Are you someone who excessively worries about what's going to happen in the future – whether it be tomorrow or years down the road? This has been a struggle of mine for most of my life; however, it's gotten drastically better over the last couple of years. Some common things people

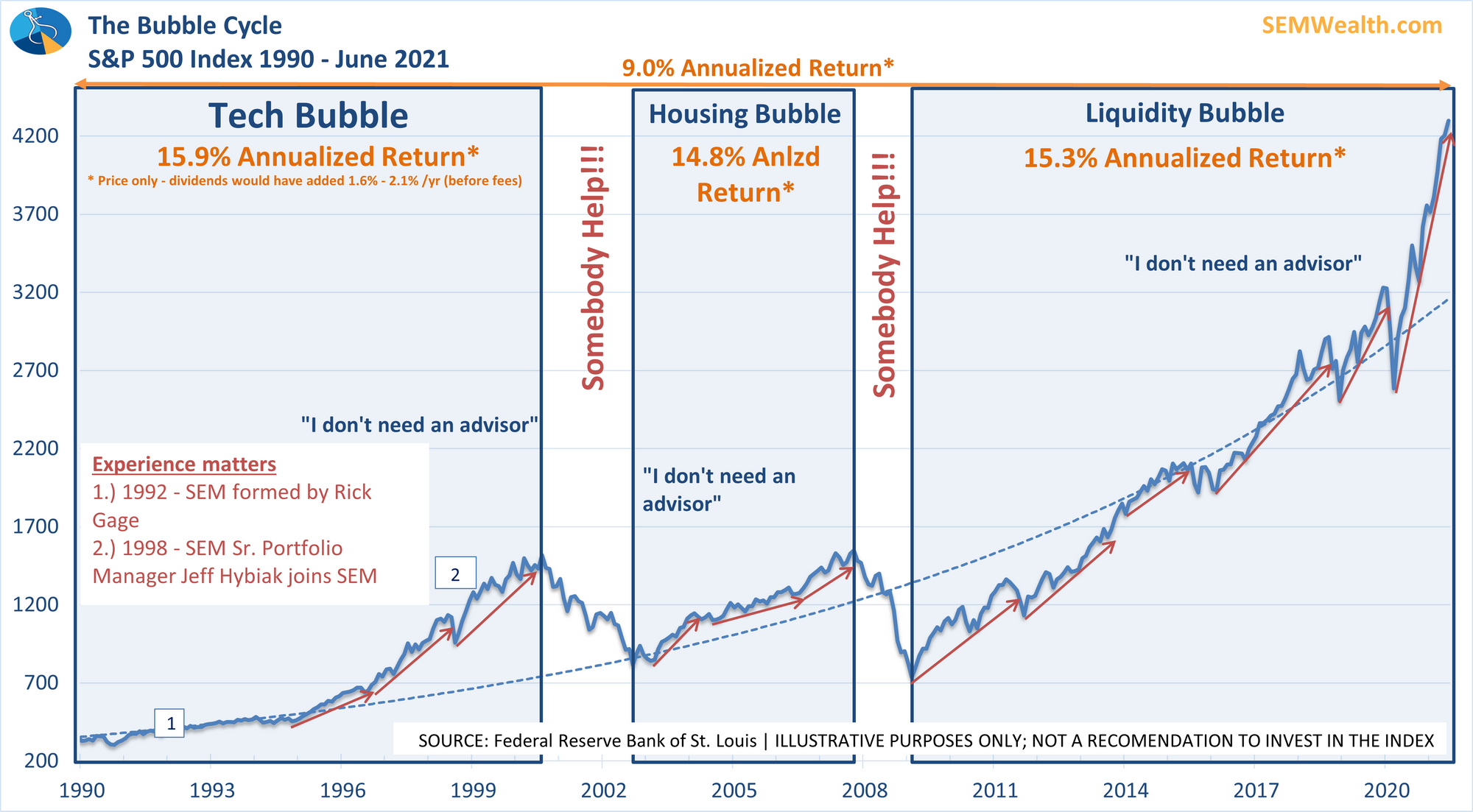

Last week was a good reminder that while things were looking brighter for us economically, we still weren’t fully out of this mess. Perhaps the biggest sign of our complacency has led us to the CDC reversing course on mask mandates, once again recommending masks for people indoors regardless

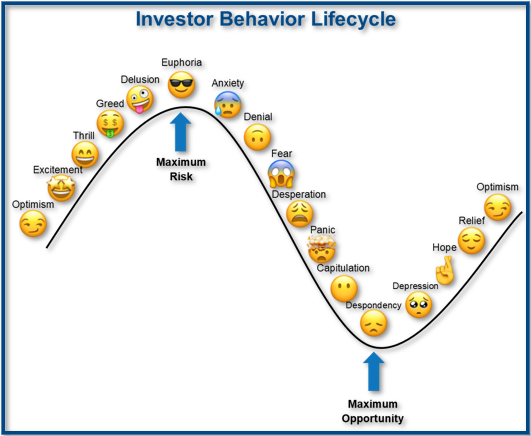

Over the last year, we've seen people be overly optimistic and overly pessimistic with their market forecasts.

We're dealing with an unprecedented situation – we've never seen the amount of money dropped on the economy like we've seen the last 15 months. However, Wall Street is still making these confident forecasts

Last week, I mentioned being cautious about reading into market moves over the summer. It doesn't mean we can't completely ignore what is happening. Losses are losses and gains are gains. I highlighted 3 Themes that are worth watching. This week, the market is conflicted with two of the themes

"But to all who receive him, who believed in his name, he gave them the right to become children of God." - John 1:12

Where do you find your identity? As a Christian, it's easy to say that our identity is found in Christ. While our identity is (and