Being a data driven, scientifically-minded investment manager, we've always been uncomfortable making decisions that did not have a solid basis. Our study of behavioral finance and market history, as well as nearly three decades of experience managing money tells us our brains often can play tricks on us. This realization

Tag: SEM Model Update

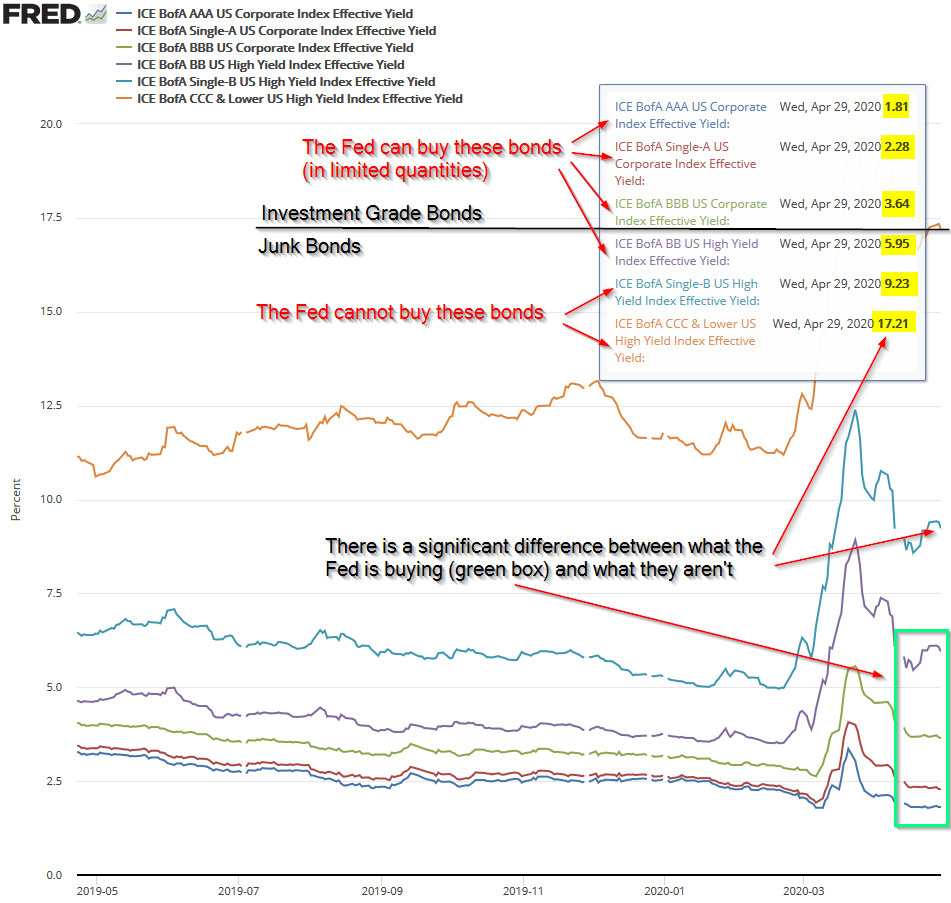

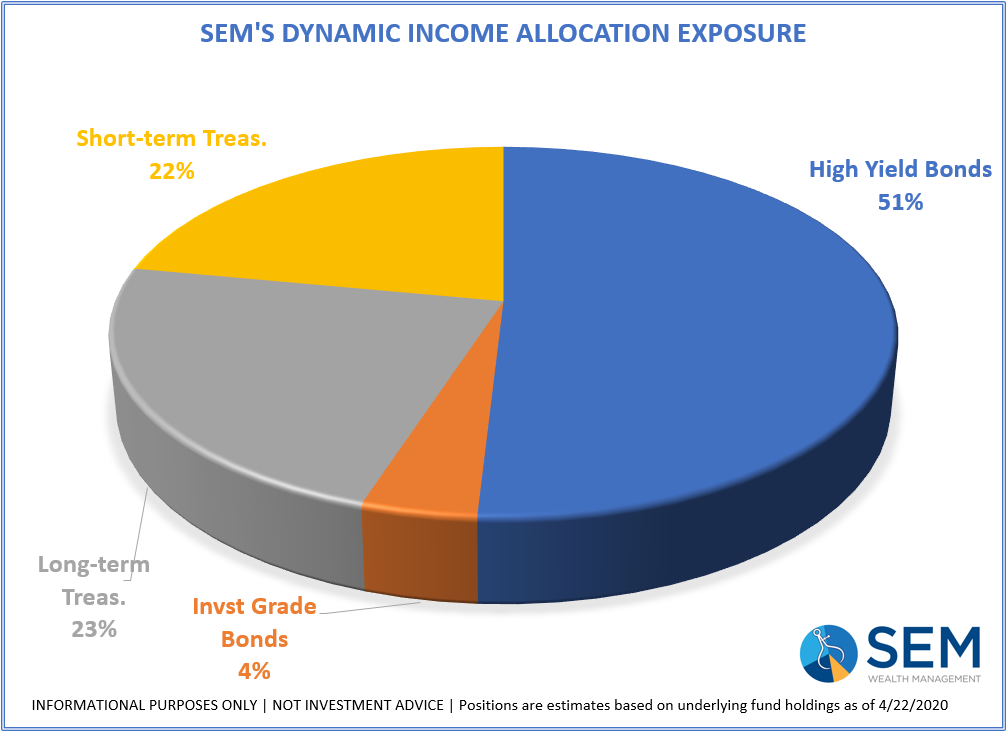

The virtual ink had barely dried on my "time to get excited about valuations" post when the Federal Reserve did what, up until that point, most of us thought would never happen. They announced they would not only be buying junk bonds, but also junk bond ETFs. The spread between

For over a decade I've been listening to "experts" recommend investors dump bonds and use dividend paying stocks for the fixed income needs of clients. I've again heard this advice in the past month. This is what I thought of:

For over a decade I've pointed out two

For those of you who have been following along, I've been using this space each Monday to list all the things I thought about over the weekend. It's something I did during the financial crisis and the 2011 "debt ceiling circus/EU debt panic". There's just too much happening to

With the stock market calming down somewhat and the country looking at the next phase of the crisis, I wanted to take some time to walk through what we are seeing in the economy, the stock market, and SEM's investment models. I know many advisors and investors alike have questioned