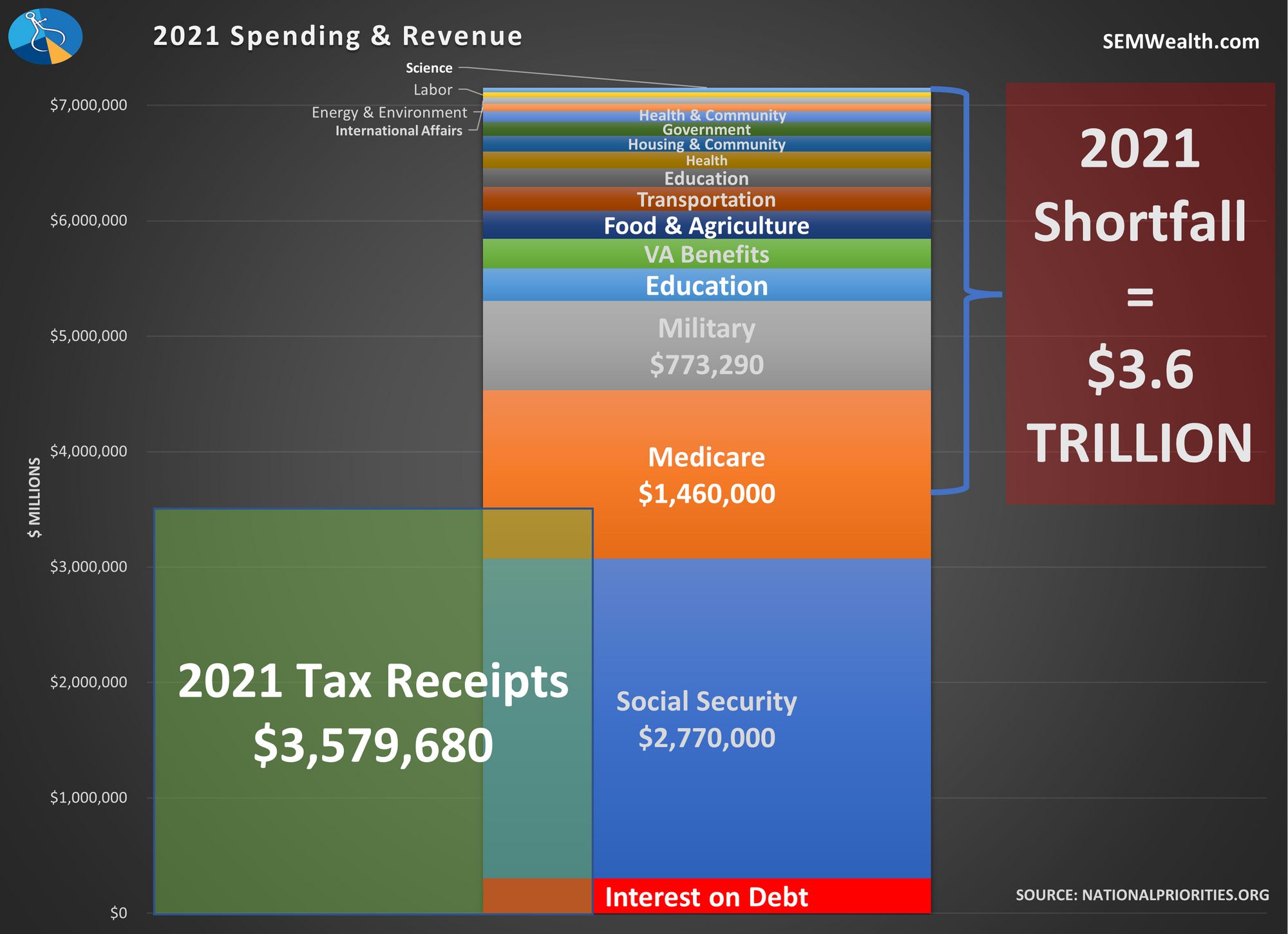

I hate talking politics, but we've been fielding a lot of questions about the debt ceiling and the chances of default. I've actually been avoiding writing about this because every time I think about it, my blood pressure skyrockets. The fact that we are back here AGAIN is a failure

Tag: Musings

Despite the much better than expected payrolls report, nearly all of the economic data in our model is showing signs of stalling out. Our economic model has been "bearish" since April 2022 after going "neutral" in October 2021. Our model isn't designed to call the beginning of a recession or

We wake up this morning with news of the 2nd largest bank failure in the history of our country. Interestingly enough, this is not being looked at as a major move by investors. After the failure of Silicon Valley Bank in March and the swift actions by the Fed, FDIC,

Sometimes I have a lot of topics to discuss on this page, other times I cannot think of much to say at all. Today is the latter. I'm not sure how many different ways I can say the same thing:

- Stocks are extremely overvalued

- The economy is likely heading towards

The stock market is supposed to be "efficient", at least according to academics (and those firms who have bought into this theory). Supposedly, the market (mostly) reflects all known information. In my experience this is not even close to reality. There have been dozens of times where we see a