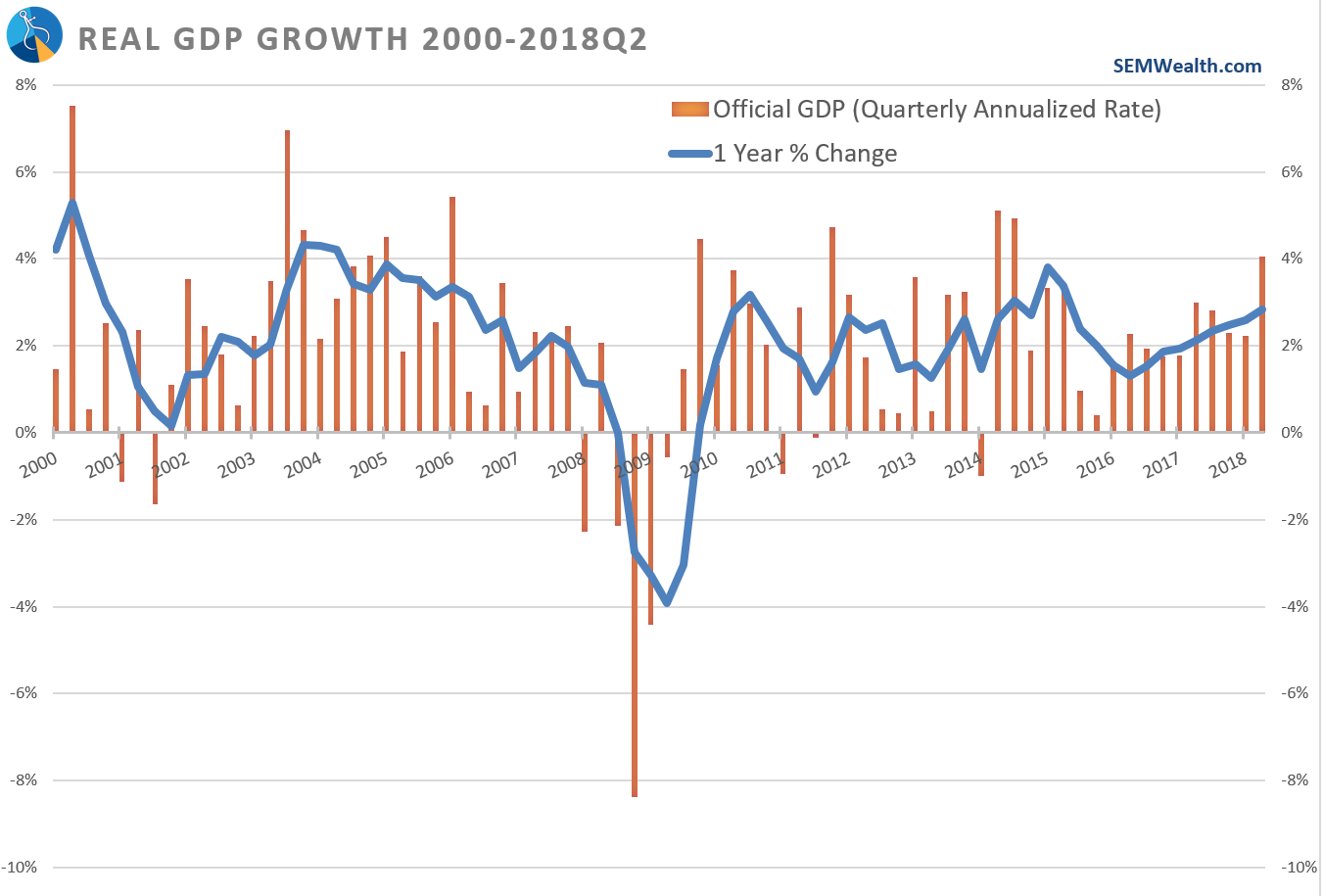

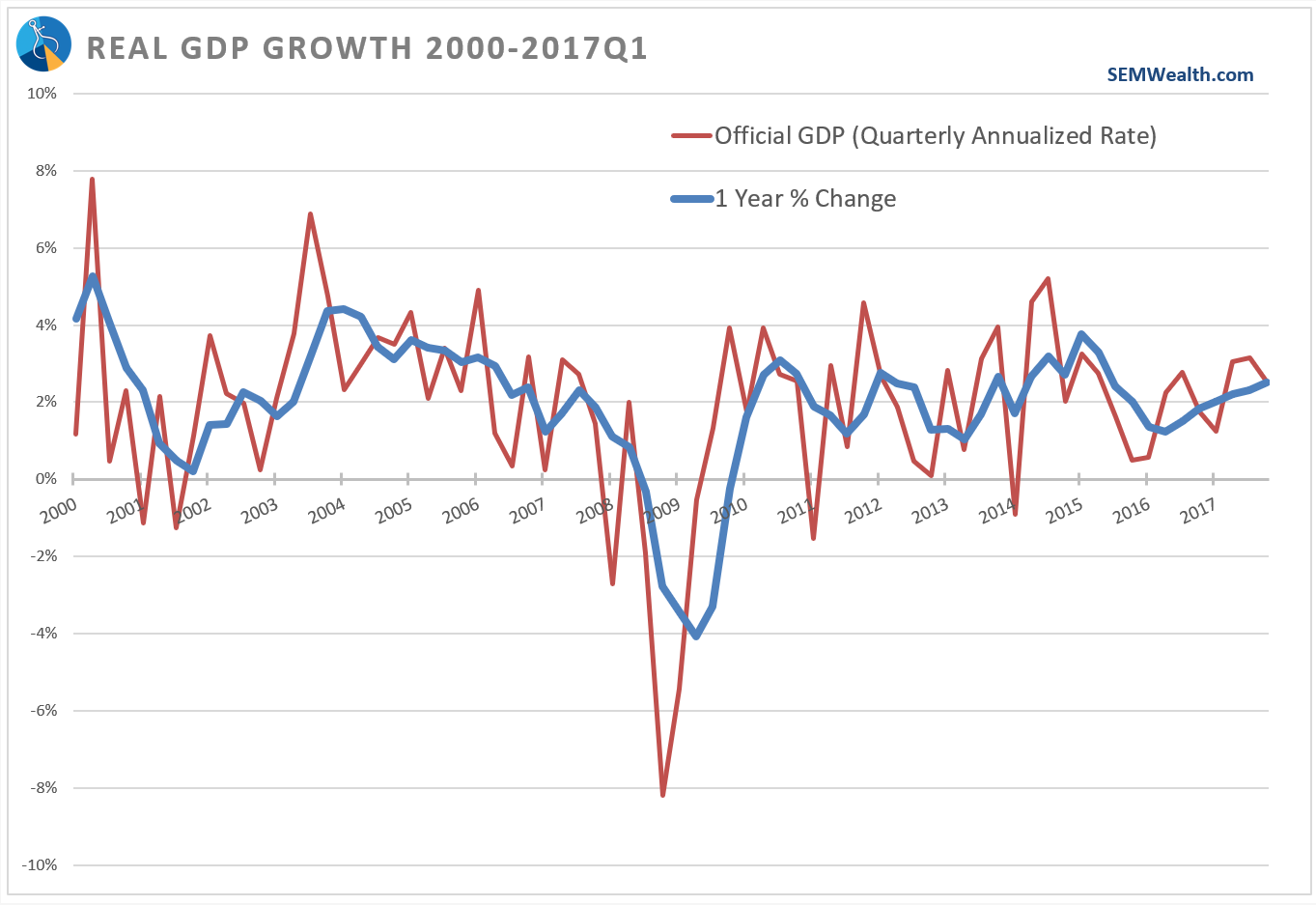

When the estimated growth rate for the US economy was released for the 2nd quarter, President Trump touted it as evidence of “an economic turnaround of historic proportions.” One of the secrets of the President’s success throughout his life has been his ability to spin things

Tag: GDP

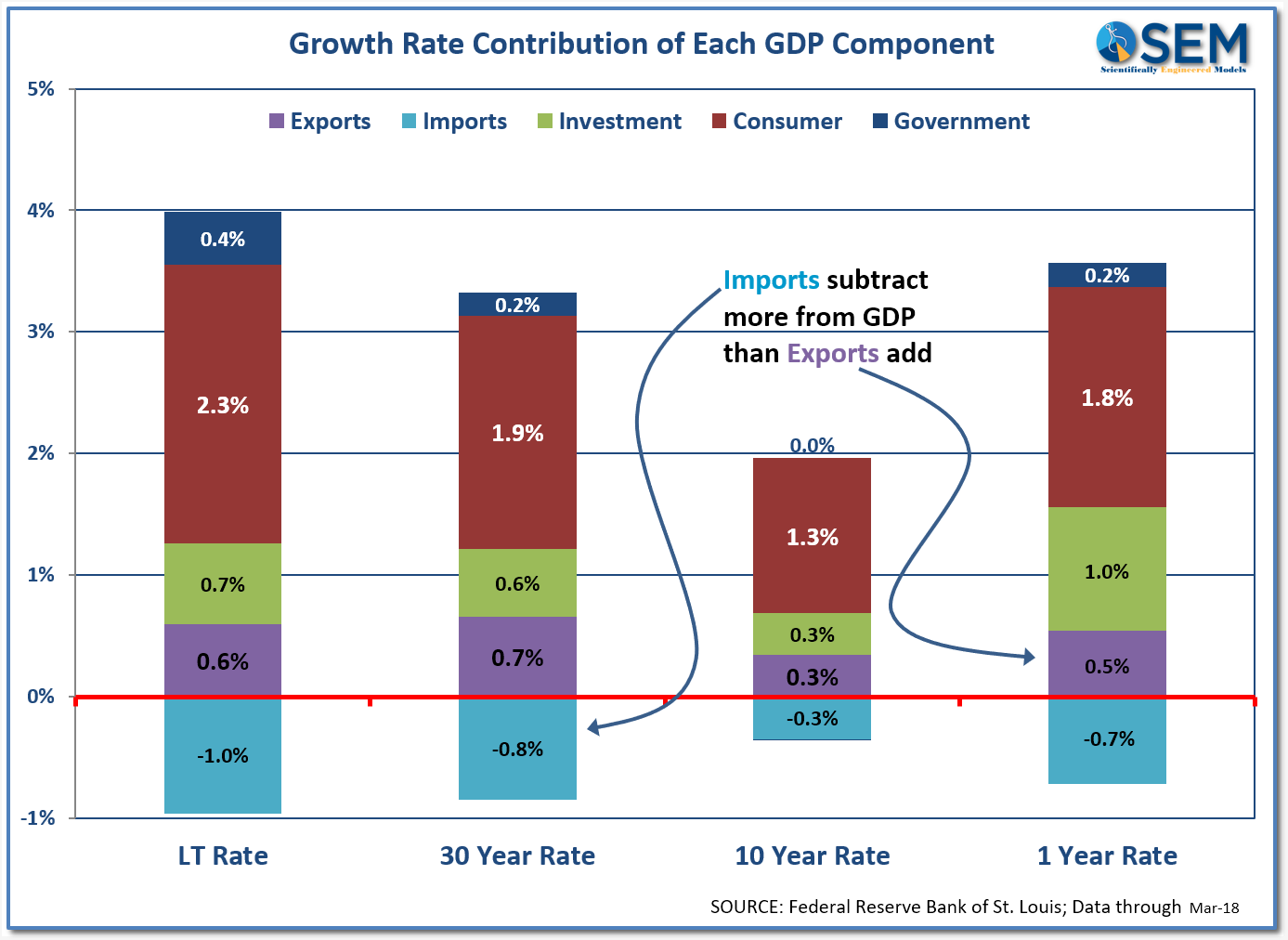

Tariffs and Trade Wars are dominating the headlines. Stock market participants are worried and the market indices have been falling every time one of the sides announces a new tariff or other restrictions on trade. Whenever markets start falling emotions begin to take over. The logic is “stocks dropped

The stock market has rallied since the election of Donald Trump in an unprecedented fashion. It has broken records for most consecutive positive months, the first calendar year on record to not have a losing month, the longest streak without a 3% or 5% correction, the lowest daily standard deviation,

-

GDP Growth at a 2 Year High!

-

US GDP Growth Roars Back

-

US Finally Showing Its Strength

-

GDP Crushes Estimates

-

GDP Number Throws Wrench In Trump’s Economic Attacks

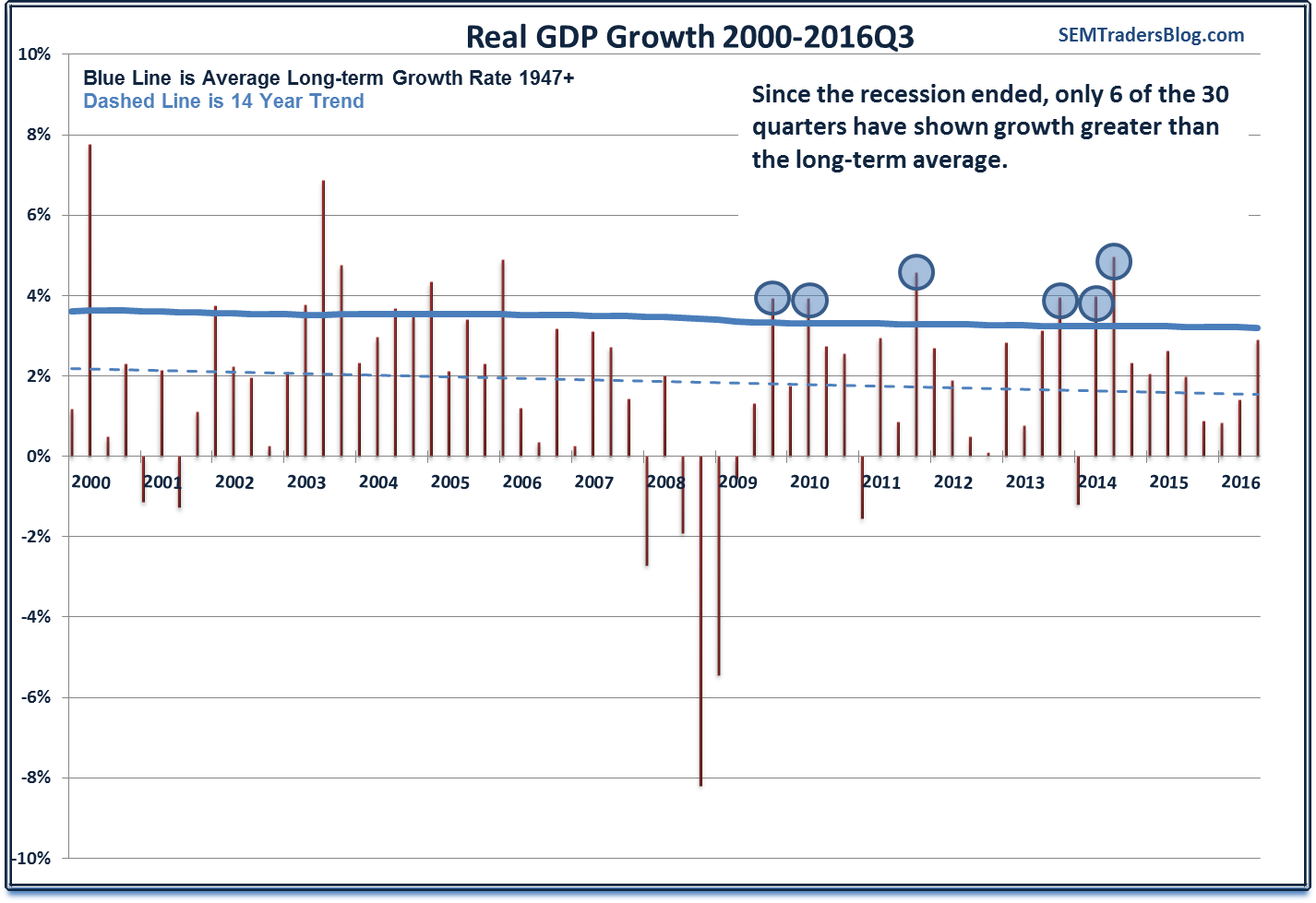

Those are all nice headlines, especially for those supporting the incumbent party. If you ignore my comments on the

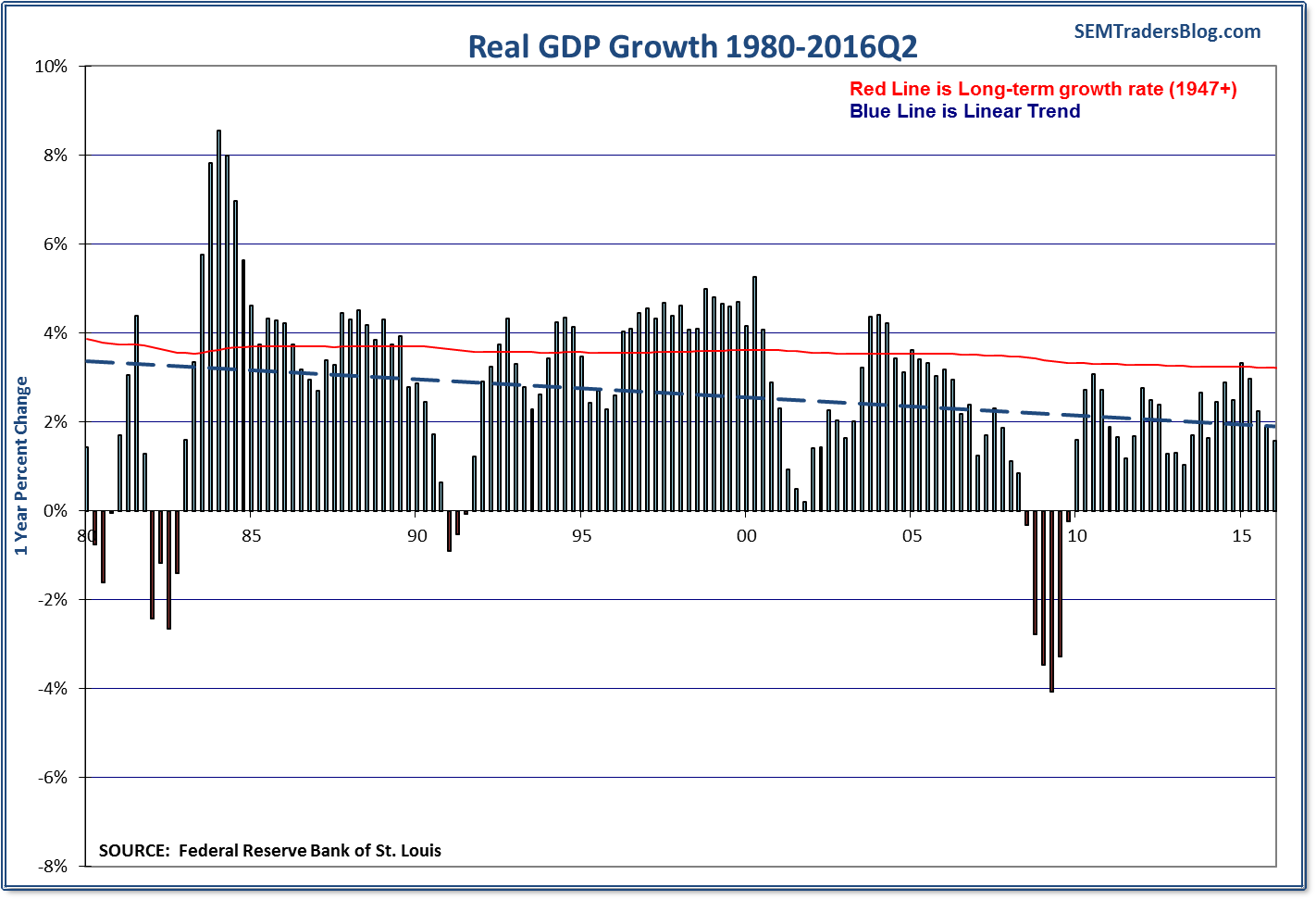

From the Fed, to the Congressional Budget Office, to most mainstream economists, “average”, “trend” , or “normal” growth is assumed to be around 3%. During this economic recovery we’ve only seen GDP growth exceed the “normal” rate once…