Many clients received their June TCA statement last month and were surprised to see their accounts lower than the start of the year. After a year where most accounts were up double digits, this sudden reversal was something many were not ready for. While evaluating any investments over a 6

Tag: Behavioral Finance

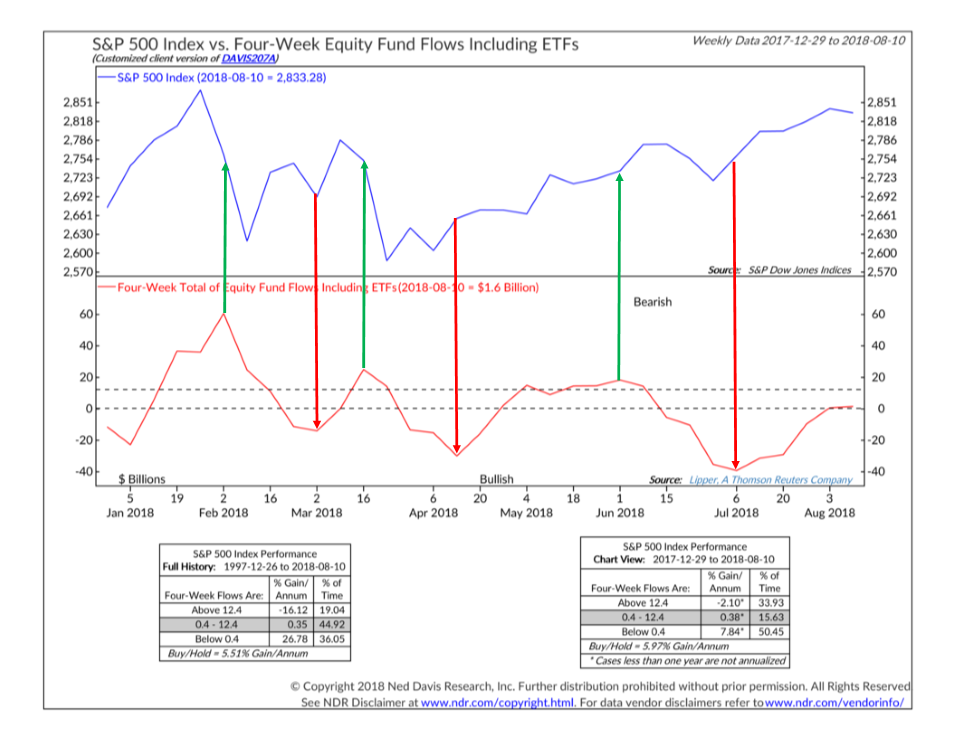

Buy after the market goes up. Sell after the market goes down. While that is not the ideal strategy, this is exactly what individual investors have done for as long as the data has been tracked. 2018 has been no different. As the stock market rallied over 7% in January,

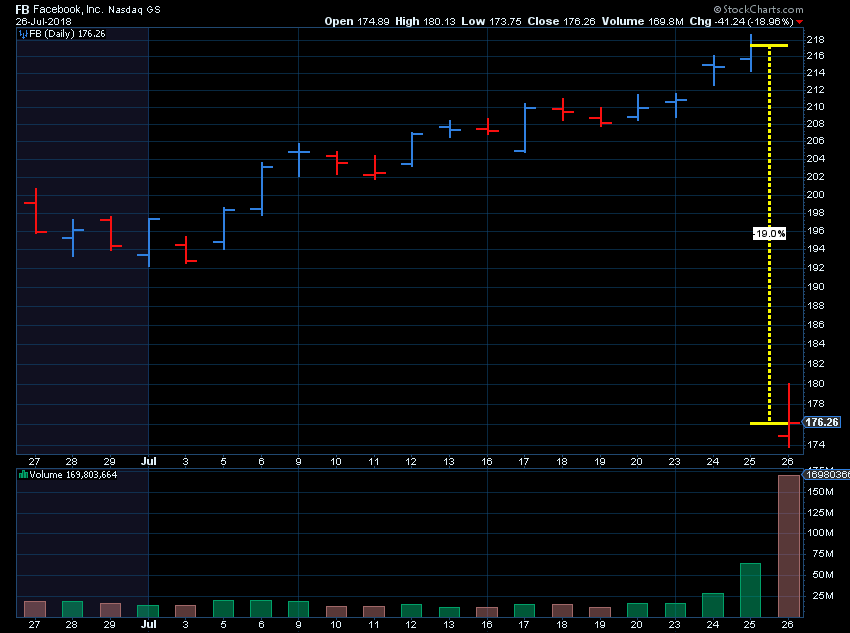

On Friday Jeff wrote a very well thought out and sophisticated article going over the reasoning and data behind Facebook’s valuation after it fell 25 percent (located here). I saw that same drop and clicked buy (for my non-SEM account that is completely discretionary and has nothing to

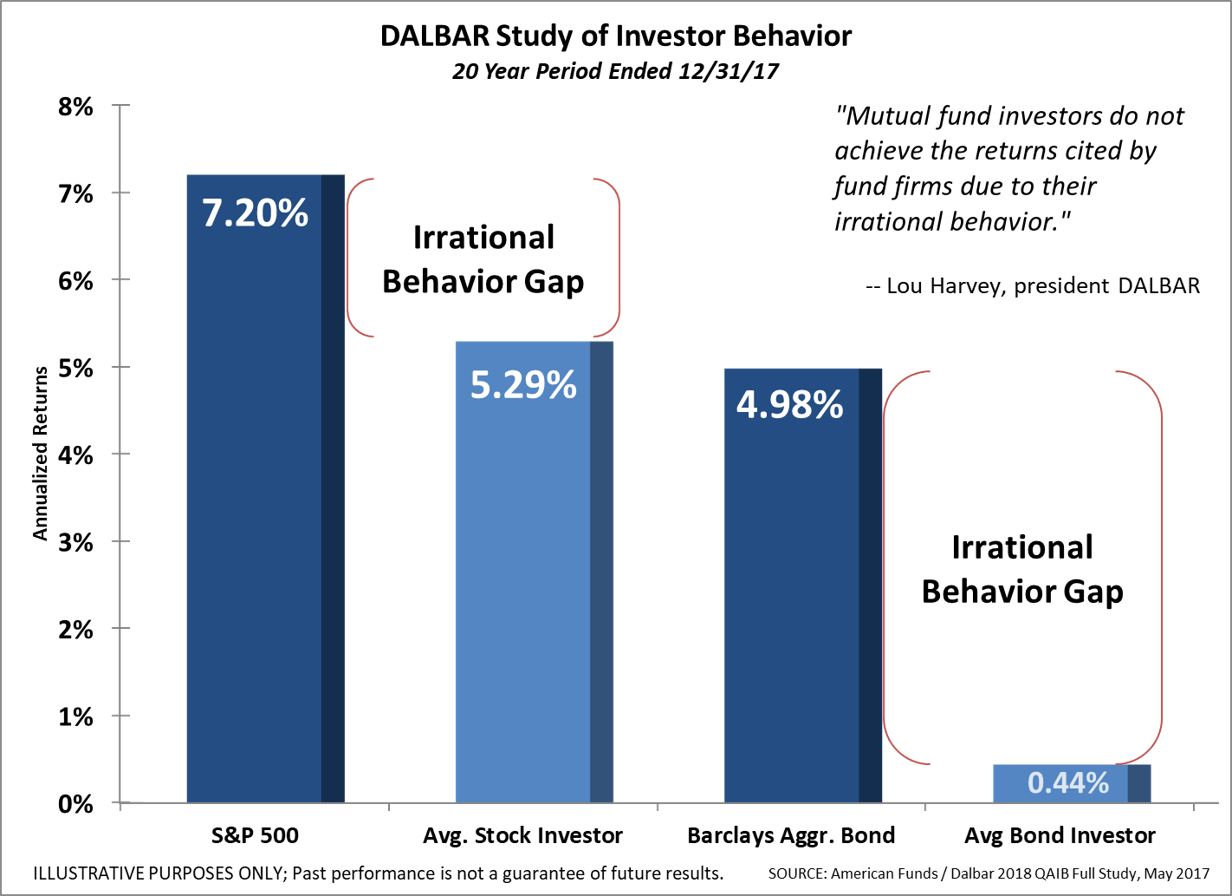

Being human means we are not always completely rational. There is nothing wrong with that. This is what makes life interesting and makes each person unique. If everyone behaved rationally we would have a world full of robots. When it comes to investing, however, our natural human traits can cause

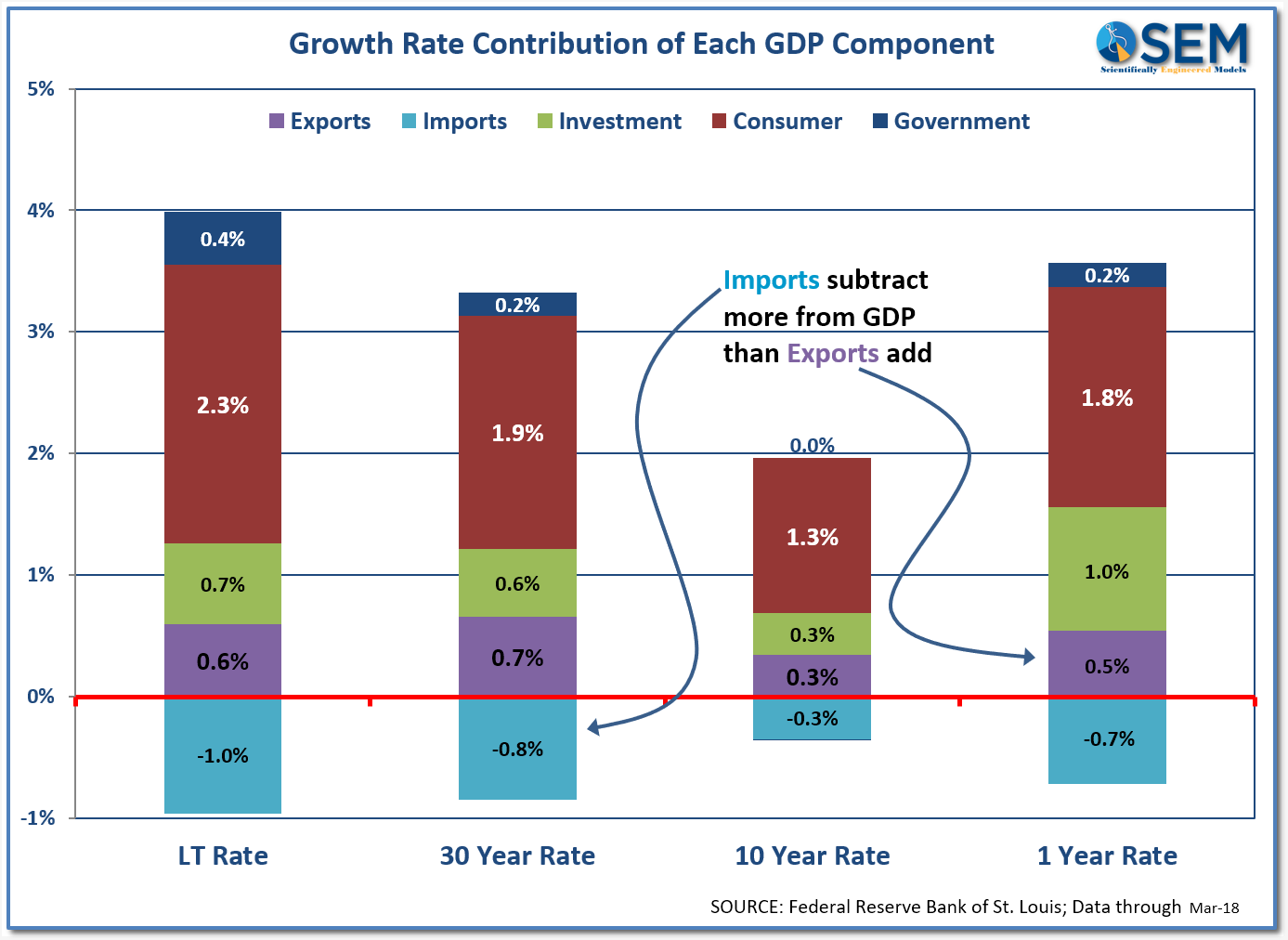

Tariffs and Trade Wars are dominating the headlines. Stock market participants are worried and the market indices have been falling every time one of the sides announces a new tariff or other restrictions on trade. Whenever markets start falling emotions begin to take over. The logic is “stocks dropped