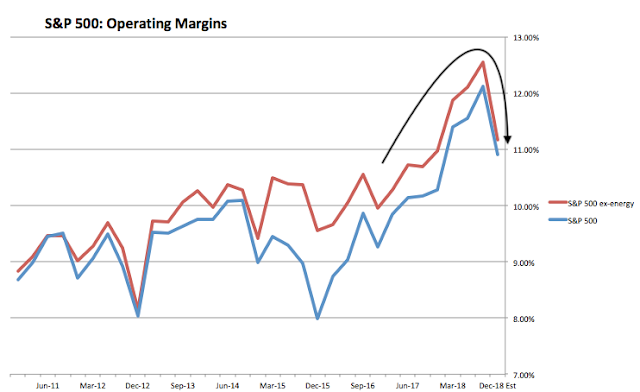

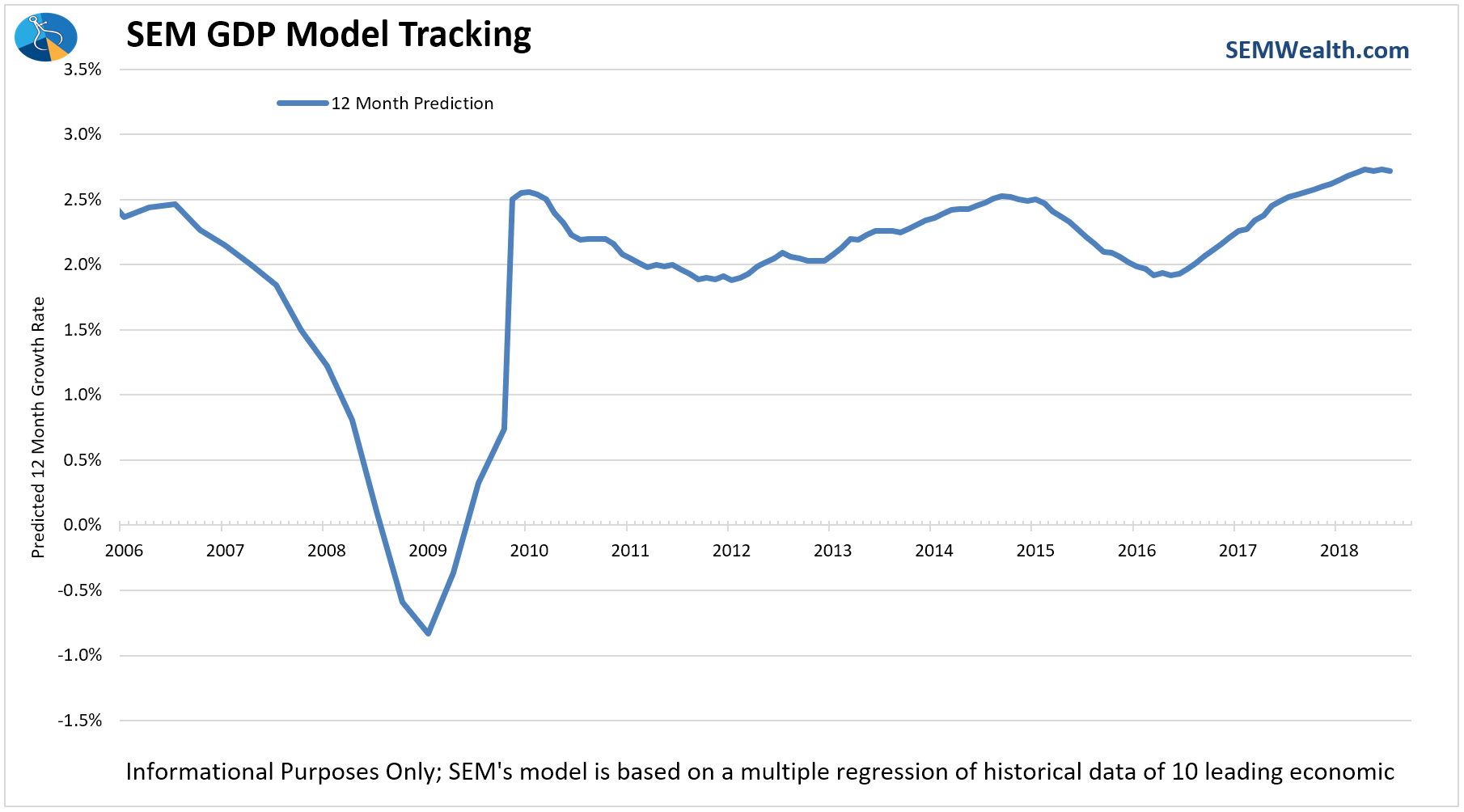

Last week we reported the shift to “slowing growth” in our economic model. This resulted in a significant decrease in risky assets in our Dynamic models. A few advisors have commented on how the economy doesn’t matter for stock prices. On the surface (and a great

Tag: Chart of the Week

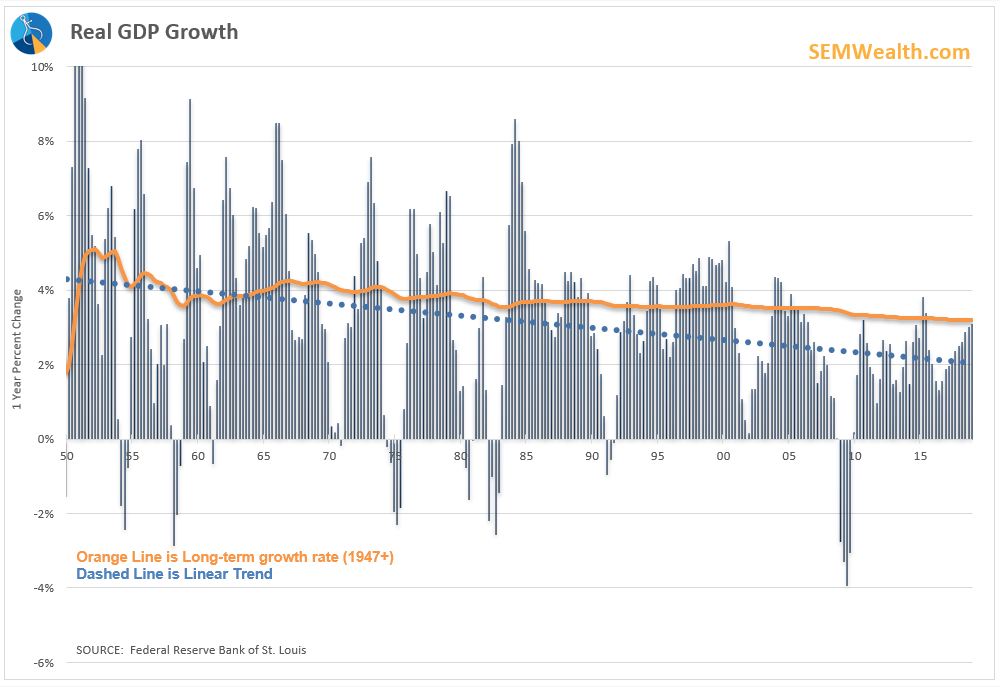

As we edge closer to the longest economic expansion on record, I think most people are expecting some sort of slow down in growth. It’s not the Fed’s fault as one popular Twitter user likes to point out, but rather an economic fact that simply cannot

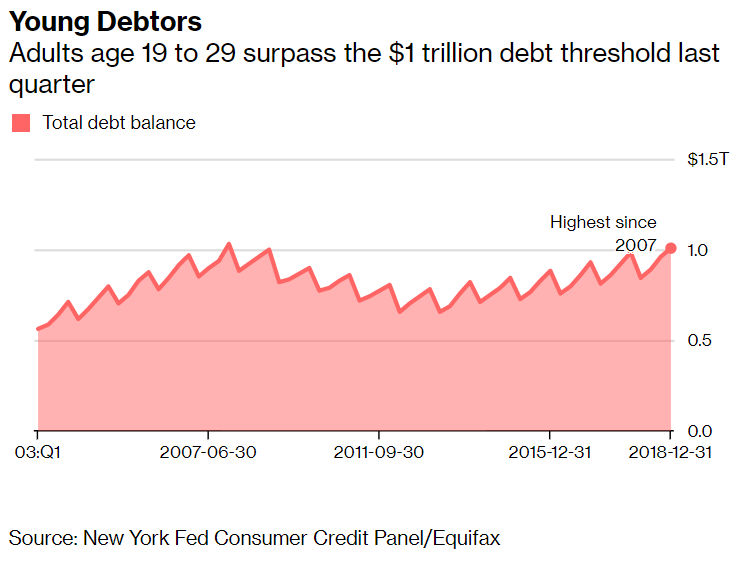

It’s not like it is a new phenomenon. With the exception of a brief period in the late 1990s every year of my life has seen Americans go deeper into debt. From the federal government, to state & local governments, to corporations, to individual Americans, debt has been

Regulators in our industry frown upon the use of the word ‘guarantee’ for obvious reasons. If you live long enough (or study economic history) the only guarantee in life is we will all eventually die. The exception to the use of the “G” word seems to

Hello again everyone. I’m sure all of you are being extra productive today (why is it not Super Bowl Monday?) Well don’t worry, for those of you watching closely SEM isn’t slacking given the passing of the first day of the month with no changes