Last week's Musings focused more on the big picture and my message to clients and advisors on where we go next. With that focus a lot of my random thoughts last week were on the long-term impact COVID will have on our economy, the markets, and our lives. We will

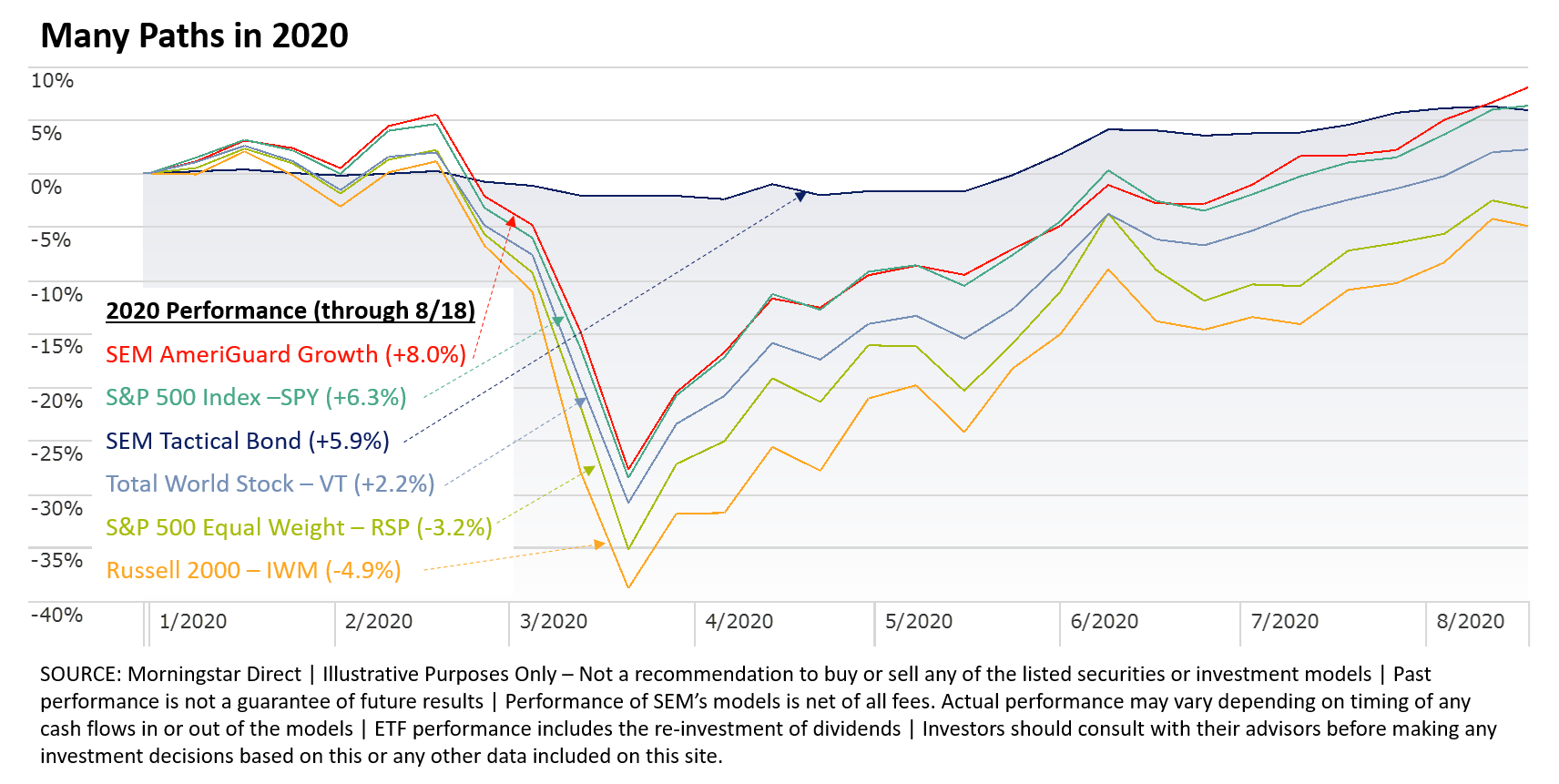

The S&P 500 index hit an all-time record high on Tuesday. Many people are celebrating what is officially the shortest bear market in history. A typical bear market sees stocks losing 35-55% over 12-18 months and then taking 5-8 years to fully recover those losses. I've argued since

We love working with our Cornerstone partners! This month's update focuses on ways our partners are speaking out on important topics.

Eventide

The Chief Investment Officer for Eventide funds, Dr. Finny Kuruvilla has one of the most impressive resumes for any of our portfolio managers. In our office, we like

As we go into the 23rd week since the COVID19 panic began it's hard to get a grasp on the big picture. I attended two more virtual conferences last week and two big name firms essentially said fundamentals do not matter – for now there is no other alternative to stocks

20 weeks ago, Congress came together and passed a wide-ranging, 800+ page, $2.2 Trillion legislation called the CARES (Coronavirus Aid, Relief, and Economic Security) Act.

15 weeks ago, the House passed the 1800+ page, $3 Trillion HEROS (Health and Economic Recovery Omnibus Emergency Solution) Act. The Senate did not