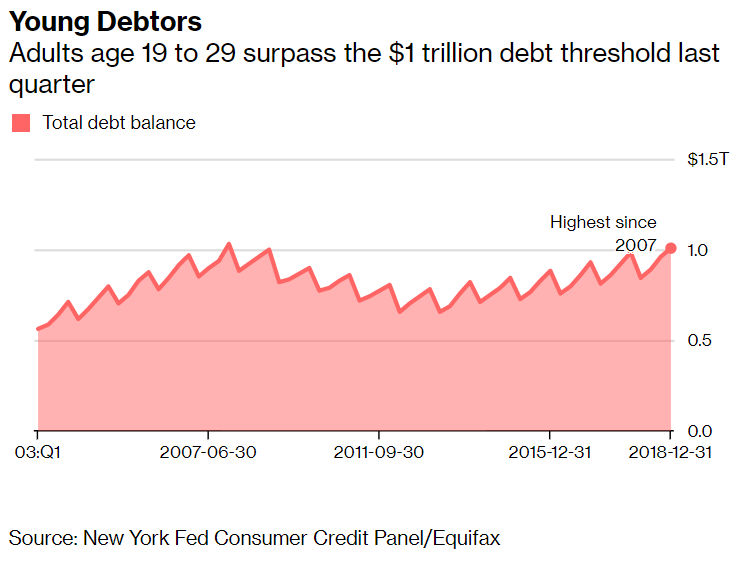

It’s not like it is a new phenomenon. With the exception of a brief period in the late 1990s every year of my life has seen Americans go deeper into debt. From the federal government, to state & local governments, to corporations, to individual Americans, debt has been

Tag: debt

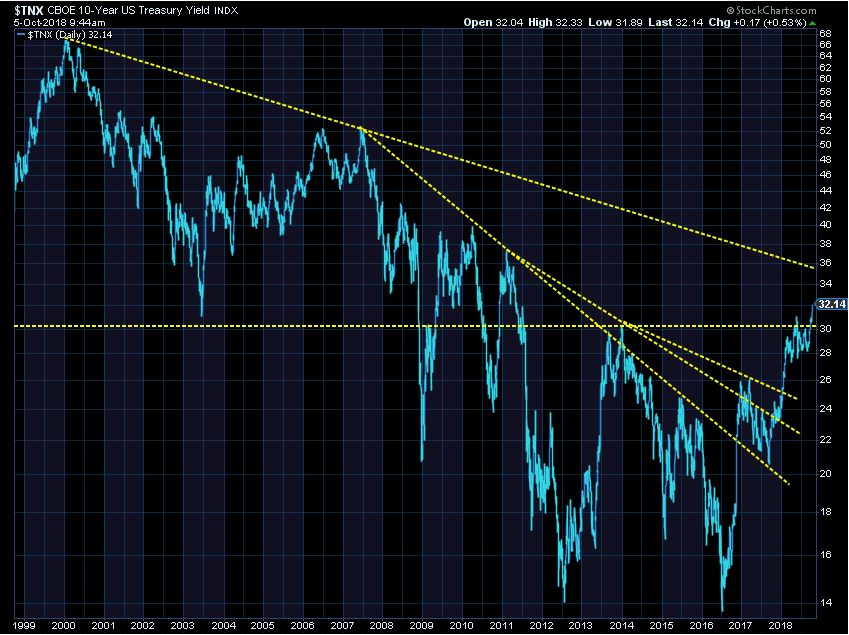

When you hear a non-business radio station discussing the rise in interest rates it is clearly something people are starting to notice. Most people, including too many financial reporters want to group all interest rates into a single category. They do not understand the inner-workings of how interest rates are

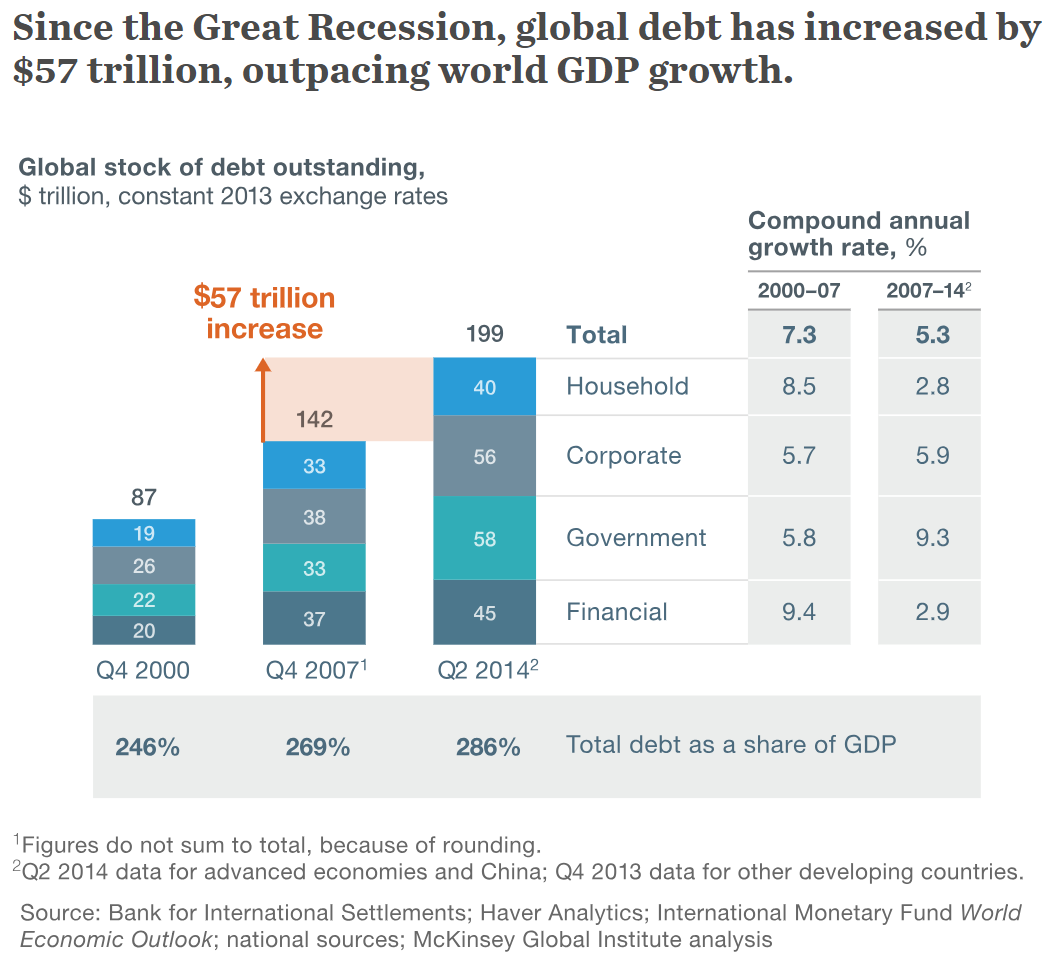

Last weekend was the “official” 10 year anniversary of the Great Financial Crisis. (This was when Lehman Brothers failed. Long-time SEM readers know the crisis actually began in 2007 with the failure of a few smaller mortgage brokers.) There has been a plethora of specials surrounding this anniversary.

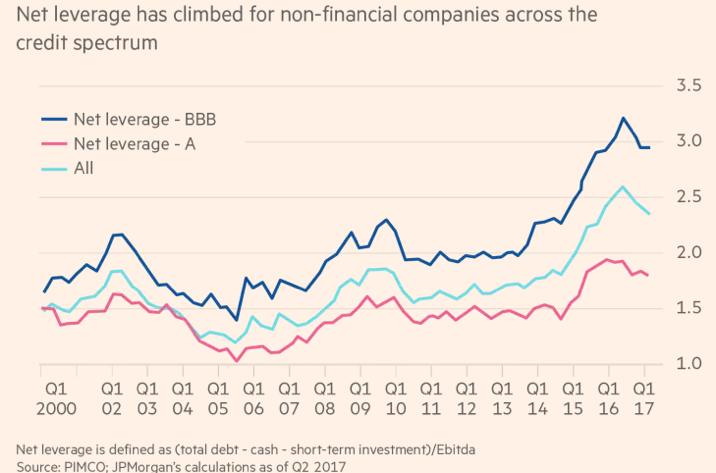

During the 2008-09 Financial Crisis, too many investors learned bonds are not as safe as you might think. Unfortunately, I am seeing a large number of people believing a financial crisis will not happen again in their lifetimes. Some believe everyone learned their lesson from the last crisis, while others

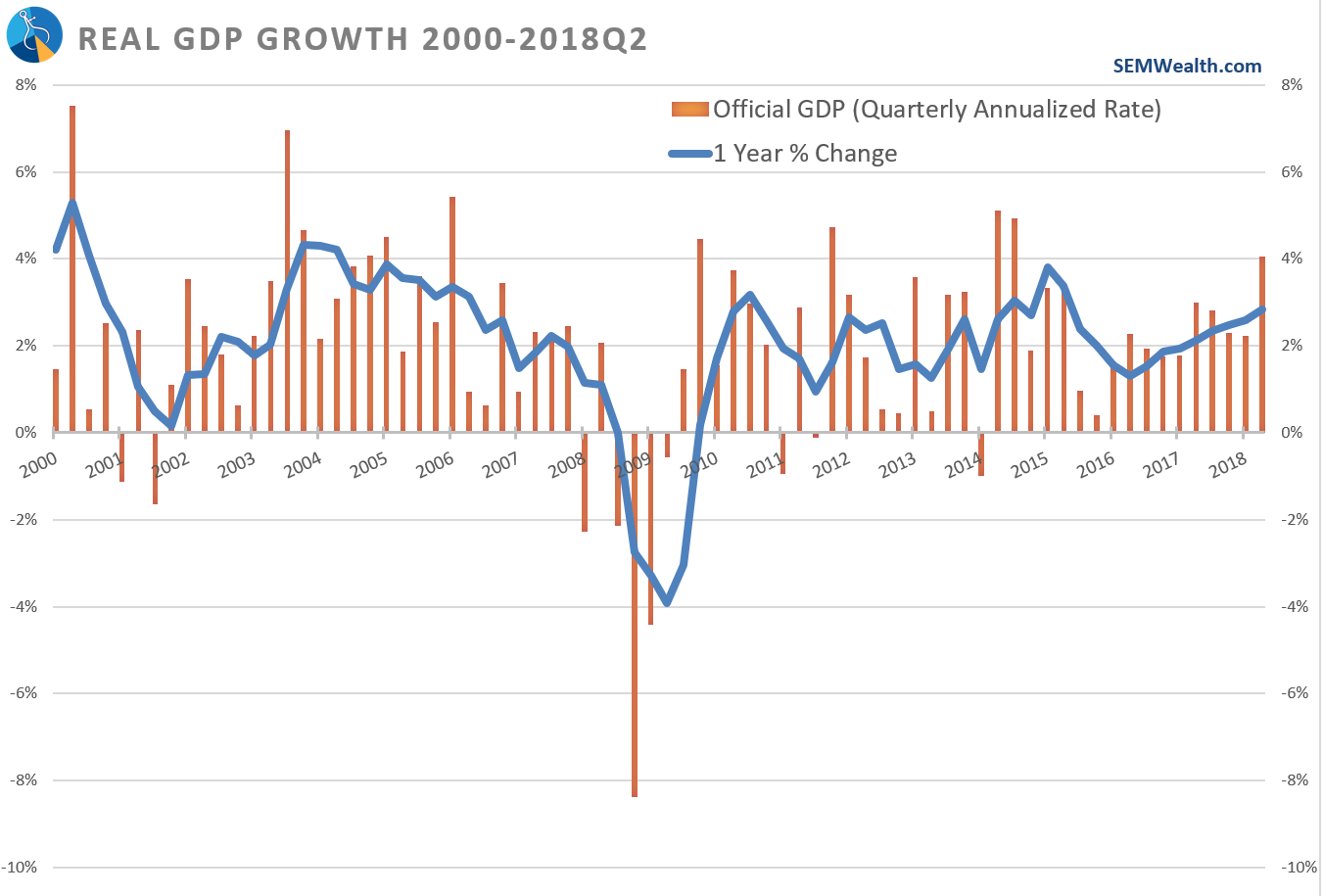

When the estimated growth rate for the US economy was released for the 2nd quarter, President Trump touted it as evidence of “an economic turnaround of historic proportions.” One of the secrets of the President’s success throughout his life has been his ability to spin things