Over the past 10 days, we've seen a lot of headlines which read, "stocks post best (worst) day since (2022 or 2020 or even 2008)." This has obviously created a lot more contact with SEM and our advisors regarding the state of the markets or the economy. We've enjoyed several

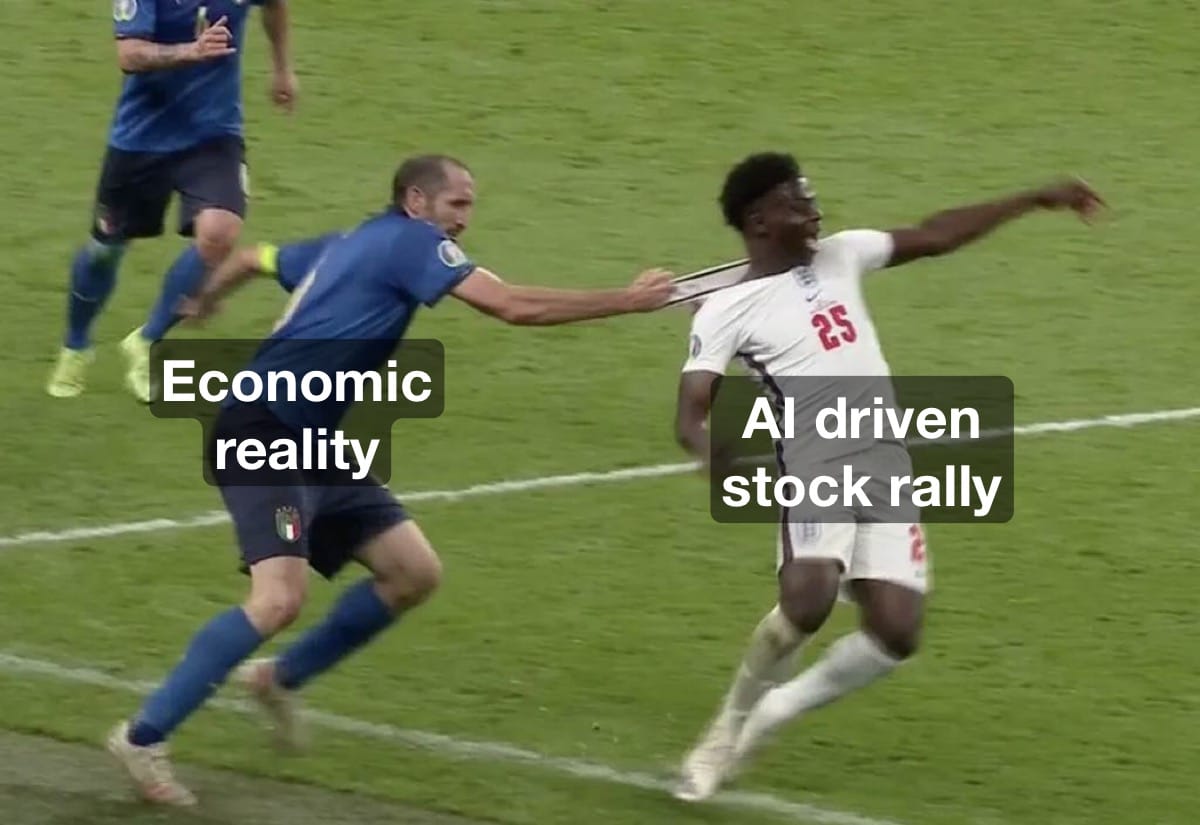

Four weeks ago the title of the blog was "Be careful (what you wish for)." At the time bad economic data was viewed as 'good' news for stocks as it meant the Fed was likely to cut interest rates at some point soon. I warned at the time about the

"It's the economy, stupid!" was a phrase often uttered in the 90s when people asked why Bill Clinton had such a high approval rating. Based on the overall economic sentiment in our country and the underlying economic data, it is not always about the economy.....or at least what the

We've talked many times through blogs and social media about the importance for Christians to care about what they're invested in. Even if you're not a Christian, you can still care about what you're invested in and have a desire to invest in companies that strive to make the world

On what was a crazy Friday after a crazy weekend prior, it feels like world events are constantly happening more and more. In my experience, there’s about a 75% chance when you tune in to a major news channel that the bottom graphic will have “BREAKING NEWS” on