Officially the economy grew at a 4.3% rate in the 3rd quarter and by some estimates may (officially) grow at a 5.3% rate in the 4th quarter. You would think we'd see all of the leading economic indicators humming along, but other than stock prices and the money

Tag: Housing

Last week’s market headlines offered a masterclass in economic complexity, with every story weaving into the next. The focus of course going into the week was the Fed’s rate cut which set the tone, sparking volatility across stocks and bonds and raising fresh questions about inflation’s staying

The Federal Reserve has been going out of their way to tell the stock and bond market that they will be focusing solely on taming inflation and won't be looking to stimulate the economy unless inflation is under control. Too much money floating around the system led to too much

Last week's Musings focused more on the big picture and my message to clients and advisors on where we go next. With that focus a lot of my random thoughts last week were on the long-term impact COVID will have on our economy, the markets, and our lives. We will

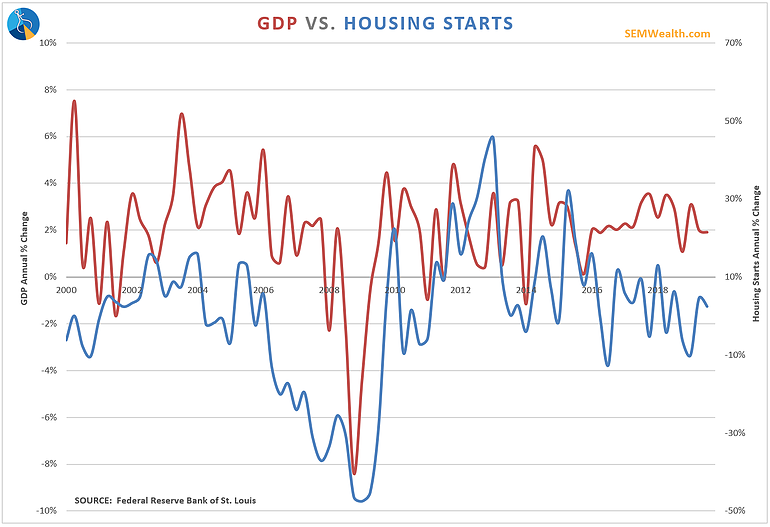

I've often said if I had to pick just one Leading Economic Indicator it would be Building Permits. If you've ever bought a house you know first-hand how much you personally stimulate your local economy. If it was a new home you've already provided jobs to the contractors and the