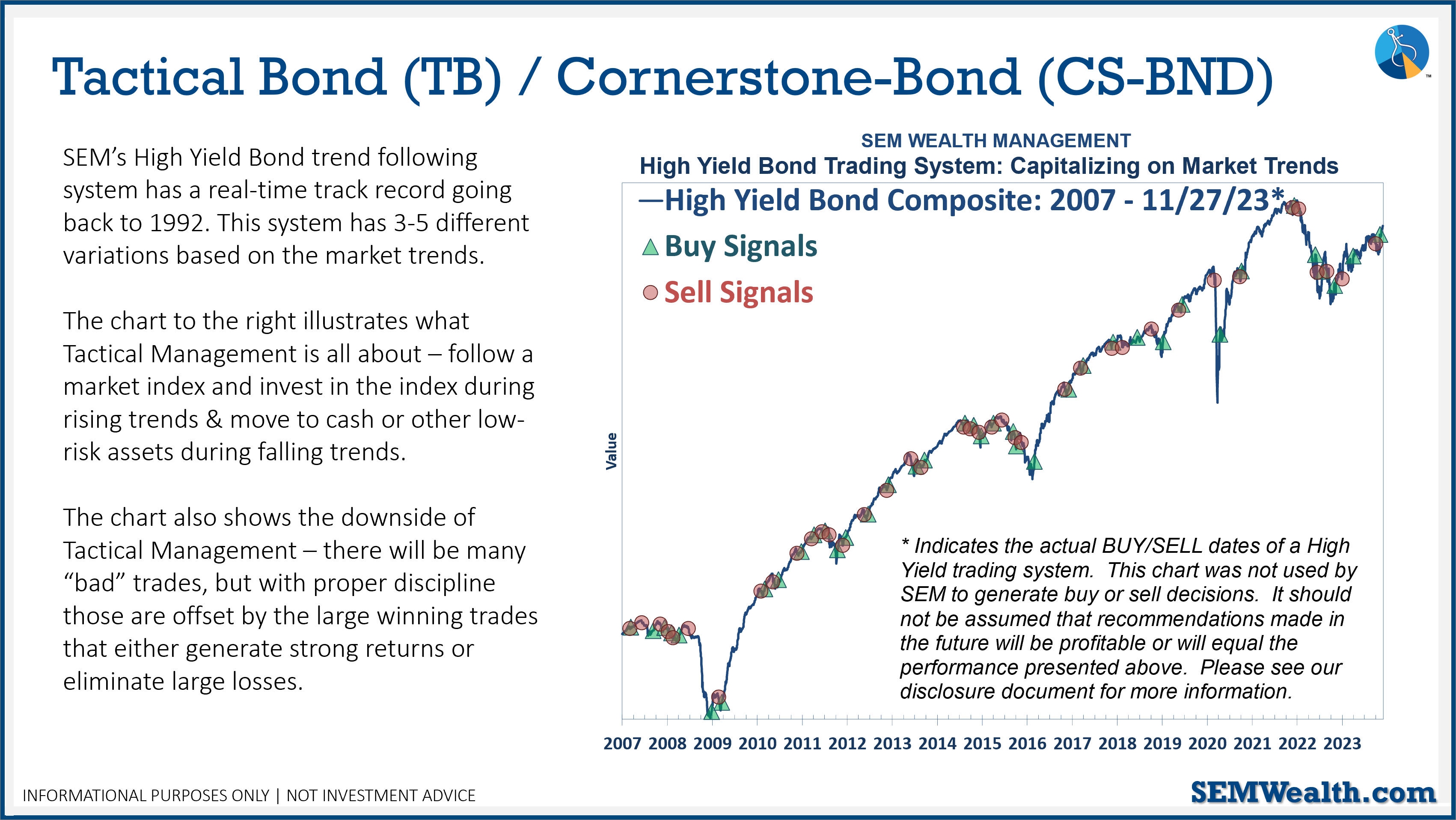

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

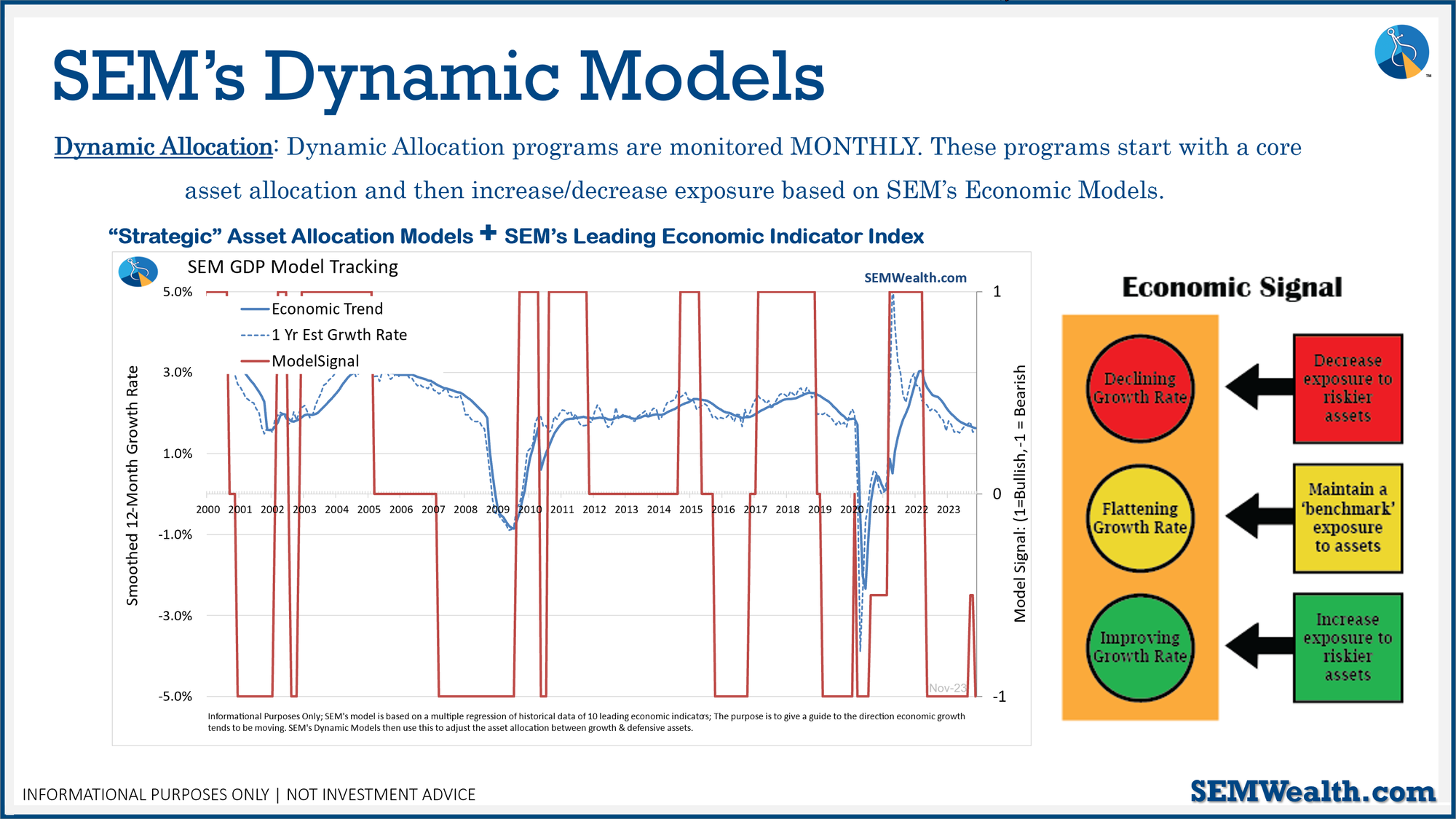

Dynamic (monthly): At the beginning of October the model moved slightly off the "bearish" signal we've had since April 2022. At the beginning of December it reverted back to "bearish". This means no positions in dividend stocks (Dynamic Income) or small cap stocks (Dynamic Aggressive Growth).

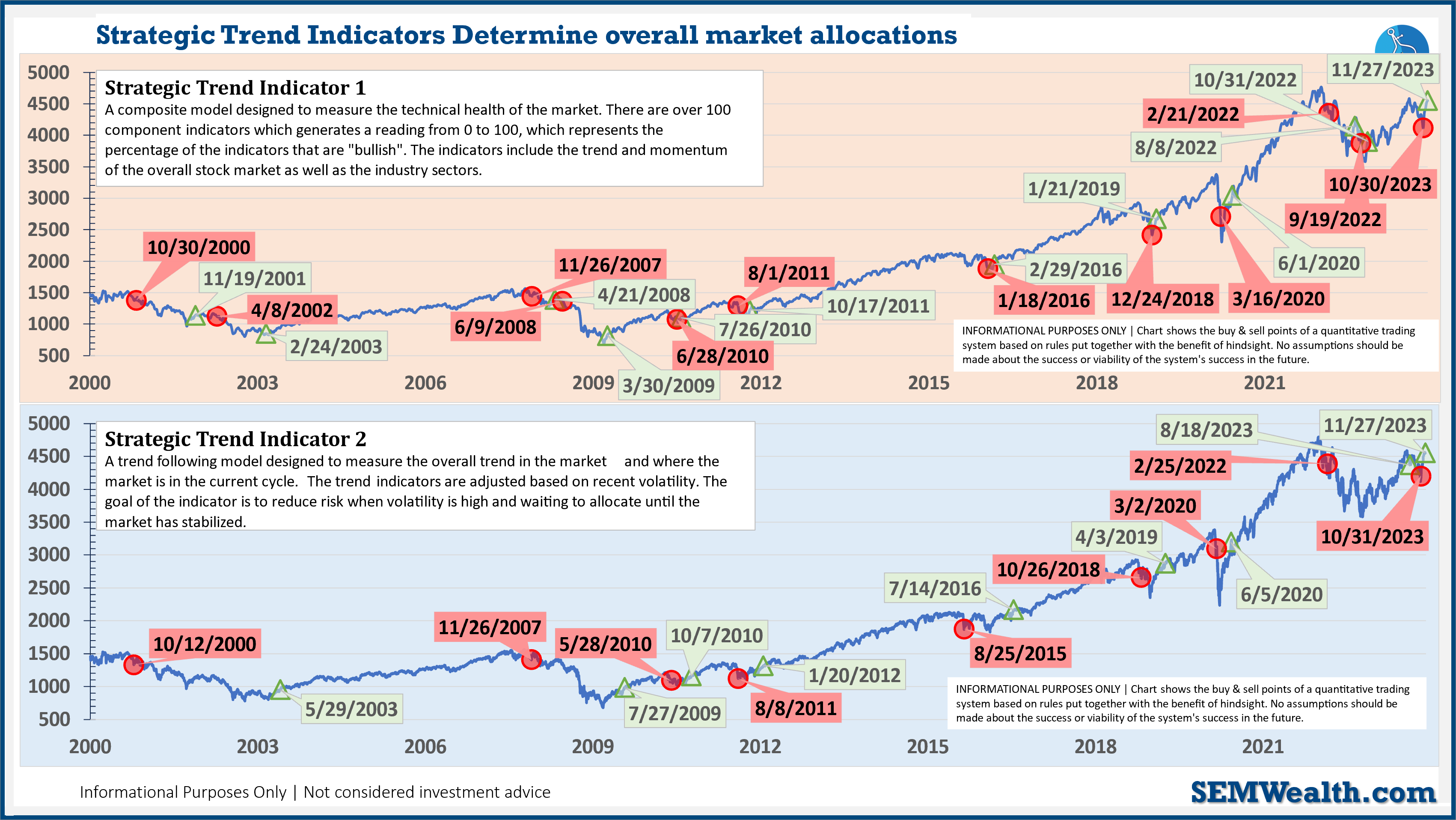

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.)

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stock up: