SEM applies a Behavioral Approach to Investing. Our total portfolio approach is designed to overcome the most common behavioral biases. To understand the importance of this we need to first understand the biases. About two years ago I posted a video clip from one of our client seminars where I

Tag: Behavioral Biases

Conservatism Bias: A belief preservation bias in which people maintain their prior views or forecasts by inadequately incorporating new information. Conservatism causes individuals to overweight initial beliefs about probabilities and outcomes and under-react to new-information; they fail to modify their beliefs and actions to the extent rationally justified by the

One of the most common behavioral biases in humans is “representativeness” bias. As Nobel Prize winning economist Dr. Daniel Kahneman described how our brains our programmed to work it is easy to see why this is the case — our brains are generally lazy and want the easiest,

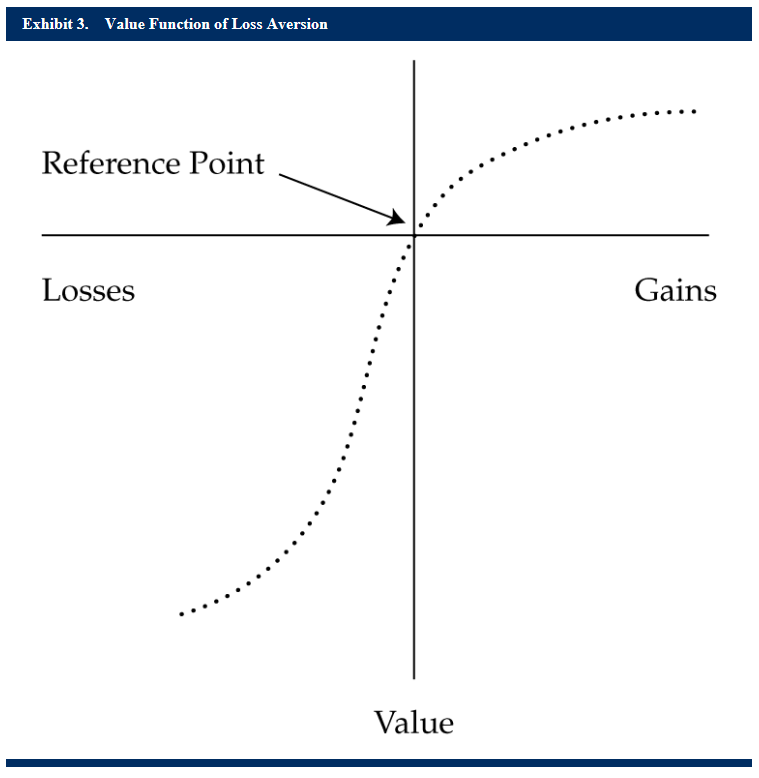

A few weeks back, Dr. Richard Thaler won the Nobel Prize in economics for his work on behavioral finance. Anybody associated with SEM the last few years is quite familiar with his work as it along with others in the field has been the major driver behind the re-design of

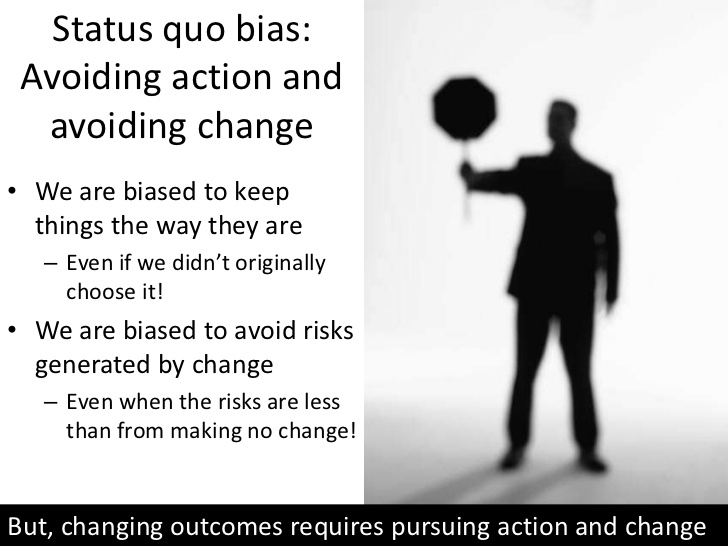

Humans do not like change. It’s just how our brains are wired. We would rather see a negative outcome by sticking with a known than risk having a negative outcome by making a change.

Last week I discussed “conservatism” bias, which is the failure