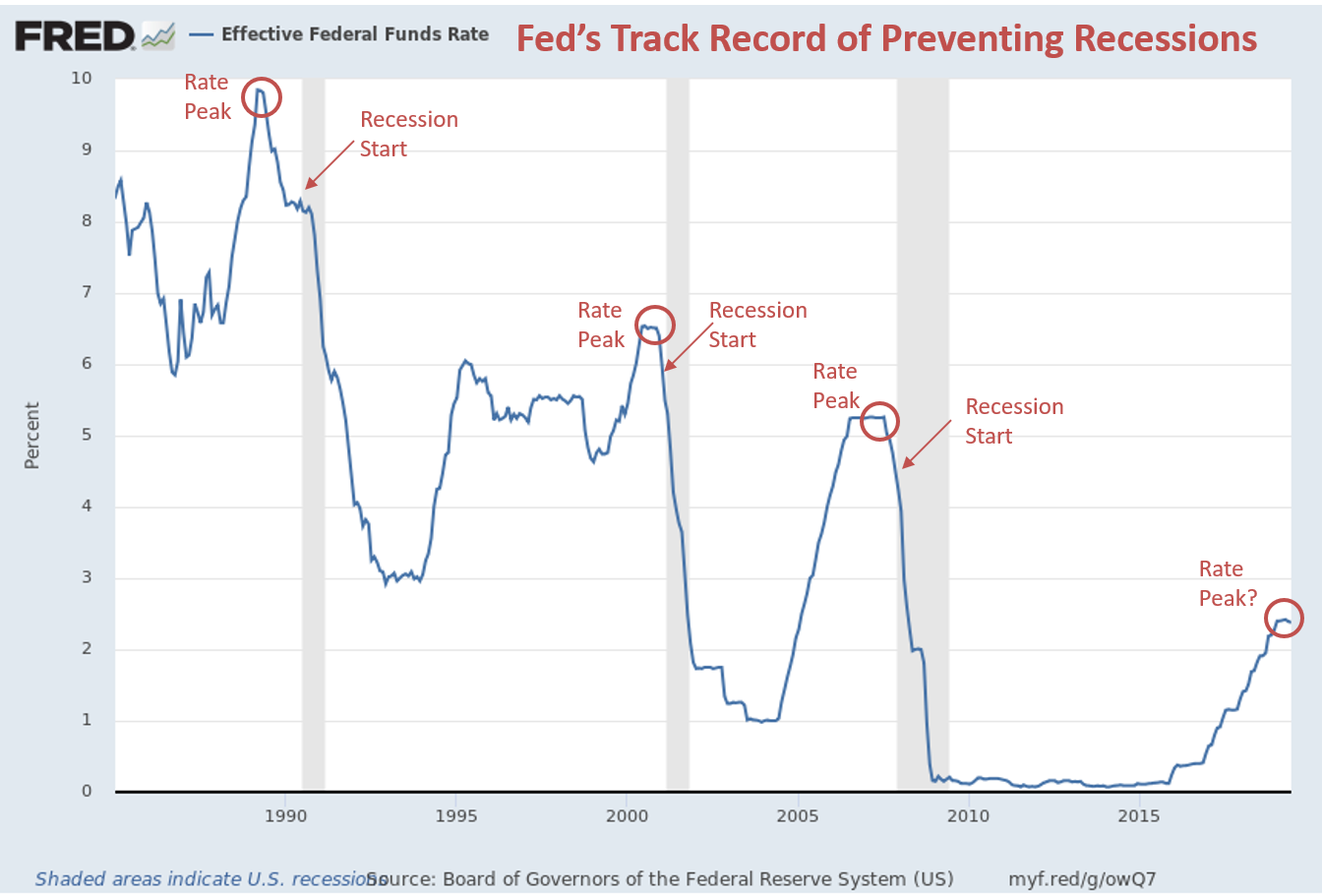

The Federal reserve cut interest rates for the first time since 2008. Since late 2015, they have raised short-term interest rates from near 0% to 2.25%. Since June when the Fed hinted at the chances they would cut rates at their next meeting, investors have poured money into the

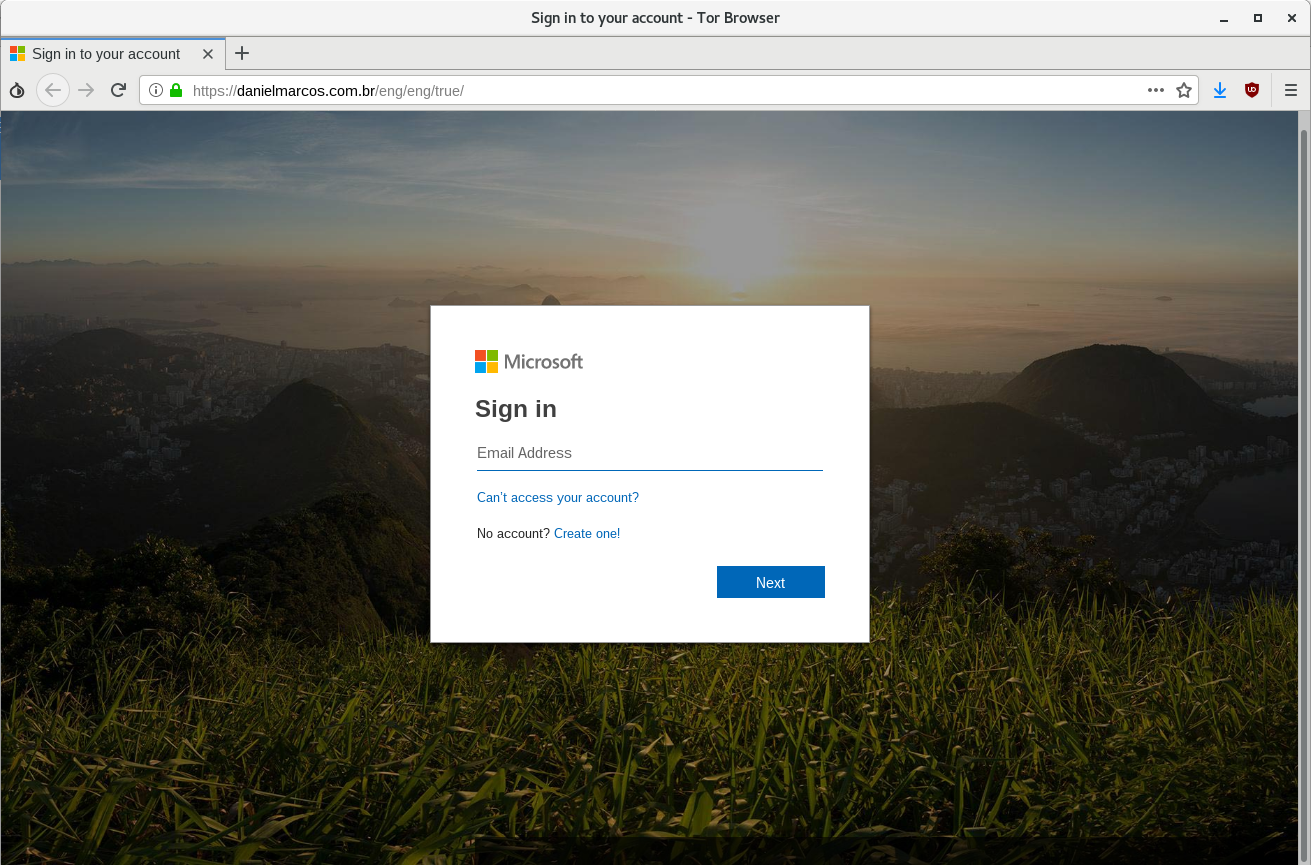

Last week we dealt with a phishing attack that turned out to be a bit scary. The attack used a technique that I knew was possible, but had only read about before (check out this post on Reddit). This was the first time I had actually seen it for myself.

Here’s a quick look at the most important charts from our 3rd Quarter Market & Economic Update.

- Check out the full 30 minute update here (including a link to download our entire chart packet).

- Read the ‘Investment Grade Junk’ article referenced in the update here.

I realize some of

2023 update: I no longer recommend using LastPass for your password manager. I strongly recommend 1Password instead.

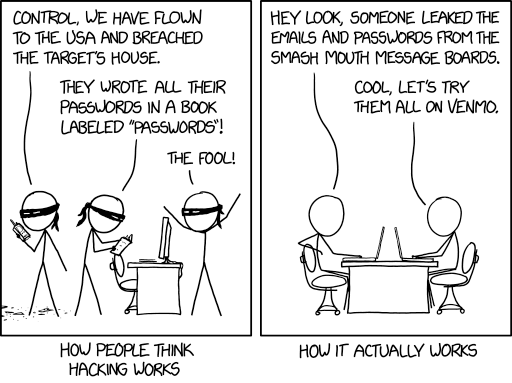

Passwords are, frankly, a bane of our online existence. You need a password to log in to pretty much everything, and in the year 2019 we log in to a lot of things.

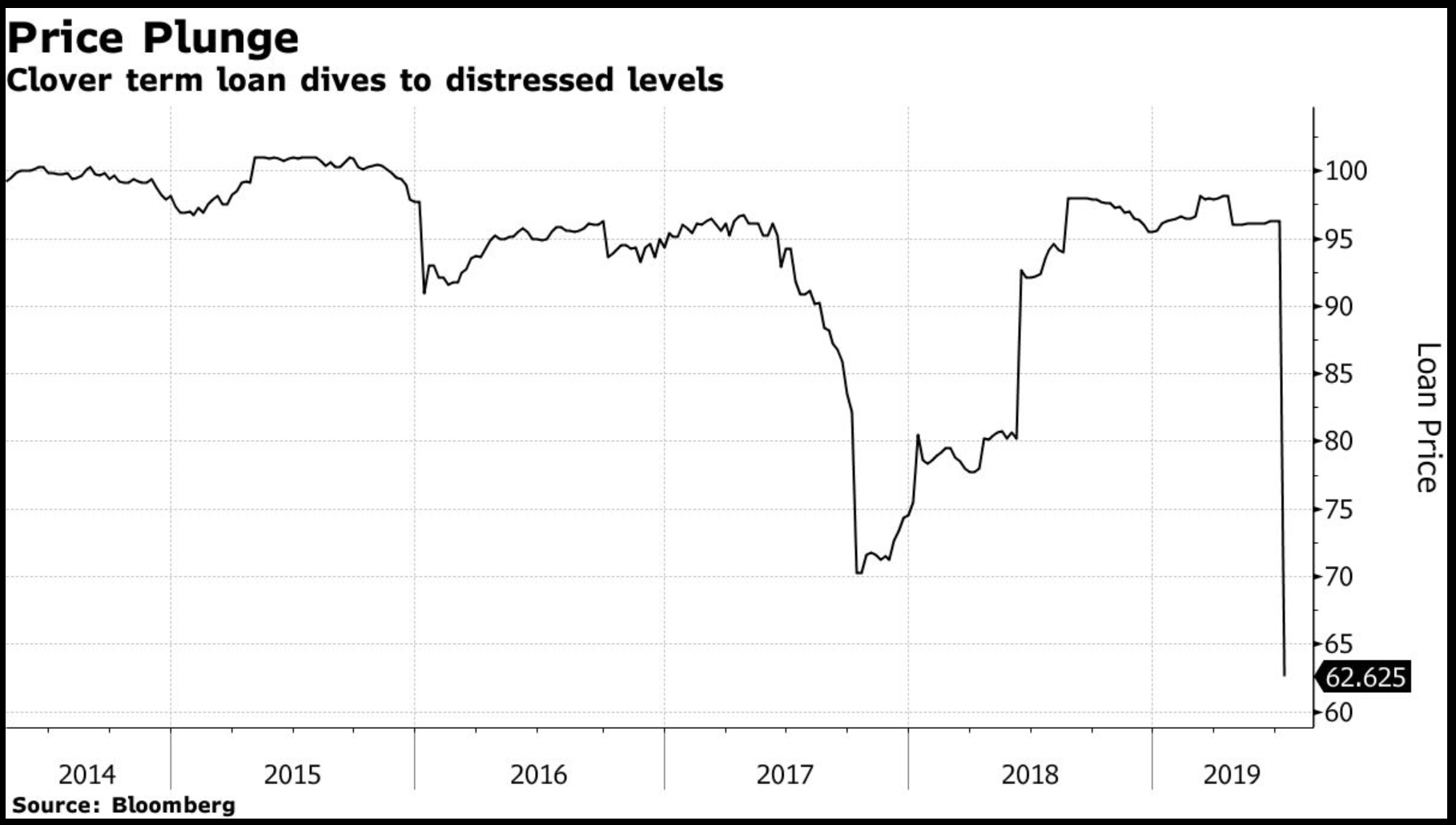

Most of you probably didn’t notice, but a $693 million loan lost 1/3 of its value in the past week. It wasn’t a company anybody has heard of, which is part of the problem. Clover Technologies, a company that recycles printer cartridges, cell phones, and