As we go into the 23rd week since the COVID19 panic began it's hard to get a grasp on the big picture. I attended two more virtual conferences last week and two big name firms essentially said fundamentals do not matter – for now there is no other alternative to stocks

20 weeks ago, Congress came together and passed a wide-ranging, 800+ page, $2.2 Trillion legislation called the CARES (Coronavirus Aid, Relief, and Economic Security) Act.

15 weeks ago, the House passed the 1800+ page, $3 Trillion HEROS (Health and Economic Recovery Omnibus Emergency Solution) Act. The Senate did not

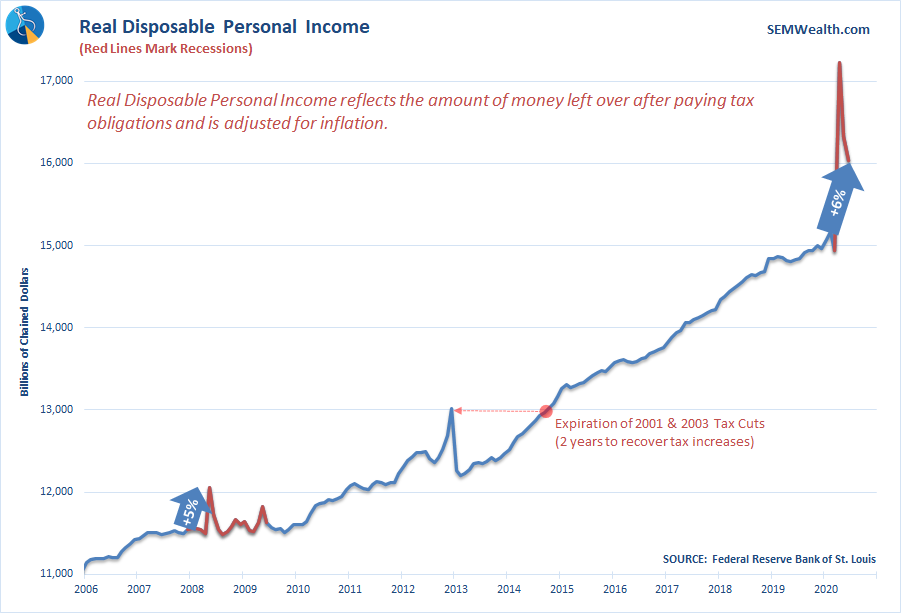

The most often asked question during my client and advisor presentations the past four months has been "why is the stock market rallying so much with so many people out of work?" Ignoring the long-term impact on economic growth due to the ballooning debt obligations, the CARES Act has played

Each week is different, but yet every week seems the same. We get some good news on the economy, some really bad numbers, some good earnings reports, some bad earnings reports, some sort of news item from the Fed, talk of more stimulus, delays of those talks, and of course

When we are facing uncertainty, our brains are prone to using heuristics, or mental short-cuts to help us make decisions. These short-cuts are full of various biases that influence how we look at specific situations. There's nothing wrong with that. It's what makes us human. The best way to overcome