As we go into the 23rd week since the COVID19 panic began it's hard to get a grasp on the big picture. I attended two more virtual conferences last week and two big name firms essentially said fundamentals do not matter – for now there is no other alternative to stocks (according to them). Earnings might matter......in 2022. Bond yields might go up.......in 2022. We might have another recession.......in 2022.

Having managed money for a quarter century, I'm always weary when the big names are saying, "everything is awesome!" They both used the acronym TINA - There is No Alternative. This belief has led to the very natural human bias in the stock and bond markets that always makes me worry – FOMO - Fear of Missing Out.

I was on a radio show last week and a listener asked, 'what advice do you give somebody who panicked in March and now has watched the greatest rally of our lifetime pass them by.' After the usual, reminder that investment advice only works inside a financial planning, cash flow, and overall risk personality framework, I reminded the listener that the only reason some people have called this the "greatest rally ever" is because stocks lost 35% in a little over a month, which has also never happened before.

Investing is a long-term endeavor. At a time when FOMO is prevalent, it's best to take a step back and focus on the big picture. Here is the list I gave the listeners to consider:

- Stocks are very overvalued

- Bonds are also overvalued

- But we have the Fed

- Congress is doing what they do best

- And of course we still have 'rona'

At the end of the article is my suggestion for those who are both under and over exposed to stocks right now. Let's take a deeper look at each item on the list.

Stocks are very overvalued

Wall Street wants us to ignore 2020 earnings. They are also hedging on 2021 and saying we need to wait until 2022 to evaluate the health of companies. Call me old fashioned, but when I invest in a company I want to know how much I'm paying for future growth. The most popular measure of market value is the Price/Earnings (P/E) ratio. As prices go up and earnings don't, the P/E goes up. We can then compare the current level to the past to see whether or not stocks are attractive.

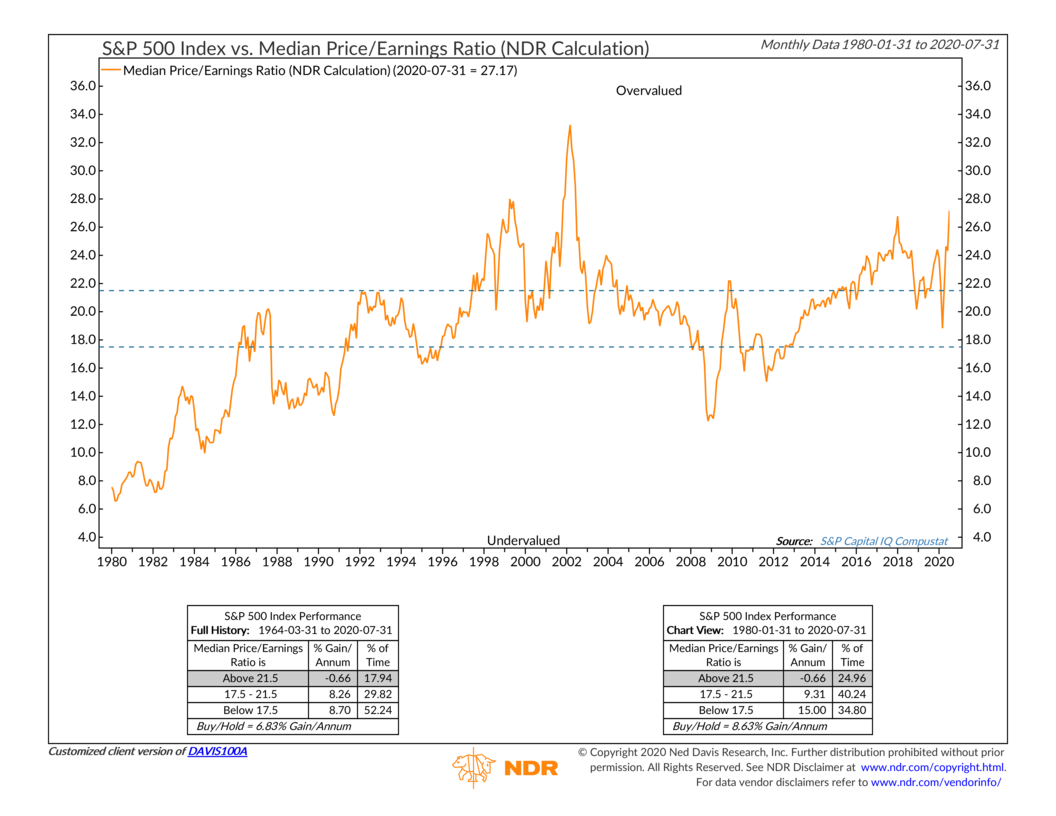

Depending on the period, the average P/E ratio is somewhere between 15-17. Averages can be skewed, so looking at the median P/E is useful. Here's a useful chart from NDR. Note the only other time the median P/E has been higher was during the tech bubble.

Pay attention to the bottom tables. This shows the annualized returns if you invested when the P/E was in those brackets. Based on history, your odds of making any money at these levels is low. You're better to wait until it gets back to a more normal valuation.

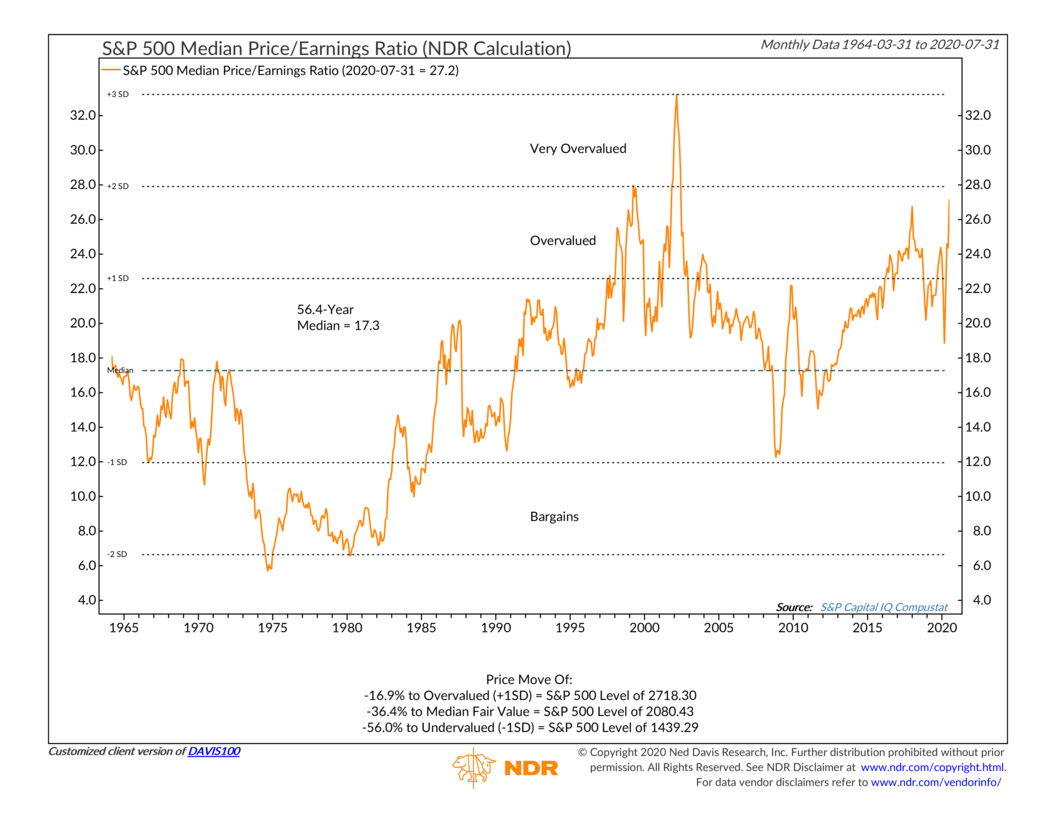

How long should you wait? NDR provided a guide. Getting back to 2700 (down 17% from here) puts stocks back in the "overvalued" bracket. Fair value is down around 2080 (-36% from here). This would also be a close-enough retest of the March lows. I personally would back-up the truck to buy (with a 10 year+ time horizon) if stocks get to those levels knowing they could become "undervalued" if things get too bad.

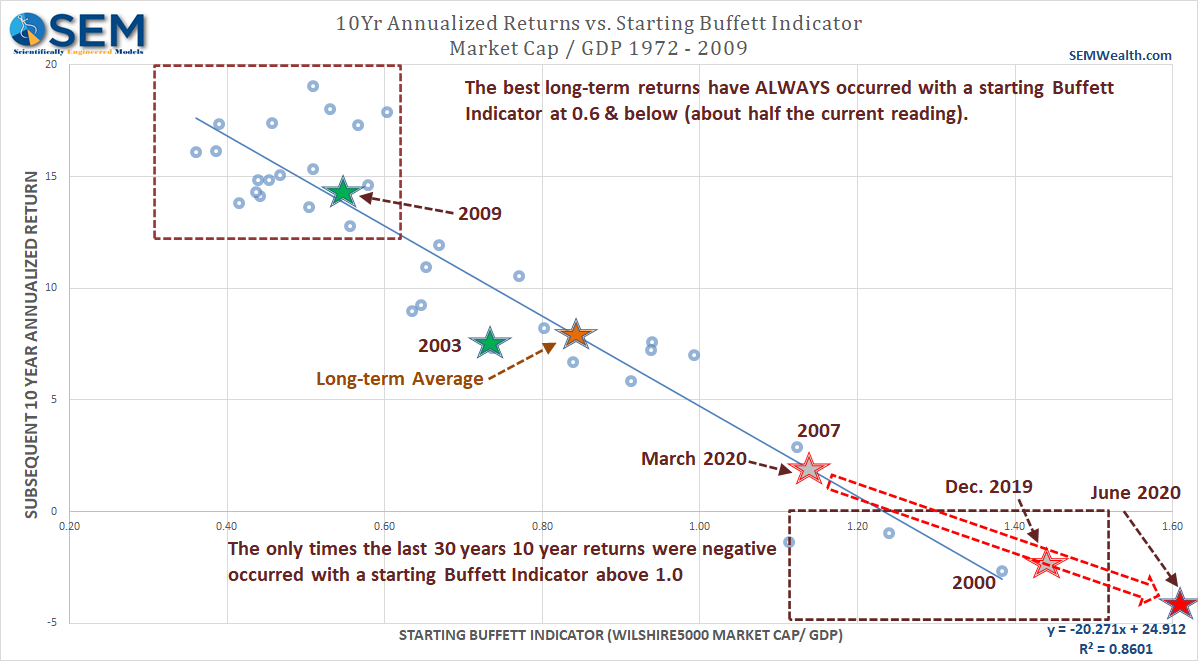

For those who have followed me for a while, you know I'm a former accountant who does not like using earnings to evaluate investments. They can be too easily manipulated. I'm also a huge fan of Warren Buffett and his fundamental approach. Back in 2001 he was asked his favorite valuation indicator. Mr. Buffett said the best way to look at long-term attractiveness is to divide the overall capitalization of the stock market by the output of the economy. The logic is simple – over the long-term a stock market cannot be worth more than the underlying economy.

Through June, the Buffett Indicator has NEVER BEEN HIGHER at a 1.63 reading. This indicator is the single best one I've found in predicting long-term investment returns and is significantly better than the P/E ratio. If you're holding for 10 years, the expected returns at the current valuation levels is 7%!

Bonds are also overvalued

While stocks are overvalued, it could be argued bonds are more overvalued (in fact this was one of the reasons the big Wall Street firms are suggesting stocks are still attractive here). I'm not one of those as even with bonds being overvalued, the benefits of having bonds, especially an actively managed bond portfolio are substantial. Whether they are dividend payers or not, stocks are far too risk to be the only investment for most investors, especially those retired or within 10 years of retirement.

That said, we need to be careful in bonds right now.

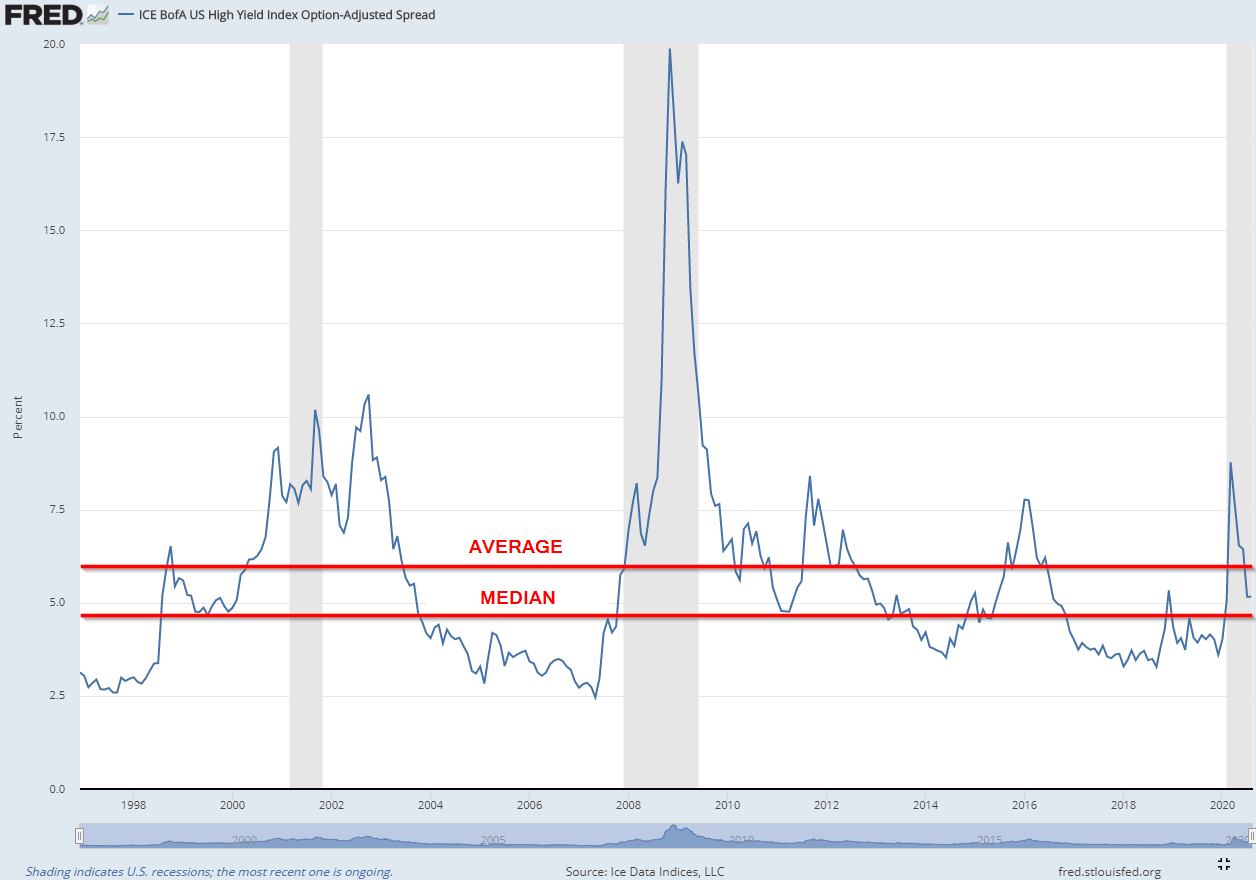

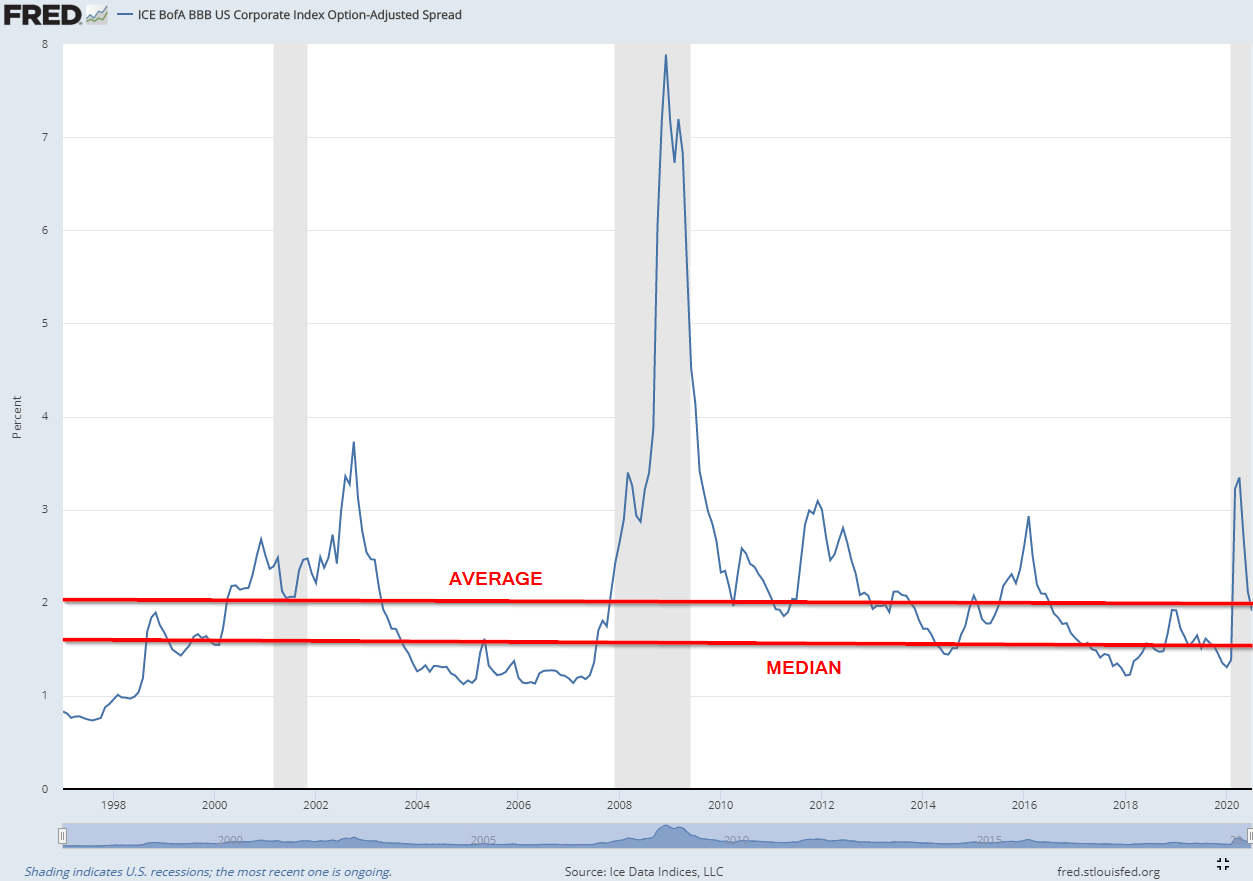

The best way to measure the value of a bond is the "spread", which is the difference in yields. In this case versus the 10-Year Treasury Bond since the chances of default in those bonds is quite small. Looking at high yield bonds, the spread has fallen below the long-term average and is just barely above the median spread. Granted spreads can go even lower, which will generate some nice returns, but the best returns come when the spread is above 750 basis points (7.5%).

The lowest rated investment grade bonds are also overvalued and are approaching their median spread levels. Given all that has happened and the very high likelihood of widespread business closures, defaults, and bankruptcies, it's hard to get excited about investing in bonds right now.

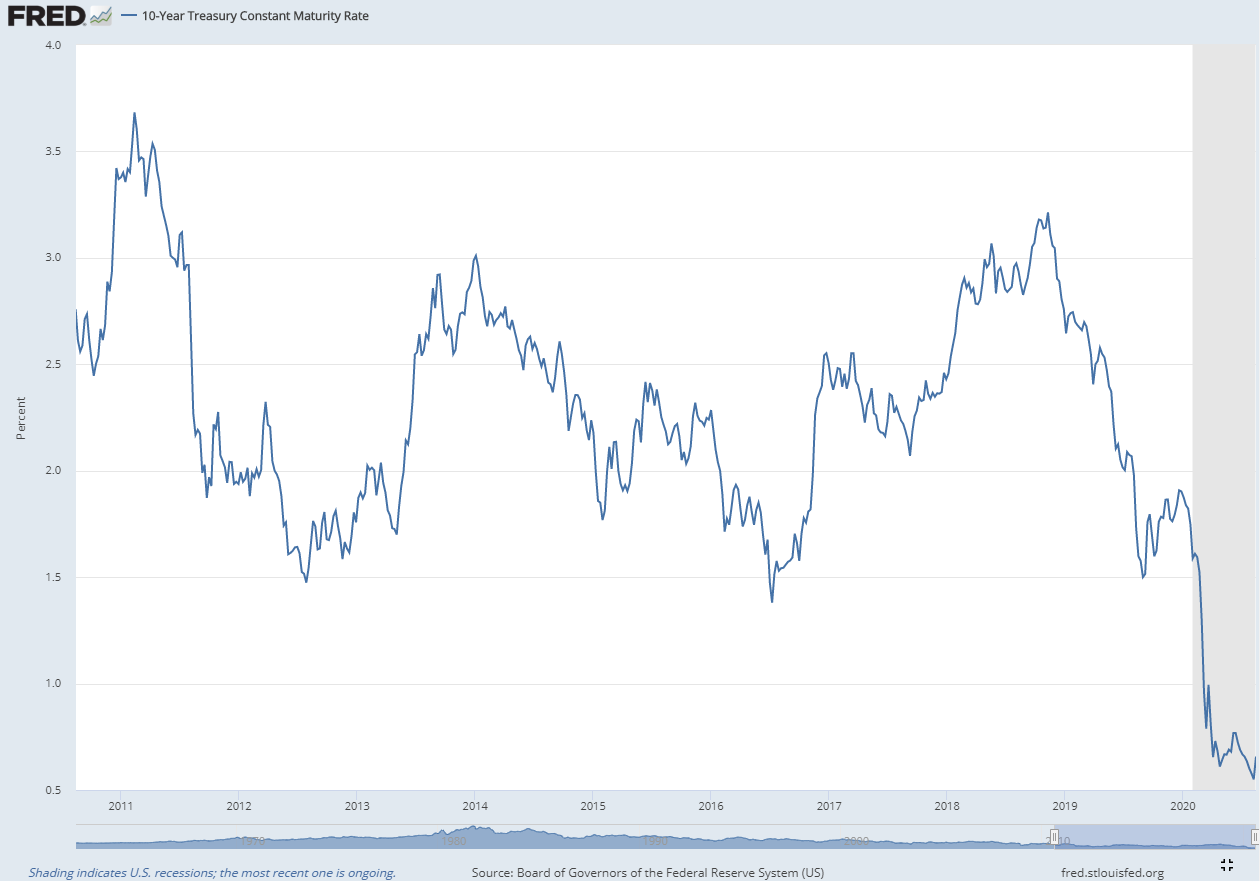

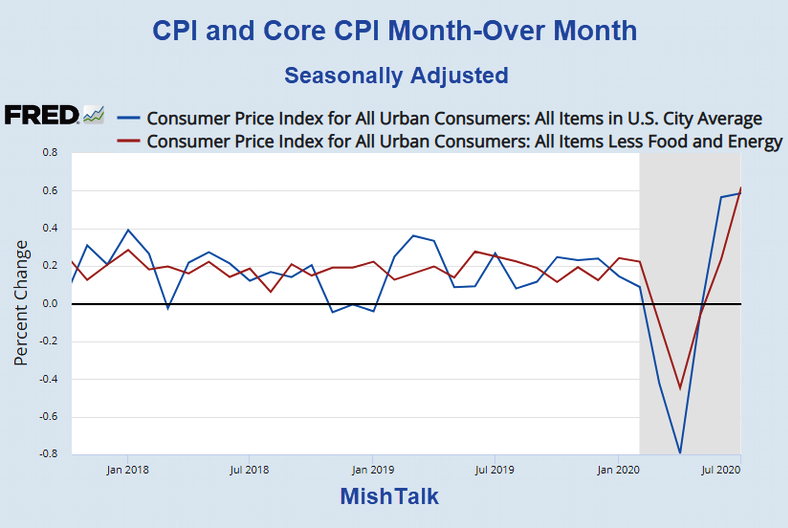

Looking at Treasury Bonds, long-term Treasuries took a big hit last week following a much higher than expected increase in some inflation readings last week. While the inflation numbers are still low (only up 1% over the past year), most people thought inflation would remain low, which would allow the Fed to stay active for several years in propping up risky assets (see next point).

The "big" move is tough to see on this 10-year chart, but the price hit was significant last week. TLT, the ETF which tracks the long-term Treasury bond, lost 4% last week. Yields moved from 0.55 to as high as 0.71 during the week.

See my advice at the end of the article for how we're using bonds.

But we have the Fed

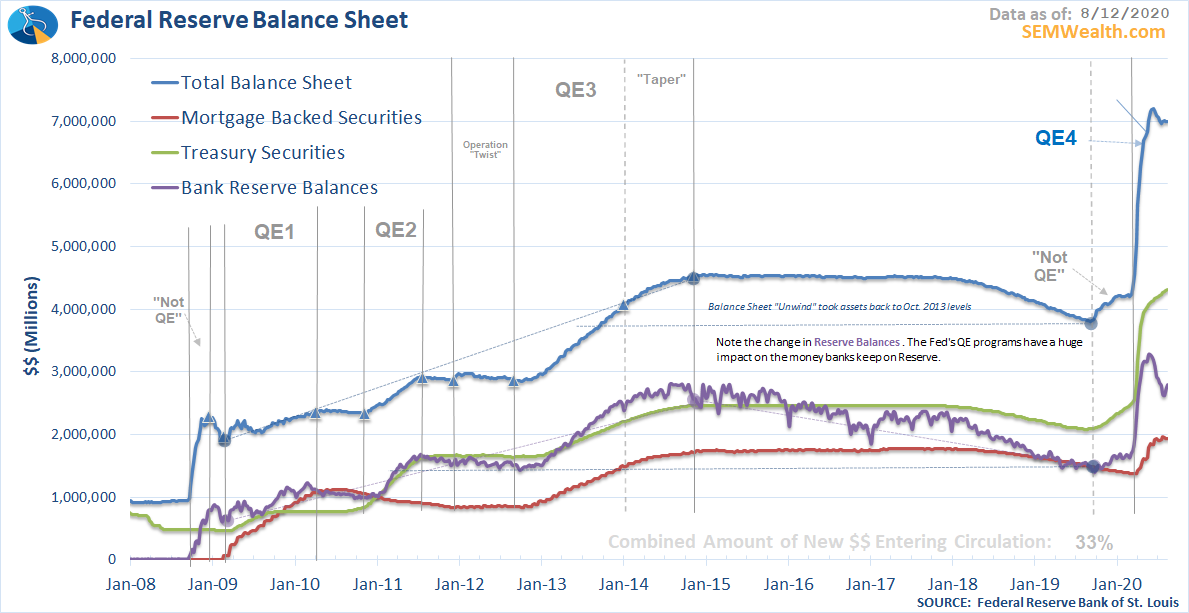

The Fed has been the best friend of Wall Street for 12 years (I'd argue for 22 years since the arranged the bailout of the banks exposed to Long-Term Capital). The Fed's actions in March, while necessary to keep the financial system functioning has brought on a new breed of risk taking. Our country was due for a recession, "investment grade" bond issuers had 33% more leverage in 2019 than they did in 2007, economic growth was slowing, and the government deficit was skyrocketing.

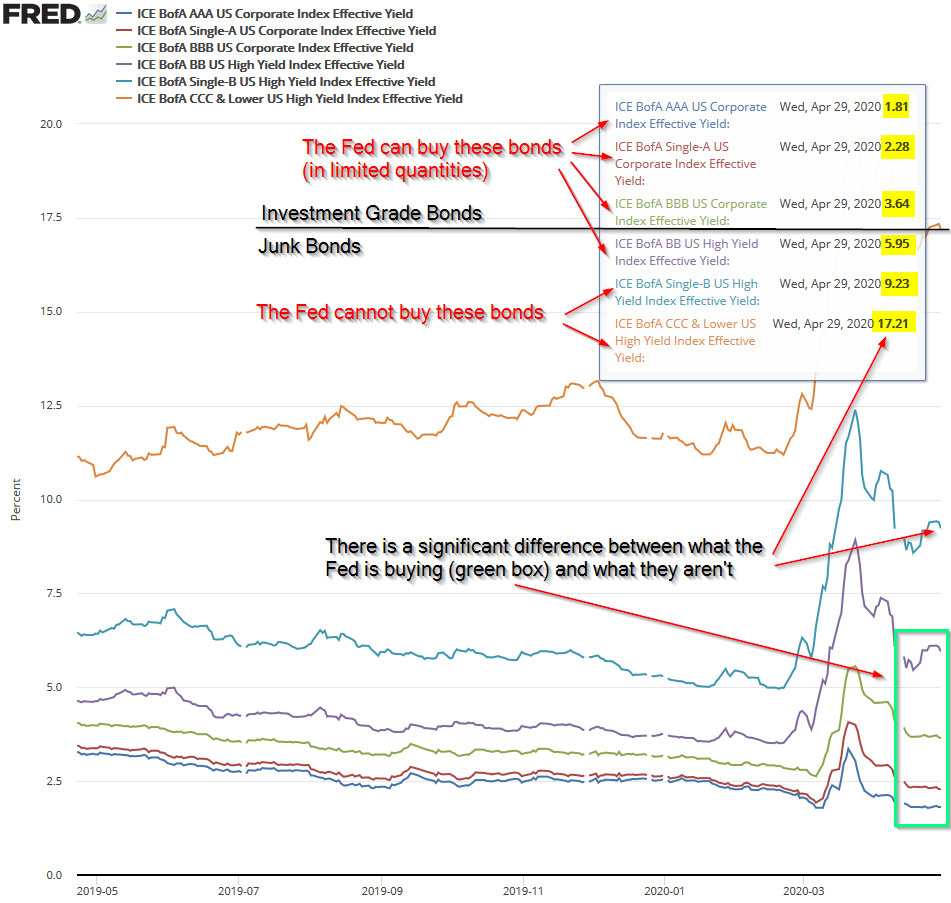

The advice from portfolio managers has been "buy what the Fed is buying", which includes an unprecedented move into purchasing both high yield bonds and the ETFs which track the high yield bond index (although they've since said they would focus on the individual issues not the ETFs). This has emboldened weak companies to issue more junk bonds, which the market was willingly buying. At the same time, the US is scheduled to borrow $4.5 Trillion this year. The assumption is the Fed will be there to step in any time there is weakness in the bond market, whether corporate or government bonds.

We'll get an idea this week how much the Fed is willing to keep bond yields low. The surprisingly high inflation data last week (discussed on TheStreet.com here) led to very weak demand in some longer-term Treasury auctions last week. The thought is if inflation gets too high the Fed will be forced to pull back their support of the bond market, which will be bad news for all those following the "buy what the Fed is buying" strategy.

We only get weekly updates on the Fed's balance sheet. It had been declining slightly for 5 weeks before ticking slightly higher last week. If we see yields going back down again we will have to wait until Thursday to see how much of that was due to Fed purchases.

Remember, unlike past QE operations, there are no caps, no timelines, and barely any rules.

Congress is doing what they do best

If there's one institution I've been more critical of than the Fed the past 20 years, it's been Congress. Here's the summary of their actions:

- 21 weeks ago, Congress came together and passed a wide-ranging, 800+ page, $2.2 Trillion legislation called the CARES (Coronavirus Aid, Relief, and Economic Security) Act.

- 16 weeks ago, the House passed the 1800+ page, $3 Trillion HEROS (Health and Economic Recovery Omnibus Emergency Solution) Act. The Senate did not take the bill up and said it was more prudent to wait.

- 3 weeks ago, Republicans in the Senate introduced the 700+ page, $1 Trillion HEALS (Health, Economic Assistance, Liability Protection, and Schools) Act. The Senate response is actually 8 separate Senate resolutions rolled into one.

- 1 week ago, after failing to negotiate a compromise between the two sides, President Trump signed 4 executive orders to provide additional unemployment assistance (but not expand the current program), a suggestion to extend the moratorium on evictions for some renters, extend student loan, and to defer payroll taxes. The legality and effectiveness are still in question.

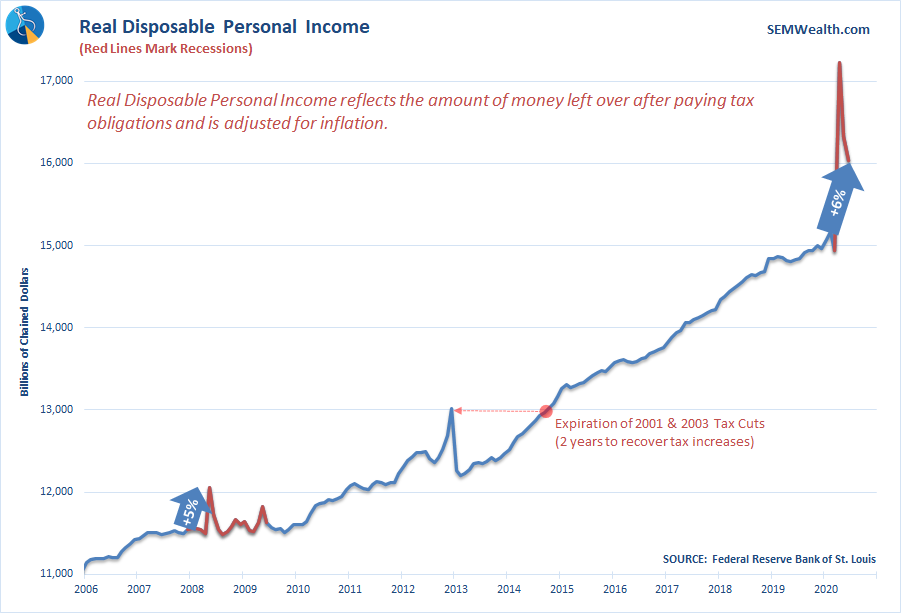

The Senate is on recess, the House is coming back from their vacation, but to focus on the US Postal Service, and there is less and less chance of any real stimulus being approved before we see another air pocket in the economy. It pains me to say this, but we NEED more stimulus if we want the economic damaged to be (temporarily) contained. I broke down the impact the past stimulus had on income and we can see all of the lost income and then some was replaced with the CARES Act. Any drop in spending will lead to another round of small business closures, layoffs, bond defaults, and more bankruptcies.

How we pay all of this back is another story and something that investors should be focusing on, but I don't see that happening until it's too late.

And of course we still have 'rona'

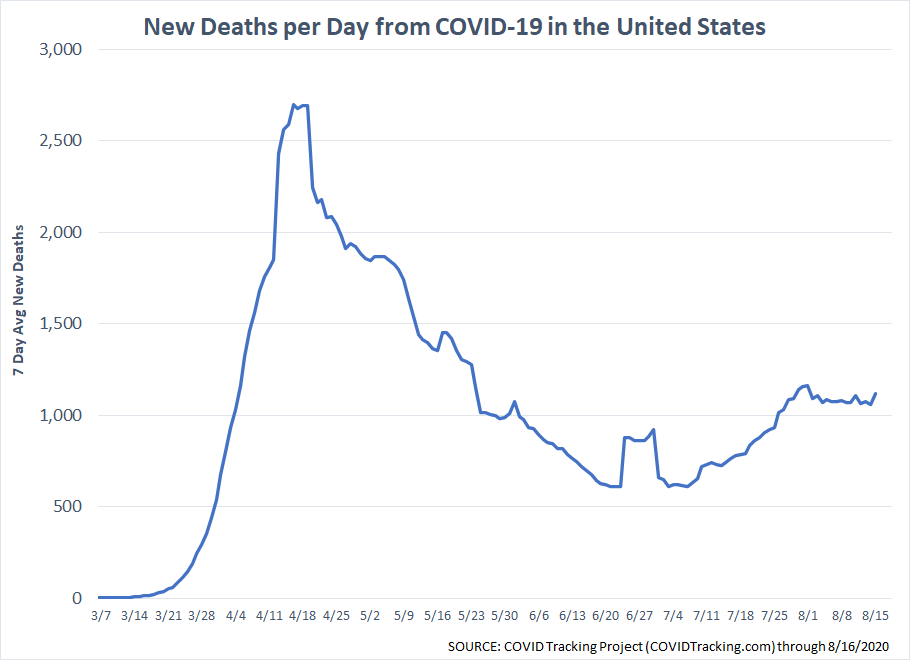

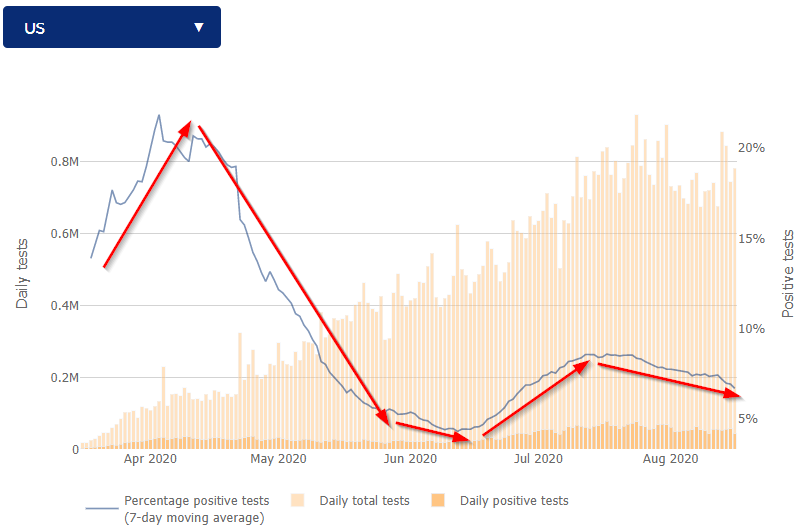

This to me is the biggest unknown. Ever since it became political in April, my enthusiasm for this being a short-term event has diminished. We have the most brilliant scientists in the world and we just need to give them time to figure it out. They've already improved the treatment of patients significantly, which has dramatically cut the number of deaths. We have run hundreds of experiments around the country and learned what works and what doesn't work. I feel like the momentum has swung, but we still have to get through school re-openings and into the fall to know whether or not we are on the road to rebuilding or will go through another devastating wave.

If you haven't done so already, check out this great video presentation from one of our Cornerstone Partners discussing the progress we've made on the virus.

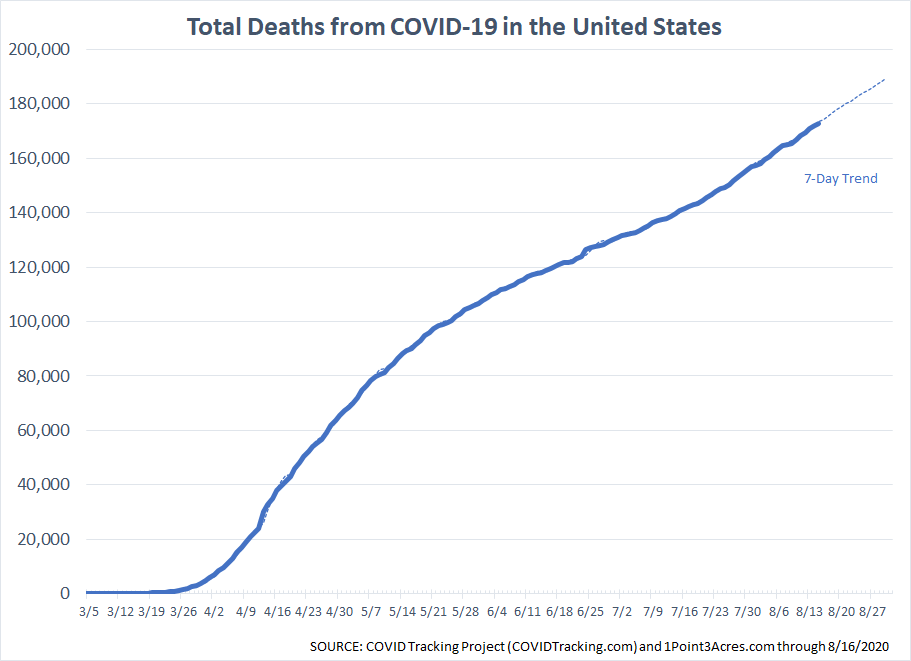

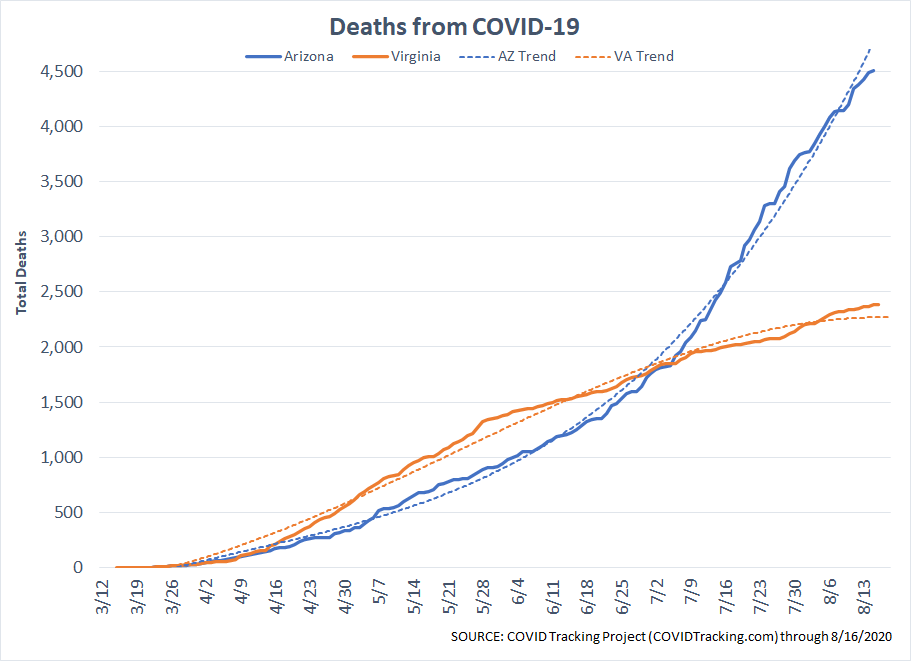

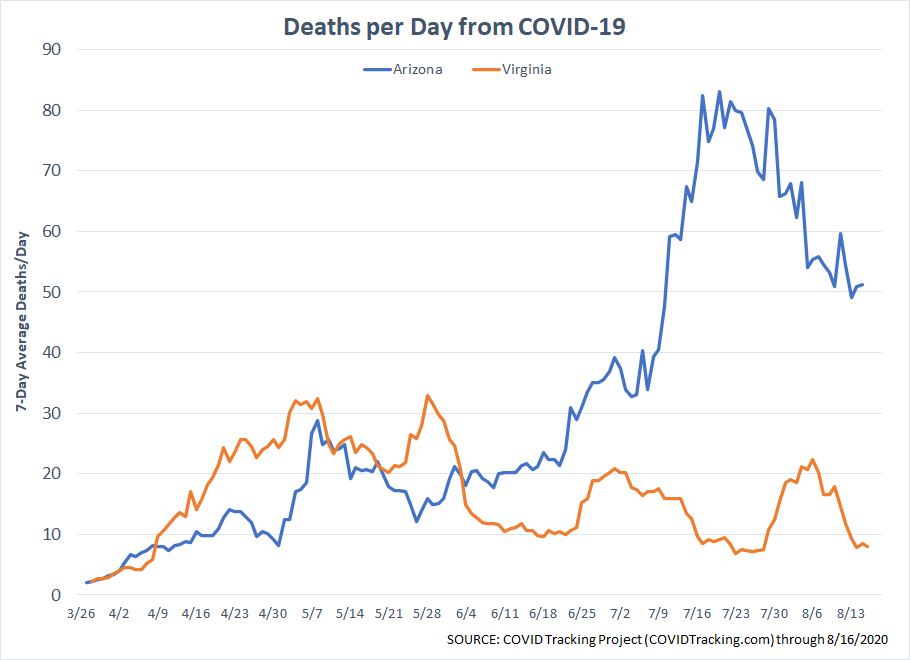

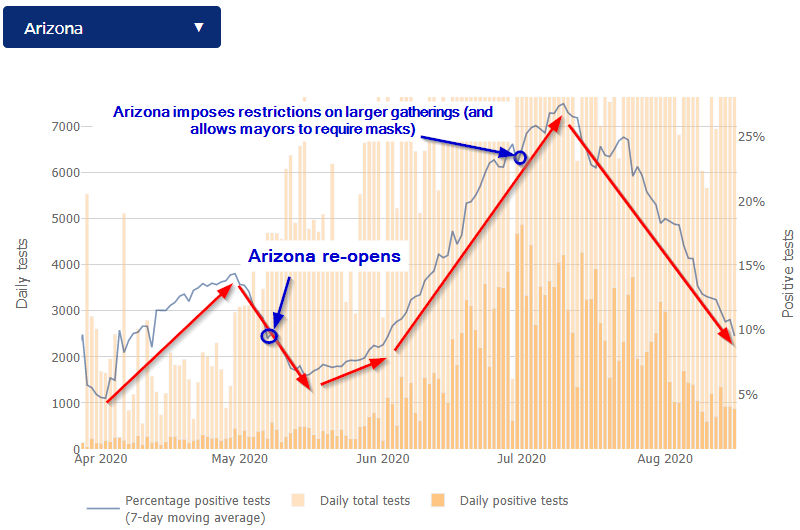

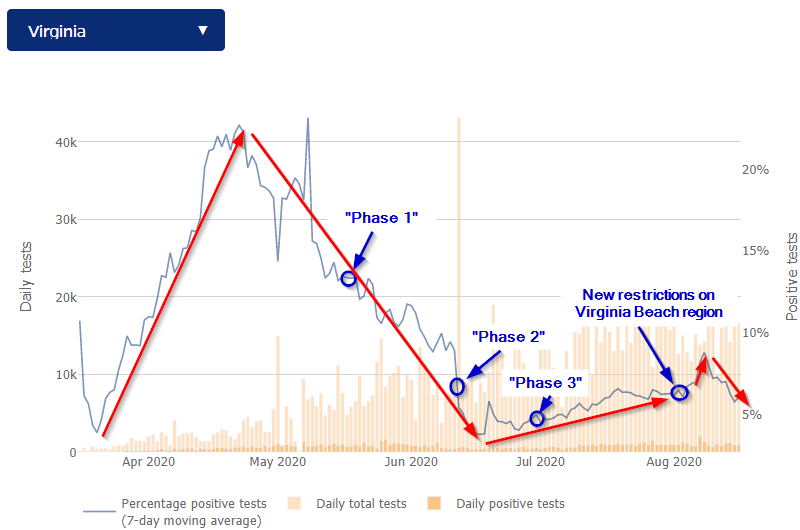

Here's the updated charts I've been tracking:

Masks and logical restrictions on gatherings seem to work, at least based on the data from Arizona, Virginia, our professional sports leagues, and other communities around the country. In general, about 7-10 days after restrictions have lifted we've seen spikes in cases and 7-10 days after restrictions were added we've seen a drop in cases. Deaths lag another 10-14 days after the spike in positive tests. We know what works.

That said, it seems every time we let down our guard we have another wave, which threatens consumer confidence and thus consumer spending. With stocks and bonds both overvalued, you're taking a big risk betting the worst is over.

My advice

First off, all investment allocations need to be inside a financial planning and cash flow framework, with consideration of the investor's overall risk personality. The plan doesn't have to be complicated. I've seen successful plans completed on a legal pad. If you need a plan or are an advisor who doesn't currently offer plans, we created a free resource that takes 10-15 minutes and gives you a nice starting point at WhatsMyScore.net.

If you're invested in stocks and weren't comfortable with the losses you had in February and March, now is the perfect time to "right-size" your portfolio. SEM can provide a free portfolio analysis from Morningstar (for both individual investors and advisors). To get started, head over to Risk.SEMWealth.com. After submitting the risk questionnaire there is a button to securely upload your current portfolio for review. I've found most people have far more risk in their portfolios than they realize. The portfolio analysis allows you to see how much risk you really have.

If you sold during the panic, my advice is to step back into the market slowly. Dollar Cost Averaging (DCA) is one of the best techniques you can use to avoid buying at the highs. Each person has a different stock allocation target (again based on the financial plan, cash flow strategy, and risk personality). Work over the next 12-24 months to get back there in equal increments.

With money market yields essentially at zero, I will put in a plug for our Tactical Bond (and Cornerstone Bond). We are currently still invested in high yield bonds (although we did sell about 15% of our exposure last week). Bonds are overvalued, but they may still have room to run. The reason I like these bond models is they have a fairly short tolerance for risk, meaning if the trend reverses, both can retreat to lower risk bonds and wait for the next opportunity. Here's a recent article discussing this unique model:

On the other side of whatever the next phase of the recession looks like, there will be tremendous opportunities in high yield bonds, which is exciting for Tactical Bond, Cornerstone Bond, and a lessor extent Dynamic Income Allocation.

Speaking of Cornerstone – given the unrest in our country I cannot think of a better investment for this time for those investors looking to make a bigger impact with their investments. Our partners are actively working every day to make positive changes (while still seeking strong investment returns). Each month Courtney writes an "impact blog". She posted the August one this week. I've included links to it and the July entry below:

Remember, when the market gets crazy, it's important to have a plan to avoid falling into the FOMO trap. SEM is here to help.