The great COVID experiment has begun. As we enter the 8th week since the US Coronavirus panic began, some states have begun to open back up. While not a controlled experiment with a ton of different variables coming into play, in four weeks we will at least have some data on what the impact the various shutdown strategies had on this virus. Even in states that were still officially shutdown, by all accounts more people were out in public than at any other time over the last eight weeks.

As I've been doing throughout the crisis, here are the random thoughts on my mind as we start the week.

-Buying stocks here is a huge gamble: For the past month I've been highlighting the fact stocks are nowhere close to undervalued. The mental gymnastics I see the "experts" in the media making to justify buying stocks at these prices is embarrassing for our industry. I get it. We SHOULD all have a very long-term perspective, but as humans, we rarely do what we should. Instead our behavioral approach is designed to adjust to what most of us WILL do. This means properly setting expectations. I do not see any of these "experts" preparing investors for what I believe is a very high probability event – a big disappointment in the pace of the economic recovery, including in how quickly earnings snap-back. A lower, but still uncomfortably high probability is the return of the virus whether this summer or next fall/winter before we have a vaccine (and enough supplies of it) is also a big risk.

One person on TV from a big name Wall Street firm said, "We aren't buying stocks based on 2020 earnings. We're not buying stocks based on 2021 earnings. Instead we are looking at 2022 earnings." Wall Street has had a terrible track record of predicting earnings one year out. Now we're supposed to trust their outlook for 3 years from now?

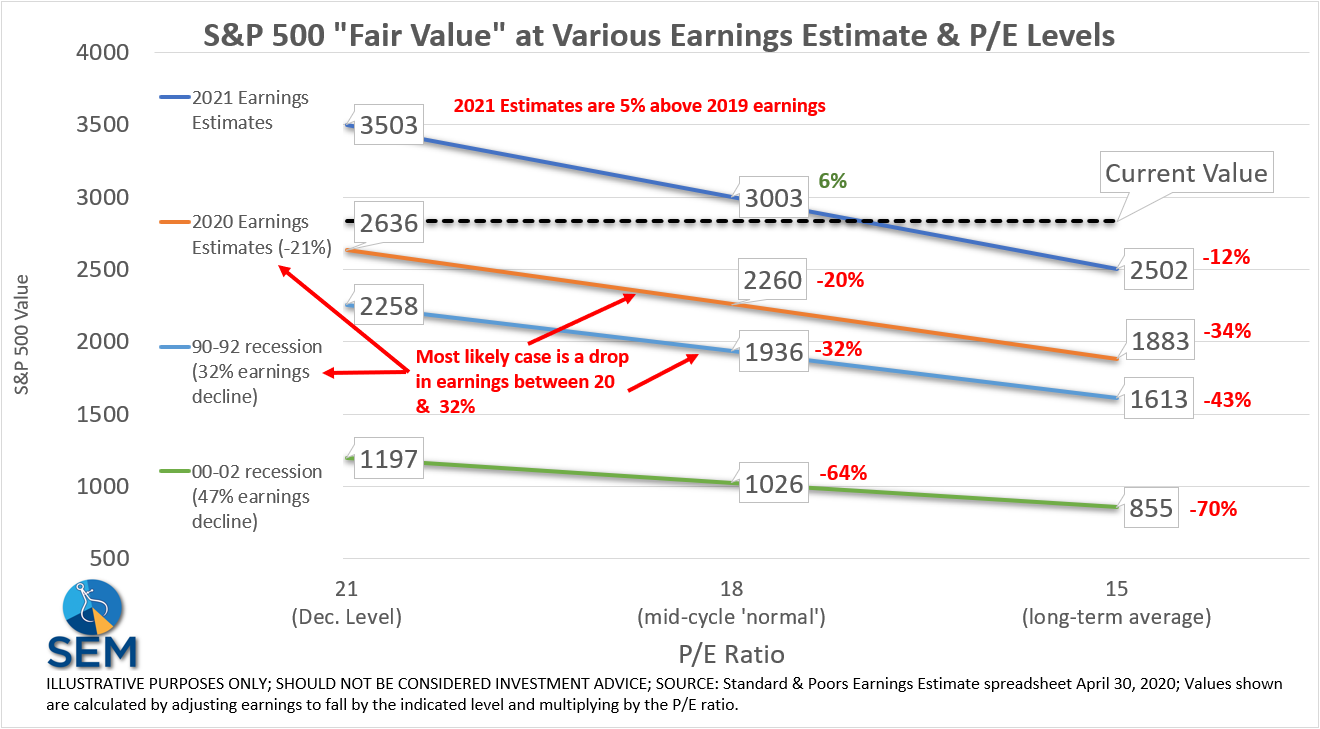

While we don't have 2022 earnings estimates, we do know what they are expecting for 2021 – a full recovery 5% above where we were at before the crisis. I hope they are right, but hope is not a strategy. Logic and experience tells me we are in for a tough road ahead. If you're a long-term investor this should matter. Even if you're using a P/E ratio for future earnings of 18 (which is VERY high), stocks are not attractive.

Here is the updated chart showing the various valuations for stocks based on your earnings expectations and what P/E ratio you think is "fair". Pick your P/E ratio and then move up to see where it crosses your earnings expectations and you know whether or not stocks are trading at a good value.

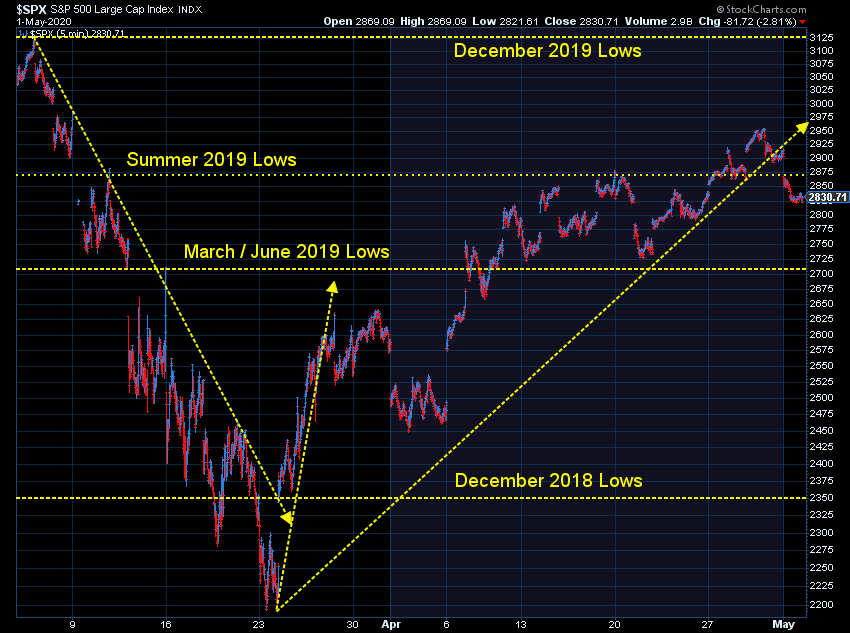

-Back in the consolidation zone: The market attempted to breakout last week, but quickly fell back into the consolidation zone. This isn't a bad thing. While we all welcome a more "calm" market, seeing small cap stocks move up and down 6% in a day or even the S&P 500 moving in 2-3% increments is far from normal. This is the result of NOBODY knowing what the economic damage has been and how long-term the damage will be.

-We heard why Buffett isn't buying: It's pretty simple. It's hard to see how this plays out and the Fed/Congress stepped in so fast there were no attractive prices to buy. In other words, like we've been saying all along, stocks at these levels are not attractive. We did a deep dive on stock valuations at the beginning of April. Nothing has changed except stocks are now even more overvalued. Read it before you declare stocks are attractive at these levels.

-I'm not betting against America: As I've said all along, I'm a long-term believer in the American spirit. I know we'll get through this and we'll come out the other side with new companies, a new way to do business, new technologies, new medical treatments, and hopefully a new appreciation for what is important. Just because I'm bullish on America doesn't mean I need to be bullish on the stock market at all prices.

-A decision to HOLD is a decision to BUY: People value something they already own more than they would if they didn't own it. This is called Endowment Bias. One of the critical things to understand with investing (especially in tax deferred or exempt accounts), is when you choose to hold onto an investment you are choosing to not buy something else. This means if you are choosing to hold onto your stocks, you are ok with buying something that is significantly overvalued.

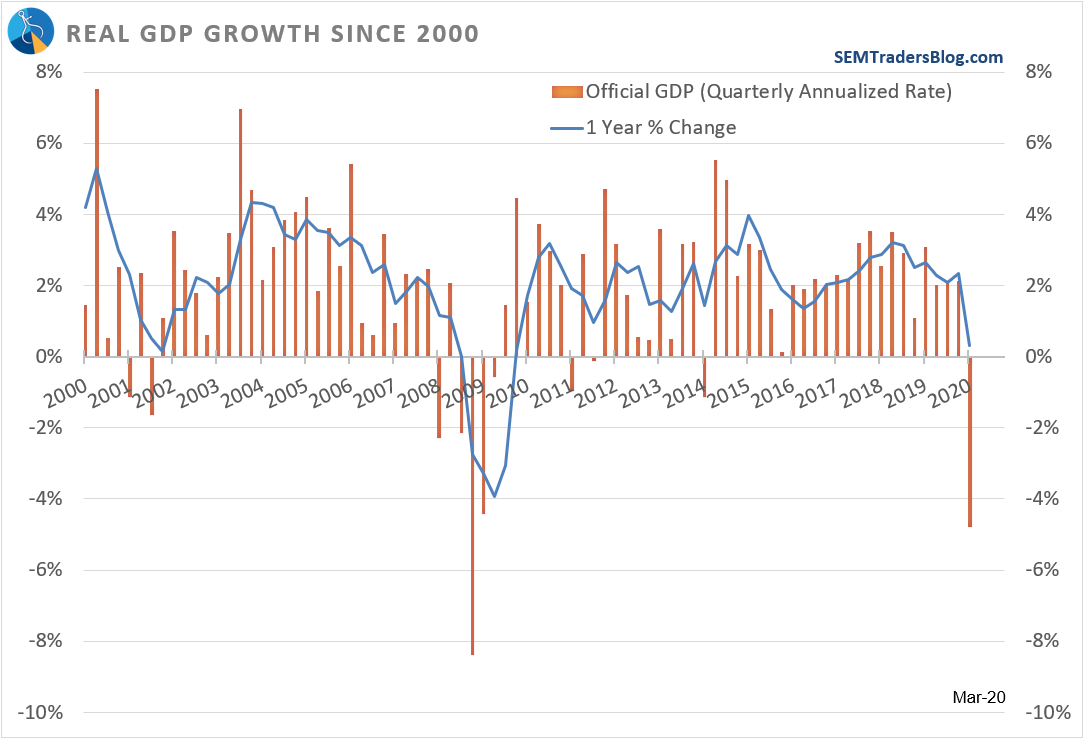

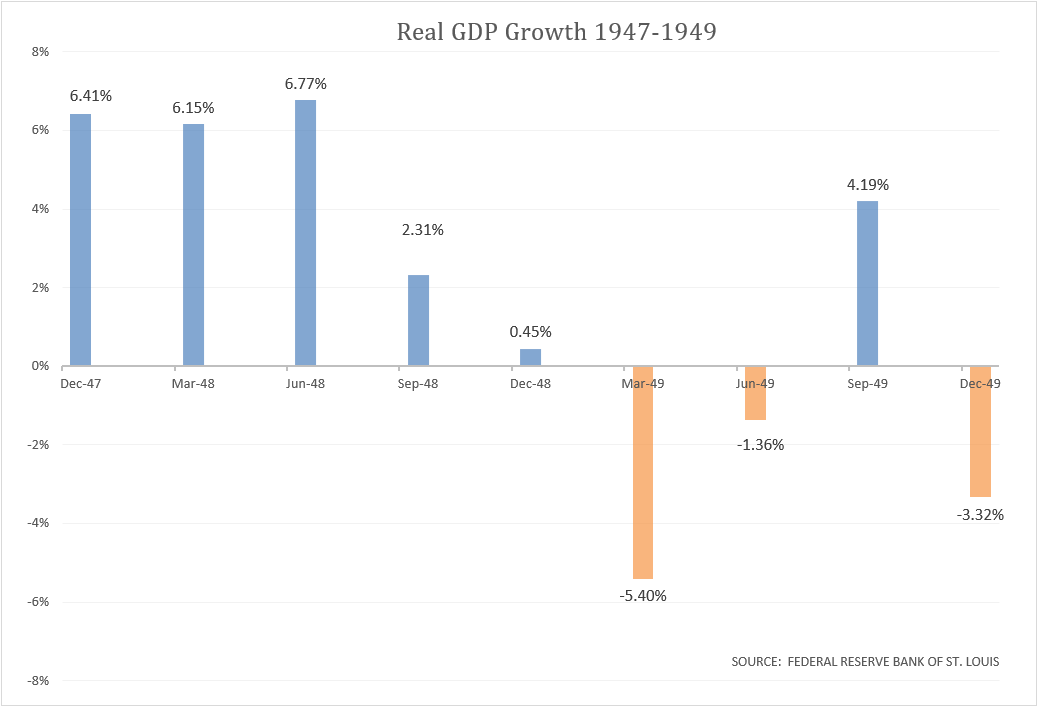

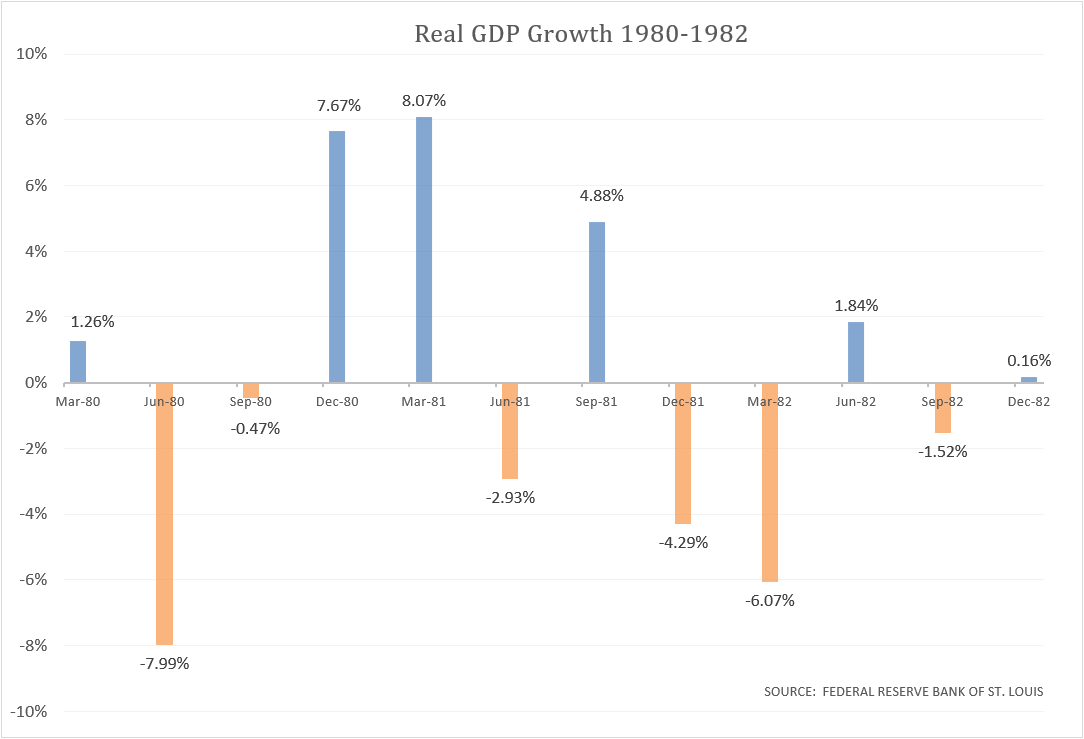

-Economic damage just starting to show-up: Last week we saw the first look at the economic damage in the first quarter. The "headline" number was bad (-4.8% seasonally adjusted annualized rate), but not unprecedented. Back before we saw the Fed attempting to squash every single recession with huge amounts of stimulus, big fluctuations in GDP were normal.

-Looking at year-over-year growth is more meaningful: Nowhere in our industry do we take the performance for the last 3 months and then essentially multiply it by 4 to give a 1-year number......except when it comes to the "official" GDP number. What is more meaningful is to look at how something is doing versus a year ago. This removes all seasonality and gives us a better look at the last 12 months. Here's the actual yearly change in the economy. Still ugly, but not as ugly as everyone is making it.

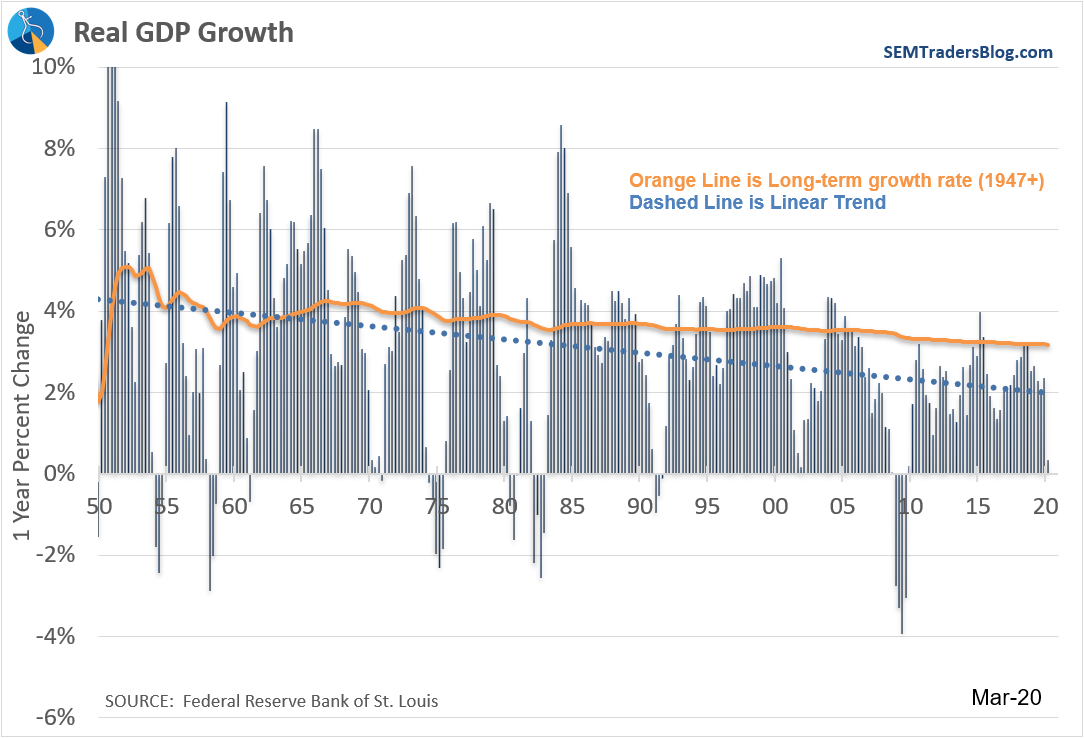

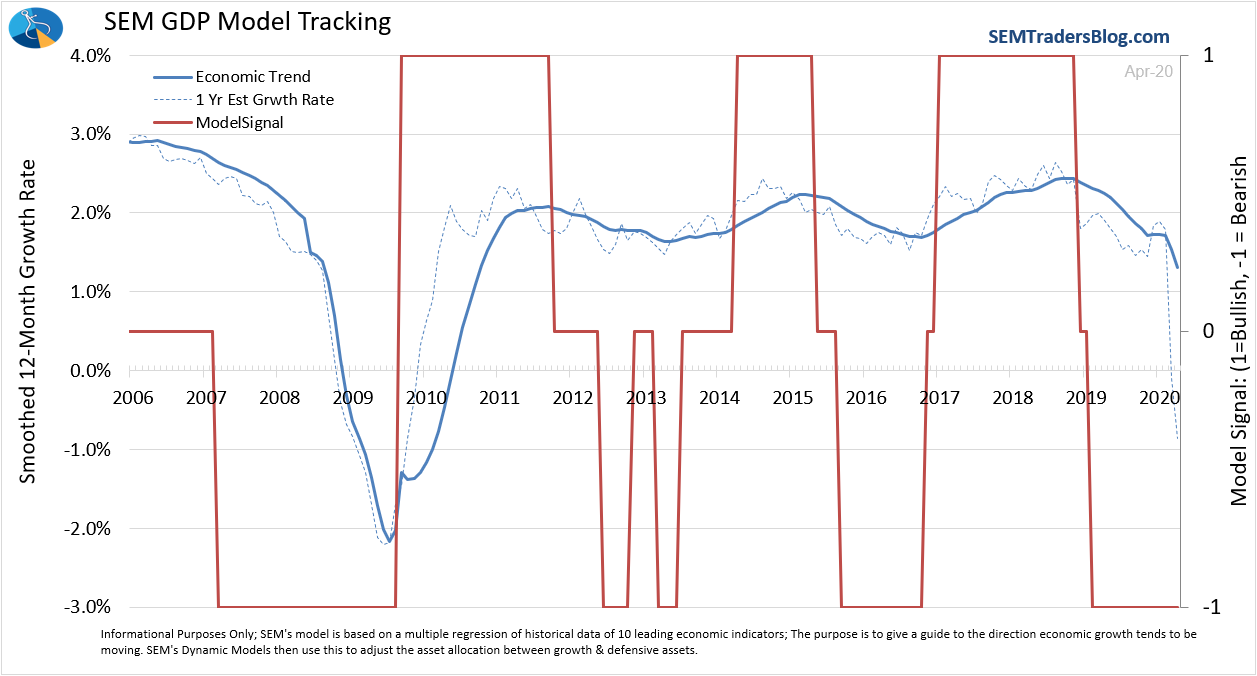

-Economy was weak BEFORE the Coronavirus: Many people believe we had a "great" economy that was only derailed by this virus. Our economic model disagrees. When you add that to the huge amount of leverage on the balance sheets of governments and corporations relative to where they were at in 2007, it makes the likelihood of a strong economic recovery much smaller. Our economic model and by extension our Dynamic models, which adjusts allocations based on this model has once again been a star this year. With April data rolling in, here is our updated model.

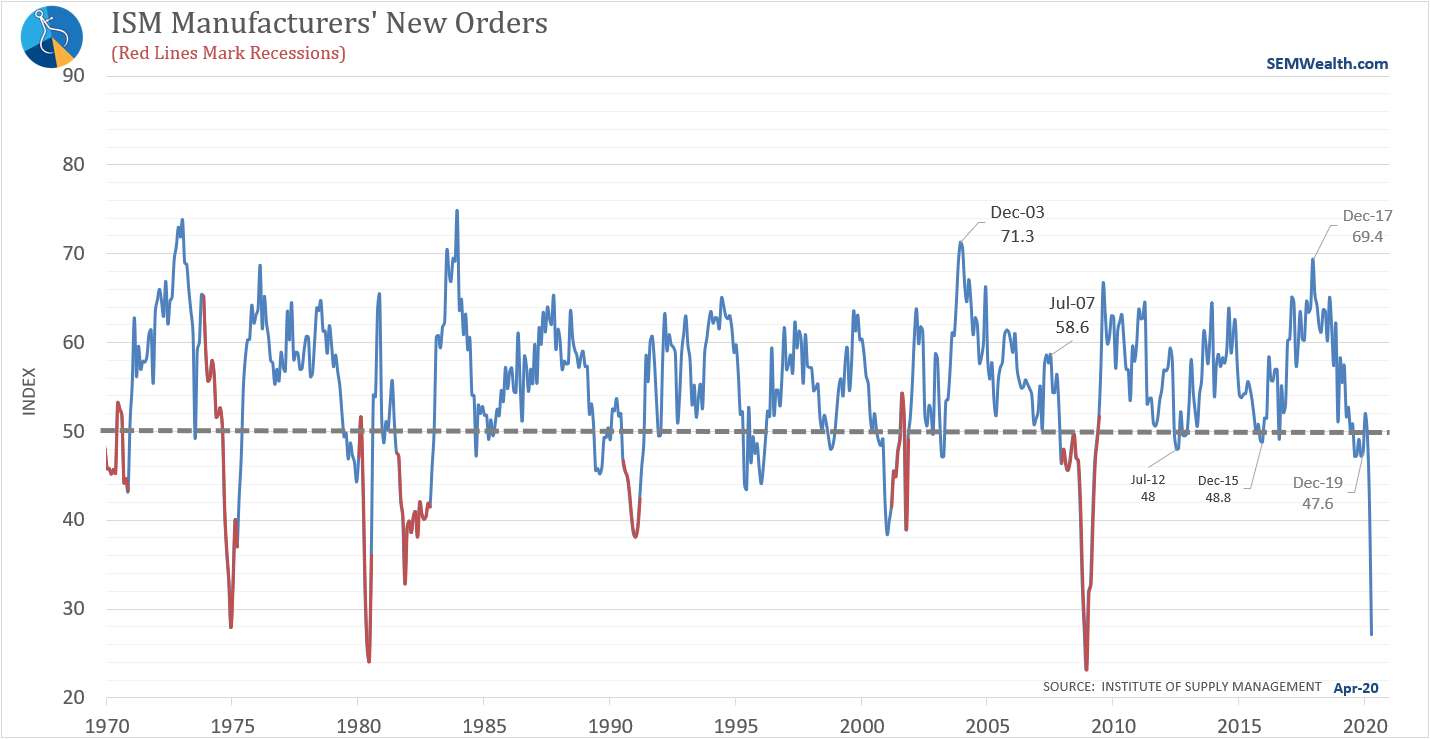

-Manufacturing slowdown is staggering, but not unprecedented. One of my favorite indicators is the ISM Manufacturing Survey, in particular the New Orders component. This is the first release of the month and gives us a look at how the just completed month looked in terms of economic activity. Any number below 50 indicates a "contraction" in activity. Remember, in December 2019 the New Orders component was already warning about a contraction in our economy. In other words, the virus attacked an economy already heading towards recession.

-We warned about slow growth a year ago: One of the things we highlighted when our economic model went negative last year was the timing of the 2017 tax cuts and what they would do to the deficit. This is what I said last year in our "Growth at What Cost" article:

This is not a political statement (I’m not a Republican or a Democrat, I’m an American) nor is it me saying tax cuts are bad. All things equal, giving citizens and corporations more money is a good thing. The problem is the timing — providing stimulus this late in the economic cycle has never worked. Worse, all the tax cuts did besides push the budget deficit to levels last seen as the Obama administration was trying to fight the great recession was pull some spending forward. 2018 economic growth was AVERAGE. It couldn’t even surpass the growth we saw in 2015.

This is the type of economy everyone is longing for? The extreme measures from Congress and the Fed were necessary, but they certainly won't get us back to a strong economy. Worse, the unintended consequences and the payback will cause further strains on future growth. Going back to the musings at the top of the page, this does not justify paying 18 or 21 times earnings.

-The speed and size of the reaction was impressive. I think this chart illustrates how quickly Congress and the Fed reacted. The question is how much of an impact it will really have. This blunt-force reaction was necessary, but won't save everybody (see next point) and will come with many unintended consequences (including a drag on future growth).

Comparing Phase I-IV of #coronavirus fiscal stimulus to GFC stimulus

— Gregory Daco (@GregDaco) April 24, 2020

via @OxfordEconomics @SoberLook pic.twitter.com/Dr3cDTIGFb

-Liquidity versus solvency: I don't think people fully understand the differences in what the Federal Reserve has been doing. Chairman Powell explained it well last Wednesday and maybe that is the reason we've seen stocks going lower since then. What the Fed did was provide liquidity to companies who were in a cash flow crunch because the government shut off their revenue. What they won't do is provide cash to companies who were insolvent – those companies who prior to the crisis had more debt than assets and more interest expenses than cash flow from operations. This means we're going to see the Fed allow businesses that were weak before the crisis to fail. This means bond defaults. This means stocks being wiped out. This means banks losing money on their loans.

-You need to be able to adapt: Over the last two weeks we've highlighted what in my opinion are two of the most important components in a portfolio for people in these categories:

- Already retired

- 10 years from retirement

- Uncomfortable losing more than 25% of your investment value

Our Dynamic Income and Tactical Bond models are designed to adapt to the current environment. Obviously savings vehicles and money market accounts aren't paying anything right now. Treasury bond yields are below 1%. Corporate bond yields are less than 5%. The S&P 500 dividend yield is around 2.5%. Worse, the trade off between the safety of a money market and the potential returns in the other income vehicles does not justify the huge amount of risk in those investments. This is why for most investors in the categories above we end up recommending core positions in Dynamic Income and Tactical Bond. To learn more about how they are positioned, check out these articles:

- Your Core Income Portfolio (Dynamic Income Allocator-DIA)

- (Delayed) Opportunities Emerging (Tactical Bond-TB)

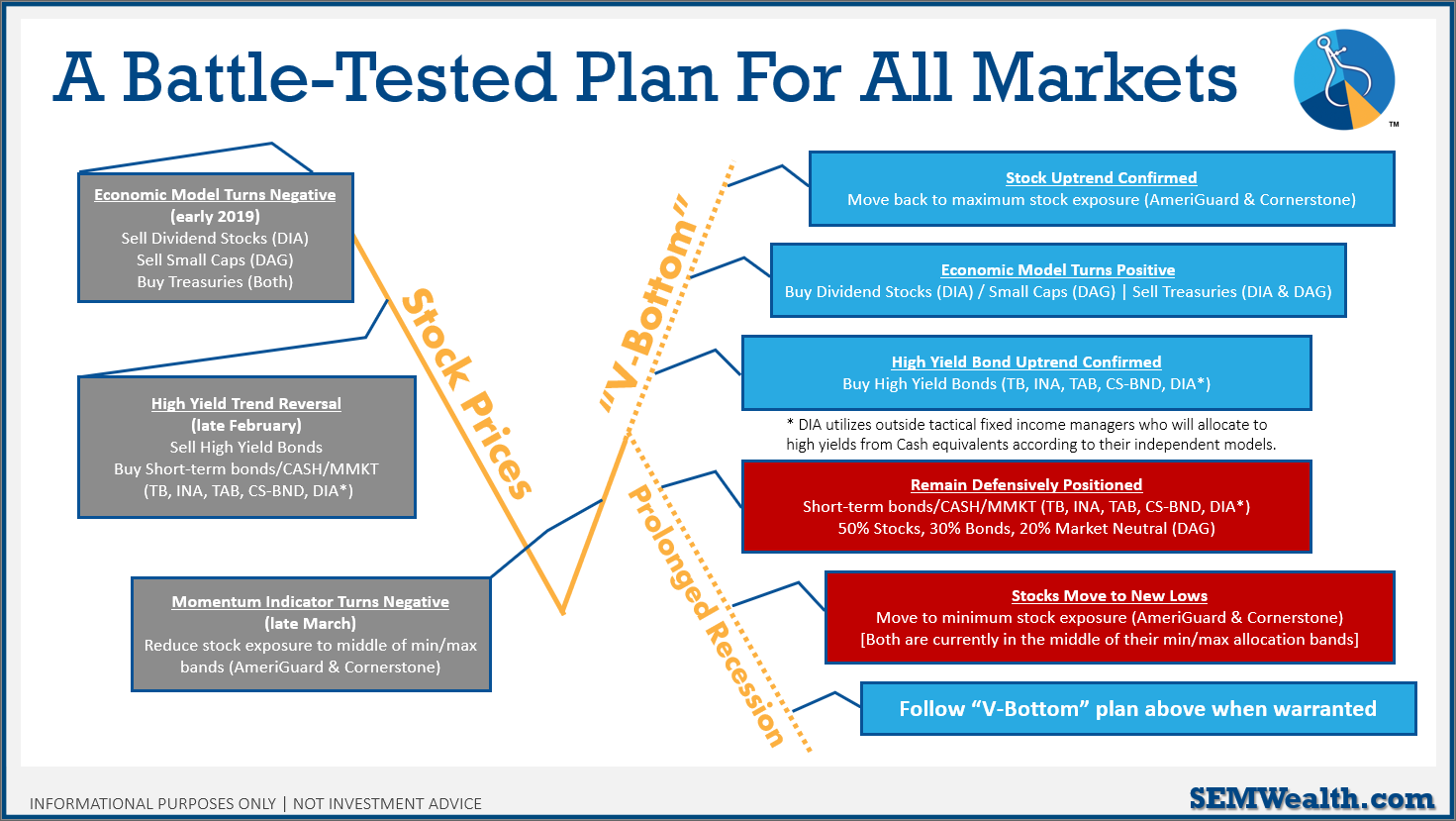

-We have a battle tested plan. The only way to get through this is to have a data-driven, process-oriented plan to adapt. We've been doing this for over 28 years. Now would be a good time to review your plans. Here's a summary of ours. Based on our models, we are right between the "V-Bottom" and "Prolonged Recession" points, meaning it's a good time to make adjustments.

-Amount of potential defaults is staggering: I saw this on LinkedIn last week and thought it put into perspective the size of the "investment grade" bond market. BBB bonds are one notch from junk. Their leverage ratios are double what it was in 2007 (ratings agencies have lowered their standards). The Fed can't (and won't) buy them all. These companies had low ratings because their solvency was risky. This crisis will only accelerate the insolvency.

Broad-based downgrades of BBB bonds from investment-grade to speculative-grade could flood the narrower BB market and trigger fire sales by investors.

— Gregory Daco (@GregDaco) April 24, 2020

Fed is a backstop for "fallen angels" but HY default rate will rise

via Lydia Boussour @OxfordEconomics @SoberLook pic.twitter.com/6lro3EHJkt

-What will be the impact on insurers? We've seen several lawsuits from companies against their insurers arguing the business interruption is a covered event. Event planners are also having to sue their insurance companies to cover what they thought was protection against cancellations outside of their control. After the SARS outbreak in 2009 many insurers added a clause deep in the contract for "pandemics", but some did not. Regardless of how this plays out in courts, the increased number of deaths (see next item) as well as the potential damage to their investment portfolios (insurance companies are heavy users of "investment grade" bonds) could lead to large losses in the insurance industry.

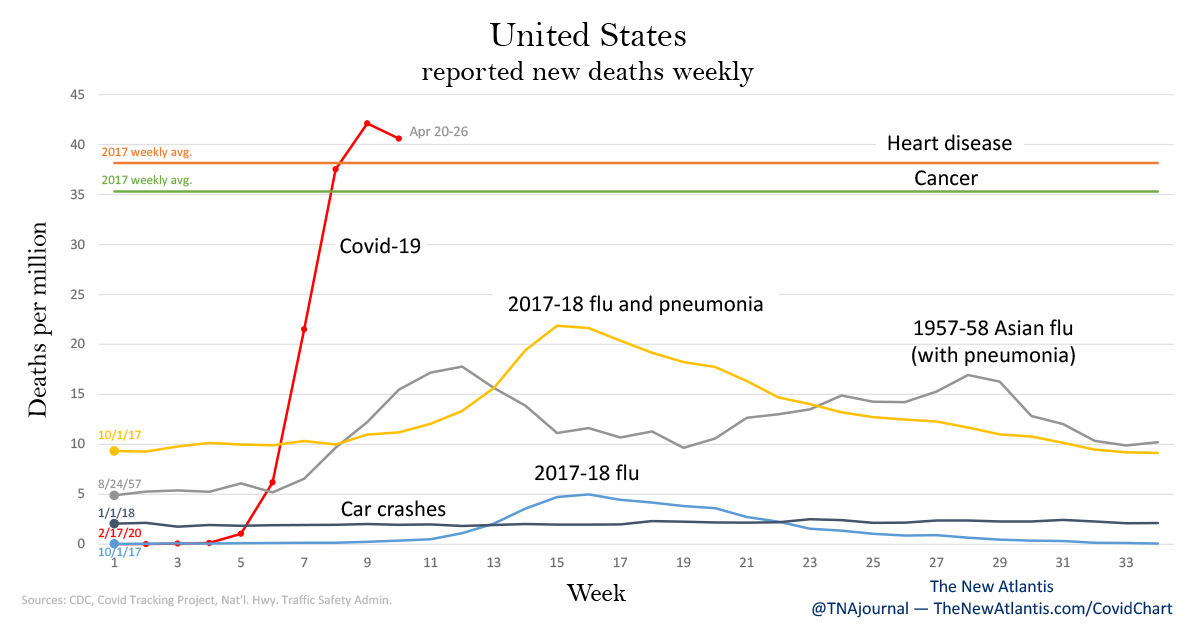

-Why this isn't like the flu: Many people (including me in mid-February) have argued the flu kills far more people than COVID19. I've changed my mind because the annual statistics hide the impact on specific locations who are overwhelmed by too many illnesses at once. This chart highlights the differences (source).

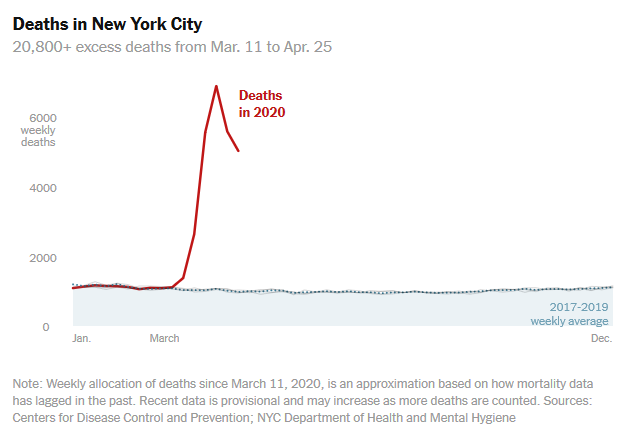

-COVID19 deaths are likely HIGHER than reported: I've seen people argue that the death statistics are being overinflated. What we are finding in the data is it is very likely they are under-reported. Early on, the thought was COVID19 caused a pneumonia-like reaction, so only those with those symptoms had tests run after their death. Now we've learned COVID19 can cause liver and kidney failure as well as blood clots. We also are learning that there continues to be a huge backlog in postmortem tests. We'll never know for sure how many deaths were directly related to COVID19. This chart of deaths in New York city shows how quickly the number of deaths spiked. This is much faster than would be explained by just the number attributed to COVID19 (source).

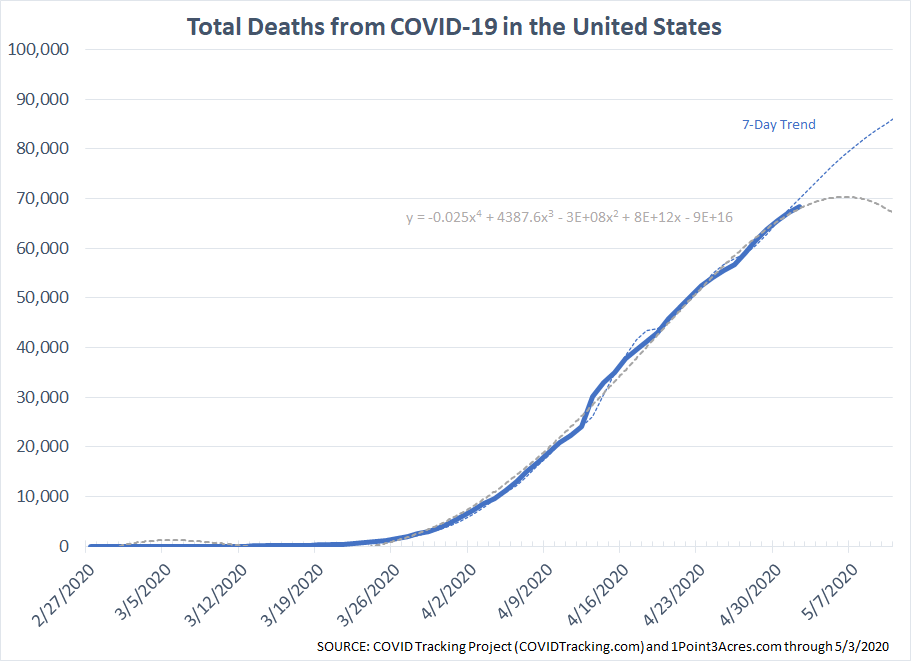

-Trends improving, but not rapidly enough. We continue updating our "Worse Before it Gets Better" post which was generated after the President scared everyone about the potential of 100,000 to 200,000 deaths. It is getting better and never got as bad as he had warned (likely because of the mass shutdowns), but we still could hit 100,000 deaths before this has run its course.

-Genius or delusional? We're big fans of Elon Musk and Tesla in our office. Not all of us agree on the merits of investing in Tesla stock, but he has certainly been a revolutionary. He is also good for some laughs. Last week we had commented how insane it was that Tesla stock was over $800 again and rapidly approaching the pre-COVID highs in the $900s. Apparently Elon thought it was insane as well. Unlike most CEOs who are always cheerleaders of their stock, he tweeted that the stock was "too high", which led to this meme being shared in our family chat.

A Behavioral Approach to Coronavirus

I’ve studied Behavioral Finance for a long time. A big part of that is the way our brains process information and make decisions. When we lack data or have an unknown event, we each have our own “heuristics” (mental shortcuts) which are subject to many of our own biases. It’s not necessarily a bad thing, but we all need to be aware that the less data we have and the more unknown the outcomes are, the more heavily our biases will play a critical role. When our emotions get involved, our biases cloud our decisions even more.

We are seeing this in real-time with the COVID19 panic. We don’t have enough good data or experience in dealing with something like this as a country. Our leaders are trying to rely on experts and as much data as possible to make difficult decisions for the people they are responsible for. This is an impossible situation. When it’s all over, we will likely all deploy hindsight bias in second guessing every decision that was made. After the outcome is known, the causes and solutions are obvious. We should grant our leaders grace and patience regardless of your political affiliation. Most of them are up for re-election in November.

One of the difficulties in the lack of data is showing up here in Virginia. Our state’s nursing and long-term care facilities have apparently been hiding behind health care privacy laws by considering the entire facility a “person”, which meant they weren’t disclosing how many deaths were coming from their facilities. The deaths were still being counted, but not disclosed publicly as coming from a nursing facility. On Thursday the CDC declared that all facilities receiving Medicare or Medicaid payments must disclose their deaths. On Friday we learned Virginia has 311 deaths inside these facilities. That’s 54% of all deaths in Virginia. Another way to look at it, in a state of 8.5 million people, only 270 residents not living in a long-term care or nursing facility has died from COVID19. That’s an impressive number and shows Virginians have done an amazing job of following the stay-at-home orders.

The question is with this new data should the governor reopen the state sooner? That’s not an easy answer either. At one of the hardest hit facilities in Richmond, the staff was tested 3 times over 6 weeks. They recently ran anti-body tests and found 75% of the staff had already had COVID19 yet never tested positive. “Herd Immunity” looks to have kicked in. They have not had any new deaths in 2 weeks. Sadly 1/3 of the residents have died. These facilities have obviously done everything possible to protect their residents and yet the disease is decimating their populations. You can’t quarantine all staff members, which means if you open the state and a staff member goes to the movies or church or the nail salon and then brings the virus into the facility, you put their residents at risk.

I don’t know the right answer. Nobody does. For everybody demanding a blanket reopening, would you be comfortable making a decision that kills 1/3 of the residents in all nursing facilities in your region? At the same time, would you be comfortable essentially bankrupting 20-40% of the businesses in your region while trying to protect people in nursing facilities? What is a life worth? What is the psychological, physical, and financial damage done to your region because of your decisions?

This is a terrible situation for all. Again, even if you don’t like the people making decisions, they are doing their best in an impossible situation. Whether you voted for them or not, they were elected. If you think there are better people, get behind them for the next election because sadly it looks like they’ll be having to make these same decisions next year.

I try to be an optimist, but I'm also a realist. I also try to find humor in situations. Not because I don't appreciate the pain and heartache people are going through, it's simply how I cope with things. To me, laughter is the best medicine. Social media can be a great tool for information and to stay in touch with our friends and family, but it can also cause serious damage to our country. I had to get off Facebook this weekend. It was no longer a welcome resource full of encouragement, funny memes and anecdotes about not being able to find toilet paper or seeing how people are not correctly wearing their masks. Instead it was filled with anger, accusations, name calling, and misinformation. It makes me sad to see our country devolving, but I also know that is part of this stage of the social cycle.

I wrote the message above trying to help everyone put this situation in perspective. We are all humans and subject to our own biases. Being aware of them is important and allows us to make better decisions. Prayers for our leaders and understanding of the terrible position they are in go along way. Regardless of your political affiliation, we should be praying for them to make wise decisions, not hoping they fail so your candidate can take their position. We shouldn't identify as Republicans or Democrats but as Americans. One country going through a terrible crisis, working together to get through it and heal the damage already done.

If you agree with the Behavioral Approach to Coronavirus, you can copy this link and share it on your own social media feeds.

I wanted to end with something positive. I love seeing the creativity in our country. Here are a couple of videos that brought a smile to my face over the weekend. The first is a take on the different social media platforms:

I've watched this one a few times. One of the things Brandi and I are missing the most is our trips to the Theater. We were season ticket holders to Broadway in Tucson and now Broadway in Richmond the past five years. This made us miss the amazing performances even more. What talent!

I hope y'all can have a great week. Focus on the positive. Hope for the best, but plan for the worst (which is where we come in.) With SEM we'll take care of focusing on all the bad things that can happen so you can focus on taking care of yourself, your family, and maintaining positivity.