2022 was the worst year for stocks since the financial crisis. The year started with the worst performers of 2022 posting some impressive results the first 5 weeks of the year. After, the inevitable bounceback reality set in. There were plenty of risks in play – a looming recession, on-going Fed

Throughout Part 3 of "Every Good Endeavor," we've been seeing how the gospel changes different aspect of our life that ultimately have an impact in our work. For the next several weeks, we're going to be focusing on our motivation for our work and rest from our work.

Earlier in

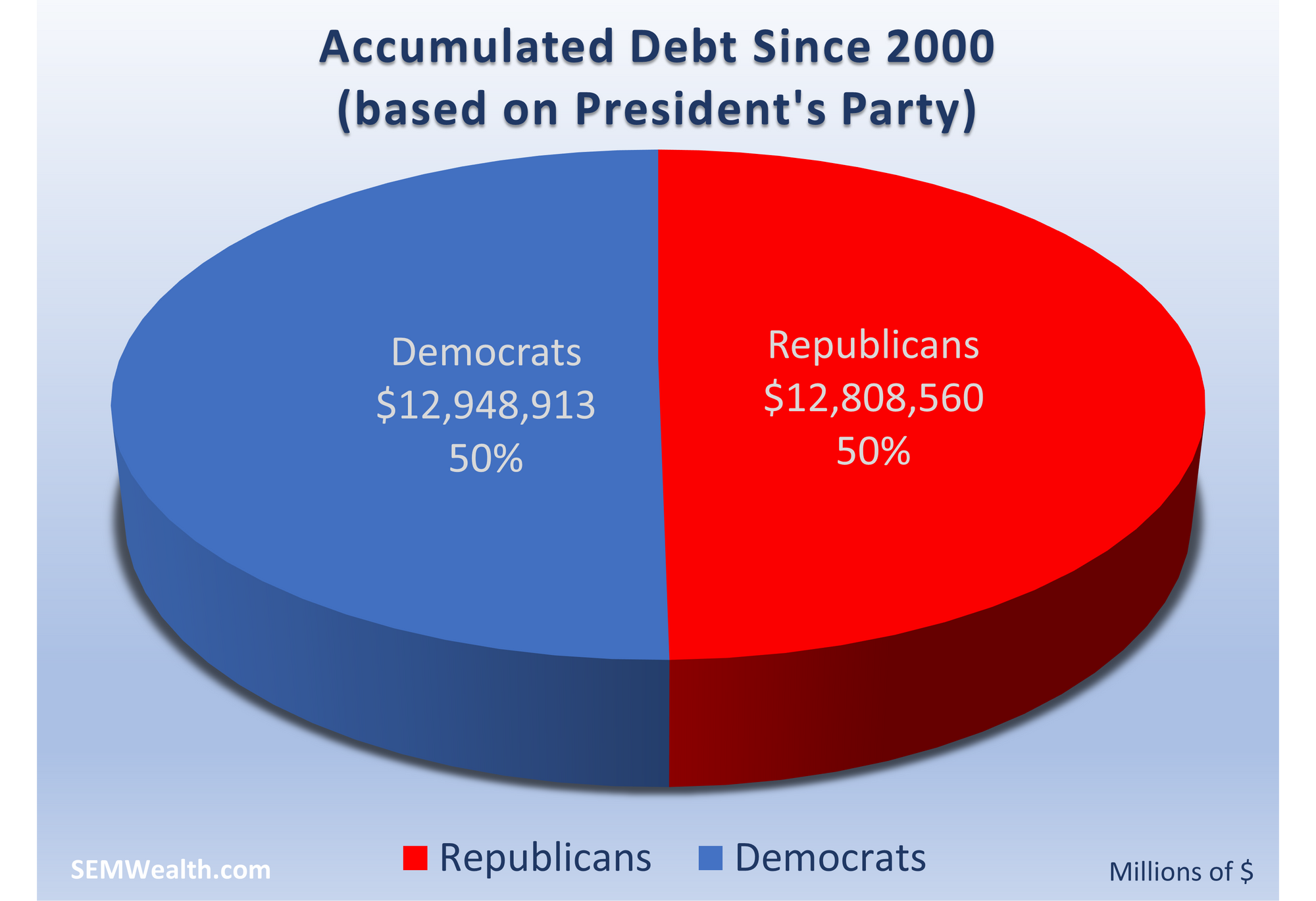

As expected, the debt ceiling negotiators have worked out a deal to avoid "catastrophe". The stock market never really thought the debt ceiling wouldn't be raised/temporarily cancelled. The bond market has been showing a bit of a concern over short-term liquidity as well as putting in place plans to

Throughout this entire series, we start with where our heart (or attitude) should be on the specific topic. Last month we looked at what our attitude towards saving should be. Take a look at it here if you missed it. Now that we have our attitude right, let's talk about

I don't know about you, but I'm already tired of hearing about the debt ceiling. The media is sensationalizing it. Both sides of the political aisle are blaming the other side and acting like they had nothing to do with it. Worry is picking up among individual investors. Meanwhile the