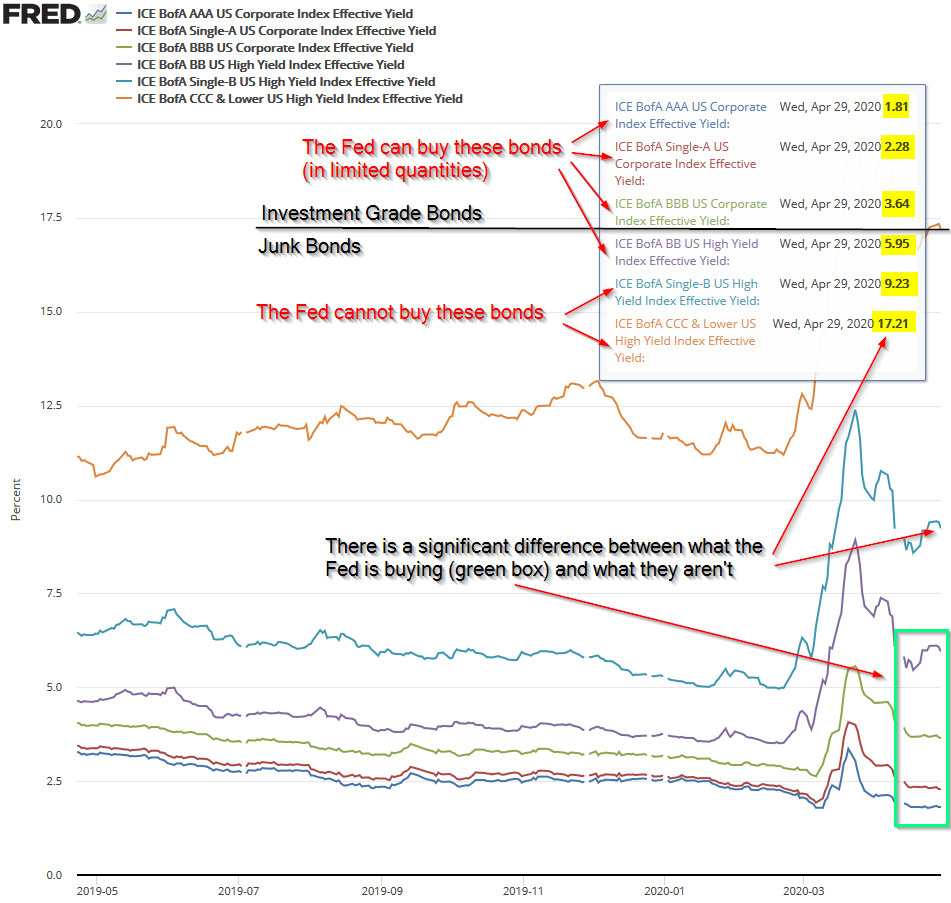

The virtual ink had barely dried on my "time to get excited about valuations" post when the Federal Reserve did what, up until that point, most of us thought would never happen. They announced they would not only be buying junk bonds, but also junk bond ETFs. The spread between

Tag: Chart of the Week

For over a decade I've been listening to "experts" recommend investors dump bonds and use dividend paying stocks for the fixed income needs of clients. I've again heard this advice in the past month. This is what I thought of:

For over a decade I've pointed out two

With the stock market calming down somewhat and the country looking at the next phase of the crisis, I wanted to take some time to walk through what we are seeing in the economy, the stock market, and SEM's investment models. I know many advisors and investors alike have questioned

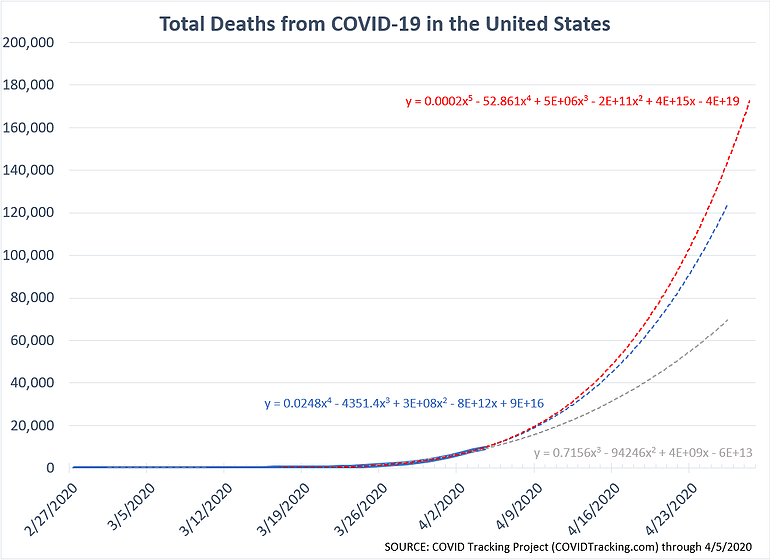

We are all being bombarded with charts, data, projections, opinions, and webinars on what will happen with the economy and the stock market. Advisors and investors alike are scrambling to come up with a plan. As you work on them, here are 10 thoughts to consider:

1.) Clearly the stock

[Updated 5/18/2020] On Tuesday night, March 31, President Trump's press conference was pretty dire. He had already backed-up on his plan to "open the country" on Easter Sunday (April 12), saying we should stick to the CDC's recommendation to "shelter in place" through April 30. That guidance has