Despite some bumps last week, the stock market starts the week near record highs. FOMO + TINA is driving investors (Fear of Missing Out / There is No Alternative [to stocks]). We're seeing some of the most conservative investors saying the 9% annualized rate of return they have gotten so far through the first 3 3/4 months of the year in our conservative models is "terrible". We have 70 year olds who told us they don't want to lose more than 10% asking how they can invest in Bitcoin. One even asked if we could buy Dogecoin in their account.

Ignoring Bitcoin, Gamestop, and other mania investments, the signs are clear pretty much everybody wants in on this market rally. March saw the highest inflows ever into stock ETFs and mutual funds.

I don't want to throw cold water on anybody's enthusiasm. 3 weeks have past since my second Pfizer vaccine and I'm ready to get to whatever the new normal will look like. I'm asked by advisors in nearly every meeting – how much further can this go? My answer is simple – as long as the 4 pillars of the rally remain in tact and do not disappoint, it can go on for a while.

The 4 Pillars

Let's look briefly at those pillars and what if anything changed last week:

- Federal Reserve Support: We heard from several Fed officials. A few discussed what a "taper" (of Quantitative Easing) may look like, but all hinted it is a ways off.

- Congressional Spending: While the Biden Administration works to sell the benefits of their infrastructure bill (phase 2 of the 'Build Back Better' platform; Phase 1 was the stimulus bill), the focused turned to phase 3 which is focused on helping the middle class. Infrastructure is supposed to be paid for an increase in the corporate tax. The middle class spending plan is to be paid for by increases in individual taxes. Late last week, rumors of a planned hike in the capital gains tax roiled markets. Getting either of the spending plans paid for could prove difficult, which is certainly a crack in this pillar.

- Improving Economy: The economic data again continues to support this. We'll certainly keep a close eye on this one as our quantitative economic model has our Dynamic models at maximum risk levels currently. Goldman Sachs, who has a higher GDP estimate than most Wall Street banks, believes we are close to the peak in the COVID GDP. The focus will quickly turn to post-COVID economic activity.

- Vaccine Distribution/COVID Cases: The vaccine rollout has been faster than most people expected, but we are now getting to the point where close to everyone who wants a vaccine has it (or at least has an appointment). The question of the summer and likely fall will be if the combination of vaccinated individuals and those immune to the virus for whatever reason is enough to offset the variants that keep popping up. This variant discovered in Texas is certainly something to keep our eyes on.

What can go wrong?

We documented this in detail over the past two months. I'll include those links at the bottom of the page. Besides the obvious issues with any of the pillars above, any decisions have to keep the following in mind:

- Valuations are at or above the peak tech bubble levels: Do you really believe economic growth going forward will be better than we expected going into 2000? At least back then we had a game-changing invention that had the potential to change every single business around the world. What do we have now? A whole lot of spending to try to help the country recover from a virus that has destroyed so much of it.

- The underlying economy is weak: We said this going into COVID – we were on the brink of recession at the end of 2019. The Trump Tax cuts provided about an 18 month boost, but when left to stand on its own the structural issues were becoming apparent. Once all the stimulus runs its course we'll see what is left and my assessment is it will be an economy that will struggle to grow anywhere close to 3% (the long-term average).

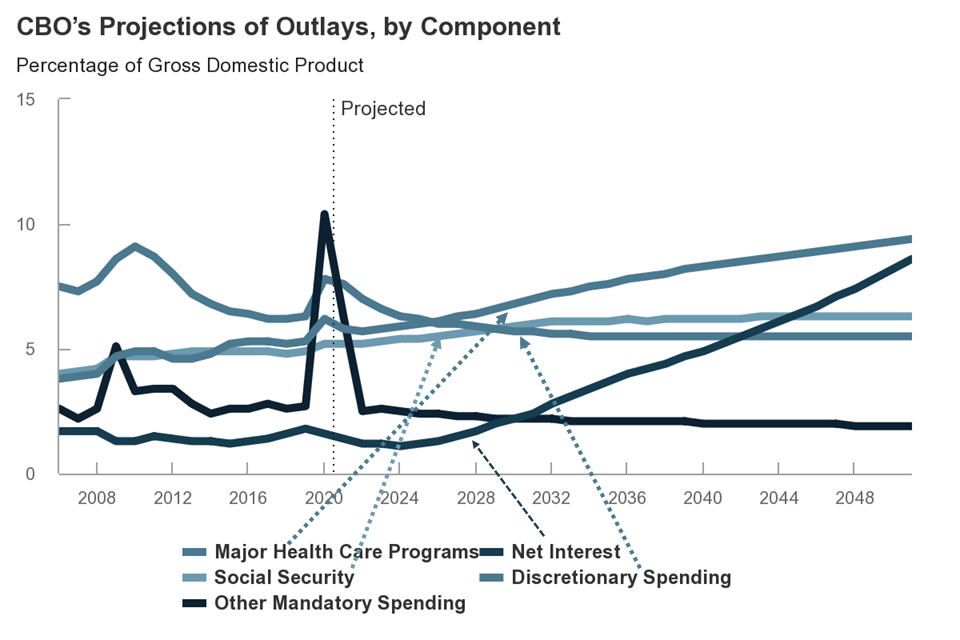

- Debt load is a concern: Unless it is INVESTED, debt is simply future spending pulled forward. There has not been any INVESTMENT in any of the past spending bills. There is some investment in the proposed infrastructure plan, but also some spending. The same is likely for phase 3 of the 'Build Back Better' plan. I showed this chart last week – this is before any of the spending in the 'Build Back Better' plan. Interest expenses are going to be a serious drag on any future growth.

Remember, we are fully (or nearly fully) invested across the board in our models. We are participating in the rally as much as possible. The difference between us and most other investment plans is we don't have to rely on everything working out. We will do what we always do – watch our models for signs of problems and allow them to lock in the gains and move to less risky investments as necessary.

No guessing, no opinions, no emotions.

For a deeper look at the pillars and risks to the rally check out: