For those of you who have been following along, I've been using this space each Monday to list all the things I thought about over the weekend. It's something I did during the financial crisis and the 2011 "debt ceiling circus/EU debt panic". There's just too much happening to

Tag: High Yield Bonds

Bad news is good news right now for investors. It seems the uglier the economic data, the more excited they become. The reason, as we cited last week was the belief this will lead to Fed interest rate cuts sooner rather than later. Investors are conditioned to believe anytime the

The last few months I’ve periodically pointed out some stress points that all investors should be wary of as the economic expansion and bull market approaches record length. While the Federal Reserve capitulated to the constant pressure from the president and Wall Street’s panic in the

The S&P 500 went 42 days without a move of 1% in either direction and 51 without a 1% or larger drop, Friday brought the largest loss for stocks since the Brexit vote in June. Ironically that drop ended a 54 day streak without a 1% drop.

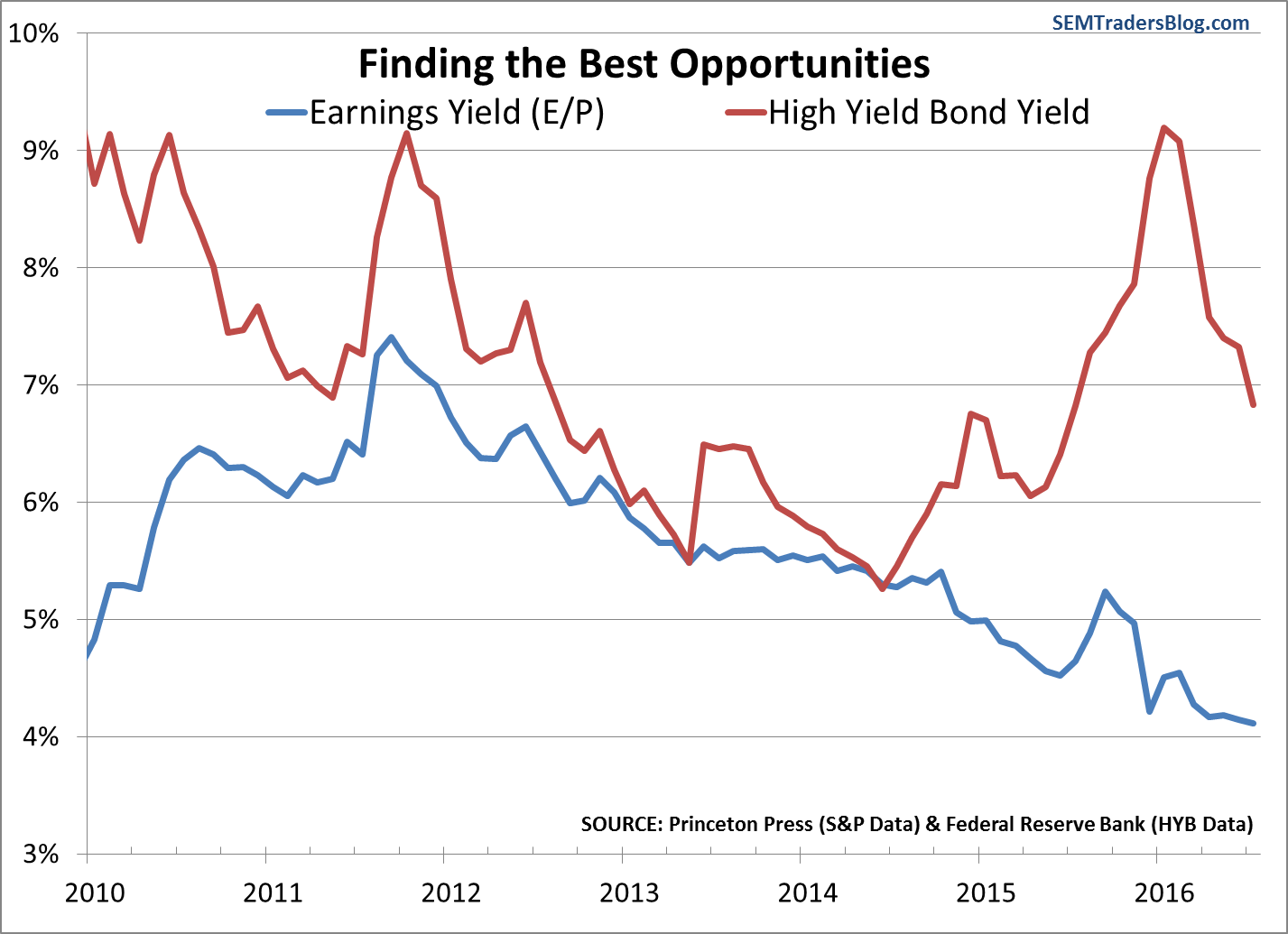

“Stocks are more attractive than bonds.”

The S&P 500 dividend yield is 2.03% compared to the 10-Year Treasury Yield of 1.51%.

This type of comparison drives me crazy. Stocks & bonds are completely different investments with completely different characteristics and roles in