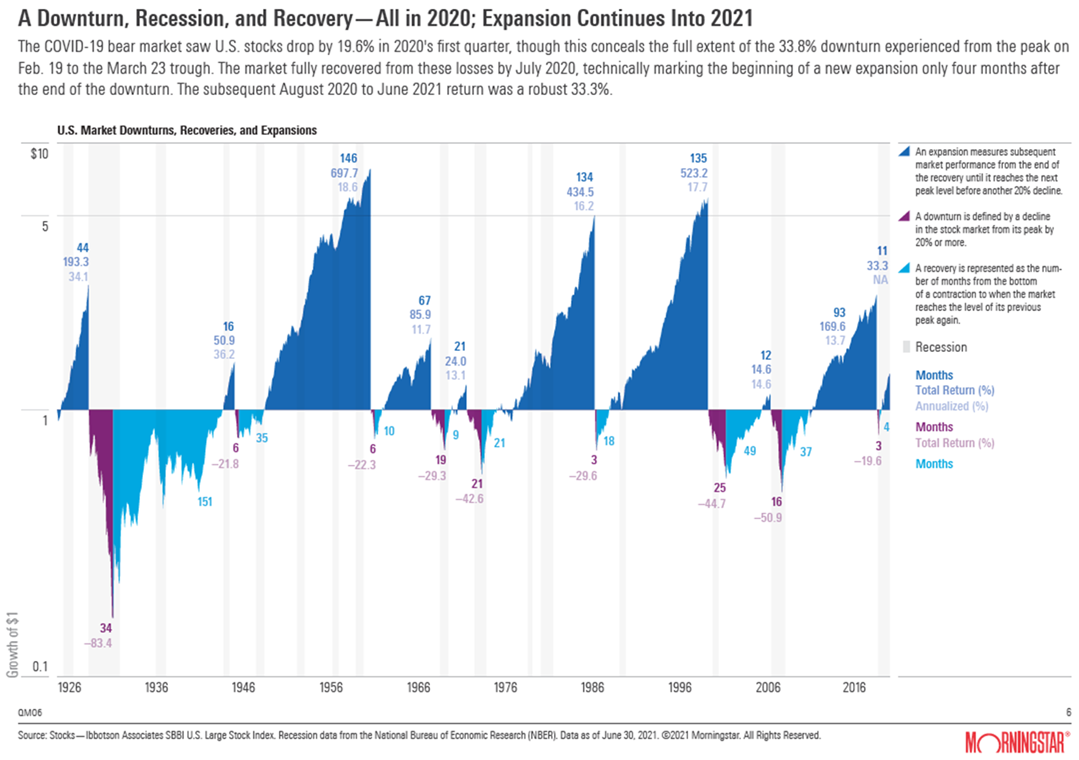

The wait for the Fed to give us more insight into their tapering decisions ended last week, with the tapering set to begin sometime this year. With the Fed's help going away, the market will remove its training wheels. Will that lead to a crash or a sharp pullback like

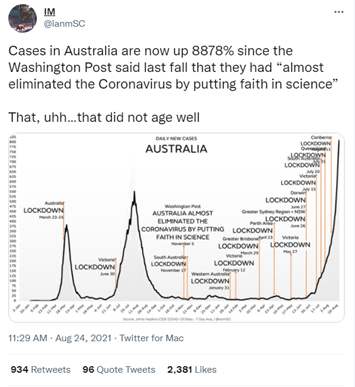

A lot of bad news this week. Mostly between the continued spread of the Delta Variant around America and the grim scenes and stories out of Afghanistan – it is easy to look at the sky falling around us. While personally both of those things are horrific, and I pray that

Dating back to my days in high school government class, the REAL most interesting branch of government I always thought was Congress. After all, the Congressional Article was the Article before the Executive Branch in the Constitution, so our founding fathers seem to agree with me. It’s typically just

Today is a sad day. For me, at least. Today is the first day in 17 days that we will not be giving out medals to the best athletes in the world, who worked mostly quietly on their craft for 5 years for this moment of peak physical showcasing. As

I recently went through a (very minor) situation that reminded me why we go through the trouble of setting up all of these "security things" - things like a password manager, unique passwords for every account, and two-factor authentication.

Here's one of several identical emails I received last month (with