For those of you who watched the Super Bowl yesterday, especially if you live on the east coast, I will keep this week's entry brief. I will say the same thing I've been saying for at least 20 years – if Congress wants to do something (or the President wants to use his Executive Order for something most Americans want) they would move President's Day to the day after the Super Bowl. Based on the parking lot outside our office this morning (which we share with a gym) and the long line at school drop-off 5 minutes after the first bell had already rung, it's going to be a tough start to the week.

After a huge rally following the Fed's meeting 2 weeks ago, stocks gave back all of this month's gains. If you've been following along our blog this year, my opinion is the concern's raised last week are justified. The mini-uptrend off the lows has been broken, but we remain above the bear market downtrend. The next few weeks could be critical in determining if the "new bull market" as some experts have called it will resume or if this was yet another bear market rally.

1.) Earnings/Economic Growth

The idea of a "soft landing" has been surging to start the year. We discussed this last week as we walked through our economic model.

Essentially the labor market is the only thing keeping the economy out of a recession. As noted in last week's blog, the "strength" in the labor market is in the lowest paying sector, which are in the "easy come, easy go" category. If you want a summary of our economic model in under a minute, check out last week's Musings Video.

@finance_nerd The labor market is not as great as it looks. Here's why #labormarket #jobs #goldilocks #economy #stockprices #becareful #investors #easycomeeasygo ♬ original sound - Finance Nerd

The most important question is whether or not earnings will be able to grow at the currently expected 13% rate. I find it hard to believe even if we avoid recession and get 2-3% economic growth that corporate earnings will jump that much. For more on earnings, check out this blog from a few weeks back.

2.) Inflation/Interest Rates

The other theme this year is that inflation will not only come back down to "average" levels, but fall below 2%, which would lead the Fed to CUT interest rates. The Fed has made it quite clear that they do not see this happening, but the stock market continues to ignore them.

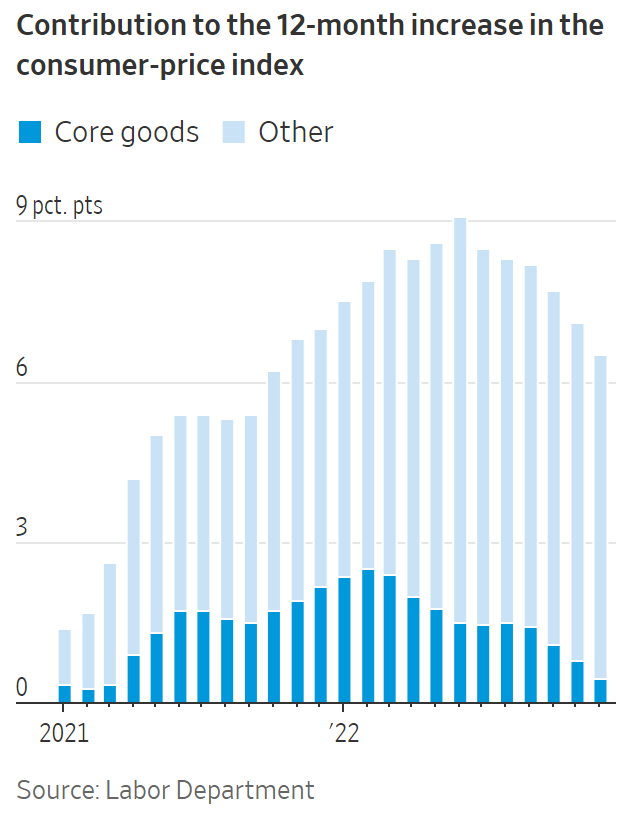

The Wall Street Journal this morning highlighted how this may not be coming to fruition any time soon. Essentially, the prices of "core goods" (those goods that were driven by a stimulus-fueled spike in demand which led to massive supply chain shortages) are plummeting, but everything else remains considerably higher (and are not falling as quickly)

The bond market is clearly becoming more concerned with inflation remaining stubbornly high (remember inflation erodes the value of the coupon payment you were promised, so rates move up to combat this erosion).

10-year rates are back to January 5 levels, breaking the downtrend put in place following the peak back in October (and shortly after the last 3/4% rate hike of the cycle).

3.) Valuations/Sentiment

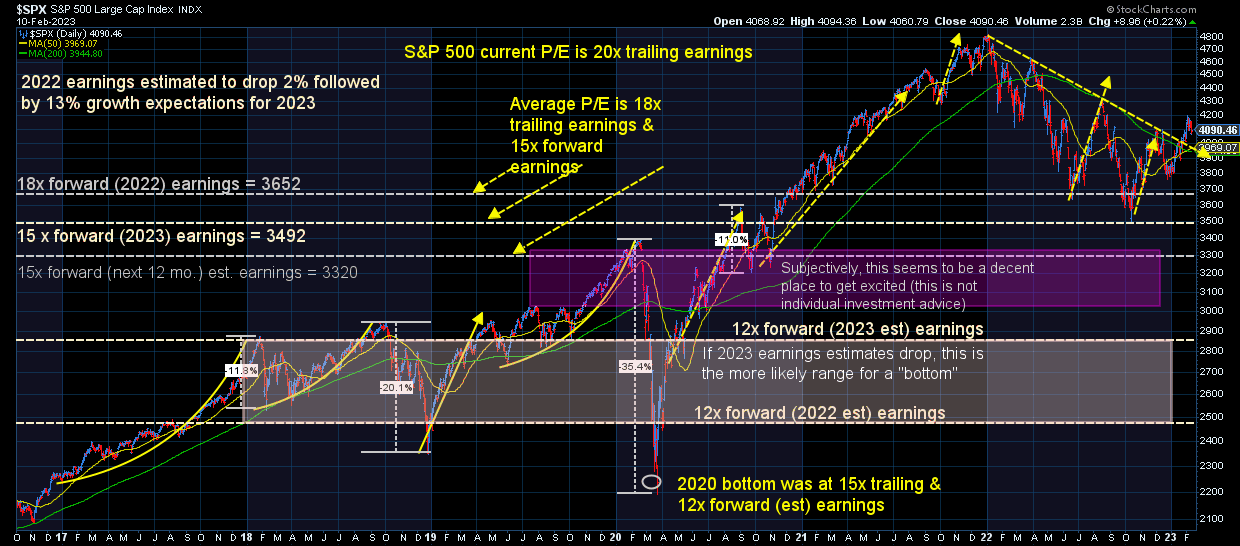

The primary concern for investors, especially with those jumping into the market and/or who will need their money in the next 3-5 years is the current valuation level. Stocks started 2022 at a P/E of 21. They fell 18%, but the P/E is at 20 because the "e" part of the ratio went from a +10% expectation to a 2% drop.

Even if we get a "soft landing" most people expect, the fact so many people have jumped into stocks expecting the soft landing means the potential profits are small. We discussed this a few weeks back:

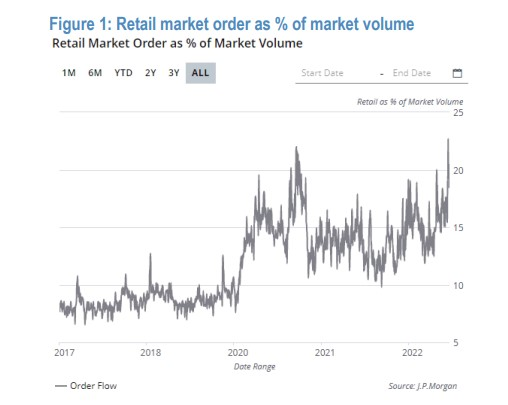

The "lower" prices for stocks has led to a resurgence of retail investors. I showed this chart last week. The % of retail trading volume to start the year has surged to the same levels we saw during the height of the "meme" stock craze in 2021.

I continue to use this chart as a general guide to frame expectations. I would not consider stocks undervalued until at least the 3300 level for the S&P 500 (which is 19% lower from here). This doesn't mean stocks cannot rally, but it would be a momentum/speculative rally that likely would not last unless we see a miraculous recovery in fundamentals.

Like the Chiefs in the Super Bowl, it's important to not panic when you're down. Create a plan and stick to it. The most important question for any investor is "do my investments align with my financial plan?" If you don't know, ask your advisor. If you don't have a plan with your current advisor, ask us, we provide those free of charge.

State of Disunion

Finally, I haven't had a chance to write about it yet, but the State of the Union speech left a really bad taste in my mouth due to the President peer pressuring Congress to "agree" nobody will touch Social Security or Medicare. I last wrote about this in 2021 (but I've written about this over a dozen times the past 20 years).

We also posted this video to our social media channels discussing this.

@finance_nerd You're not as important if you're under age 55. Here's why. #socialsecurity #spicytake #biden #boomers #medicare #congress #insolvent #generationwar ♬ original sound - Finance Nerd

Look, I'm not anti-Boomer (or any generation), but the data and facts speak for themselves. This problem was identified back in 1992 and Congressional leadership (which Boomers have held since 1994) has continued to kick the can down the road. As they are cashing in on the promises they made to themselves, they are leaving the next generations to figure out both how to pay the Boomers their retirement, but also how to actually save for their own.

There are things that can be done that would be equitable to ALL generations, but the President and Congress essentially have guaranteed they won't even look to address it until 2025. They have convinced Americans you are "evil" if you dare mention ANY changes to Social Security or Medicare. It's sad because all of the easy changes could have been made 30 years ago (or even 20 years ago.) Each year that goes by the bigger and more painful the changes will have to be to make these programs last.