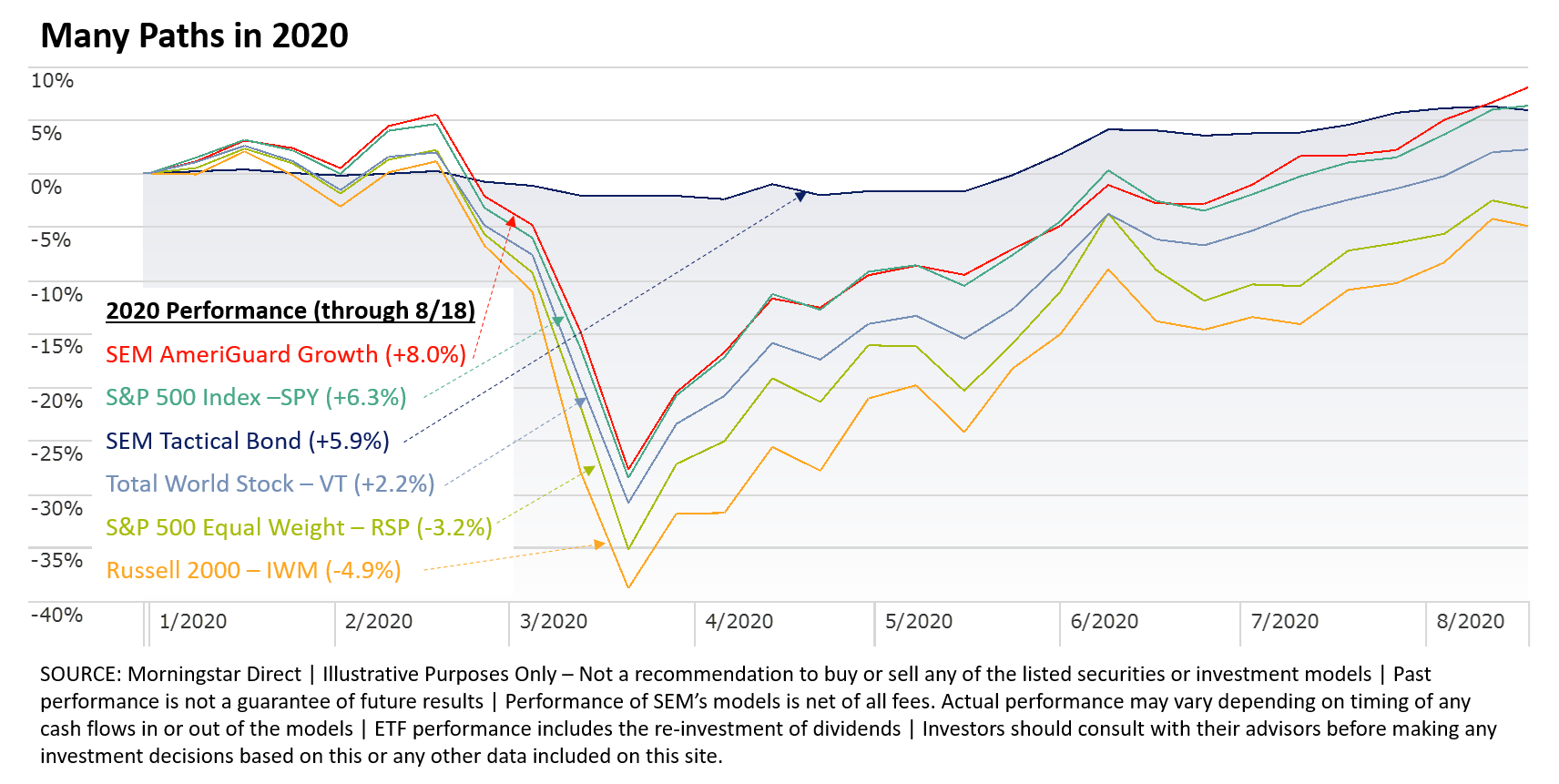

The S&P 500 index hit an all-time record high on Tuesday. Many people are celebrating what is officially the shortest bear market in history. A typical bear market sees stocks losing 35-55% over 12-18 months and then taking 5-8 years to fully recover those losses. I've argued since

Tag: Chart of the Week

20 weeks ago, Congress came together and passed a wide-ranging, 800+ page, $2.2 Trillion legislation called the CARES (Coronavirus Aid, Relief, and Economic Security) Act.

15 weeks ago, the House passed the 1800+ page, $3 Trillion HEROS (Health and Economic Recovery Omnibus Emergency Solution) Act. The Senate did not

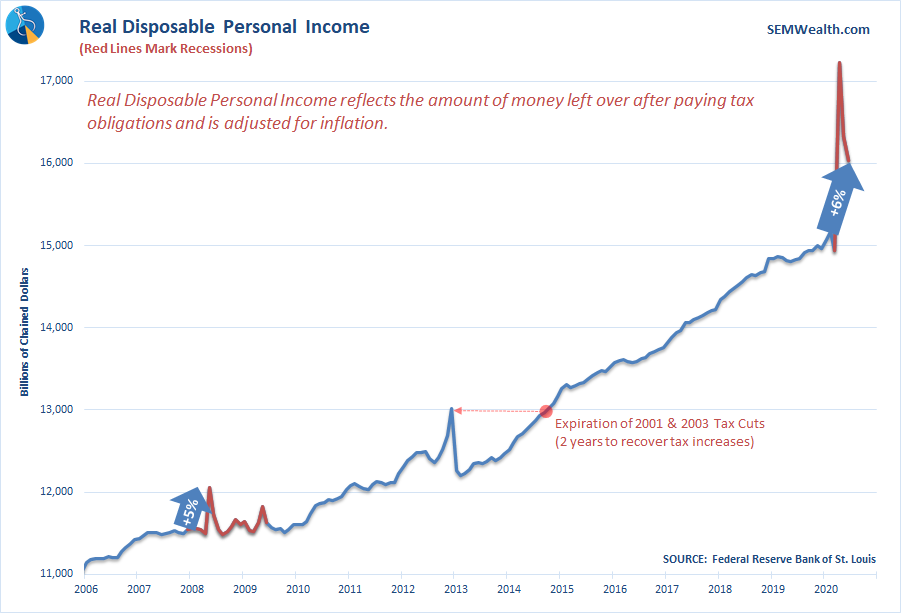

The most often asked question during my client and advisor presentations the past four months has been "why is the stock market rallying so much with so many people out of work?" Ignoring the long-term impact on economic growth due to the ballooning debt obligations, the CARES Act has played

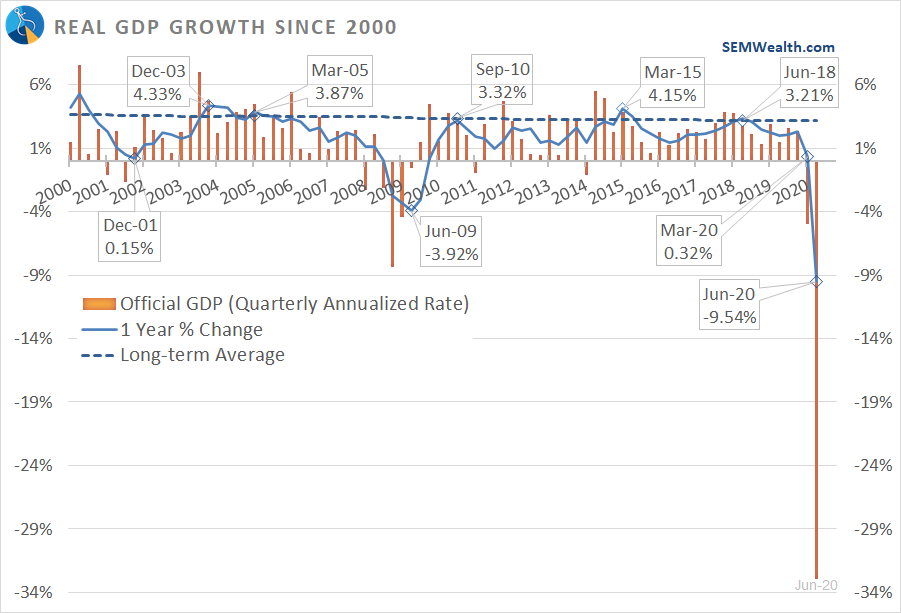

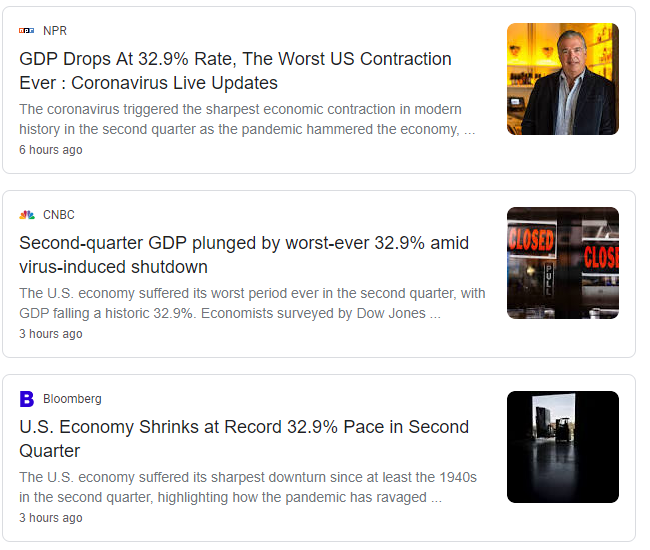

These headlines are shocking and certainly something I don't want to make light of. While it is indeed the worst number since the Great Depression, the way GDP is calculated does not fairly represent what is actually happening. The government takes the estimated economic output for the last three months,

Like a prisoner, marking the days is a way to keep track of the passage of time. Days can blur together and it is easy to lose touch with the outside world. For the past 19 weeks I've been marking the weeks with the hope we'll be able to resume