Is it possible for the last 10 weeks to have flown by, but also to feel like the longest 10 weeks of your life? The last 10 weeks have been a whirlwind and have had seemingly inconceivable developments every single day. At the same time, they've also felt like this:

For the past 10 weeks I've been posting my random musings, essentially a "brain dump" of everything on my mind. I start each morning by reading for an hour. I then spend several hours Saturday and Sunday morning reading the deeper thought pieces I've accumulated that week. I think I have a pretty good filter of what matters and what doesn't after doing this for 25 years. Last week was the first three days of the Virtual Strategic Investment Conference, hosted by Mauldin Economics. The presentations were impressive and served as a look inside the brains of a wide range of money managers, economists, political scientists, and historians. There are two more days of the conference this week. At the same time I'll be at the Virtual CFA Institute Annual Conference. I have many pages of notes already. It will take some time to filter through everything and I'm looking forward to watching the replays of several presentations once they are available.

I also sat in on several webinars with managers I have deep respect for due to their long-term track record and data-driven approaches. There is an interesting divide between what you hear on CNBC/Bloomberg or coming out of the Wall Street firms and what came out of the conference. I'm trying to keep my mind open and look at all sides and all possibilities.

Plenty of Positives / Plenty of Risks

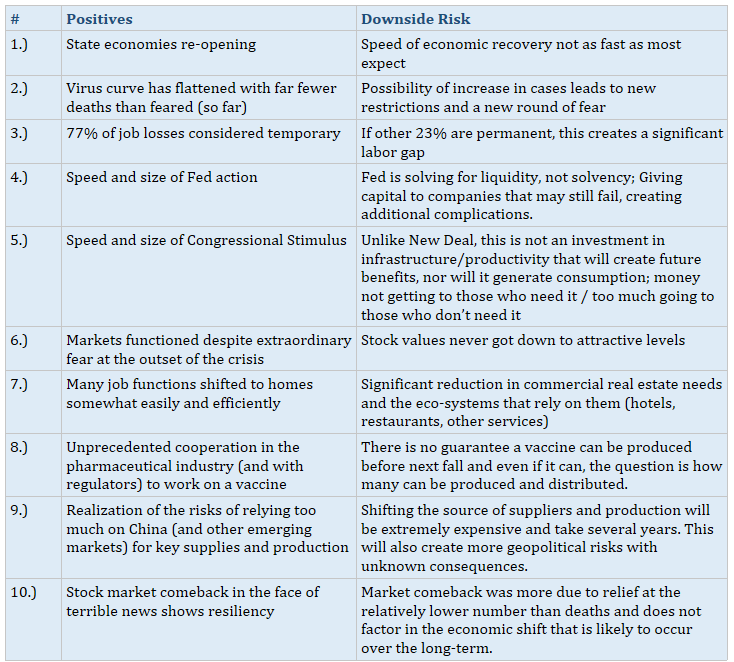

I spent some time this weekend reviewing my notes and all 10 weeks of the Monday Morning Musings. (The new blog makes it easy – just click on the various 'tags' to see a list of all articles with that tag. I purposely bullet pointed the Musings to make it easy to scan.) The comeback from the lows in March has been impressive. I decided to make a list of all the reasons for the huge rally. Next to each point is the potential risk of that item being reversed.

At this point you really have 3 options:

- Focus on the Positive / Stay Fully Invested

- Focus on the Negative / Stay in Low Risk Investments

- Take a data driven approach that can adapt to whatever happens next

-A Typical Market Cycle: Look, I clearly have my own bias and opinions. I firmly believe stock prices do not reflect reality. Having studied market and economic history (along with the social cycle) as well as experiencing the major shocks of 2000-2002 and 2008-2009 we are following the typical roadmap.

1.) Panic/Steep Sell-off

2.) Relief Rally / Sharp Comeback

3.) Reality Adjustment / Prolonged moved to the downside (with many sucker's rally)

4.) Capitulation Low

5.) Recovery

The data and my experience tells me we are in between 2 & 3. A month ago I posted an update titled, "What's Next?". The key point of the presentation was the data driven plan that was already mapped out.

-Which makes more sense? Since posting the update a month ago the S&P 500 has moved 2%. In one sense the consolidation at these levels is a good thing. The market moved too far too fast with little data to justify the move. Stopping to take a breather is healthy. In the same sense read through the downside risks again. As market participants begin to adjust to the reality of the situation, things could get ugly. I have a hard time believing this will not turn into a prolonged recession. That said, we are partially invested in high yield bonds, which is the first part of our "V-bottom" plan. Those positions can be reversed if the market starts reflecting the economic reality.

-Paralyzed: We see a lot of people, both advisors and investors alike somewhat paralyzed. They don't know what's going to happen so they are choosing to do nothing. If they moved to cash or low risk investments they are sitting there. If they were fully invested, they are holding tight. Working with SEM allows you to have a plan for either scenario and removes the guesswork from the allocation process.

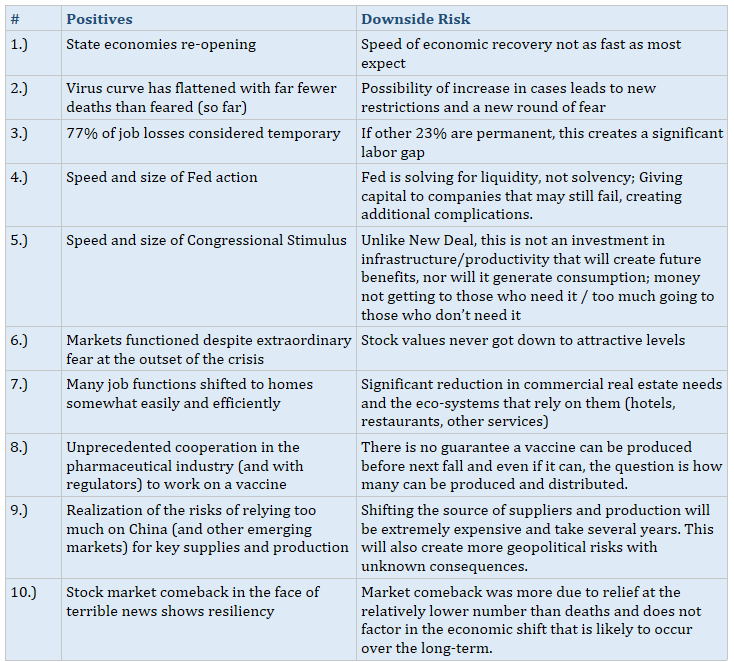

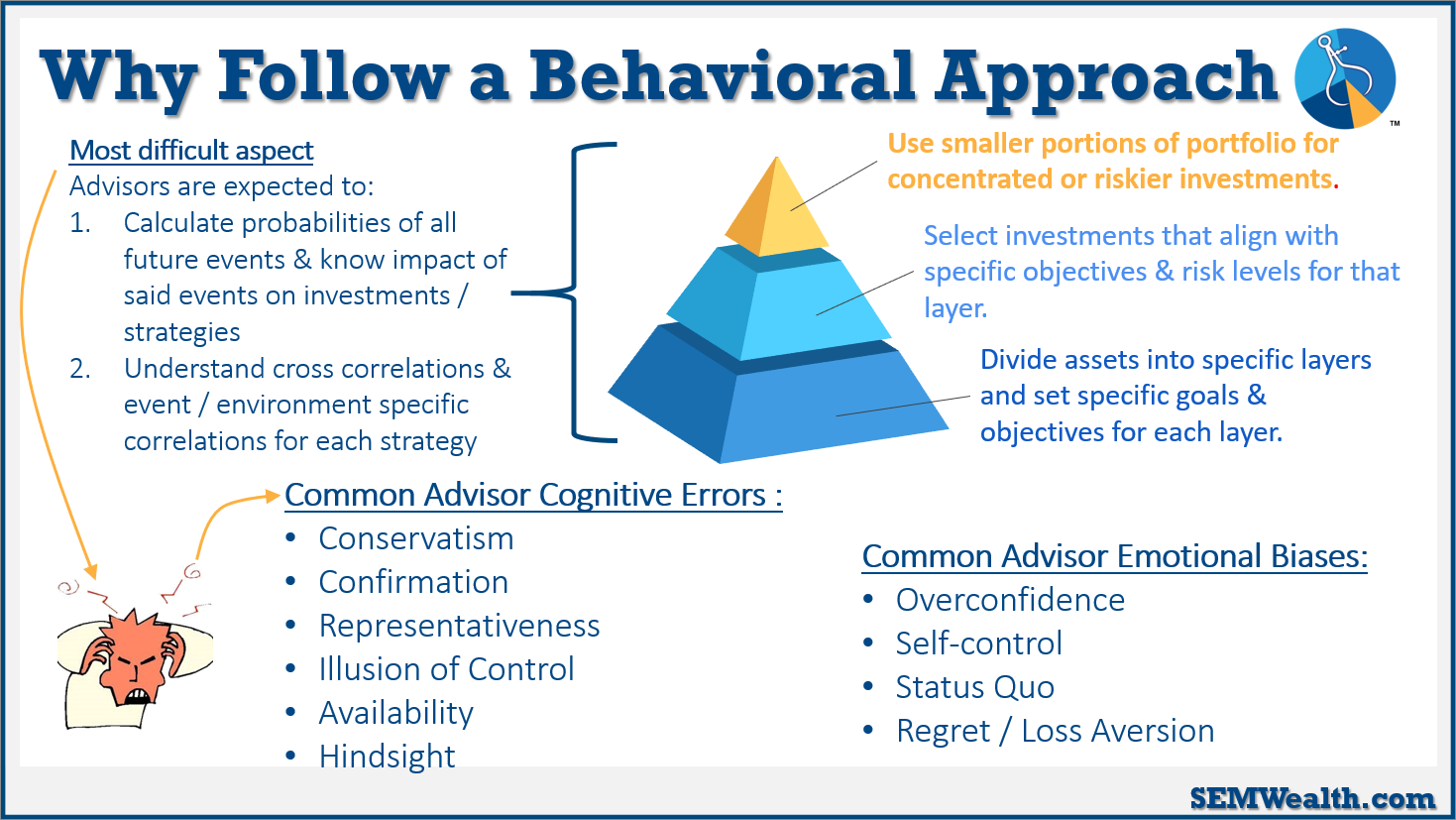

-Behavioral Biases Everywhere: The more stress or uncertainty, the more our brains are subject to behavioral biases. Here is the issue advisors without a data driven process are facing and the biases which are prevalent. For a deeper understanding, check out our primer on Behavioral Biases here.

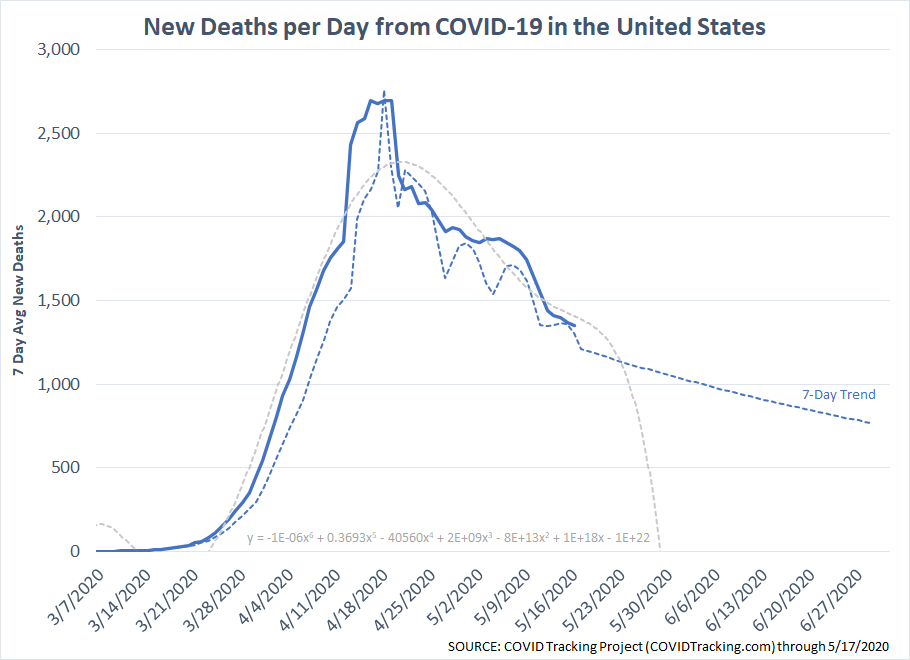

-50 Different Experiments: At the end of March, President Trump tried to prepare the country about the prospect of 100,000 to 240,000 deaths from Coronavirus. We wrote about that in 'Worse Before it Gets Better' where we've been updating the charts at least weekly. With nearly every state re-opened at least partially we will start gathering all kinds of data and testing numerous theories. One of them was the heat of summer would stop the spread of the virus. That may be good news temporarily, but it also could lead to a false sense of security. Regardless, we'll never know how many actual deaths there were and even if there were independent studies one side of the political spectrum would ignore the data. That's the world we live in today.

-End of the EU? One thing several people at the Strategic Investment Conference have mentioned is the perilous situation the EU is facing. They were already on the edge and the possible prolonged recession/depression the world is facing will probably be the breaking point. Unlike the US, the EU simply can't create currency to finance the EU debt. Instead they have to purchase the debt of each individual country. This will lead to further divides between the stronger countries and the weaker ones. The experts at the conference say 'Brexit' was the first of many dominoes to fall.

-What are savers supposed to do? I recently received this notice.

With the Fed pushing short-term interest rates to 0% and short-duration bonds occasionally trading at negative yields, money market issuers have a decision – either supplement their funds by waiving their fees and standing ready to infuse cash to keep the price at $1, or simply close them down. This will be the first of many if rates continue low or we see the market push rates firmly into negative territory.

-The prospect of negative rates: Federal Reserve Chairman Jerome Powell has repeatedly said negative interest rates are not in the Fed's playbook. They would cause systematic problems since most derivative instruments are priced off the US's short-term rates. If your "risk-free" rate is negative you can't value a derivative. This doesn't mean we won't see Treasury Bills and possibly even longer-term Treasury Bonds with negative interest rates. Remember, (at least for now) bonds are priced by supply and demand. With every developed country having negative long-term rates, US bonds are quite attractive. Commerce is also mostly done in US currency and many debt payments are also dollar-denominated. This leads to significant demand for both the dollar and US government debt.

-What can investors do? Obviously if you have money you cannot lose you're stuck with whatever you can get from your bank or in a money market, which is essentially nothing. However, if you have more intermediate income needs, our Tactical Bond and Dynamic Income Allocation models are viable options. They are designed to adjust to the market environment. We may have hit the end of the bond bull market, but if rates move into negative territory there is plenty of room for Treasury bonds to generate significant gains. Flexibility is key as is a data driven process. Learn more about these two core models here:

- Tactical Bond: (Delayed) Opportunities Emerging

- Dynamic Income Allocation: Your Core Income Portfolio

-What Really Matters: On Friday Courtney posted a new monthly feature – the Cornerstone Impact Update. For those of you not aware, our Cornerstone Models are Biblically Responsible models which still follow our Behavioral Approach. What we love most about these models is what the underlying fund partners are doing with our clients' investments. Money talks and these partners are using the influcence to make a difference in the world.

Check out the Impact we are making through Cornerstone here.

-Supply Chain Issues: I mentioned this as one of the downside risks in the table at the top. There were behavioral reasons for all the hoarding. Stories of empty shelves create more demand, so people rush in to buy whatever they can, which creates more stories of empty shelves. At the Hybiak household we have paid the price for our trust in Amazon. We've been users of their "subscribe and save" service for years. We typically get our order at the end of each month. We try to keep one month of supplies on hand and occasionally have to adjust or skip our order if we have too much on hand. Brandi tried to actually reduce our toilet paper shipment in February, but logged in too late. Thankfully she did. Amazon cancelled our order for March and again for the end of April. We had tried Costco and Wal-Mart delivery in early April and had no luck. We've only gone to the grocery store every other week and every time the shelves were completely empty. As our supply dwindled we asked again and some friends reported Wal-Mart had come through for them. We hopped online and ordered as much as we could (3 packages). This is one minor example, but here we are 3 months in to the panic and our manufacturers and our supply chain still has some glaring holes. As one panelist at the Strategic Investment Conference put it:

"In their quest to squeeze every penny to boost earnings, companies over-optimized their supply chains. That led to pretty much everybody relying on China to produce everything possible and to not place orders until they absolutely needed it. We are now paying for this optimization."

-Over-optimized Haircuts: After two years of trying, last year I finally found somebody in Virginia who knew how to cut my curly hair. I'd had the same person in Arizona for 10 years. Through some trial and error the new stylist developed a "4-week" haircut. This way it wasn't cut too short, but also minimized the fly away curls that pop up if left too long. I was due for a haircut on March 24. The governor of Virginia shut everything down on the 20. Last week the governor finally allowed salons to open, but I was too late in trying to get an appointment. The soonest I can get is the second week of June. For those of you who see me on a video call, please understand.

-Who needs inspectors? The Democrats demanded an inspector general be part of the CARES Act to supervise the distribution of the $3 Trillion. Republicans reluctantly agreed. 6 weeks after the passage of the bill, we are nowhere close to having somebody supervising the distribution. With the stock market rallying so much and the Fed seemingly bailing out Wall Street once again via Quantitative Easing and all the new "Special Purchase Vehicles", this will only create a much bigger social divide in our country if unemployment remains high.

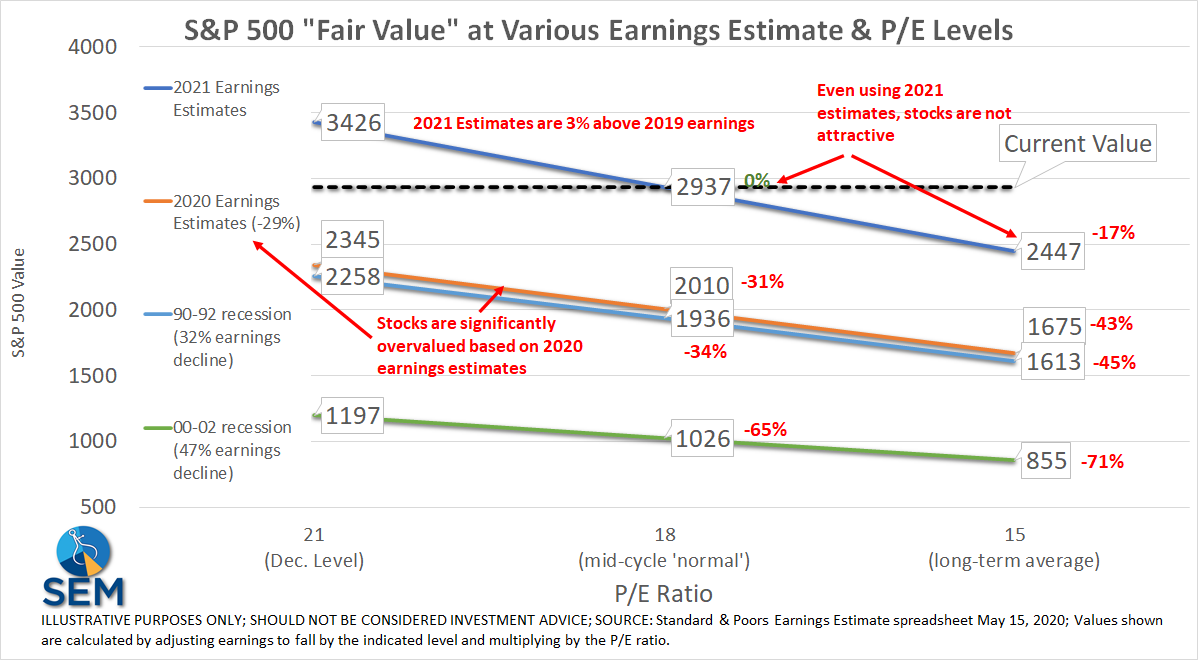

-One of the most expensive markets ever! Last week we heard from several big name investment managers who voiced their concern about market valuations. Long-time readers know I do not like using earnings for any market valuations, but that is what most of Wall Street focuses on so we are stuck looking at this metric as well. Since the market is "forward-looking", most Wall Street firms advocate using "forward earnings" to value stocks. Even though they have a pathetic track record of predicting earnings (almost always 10-20% too optimistic) we are supposed to trust these estimates.

Let's say they are correct. The average forward P/E using earnings 12 months out is 15. Using the current 2020 estimates, stocks are 43% overvalued. 2020 is an outlier, so Wall Street is telling us to use 2021 estimates (which assume a return to the pre-crisis earnings levels). Using 2021 estimates, stocks are 17% overvalued. Oh wait, they say, 2021 will still have some Coronavirus impact. You should use 2022 estimates (even though there is no published estimate of these numbers). If you use those estimates, stocks are attractive (according to these analysts.)

-It's All About Expectations: Valuations are a terrible timing metric. Stocks will stay overvalued for quite some time. The problem is the more overvalued stocks become the worse they fall will be when the market/economy fails to generate the expected growth rate. Think of valuations as a measure of sensitivity to disappointment. When stocks are significantly overvalued (like they are now), the risk is high. When stocks become significantly undervalued (which we've yet to see this crisis), the risk is low.

-Relative vs Absolute Economy: We have to be careful to not get sucked into the enthusiasm. Right now, everyone is assuming we return to the old economic and earnings output once we put the virus behind us. They see improvements in economic activity compared to the last week or month (relative improvement) as a clear sign we are heading back to the old numbers. What is being missed is the economic destruction that is taking place. Even with the unprecedented stimulus, the retail sector is being decimated. Amazon started this a decade ago, but Coronavirus seems to be the death blow for many companies. This means lost jobs, empty real estate, and bond investors losing 100% of their investment. Then you have small businesses who supported retailers or those who were barely scraping by before the shutdown. The PPP loans didn't come fast enough (if at all) or the money is not even close enough to providing the support needed for them to remain in business. This leads to more lost jobs, empty real estate, and bankers losing 100% of their investment.

While relative improvement is nice, we very likely will have a STRUCTURAL shift to a lower ABSOLUTE level of output. We cannot mathematically get back to the old levels because the old levels were not sustainable. They were supported by too much debt and not enough savings or investment. We were heading to a "great reset" of the economy in the 2020s anyway with the demographic, economic, and social cycles all converging over the next 5-6 years. All the debt being used to try to get back to the old levels is only serving to delay the inevitable (and making the end result that much more painful).

As an investor, stocks celebrating the relative improvements and ignoring the absolute level of output should be looked at as a selling opportunity.

-What else does the President want? In January the President was pushing the Fed to reduce interest rates despite declaring the economy the "greatest of all-time". When the crisis struck, the Fed quickly reverted to zero percent interest rates, launched "open-ended" Quantitative Easing, guaranteed money market funds, and provided funding to municipalities, foreign banks and corporations to cover short-term cash demands. Through the CARES Act, the Fed is now even buying bond ETFs. Now the President is calling for negative interest rates and again criticizing the Fed. He has proven throughout his life to be fiscally careless and not have any grasp on how the free markets function. I've often criticized the Fed and will again if they do not "normalize" their balance sheet and interest rate policy when we do begin to recover, but they have done a phenomenal job throughout the crisis to keep the markets functioning. Thankfully Jerome Powell is a strong man who doesn't bow to the President's wishes. Remember, negative interest rates in the US would break the financial system.

-Are we not allowed to be critical of anybody? I'm a registered Independent because neither political party reflects my values. I resigned from the Republican party in 2008 when they decided to bailout the failures on Wall Street at the expense of the smaller banks, businesses, and middle class. I did vote for President Trump because I thought he would do the least damage to the economy and would at least not hurt the cause for some other "social" issues that are important to me. My criticism does not make me a Biden supporter (people used to instantly think I was supporting Sanders if I said anything negative about the President. There used to be a time where we could point out issues and debate them respectfully. Both sides have serious issues that stem from listening to the party elites who are at the far extremes of the political spectrum. I hope and pray we finally see some moderation on both sides (or a viable third party to fill the void left by the two extremes.)

[For more see "The Consequences of Political Polarization"]

-Taking advice from your insurance agent: I am one of the biggest Rand Paul supporters around. I’ll continue to argue he’s the only true conservative in the Senate. That said he’s an ophthalmologist not a virologist. Many on the right are rallying around his questioning of Dr. Fauci last week. Having him serve as an expert on Coronavirus is like trusting your insurance agent for investment advice. Or to be fair, asking me for advice on your auto policy. Same industry but completely different specialties.

-Finally Free! While nothing really changed for our family this weekend, our Zoom call with our Bible Study group last night showed a lot of people who were excited to be able to go to a restaurant (outside dining only), get their haircut, or the nails done, participate in an outdoor fitness class at their gym, or just go over to a friend's house (we are under a "safer at home" guideline, not "stay at home"). This is how I imagined most Virginians on Friday.

-Beware of your own biases: I don't fault anybody for their actions or opinion on this whole crisis. We've never experienced anything like this before, which means we all will have our own way of dealing with it. I just encourage you to have an open mind, to be respectful of others, and to give our leaders grace regardless of which political party you belong to. They are doing their best to handle an unprecedented situation without any solid data to base their decisions on. For a deeper discussion, see "A Behavioral Approach to Coronavirus".