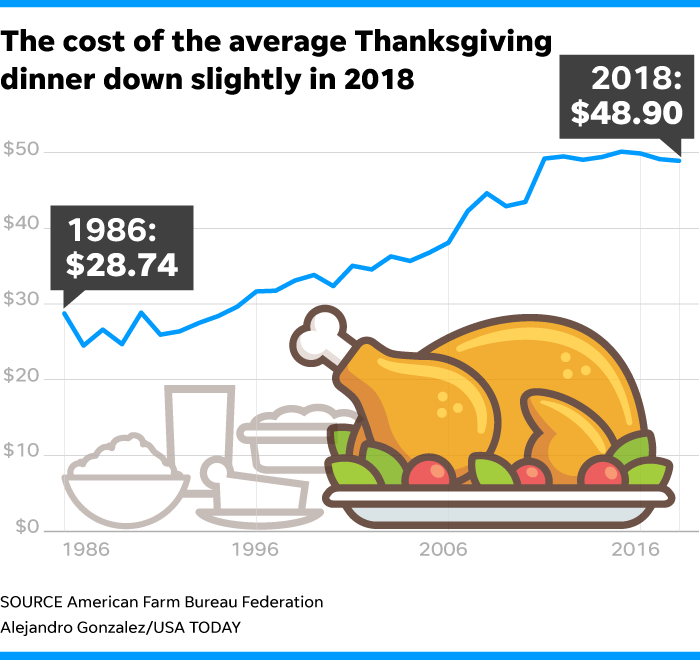

Thanksgiving is by far my favorite holiday. My mom instilled in us that no Christmas decorations, music, or movies were to appear until the day after Thanksgiving. It saddens me that Christmas season now seems to start the day after Halloween. Our family still follows my mom’s rule,

In college, my peers voted me “most likely to appear on CNBC”. Even back then I enjoyed talking about the markets and attempting to educate anyone who would listen about how the markets work (or don’t work). Some of my fondest memories occurred after class or

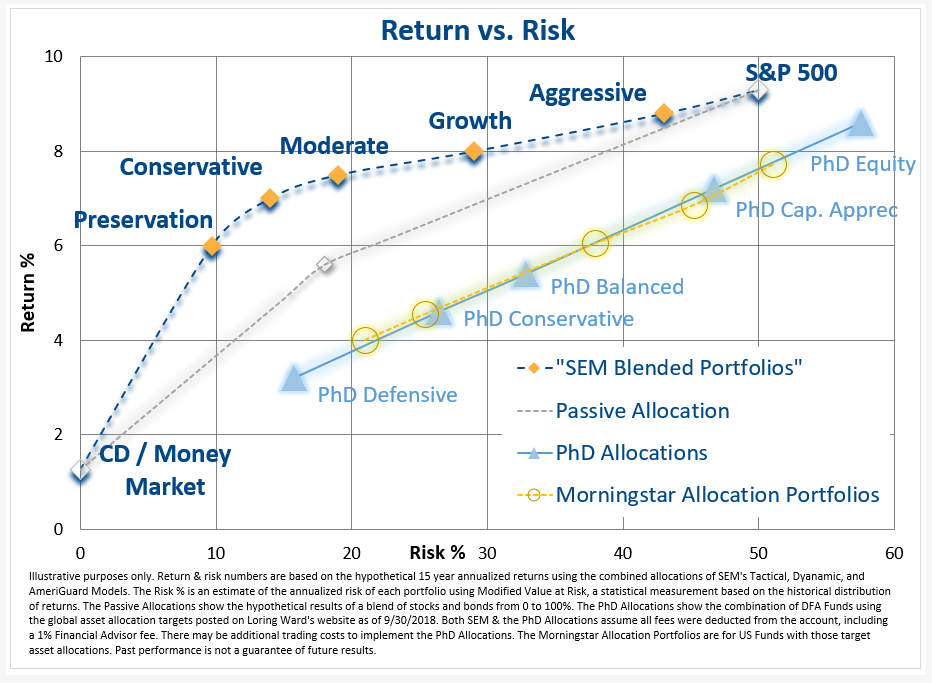

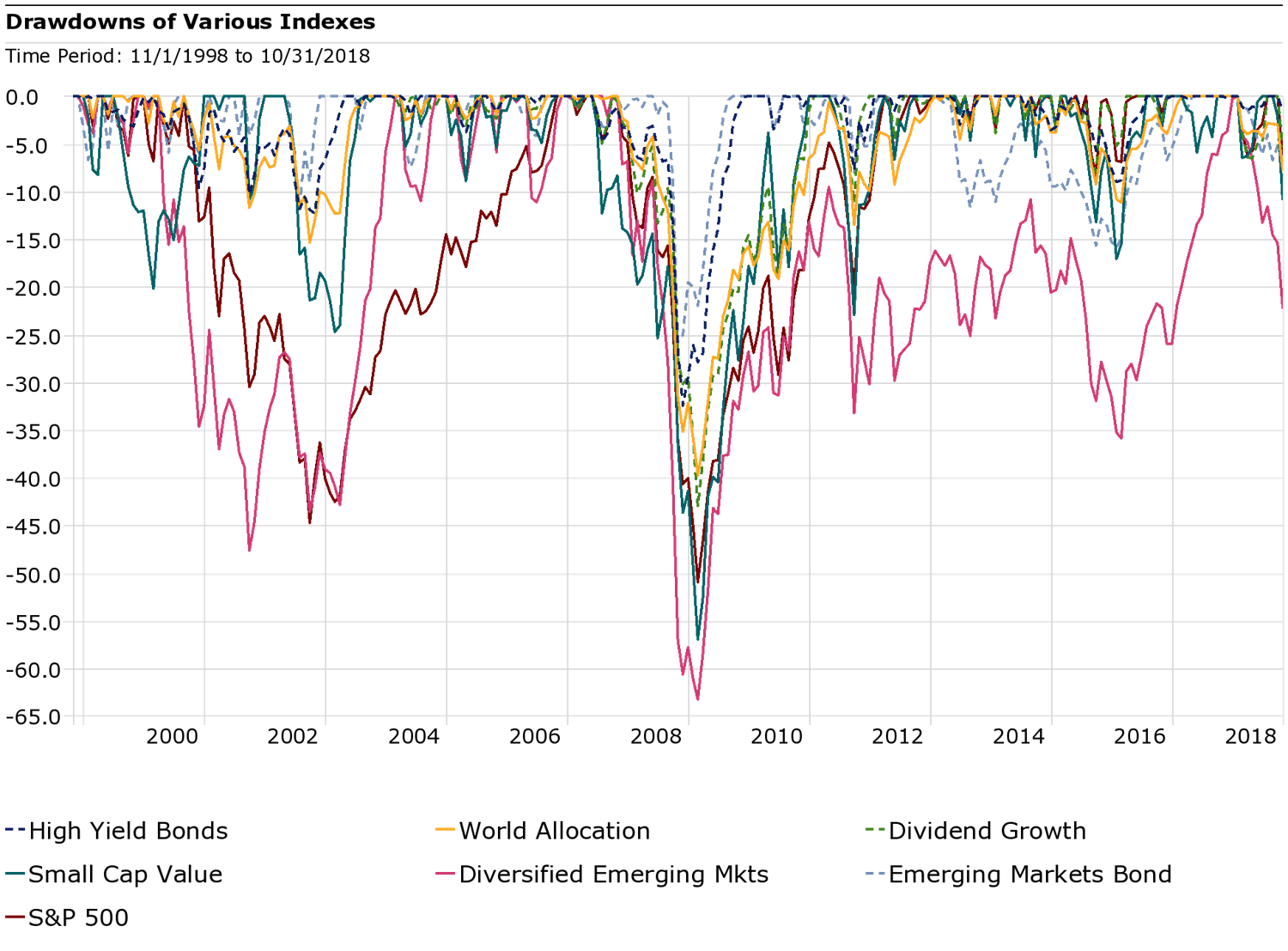

This week I was on an Investment Panel with three other portfolio managers and strategists. Two of the panel members were from large, well known firms. Several of the questions centered around ways to handle a recession or bear market. The ‘solutions’ proposed were to have “diversified

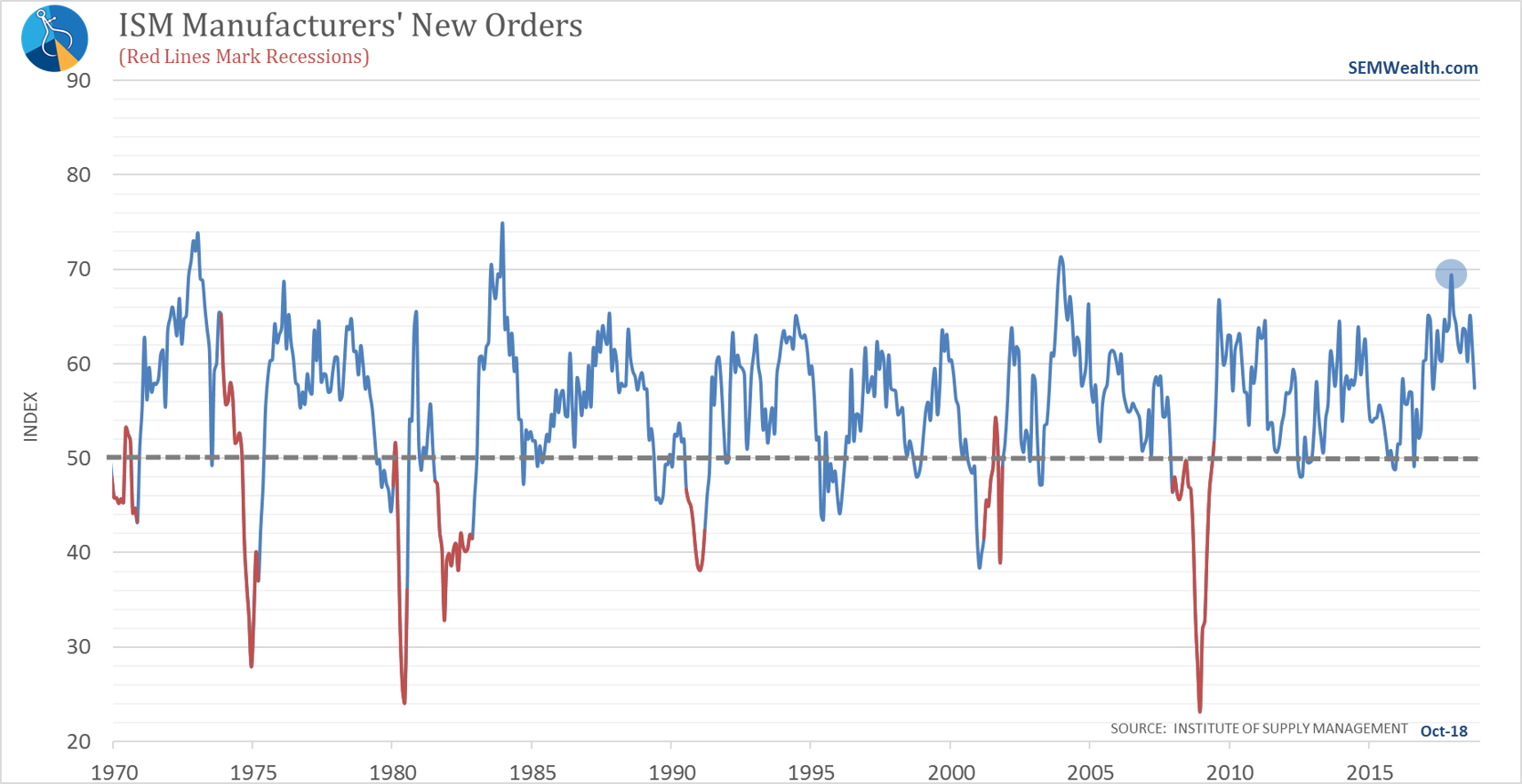

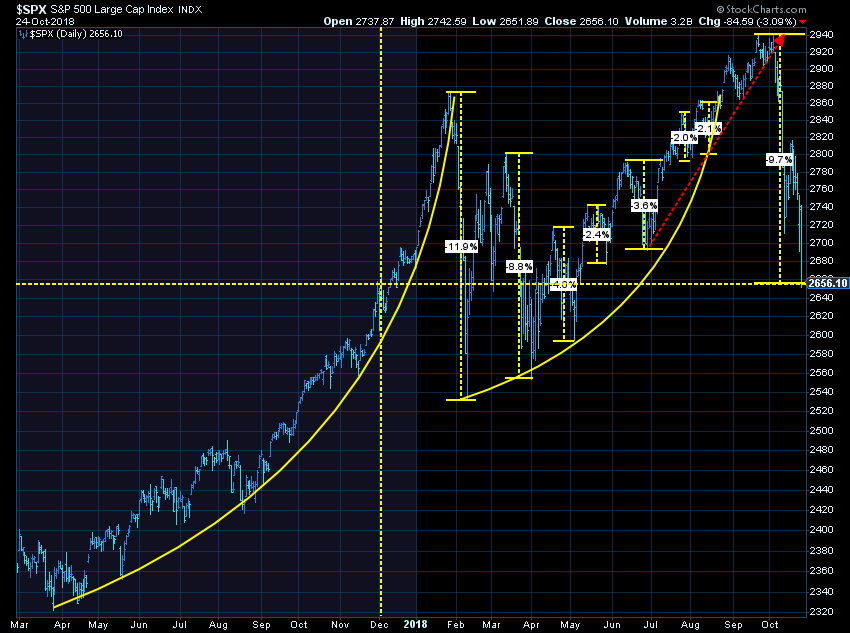

For most of the month, October was on pace to be the worst month since the Financial Crisis. The rally the last few days brought it up enough to take away that designation, but it was still the worst monthly performance for the S&P 500 since 2011. Corrections

October has been a tough month for the stock market. Here’s a brief explanation of what caused the sell-off, what is likely to happen going forward, how SEM’s models have reacted, & what you should be doing right now.

Here are some of the charts shown in the